Welcome to Our blog, a space where inquisitiveness fulfills info, and where daily subjects become appealing conversations. Whether you're seeking understandings on lifestyle, innovation, or a bit of everything in between, you've landed in the right area. Join us on this exploration as we dive into the realms of the common and phenomenal, understanding the world one post each time. Your journey into the fascinating and diverse landscape of our Are Employer Contributions To Hsa Taxable starts right here. Explore the captivating content that waits for in our Are Employer Contributions To Hsa Taxable, where we decipher the intricacies of various topics.

Are Employer Contributions To Hsa Taxable

Are Employer Contributions To Hsa Taxable

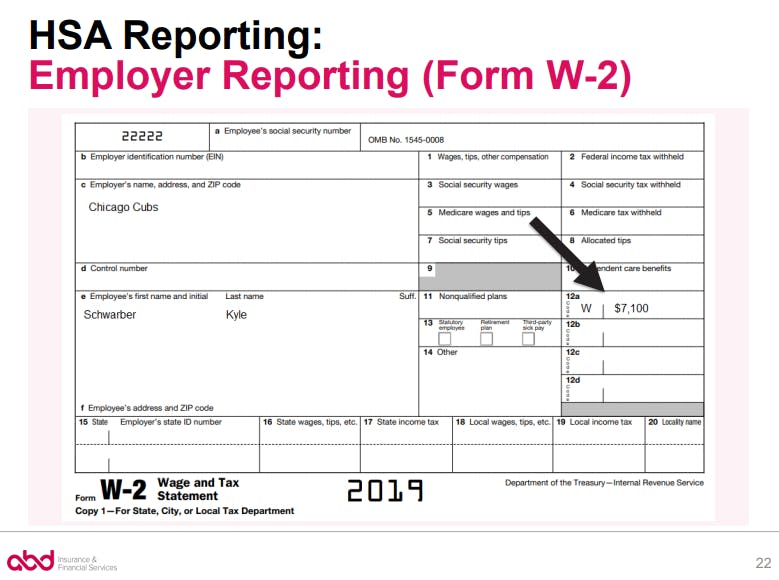

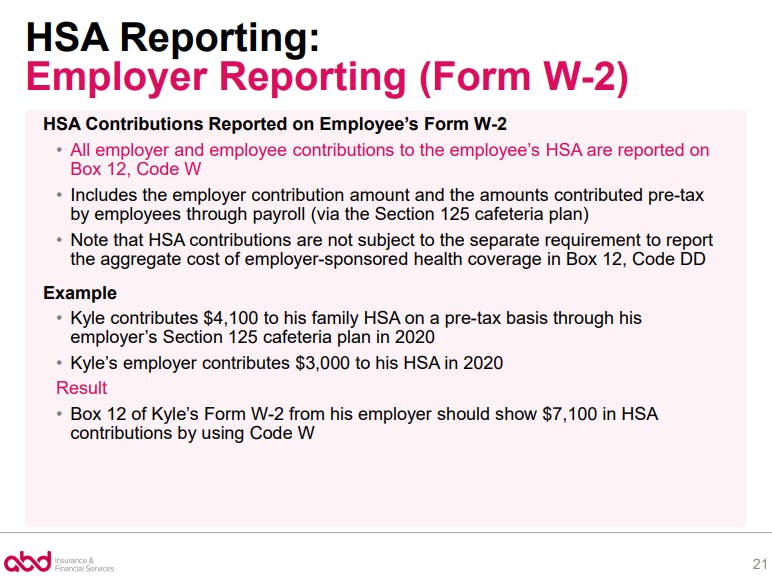

HSA Form W 2 Reporting

HSA Form W 2 Reporting

HSA Form W 2 Reporting

HSA Form W 2 Reporting

Gallery Image for Are Employer Contributions To Hsa Taxable

Are Employer Contributions To Health Insurance Premiums Eligible For

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

The Value Of Employer Contributions To Employee HSAs Wellness Works

Hoeveel Betaalt Een Werkgever Aan Loonbelasting Loonbelasting UAC Blog

How Much Can You Contribute To An Hsa In 2022 2022 CGR

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

HSA Employer Contribution Rules Limits Taxes And More

Thanks for choosing to discover our site. We regards hope your experience exceeds your expectations, which you find all the details and resources about Are Employer Contributions To Hsa Taxable that you are seeking. Our dedication is to offer a straightforward and helpful system, so do not hesitate to browse via our pages effortlessly.