Are Energy Efficient Appliances Tax Deductible In 2023 Here s some good news The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after

Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 qualified energy The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit

Are Energy Efficient Appliances Tax Deductible In 2023

Are Energy Efficient Appliances Tax Deductible In 2023

https://www.solarreviews.com/content/images/blog/post/focus_images/1092_shutterstock_701043430.jpg

Guide To Rental Property Appliance Depreciation FortuneBuilders

https://www.fortunebuilders.com/wp-content/uploads/2020/02/are-appliances-tax-deductible-768x512.jpg

Conserving Energy During Periods Of Peak Usage Office Of Sustainability

https://sustainability.tufts.edu/wp-content/uploads/unplug-appliances.jpg

There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the Energy efficiency tax credits Reducing energy consumption saves money and natural resources The IRA includes multiple clean energy tax credits to help you

Download Are Energy Efficient Appliances Tax Deductible In 2023

More picture related to Are Energy Efficient Appliances Tax Deductible In 2023

How Appliances Affect Your Household s Electricity Consumption

https://startsmarter.co.uk/wp-content/uploads/2022/06/households-electricity-consumption.jpg

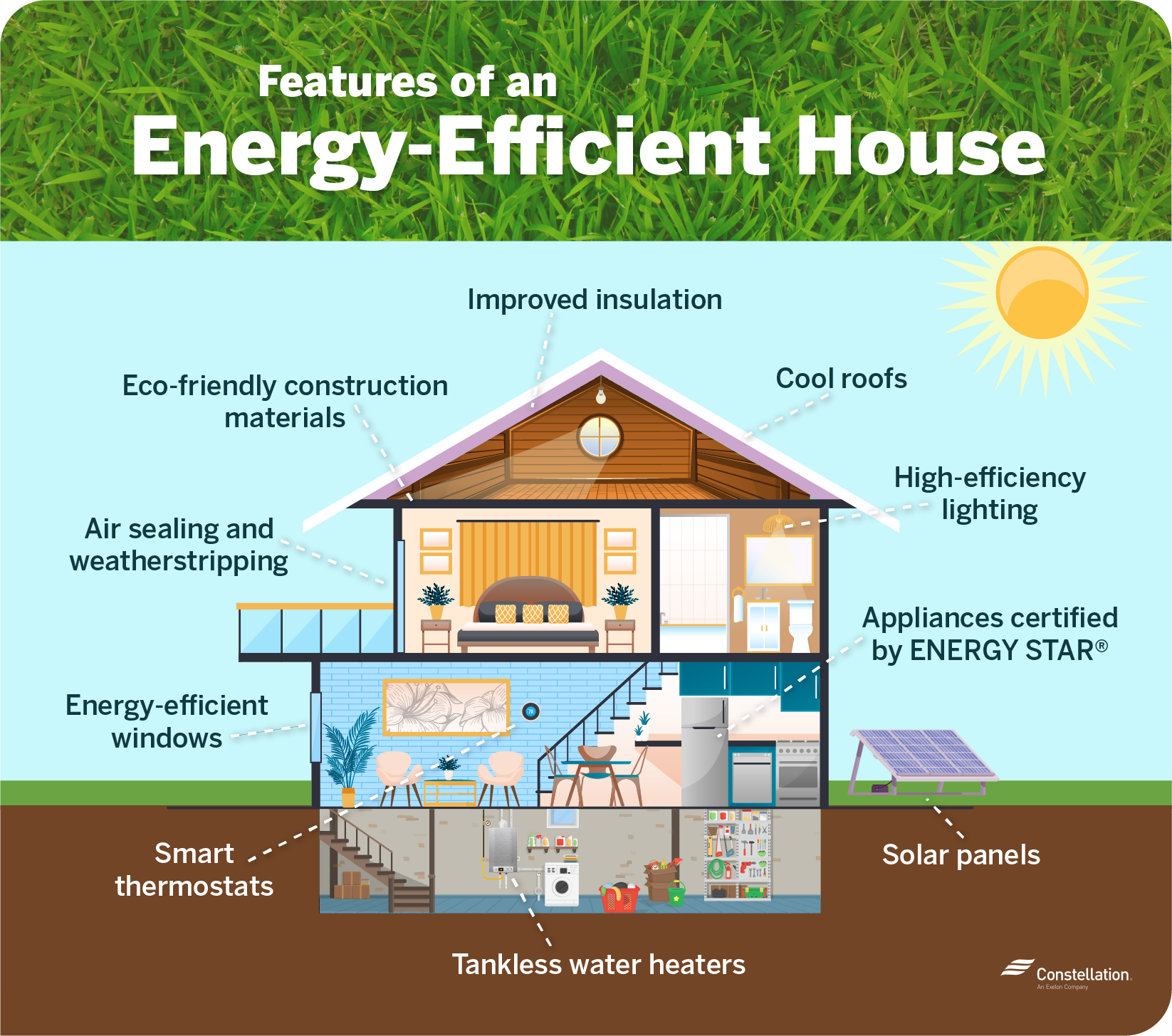

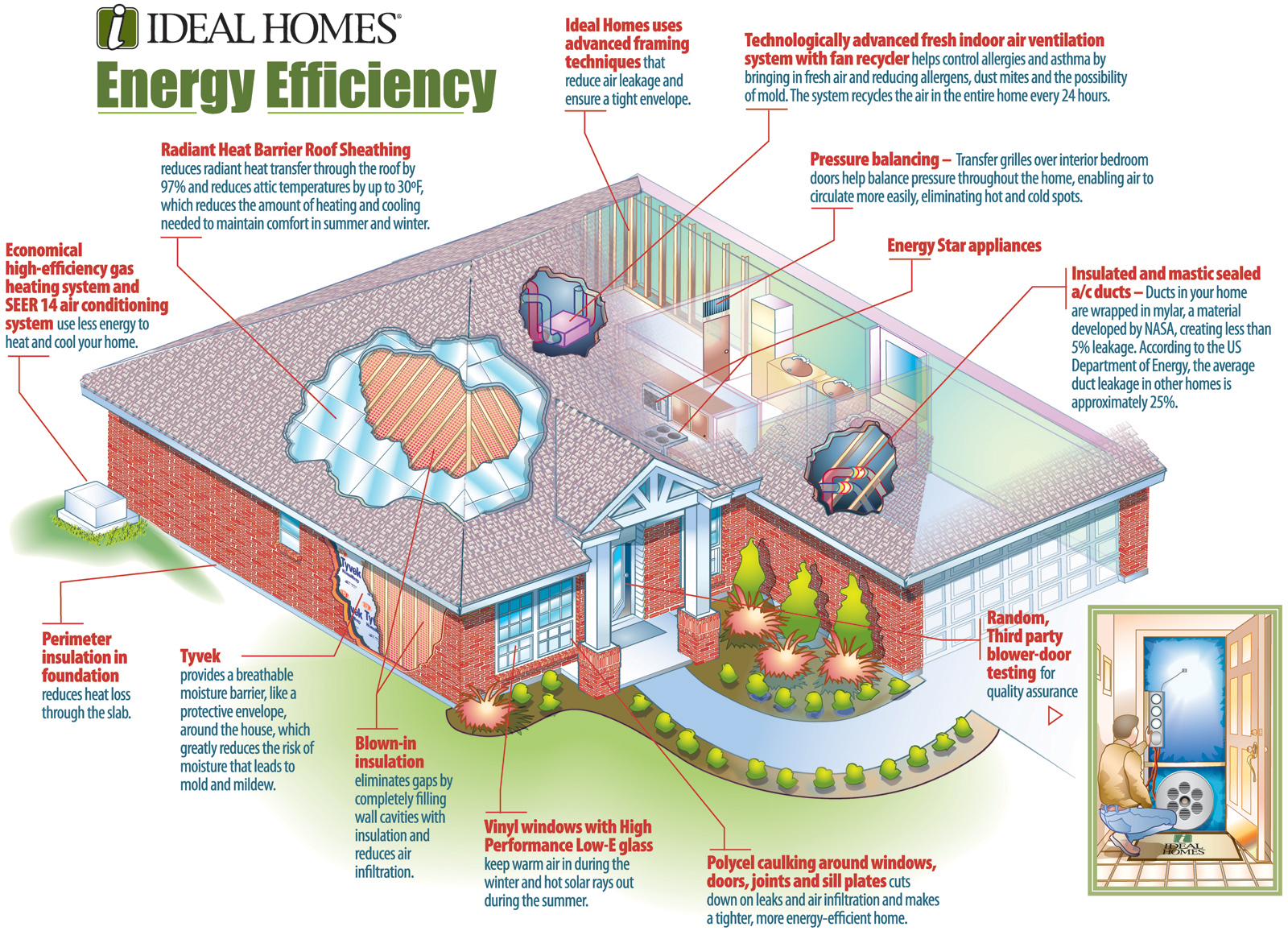

Efficient Home Design Home Design Ideas

https://blog.constellation.com/wp-content/uploads/2021/08/ways-to-make-your-home-more-energy-efficient.png

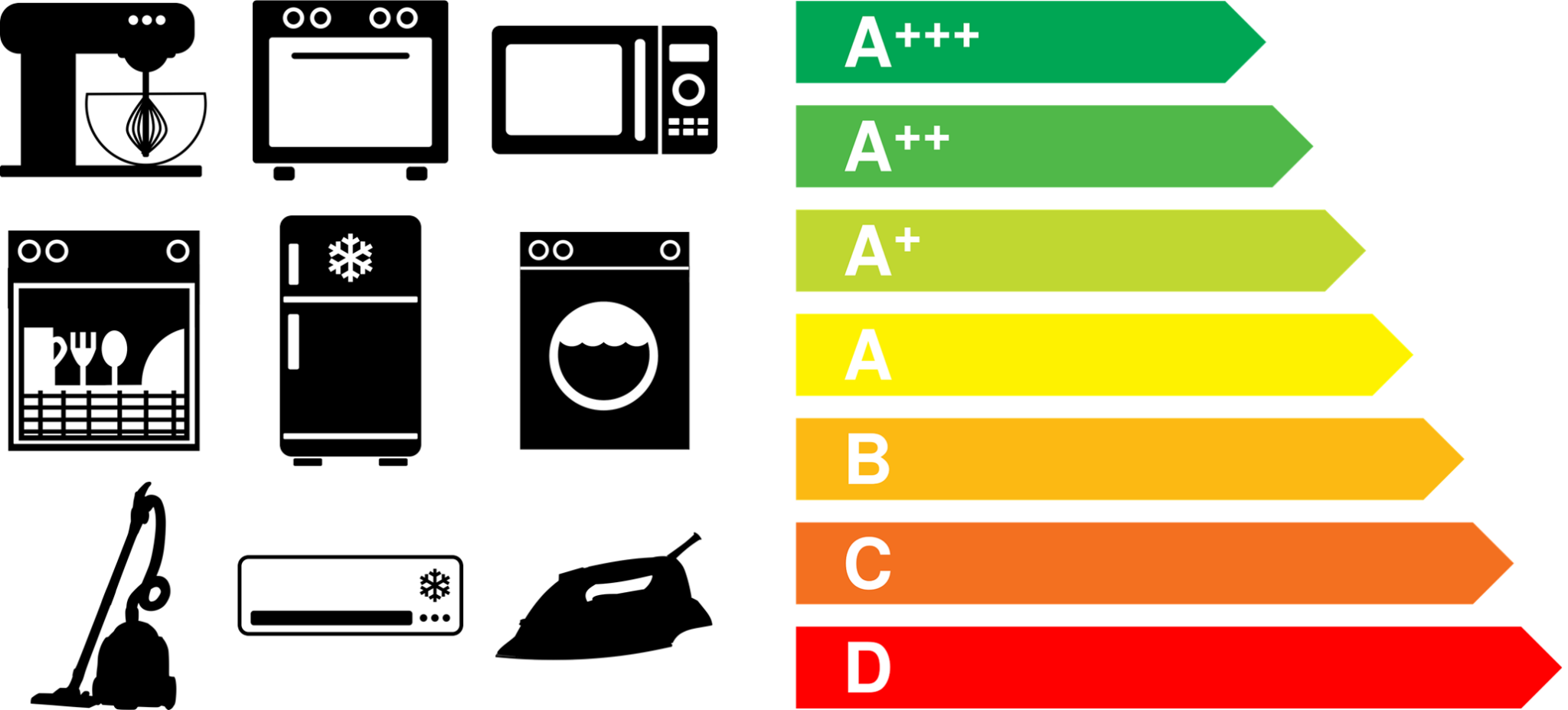

Energy Efficient Appliances How To Go Greener 15 Acre Homestead

https://15acrehomestead.com/wp-content/uploads/2018/09/image1.jpg

Information updated 2 16 2023 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories Element BTax Year 2022 Filed in 2023 Major Changes for Tax Year 2023 and eyond Rate 10 30 Qualifying Expenses Qualifying energy efficiency

Can I claim energy efficient appliances or energy saving home improvements SOLVED by TurboTax 4154 Updated November 29 2023 You can t Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A

![]()

Energy Efficient Loads Open Source Solar Project

http://www.opensourcesolar.org/w/images/thumb/c/c2/Loadsicon.png/1200px-Loadsicon.png

Energy Efficient Appliances And Their Benefits Free Hot Nude Porn Pic

https://greenplanetusa.com/wp-content/uploads/2016/09/energy-efficient-appliances-and-their-benefits.jpg

https://www.energystar.gov/products/ask-the...

Here s some good news The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after

https://www.irs.gov/credits-deductions/frequently...

Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 qualified energy

8 Awesome Kitchen Remodeling Ideas To Boost Resale Value The Stephen

Energy Efficient Loads Open Source Solar Project

Turning Off AC When Not Home A Good Or Bad Idea OBSiGeN

Are Energy Efficient Appliances Tax Deductible Garden

5 Reasons You Should Unplug All Your Appliances When Heading Out A

Making Summer More Energy Efficient The Afro News

Making Summer More Energy Efficient The Afro News

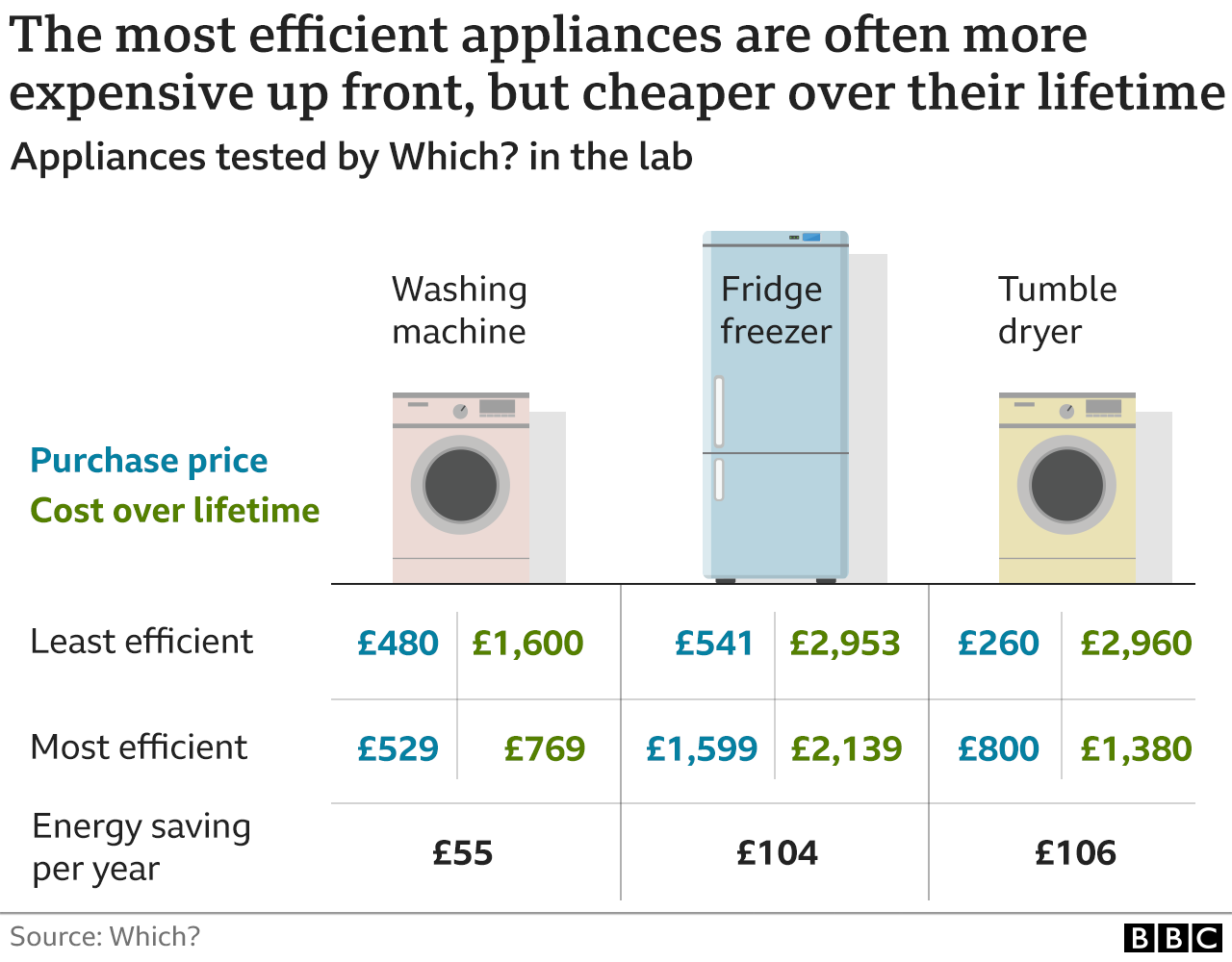

Greener Kitchen Goods Could Save Thousands Which Suggests BBC News

Planning Energy Efficiency Before A Home Is Built

Are Appliances Tax Deductible

Are Energy Efficient Appliances Tax Deductible In 2023 - Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity Fuel Cells 30 of cost Wind Turbine Battery Storage N A 30 of cost Heating Cooling