Are College Living Expenses Tax Deductible Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year

Qualifying expenses include what you pay in tuition and mandatory enrollment fees to attend any accredited public or private institution above the high school level You cannot take a deduction for Room and board optional fees such as for student health insurance transportation or other similar personal expenses Some college tuition and fees are deductible on your 2022 tax return The American Opportunity and the Lifetime Learning tax credits provide deductions but you can only use one at a time

Are College Living Expenses Tax Deductible

Are College Living Expenses Tax Deductible

https://taxsaversonline.com/wp-content/uploads/2022/07/Are-Assisted-Living-Expenses-Tax-Deductible.jpg

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

The following expenses are not qualified education expenses Room and board or other living expenses Student health fees and other medical expenses Transportation Insurance including property or renters insurance for college students Expenses for sports games or hobbies unless they re necessary for your degree program You may exclude certain educational assistance benefits from your income That means that you won t have to pay any tax on them However it also means that you can t use any of the tax free education expenses as the basis for any other deduction or credit including the lifetime learning credit

The deduction for college tuition and fees has not been available since Dec 31 2020 However you can still help yourself with college expenses through other deductions such as the American Opportunity Tax Credit and the Lifetime Learning Credit College graduates can also deduct the interest that they pay on student loans For the 2023 tax year you can claim a maximum credit of up to 2 500 per student The credit is refundable even if you don t owe any taxes In that case you may receive some of the

Download Are College Living Expenses Tax Deductible

More picture related to Are College Living Expenses Tax Deductible

Deductible Non deductible Expenses Corporate Income Tax UAE

https://kgrnaudit.com/wp-content/uploads/Deductible-Non-deductible-Expenses-Under-Corporate-Income-Tax-UAE-min-3-scaled.jpg

Are Assisted Living Expenses Tax Deductible In 2021 Vallie Harrell

https://seniorsbluebook.com/listing/976836/What-Tax-Deductions-Are-Available-For-Assisted-Living-Expenses.png

When Are Assisted Living Expenses Tax Deductible Ashley Manor Senior

https://ashleymanorseniorliving.com/wp-content/uploads/2019/09/tax-deductible-assisted-living-740x220.jpg

Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit The IRS sets the guidelines for which college expenses are deductible or eligible for a tax credit at the federal level The following higher education expenses are tax deductible under the current tax code rules Student loan interest

There used to be a Tuition and Fees Deduction which allowed people to deduct up to 4 000 in higher education expenses That particular tax break no longer exists as of 2021 But students and parents paying for college can take advantage of the currently available deductions and tax credits To claim the American Opportunity Tax Credit AOTC you must have paid qualified education expenses for either yourself your spouse or one of your dependents at an eligible post secondary institution for the first four years of post secondary studies Expenses include tuition fees college textbooks and other required class supplies

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

https://i.pinimg.com/originals/27/f7/8f/27f78f785ee4e5bf3dc13c6451ad6ed4.jpg

Sherlene Voss

https://www.seniorlivingresidences.com/app/uploads/2020/03/cropped-GettyImages-1053057484-1.jpg

https://www.irs.gov/credits-deductions/individuals/qualified-ed-expenses

Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year

https://turbotax.intuit.com/tax-tips/college-and...

Qualifying expenses include what you pay in tuition and mandatory enrollment fees to attend any accredited public or private institution above the high school level You cannot take a deduction for Room and board optional fees such as for student health insurance transportation or other similar personal expenses

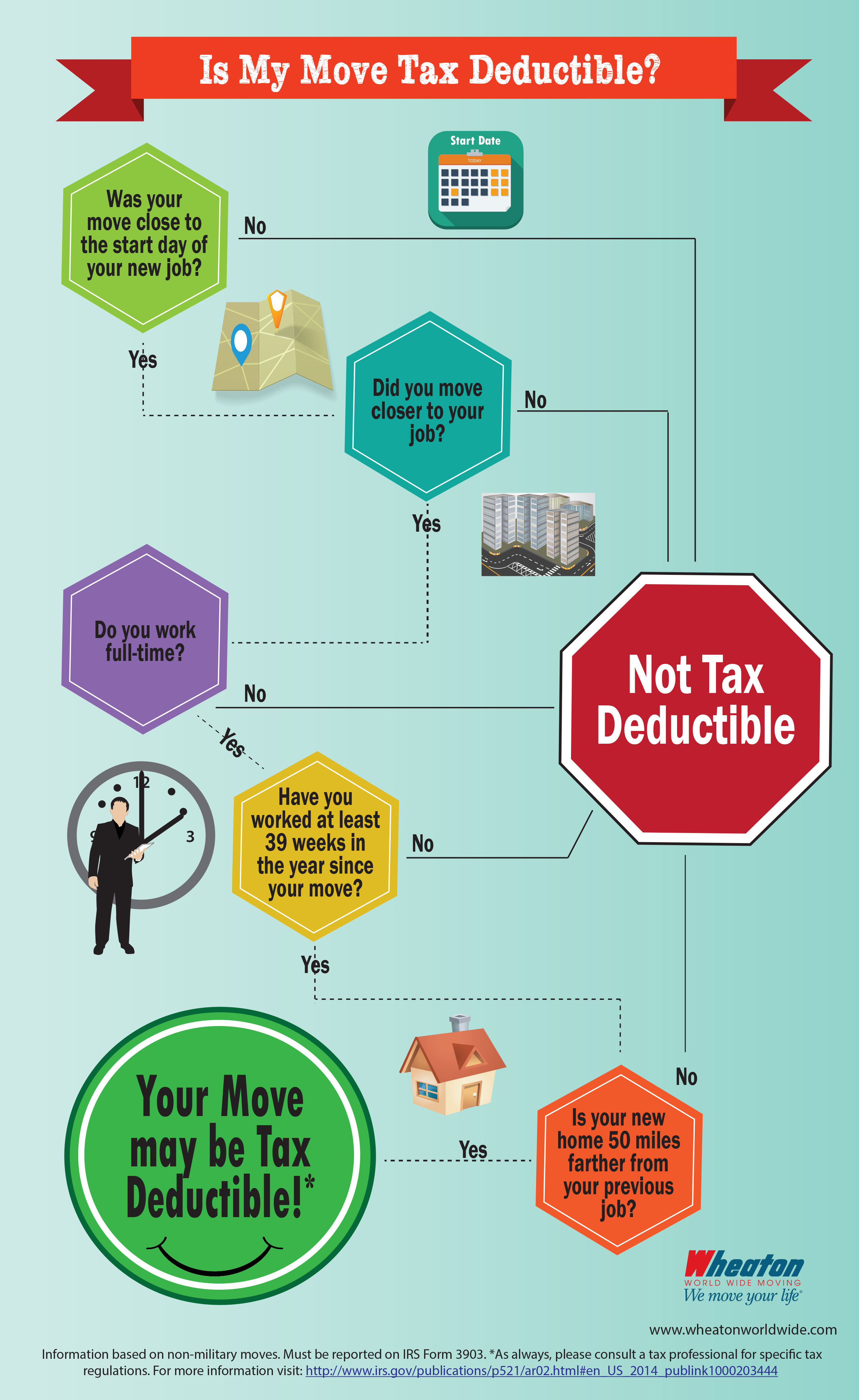

Infographic Is My Move Tax Deductible Wheaton

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

Tax Q A Many College Expenses Not Deductible

Can I Claim Wedding Expenses On My Taxes Wedding Poin

Are You Unsure What Expenses Are Deductible For You Business This

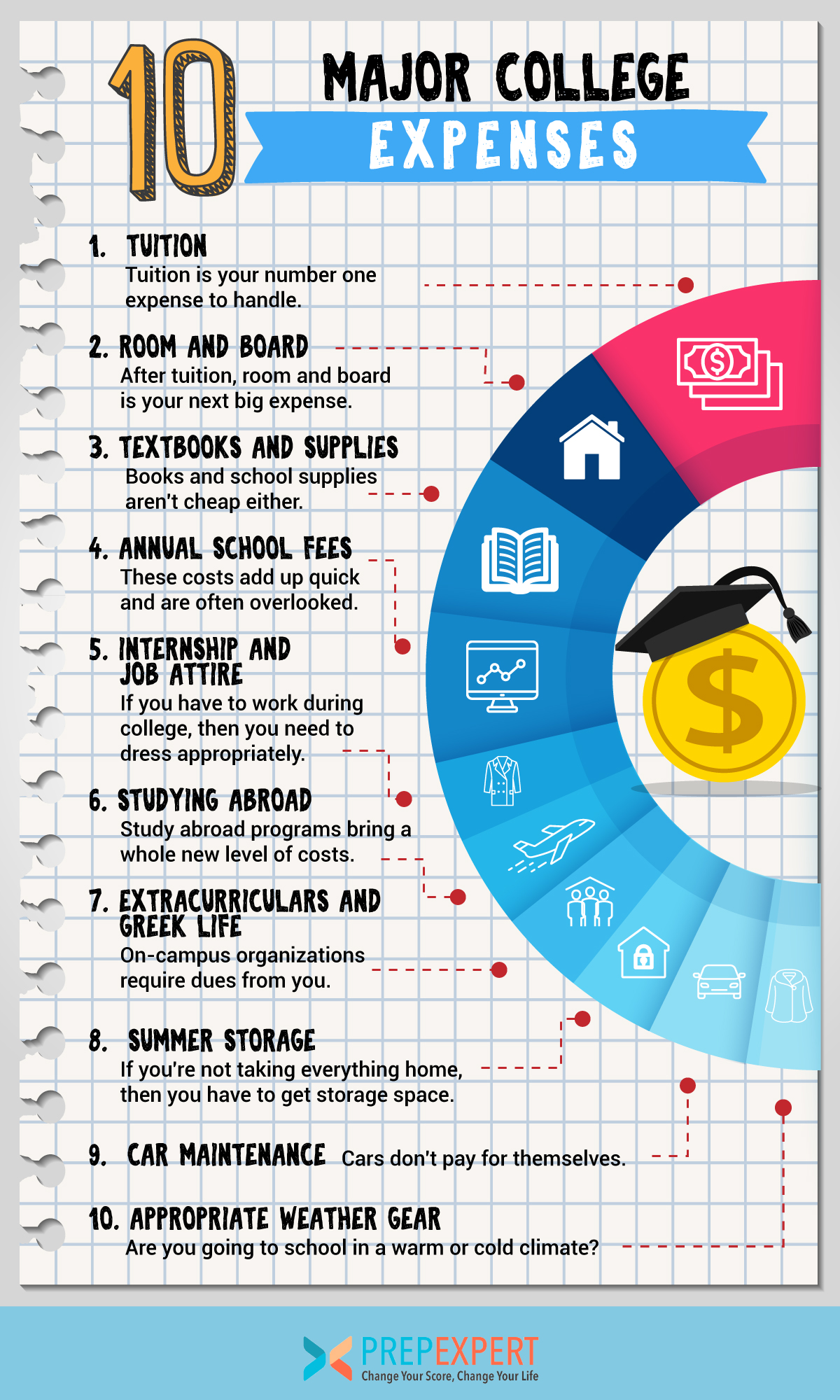

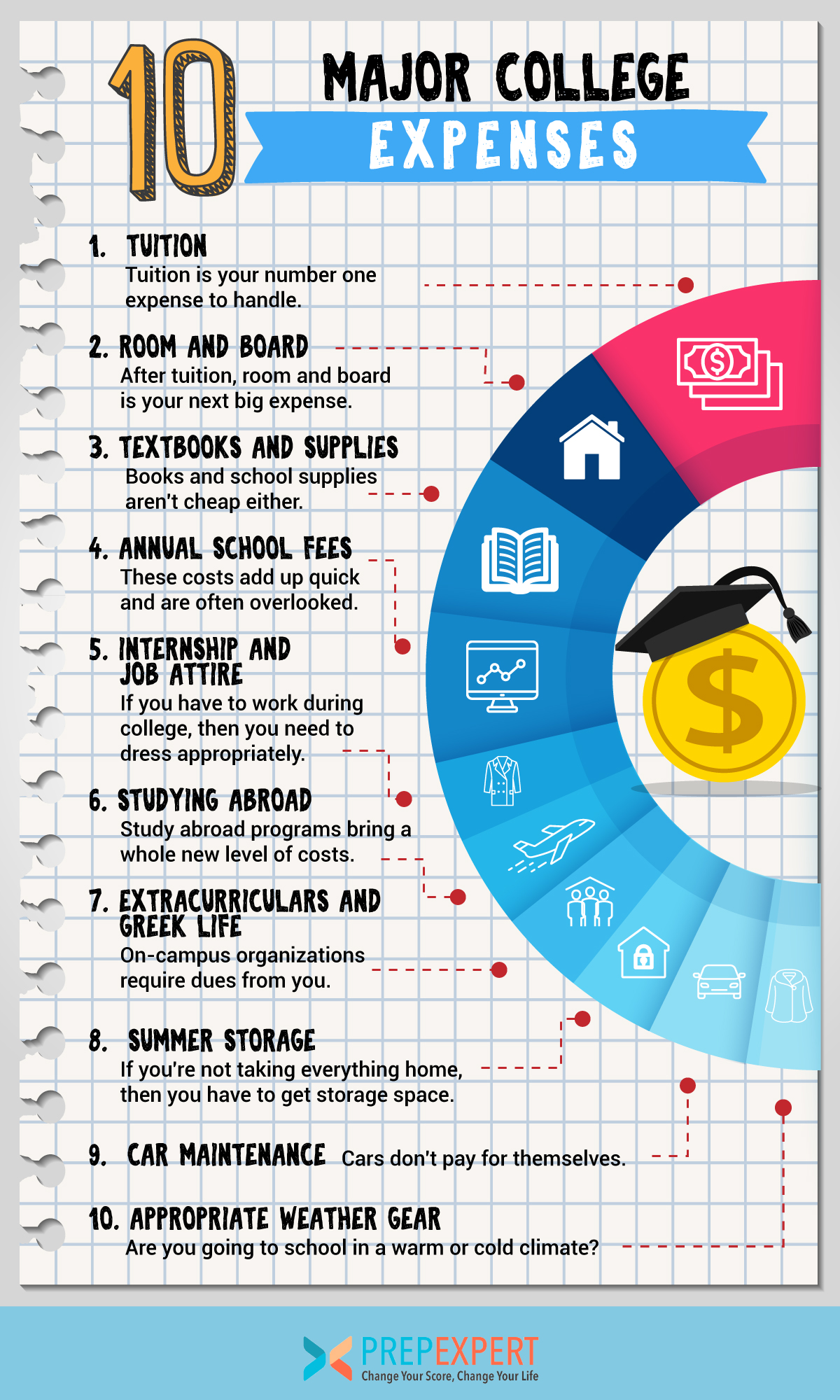

10 Major College Expenses Prep Expert

10 Major College Expenses Prep Expert

Are Moving Expenses Tax Deductible Under The New Tax Bill

/the-dog-days-of-tax-filing-524872414-58978d7c3df78caebc00d9ff.jpg)

Are Animal Fostering Rescue Expenses Tax Deductible

Free Business Expense Spreadsheet And Self Employed Business Tax

Are College Living Expenses Tax Deductible - The following expenses are not qualified education expenses Room and board or other living expenses Student health fees and other medical expenses Transportation Insurance including property or renters insurance for college students Expenses for sports games or hobbies unless they re necessary for your degree program