Are Electric Vehicle Rebates Taxable If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000

The short answer is that very few models currently qualify for the full 7 500 electric vehicle tax credit Others qualify for half that amount and some don t qualify at all The federal government offers tax credits for new and pre owned EVs These credits apply to EVs purchased in every state and can be claimed in addition to other state incentives These credits

Are Electric Vehicle Rebates Taxable

Are Electric Vehicle Rebates Taxable

https://www.rategenius.com/wp-content/uploads/FF-electric-cars-1024x491.jpg

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

Americans To Get Up To 2 500 Rebates On Electric Vehicles Under New

https://www.the-sun.com/wp-content/uploads/sites/6/2022/06/SC-Electric-Vehicle-Rebate-Comp-copy.jpg?w=660

People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models

You can claim the federal electric vehicle tax credit for your 2023 and 2024 taxes Here s what you need to know before you buy an electric car SUV or truck New plug in hybrid electric vehicles PHEVs are eligible for a 750 rebate new all electric vehicles are eligible for a rebate up to 1 000 and income qualifying customers are eligible for

Download Are Electric Vehicle Rebates Taxable

More picture related to Are Electric Vehicle Rebates Taxable

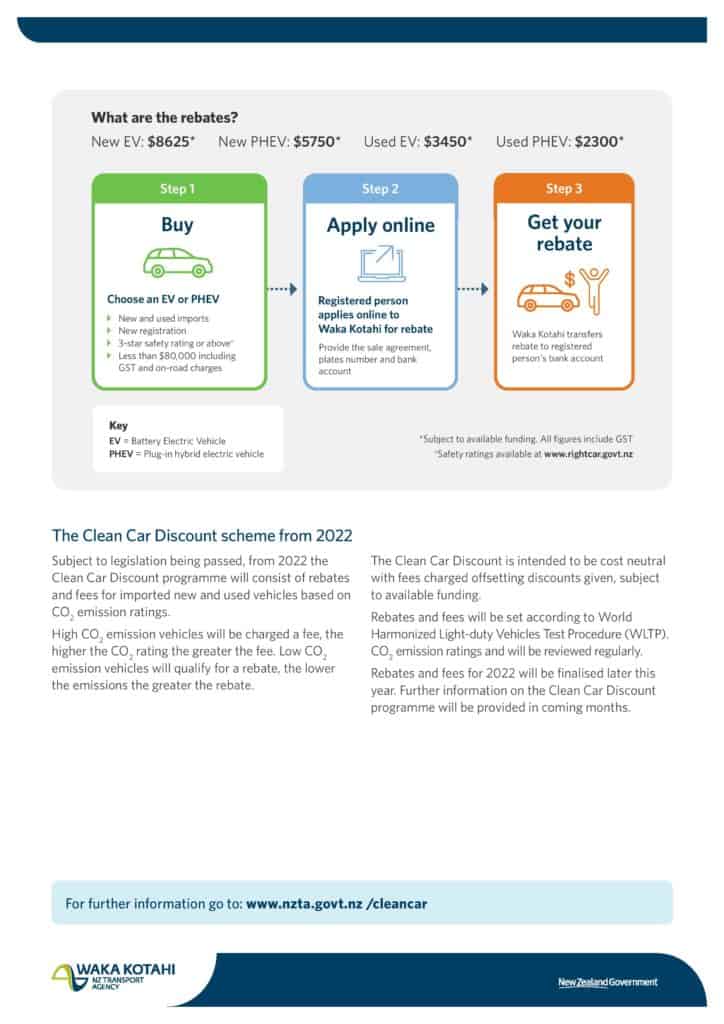

Webinar Clean Charge Network

https://cleanchargenetwork.com/wp-content/uploads/bb-plugin/cache/GettyImages-666658370-sq-1200-circle.jpg

Electric Vehicle Rebate Program Clean Fuels Michigan

https://cleanfuelsmichigan.org/wp-content/uploads/2022/05/EV-Rebate-Program.png

Electric Vehicle Tax Incentives Rebates Guide Constellation

https://www.constellation.com/content/constellation/en/energy-101/energy-education/electric-vehicle-tax-incentives-and-rebates/jcr:content/ogimage.img.png/electric-vehicle-tax-credit.png

Qualifying EVs purchased after December 31 2009 entitle you to a tax credit of 2 500 plus 417 for a vehicle that draws propulsion energy from a battery with at least five kW hours of capacity An additional 417 for Currently the tax credit for purchasing a qualifying new battery electric and plug in hybrid vehicles is either 3750 or 7500 Used EVs and PHEVs sold for 25 000 or less are also

If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both Eligible taxpayers can get a rebate of up to 4 500 for FCEVs 2 000 for BEVs 1 000 for PHEVs and 750 for emissions free motorcycles

Proposed Guidance Released For Electric Vehicle Point of Sale Discounts

https://www.motormoutharabia.com/wp-content/uploads/2023/07/mfrack_realistic_photo_of_future_Electric_Vehicle_d6fe61a9-2302-4e41-bcf1-b8c74c475c39.jpeg

As Electric Vehicle Rebates Expand Ontario Falls Behind CTV News

https://www.ctvnews.ca/polopoly_fs/1.5872726.1650664994!/httpImage/image.jpg_gen/derivatives/landscape_620/image.jpg

https://www.npr.org/2023/01/07/1147209505

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000

https://www.kiplinger.com/taxes/ev-tax-credit

The short answer is that very few models currently qualify for the full 7 500 electric vehicle tax credit Others qualify for half that amount and some don t qualify at all

Electric Vehicle Rebate Phase Out ElectricRebate

Proposed Guidance Released For Electric Vehicle Point of Sale Discounts

Are Buyer Agent Commission Rebates Taxable In NYC YouTube

Massachusetts Electric Vehicle Rebates Would Be Revived Under Climate

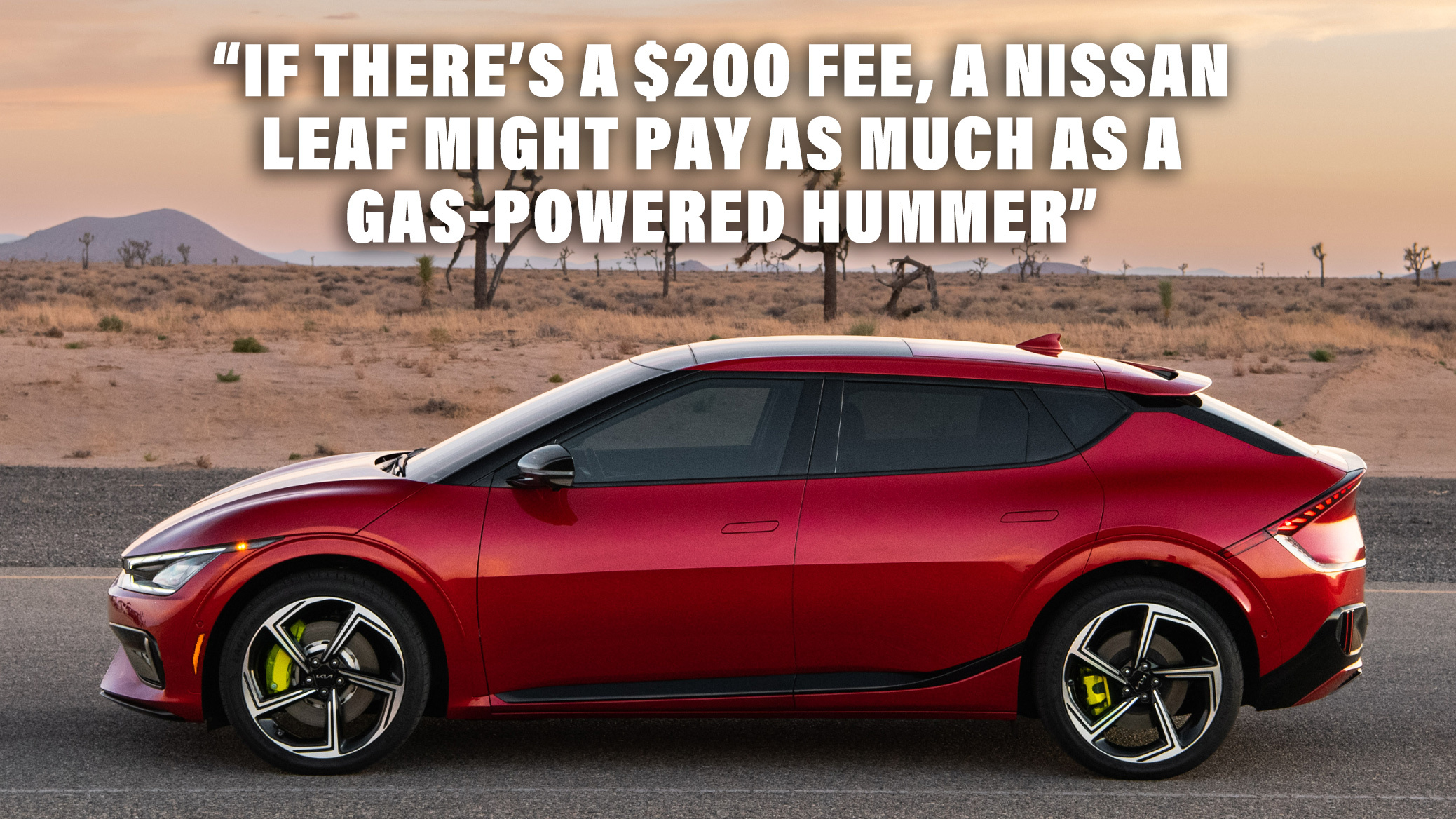

Texas Passes Bill To Charge Electric Vehicle Owners 200 Annual Fee

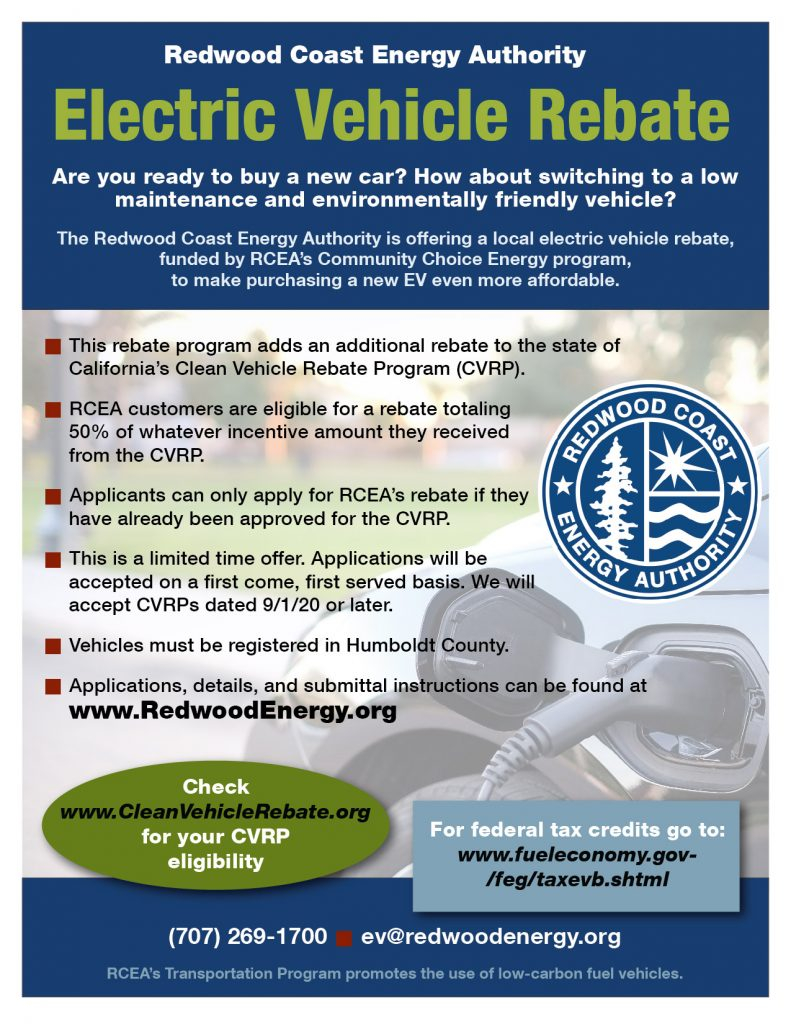

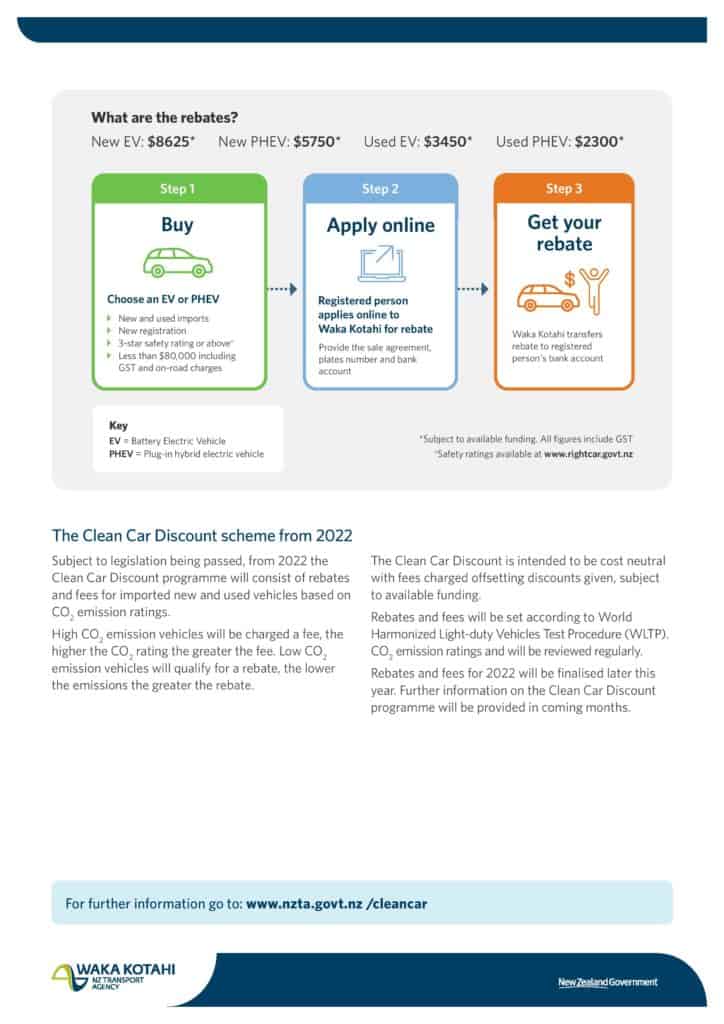

New Electric Vehicle Rebates NZTA Clean Car Autohub NZ

New Electric Vehicle Rebates NZTA Clean Car Autohub NZ

Are Idaho s Tax Rebates Taxable KBOI

Ontario Offers Electric Vehicle Rebates Of Up To 75 000 For Businesses

Make Electric Vehicle Rebates Available At The Point Of Purchase

Are Electric Vehicle Rebates Taxable - California EV Rebate Limits In addition to federal tax credits California has also implemented several incentive programs to kick start the popularity of EVs These include rebates and tax