Are Federal Taxes Deductible For Corporations A domestic entity electing to be classified as an association taxable as a corporation must generally file Form 1120 U S Corporation Income Tax Return to report its income

C corporations can lower their taxes and avoid double taxation in a number of ways Following are some of the most common strategies to save on taxes Withhold dividends Withhold dividend State and municipal taxes imposed on businesses are deductible expenses for federal income tax purposes Other significant items No deduction generally is

Are Federal Taxes Deductible For Corporations

Are Federal Taxes Deductible For Corporations

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 following the passage of the Tax Cuts and Jobs Act of 2017 State and local taxes and rules vary by jurisdiction The IRS allows you to deduct the first 5 000 of those costs on your corporate taxes This also applies to investigating and purchasing a new business

The corporate income tax raised 424 7 billion in fiscal year 2022 accounting for 8 7 percent of total federal receipts and 1 7 percent of GDP Taxable corporate profits are equal to a corporation s receipts less A corporate taxpayer generally also can claim a credit for 80 of the foreign taxes associated with GILTI Detailed description of income determination for corporate

Download Are Federal Taxes Deductible For Corporations

More picture related to Are Federal Taxes Deductible For Corporations

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Here s Where Your Federal Income Tax Dollars Go NBC News

https://media1.s-nbcnews.com/j/streams/2012/april/120404/289542-jschoen57135fcc-03a7-e4b3-f988-fc39db2b8ce9.nbcnews-ux-2880-1000.jpg

The short term debt exception also referred to as the commercial paper exception provides that non residents and foreign corporations are not subject to US During 2018 through 2025 owners of sole proprietorships partnerships limited liability companies and S corporations may deduct for income tax purposes up to 20 of the

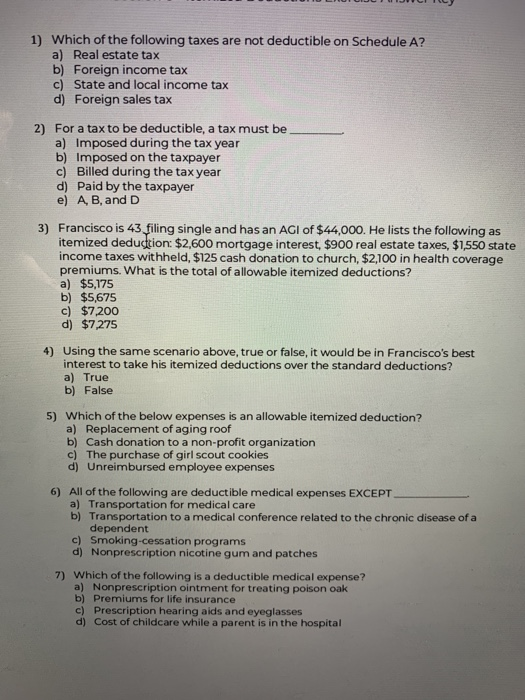

No federal taxes are never deductible whether it s a corporation or individual return State and local taxes are though Here s why if you deduct your prior year s federal tax The following section summarizes some of the key corporate income tax considerations related to stock based compensation under US federal income tax laws and

High Taxes Not The 7 25 Minimum Wage Are Holding Pennsylvanians Back

https://www.pennlive.com/resizer/kAYACNL5leWh4zOfM1h_O4IxK1A=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/opinion/photo/high-taxes-f797d00382d0fcb8.jpg

Where Do Your Tax Dollars Go Tax Foundation

https://files.taxfoundation.org/legacy/docs/Federal Spending by Type 2014_0.png

https://www.irs.gov/publications/p542

A domestic entity electing to be classified as an association taxable as a corporation must generally file Form 1120 U S Corporation Income Tax Return to report its income

https://tax.thomsonreuters.com/blog/how-ar…

C corporations can lower their taxes and avoid double taxation in a number of ways Following are some of the most common strategies to save on taxes Withhold dividends Withhold dividend

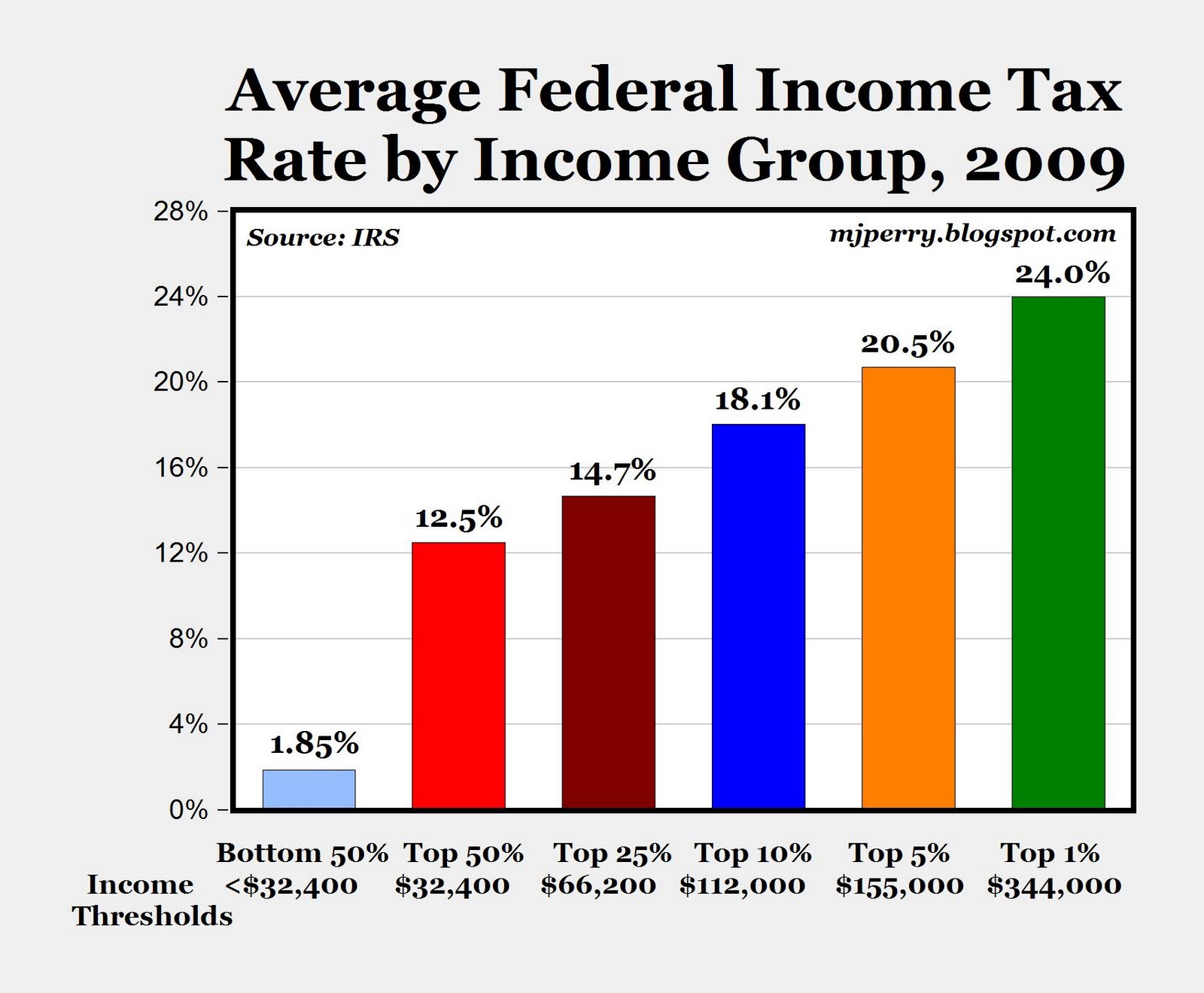

Who Pays Federal Taxes Source

High Taxes Not The 7 25 Minimum Wage Are Holding Pennsylvanians Back

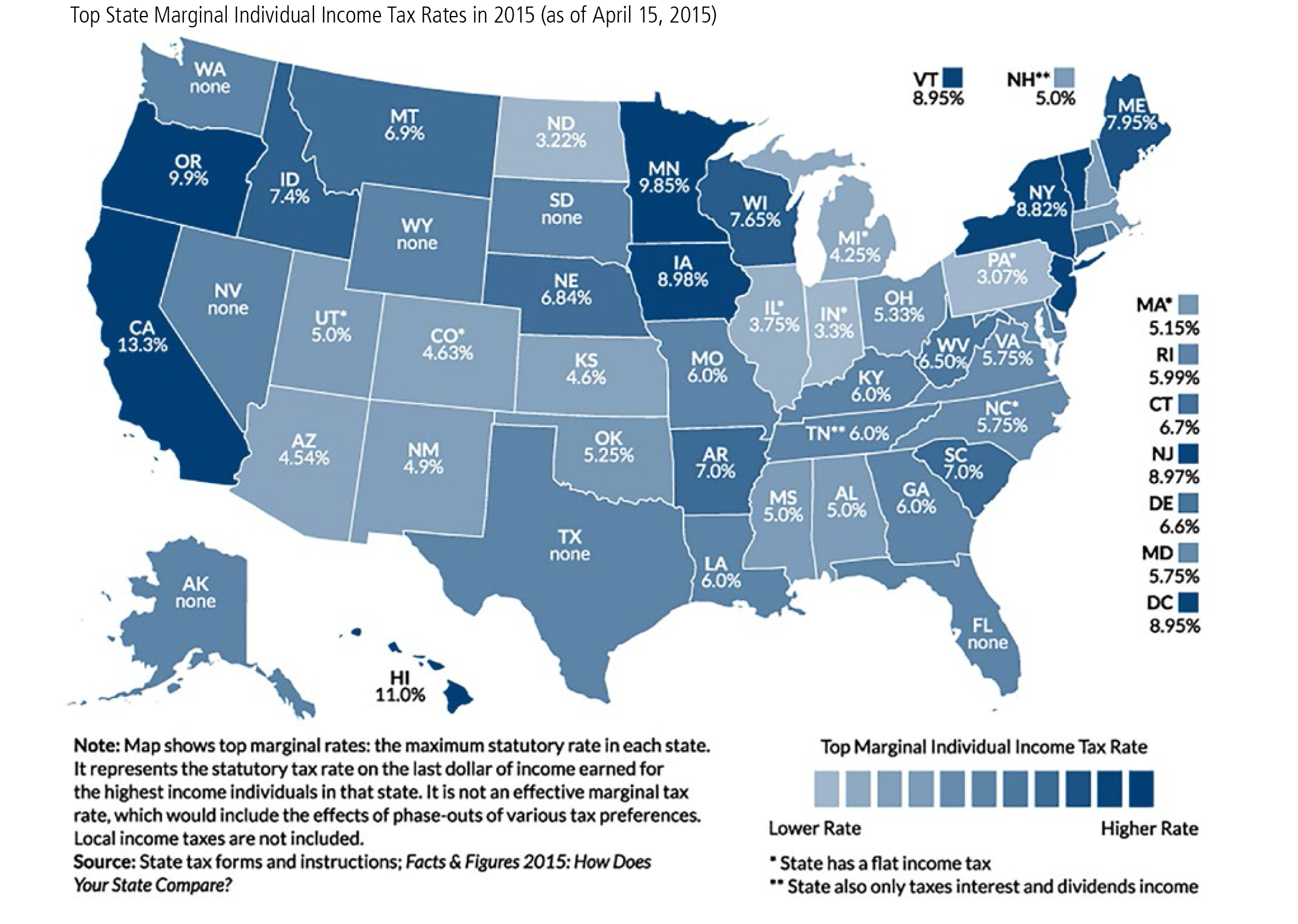

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

CARPE DIEM Warren Buffett Updates He Sheltered Millions Through

Tax Deductions Write Offs To Save You Money Financial Gym

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

How Federal Income Tax Rates Work Full Report Tax Policy Center

Are Federal Taxes Deductible For Corporations - Legitimate corporate payments for shareholder employee compensation can be deducted as ordinary and necessary business expenses Sec 162 a 1 Of course