Are Children S School Fees Tax Deductible In India Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

This comprehensive article delves into the intricacies of Section 80C deductions focusing on the significance of tuition or school fees paid for the education of children Covering eligibility criteria A Deduction Under Section 80C on Tuition Fees Paid This deduction in respect of school fees is covered under Section 80C of the I T Act A parent can claim a

Are Children S School Fees Tax Deductible In India

Are Children S School Fees Tax Deductible In India

http://www.stclare.qld.edu.au/enrolment/PublishingImages/SchoolFees2018.PNG

Are Credit Card Fees Tax Deductible Discover The Truth

https://paymentcloudinc.com/blog/wp-content/uploads/2022/01/are-credit-card-fees-tax-deductible.jpg

Why Not Make Private School Fees Tax Deductible

https://www.telegraph.co.uk/content/dam/news/2022/12/10/TELEMMGLPICT000001917908_trans_NvBQzQNjv4BqWqpbAtgKJyHaMBh-yZTXbeDb_zHeougPJk0-Rsnxim0.jpeg?imwidth=680

While children education allowance is tax exempt under section 10 14 the tuition fees paid is tax deductible under section 80C of the IT Act 1961 children When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under

Apart from Children s Education fee a separate Tax Deduction can be claimed on Tuition Fee paid by parents for the education of their children This deduction includes any Tuition Fee paid at the You can claim a deduction of up to Rs 1 5 Lakh under Section 80C of the Income Tax Act on your child s school or college fees and reduce your taxable income You can claim

Download Are Children S School Fees Tax Deductible In India

More picture related to Are Children S School Fees Tax Deductible In India

Explore Our Image Of Law Firm Invoice Template Invoice Template

https://i.pinimg.com/originals/28/20/08/2820082411b76dbc69d769f362e6e00c.jpg

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

Tax Benefits On Tuition Fees School Fees Education Allowances

https://www.alerttax.in/wp-content/uploads/2017/02/Tax-Benefits-on-Tuition-Fees-School-Fees-Education-Allowances.png

Sending kids to school has an inbuilt tax advantage for the parents as the tuition fee qualifies for tax benefit under Section 80C Here s all you need to know about To promote education in India the govt allows for Income Tax Deduction under Section 80C Section 80E Deduction under Section 80C is allowed for payments made by self

The Government of India has made various provisions for the taxpayer to claim tax reductions on the expenses on their child s education This includes children s Yes school fees are eligible for tax exemption under Section 80C deduction The amount of tax benefit is within the overall limit of the section of Rs 1 5 lakh a year

Best Letter Format Gentle Payment Reminder Letter Format

https://goschooler.com/wp-content/uploads/2021/08/solicitation-2-791x1024.png

As It Happened 2022 Election Watch Day Two

https://cdn-attachments.timesofmalta.com/763cf811116bd3bff433c45a7e0c8da61904a2bb-1645475108-a53d4a0c-1200x630.jpg

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize

https://taxguru.in/income-tax/deduction-…

This comprehensive article delves into the intricacies of Section 80C deductions focusing on the significance of tuition or school fees paid for the education of children Covering eligibility criteria

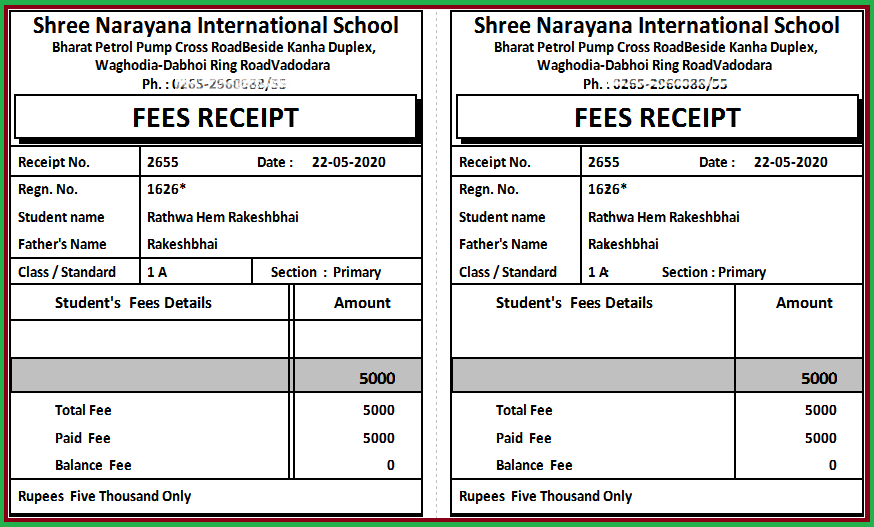

Fee Slip Format For School Toparhitecti ro

Best Letter Format Gentle Payment Reminder Letter Format

Are School Fees Tax Deductible In Australia Focusacademies

Are HOA Fees Tax Deductible Clark Simson Miller

Timeshare Tax Deduction Are Timeshare Fees Tax Deductible

Are Web Hosting Fees Tax Deductible InMotion Hosting Blog

Are Web Hosting Fees Tax Deductible InMotion Hosting Blog

Are Tax Preparation Fees Deductible Tax Relief Center

Request Letter For Tax Certificate For Income Tax SemiOffice Com

5 Business Credit card Fees That Are Tax deductible

Are Children S School Fees Tax Deductible In India - You can claim tax deductions for tuition fees paid to educate your children but not for educational expenses of yourself or your spouse The deductions apply to