Are Car Loan Payments Tax Deductible Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can

Deducting auto loan interest on a vehicle used for your small business or self employment income can provide modest tax savings each year But be sure to follow the IRS requirements closely and maintain sufficient More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of

Are Car Loan Payments Tax Deductible

Are Car Loan Payments Tax Deductible

https://www.finnable.com/wp-content/uploads/2022/01/Instant-car-loan.jpg

Are My Student Loan Payments Tax Deductible WNY Asset Management

https://www.wnyasset.com/wp-content/uploads/2022/04/WNYAsset_StudentLoanRepayment-1280x720.jpg

How To Calculate Your Auto Loan Payment Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_auto_loan_payments_formula.gif

You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest Interest paid on a car used solely for personal reasons like commuting to work or running errands isn t tax deductible Additionally you aren t allowed to deduct car loan interest if you re an employee even if you

It s natural for freelancers who use their cars to expect to claim a car tax write off on their 1099 tax But if you bought a car and are making monthly payments or you re leasing a car the payments are not actually tax deductible Experts agree that auto loan interest charges aren t inherently deductible This is why you need to list your vehicle as a business expense if you wish to deduct the interest

Download Are Car Loan Payments Tax Deductible

More picture related to Are Car Loan Payments Tax Deductible

Is Your Business Loan Tax Deductible

https://img.caminofinancial.com/wp-content/uploads/2019/12/07172627/Tax-deduction-1024x683.jpg

Are Student Loan Payments Tax Deductible

https://images.ctfassets.net/h1t3y2jud9xn/1sNksspbZMnIog9uuyDQFf/1856a78569450818009306d5da7ae168/image4.png

Are Student Loan Payments Tax Deductible

https://wordpress.sparrowfi.com/wp-content/uploads/2022/12/pexels-nataliya-vaitkevich-6863178.jpg

Car loan payments and lease payments are not fully tax deductible The general rule of thumb for deducting vehicle expenses is you can write off the portion of your For this you can use Auto Trader s car valuation service to determine your car s market price This tool considers factors like your car s make model mileage and condition

Deducting car loan interest is not allowed for regular taxpayers However it is possible for taxpayers who meet certain criteria You can write off a part of your car loan The short answer is typically no Personal car loan interest is not tax deductible for most taxpayers However there is an exception if you use the car for business

Are Van Loan Payments Tax Deductible Help Advice

https://firstoakcapital.co.uk/wp-content/uploads/2023/04/Are-van-loan-payments-tax-deductible-1-scaled.jpeg

What Are Car Loan Rates Like In The UK

https://www.carmoola.co.uk/hubfs/What Are Car Loan Rates Like in the UK.jpg#keepProtocol

https://www.bankrate.com › loans › auto-loans › car-loan...

Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can

https://themoneyknowhow.com › can-car-loan-interest...

Deducting auto loan interest on a vehicle used for your small business or self employment income can provide modest tax savings each year But be sure to follow the IRS requirements closely and maintain sufficient

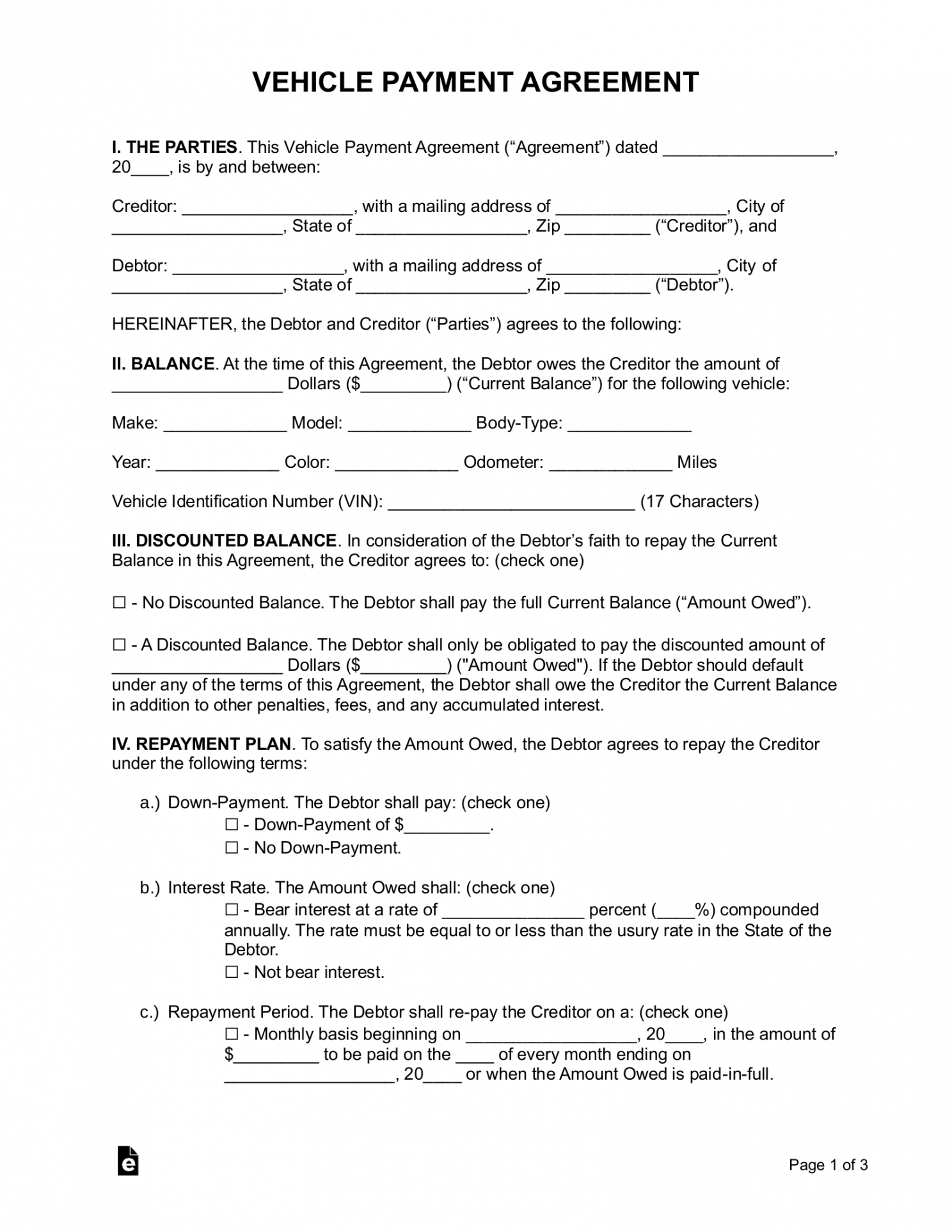

Car Sale Contract With Payments Template

Are Van Loan Payments Tax Deductible Help Advice

Is Student Loan Interest Tax Deductible RapidTax

Free Printable Contract For Taking Over Car Payments

Are Student Loan Payments Tax Deductible Student Loan Planner

Petition Make Student Loan Payments Tax Deductible To ALL Not Just

Petition Make Student Loan Payments Tax Deductible To ALL Not Just

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Are Small Business Loans Tax Deductible A Guide To Tax Deductions

Legal Document For Taking Over Car Payments AirSlate SignNow

Are Car Loan Payments Tax Deductible - You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest