Are Contributions To 529 Plans Tax Deductible In New Jersey For Tax Year 2022 and forward The New Jersey College Affordability Act allows for three Income Tax deductions for those who file tax returns showing gross income of 200 000 or less Deductions include contributions to an NJBEST 529 savings plan payments made for an NJCLASS student loan and tuition costs for New Jersey colleges and universities

Unlike traditional IRAs and 401 k s 529 plan contributions are not tax deductible at the federal level Thanks to recent legislation however you may now be able to deduct up to 10 000 of annual contributions you make to New Jersey s 529 plan the New Jersey Better Educational Savings Trust NJBEST from your state income taxes Learn how 529 plans can help you save for college and reduce your tax burden Find out if you can deduct your contributions from your state taxes and what are the federal penalties for early withdrawals

Are Contributions To 529 Plans Tax Deductible In New Jersey

Are Contributions To 529 Plans Tax Deductible In New Jersey

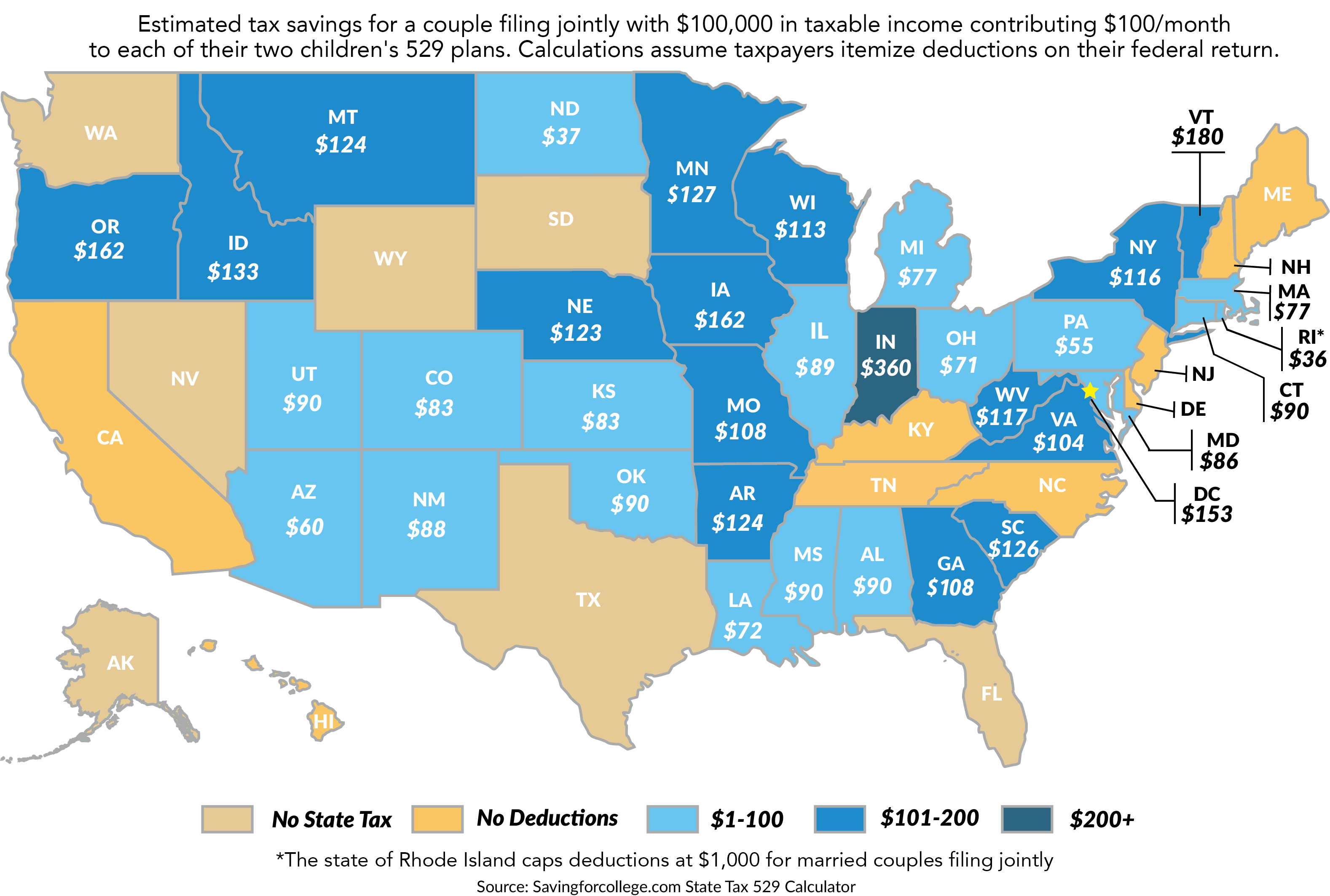

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

Are Contributions To A 529 Plan Tax Deductible Sootchy

https://global-uploads.webflow.com/5e7af514190cb858e85adbbe/5f9c2480d8e12e5446ae4d45_shutterstock_1109910923-min.jpg

529 Plans Tax Time

https://cdn.zephyrcms.com/e112549c-a559-40fd-93fb-638041043470/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1200x/529-plans-tax-time-gennext-sm.jpg

Now New Jersey taxpayers with gross income of 200 000 or less can qualify for a state income tax deduction of up to 10 000 per taxpayer for contributions to the plan That s a deduction of As you progress through your NJ return there will be a question on the screen titled New Jersey College Affordability Deductions Answer Yes on that screen to go through that section of information Then you will see a place to enter your NJBEST contributions so that you can receive the deduction

New Jersey becomes the 35 th state to offer an income tax benefit for residents who contribute to a 529 plan The new deduction is estimated to cost the state between 9 5 million and 12 1 million in lost revenue annually Learn how to open manage and withdraw from a NJBEST 529 plan a tax advantaged savings program for higher education expenses Find out if payments to NJBEST are tax deductible and how to report them to the IRS

Download Are Contributions To 529 Plans Tax Deductible In New Jersey

More picture related to Are Contributions To 529 Plans Tax Deductible In New Jersey

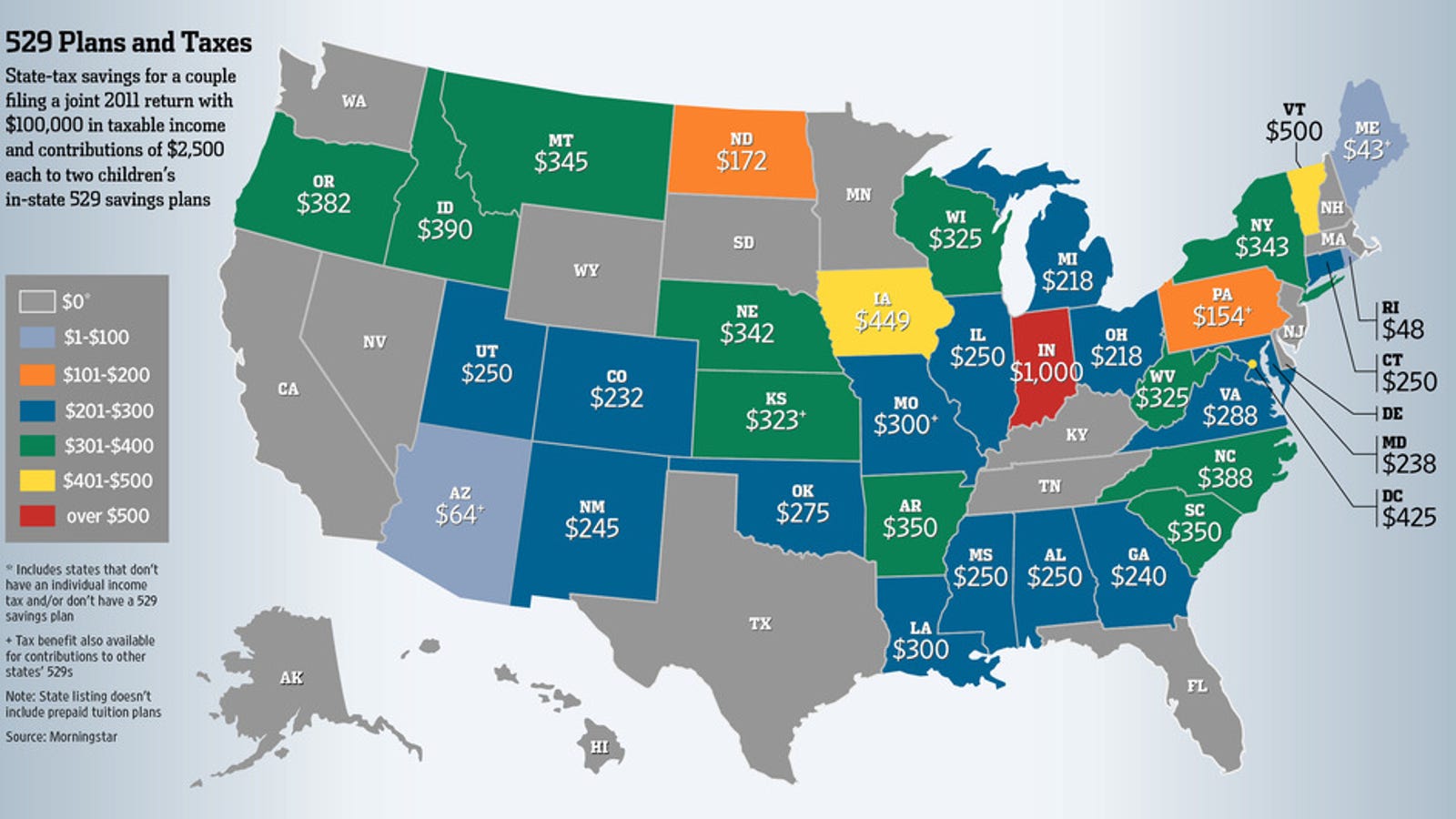

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Saving For Education 529 Plans Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/529-plans-2120x1060.jpeg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

New Jersey will offer a state tax deduction of up to 10 000 per taxpayer per year for contributions to a New Jersey 529 plan You must have a gross income of 200 000 per year or less You must be a New Jersey resident to contribute to a New Jersey 529 plan Learn how 529 plan contributions can reduce your state taxable income in most states but not all Find out the eligibility amount and time requirements for claiming a state tax deduction or credit for 529 plan contributions

The New Jersey College Affordability Act allows for a state tax deduction for contributions into a Franklin Templeton 529 College Savings Plan of up to 10 000 per year for those with gross income of 200 000 or less beginning with contributions made in tax year 2022 As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1 500 maximum scholarship by investing within the program for over 12 years

529 Maximum Contribution Limits In 2023 The Education Plan

http://theeducationplan.com/sites/default/files/styles/extra_large_landscape_1680x1120_/public/2022-12/Header Image - Max Contributions.png?itok=rIC2zKiH

If 529 Plans Get Taxed Here s Another Tax free Option

https://image.cnbcfm.com/api/v1/image/48803411-182175346.jpg?v=1532564740

https://nj.gov/treasury/taxation/individuals/collegededuction.shtml

For Tax Year 2022 and forward The New Jersey College Affordability Act allows for three Income Tax deductions for those who file tax returns showing gross income of 200 000 or less Deductions include contributions to an NJBEST 529 savings plan payments made for an NJCLASS student loan and tuition costs for New Jersey colleges and universities

https://simonquickadvisors.com/articles/are-529...

Unlike traditional IRAs and 401 k s 529 plan contributions are not tax deductible at the federal level Thanks to recent legislation however you may now be able to deduct up to 10 000 of annual contributions you make to New Jersey s 529 plan the New Jersey Better Educational Savings Trust NJBEST from your state income taxes

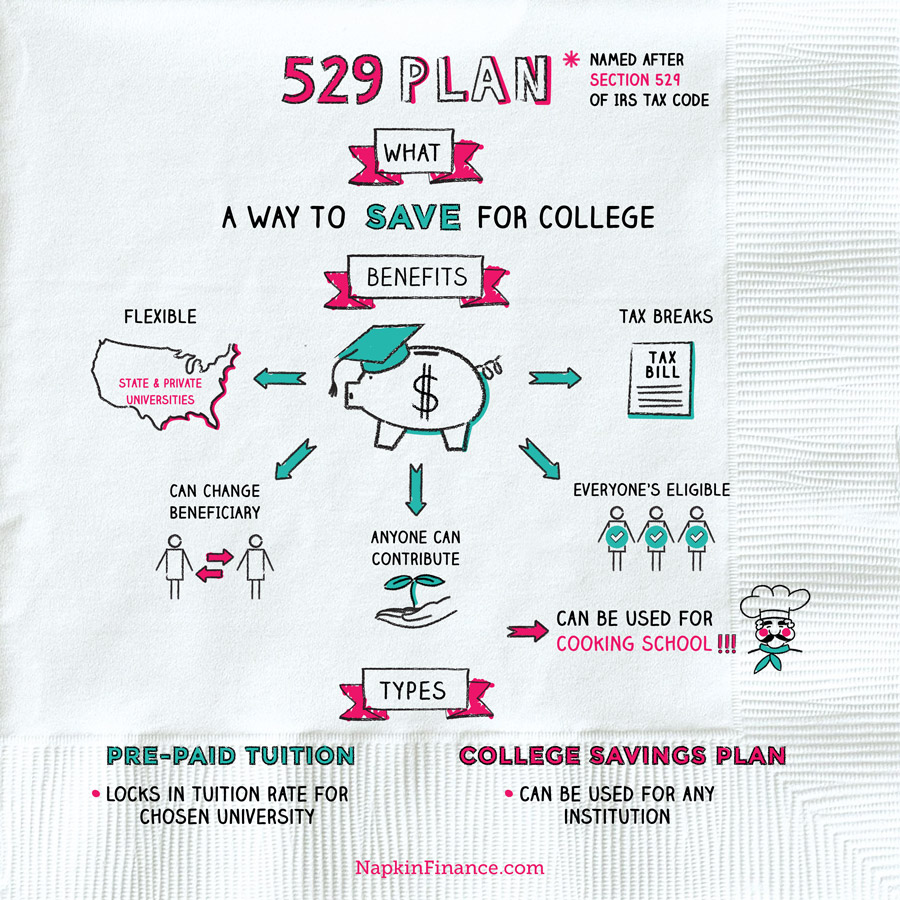

529 Plan Napkin Finance

529 Maximum Contribution Limits In 2023 The Education Plan

The Complete Guide To Virginia 529 Plans For 2024

Nj 529 Plan Tax Benefits Tiffaney Bernal

529 Plan Tax Free College Savings Plan

529 Plan Tax Deductible College Savings Plans

529 Plan Tax Deductible College Savings Plans

/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

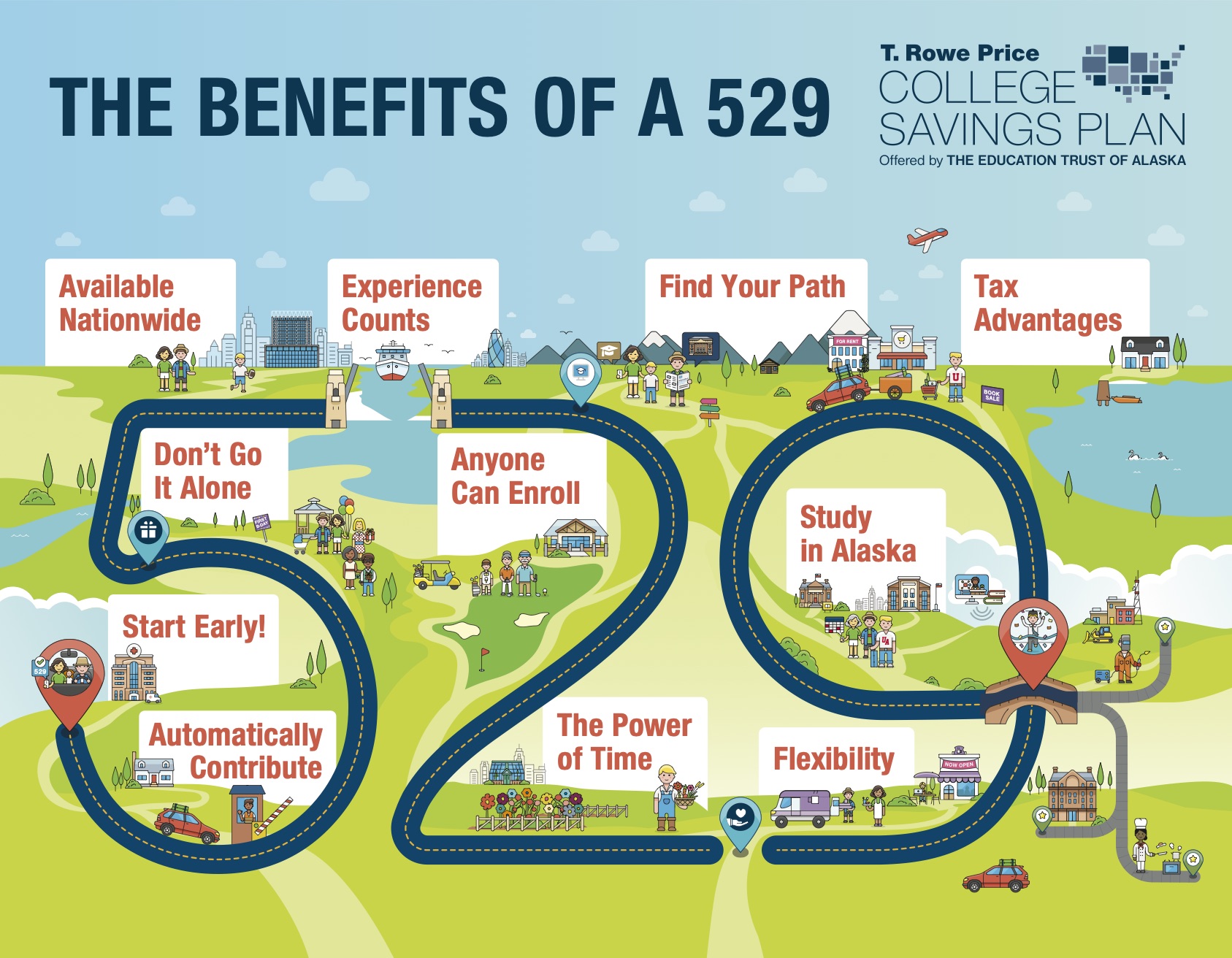

The Benefits Of A 529 Plan INFOGRAPHIC

529 Versus ESA The Best For College Savings Mark J Kohler

Are Contributions To 529 Plans Tax Deductible In New Jersey - As you progress through your NJ return there will be a question on the screen titled New Jersey College Affordability Deductions Answer Yes on that screen to go through that section of information Then you will see a place to enter your NJBEST contributions so that you can receive the deduction