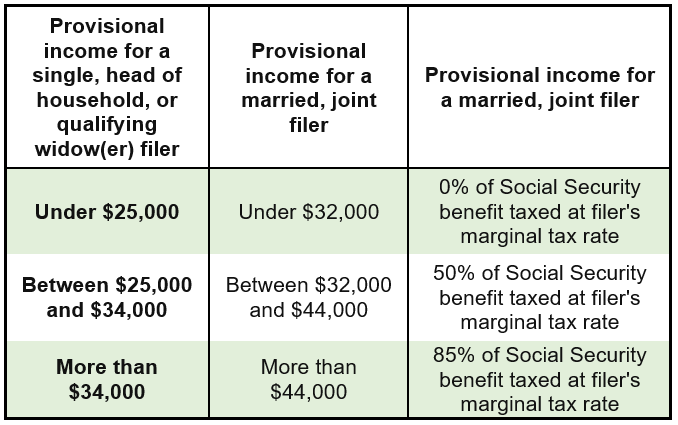

Are Disability Benefits Taxable In Nj The IRS sets the threshold for taxing Social Security disability benefits at the following limits 25 000 if you re single head of household or qualifying widow er 25 000

Unemployment compensation and temporary disability including family leave insurance benefits received from the State of New Jersey or as third party sick pay are The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received

Are Disability Benefits Taxable In Nj

Are Disability Benefits Taxable In Nj

http://www.disabilitybenefitscenter.org/sites/default/files/images/faq/is-disability-earned-income.jpg

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Are Disability Benefits Taxable Or Tax free NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2016/07/penywise-12-968x648.jpg

New Jersey disability income and unemployment benefits are not taxed on the state level However Social Security disability benefits may be taxable depending How much are disability benefits in New Jersey Disability benefit amounts vary depending on which program you qualify for TDI will consider your pre

If you suffer a temporary illness or injury as an employee but your medical condition wasn t due to your job you may be eligible for disability benefits through New Since 1948 New Jersey has required employers and employees to pay payroll taxes to fund a wage replacement insurance program for employees who suffer from a non work

Download Are Disability Benefits Taxable In Nj

More picture related to Are Disability Benefits Taxable In Nj

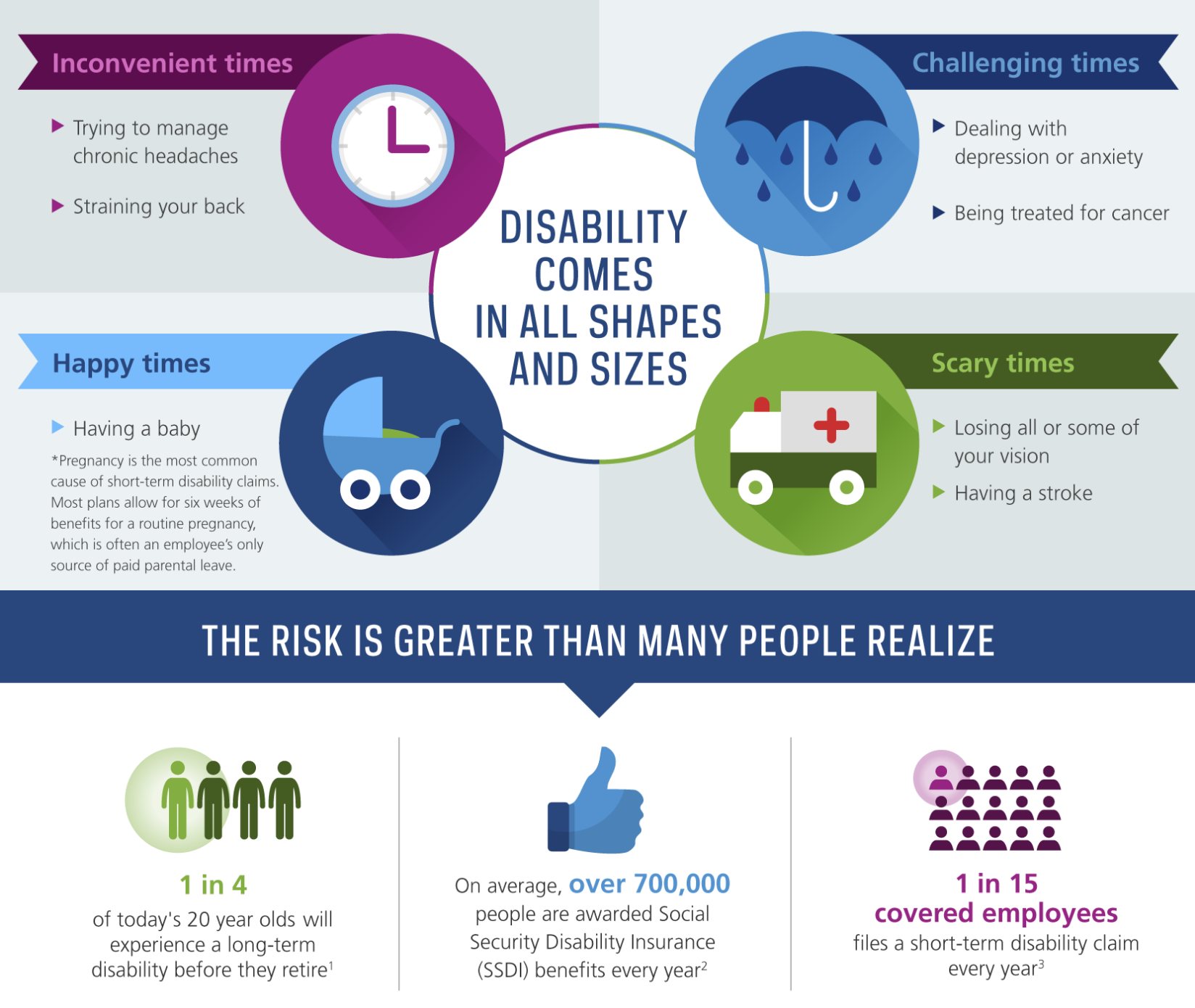

How Supplemental Disability Insurance Works For Doctors

https://www.sdtplanning.com/hs-fs/hubfs/Disability Insurance Infographic.png?width=4120&name=Disability Insurance Infographic.png

Social Security Disability Missoula Workers Compensation And Social

https://clarkforklaw.com/wp-content/uploads/2017/06/iStock-183295330.jpg

VA Disability Payment Increase VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/2020-va-disability-pay-chart-va-claims-insider-1.jpg

Temporary Disability Insurance benefits are not taxed by the State of New Jersey The amount of your benefits that is taxable will be reported to your employer in January of the year following the receipt of your benefits States that tax disability benefits only when the recipient s AGI is over a certain amount and states that tax disability benefits in the same way that the IRS

Temporary Disability benefits including family leave insurance benefits are not subject to the New Jersey state income tax according to NJ Dept of Taxation Social Security Disability Insurance SSDI benefits may be taxable if you receive income from other sources such as dividends or tax exempt interest or if your

Are Disability Insurance Benefits Taxable

https://www.longtermdisability.net/images/Dabdoub-Disability-insurance-taxable.jpg

Calculating Social Security Taxable Income TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

https://www.nj.com/news/2021/03/do-i-have-to-pay...

The IRS sets the threshold for taxing Social Security disability benefits at the following limits 25 000 if you re single head of household or qualifying widow er 25 000

https://ttlc.intuit.com/community/taxes/discussion/...

Unemployment compensation and temporary disability including family leave insurance benefits received from the State of New Jersey or as third party sick pay are

Are Disability Insurance Payments Taxable KnowYourInsurance

Are Disability Insurance Benefits Taxable

Are Disability Benefits Taxable Taxation Portal

Is Short Term Disability Taxable Taxation Portal

Are Disability Insurance Benefits Taxable Income KnowYourInsurance

Are Disability Insurance Benefits Taxable In Canada

Are Disability Insurance Benefits Taxable In Canada

2020 VA Disability Pay Chart Tucker Disability Law

Social Security Retirement Calculator 2021 MikailDalis

56 Of Social Security Households Pay Tax On Their Benefits Will You

Are Disability Benefits Taxable In Nj - If the disability insurance premium was deducted from your paycheck then the benefits received are tax free Then consider what happens if you are receiving