State Of Illinois Rebate Checks 2024 The extended due date for filing your return is October 15 2024 Quarterly 2024 estimated payments can be made in four equal installments based upon 90 percent of the expected liability for year 2024 or 100 percent of the liability of year 2023 to avoid penalty if the payments are made timely

Allowance of retroactive rebates for the Home Efficiency Rebate Program Section 50121 that are initiated on or after August 16 2022 meet all USDOE requirements and all state program requirements Allowance of virtual inspections for the Home Electrification and Appliance Rebate Program Section 50122 As part of the state of Illinois new budget agreement for fiscal year 2023 millions of taxpayers will be eligible for direct payment checks with lawmakers saying that the payments will be

State Of Illinois Rebate Checks 2024

State Of Illinois Rebate Checks 2024

https://cdn.abcotvs.com/dip/images/12010375_070122-wls-electric-vehicle-rebate-img.jpg?w=1600

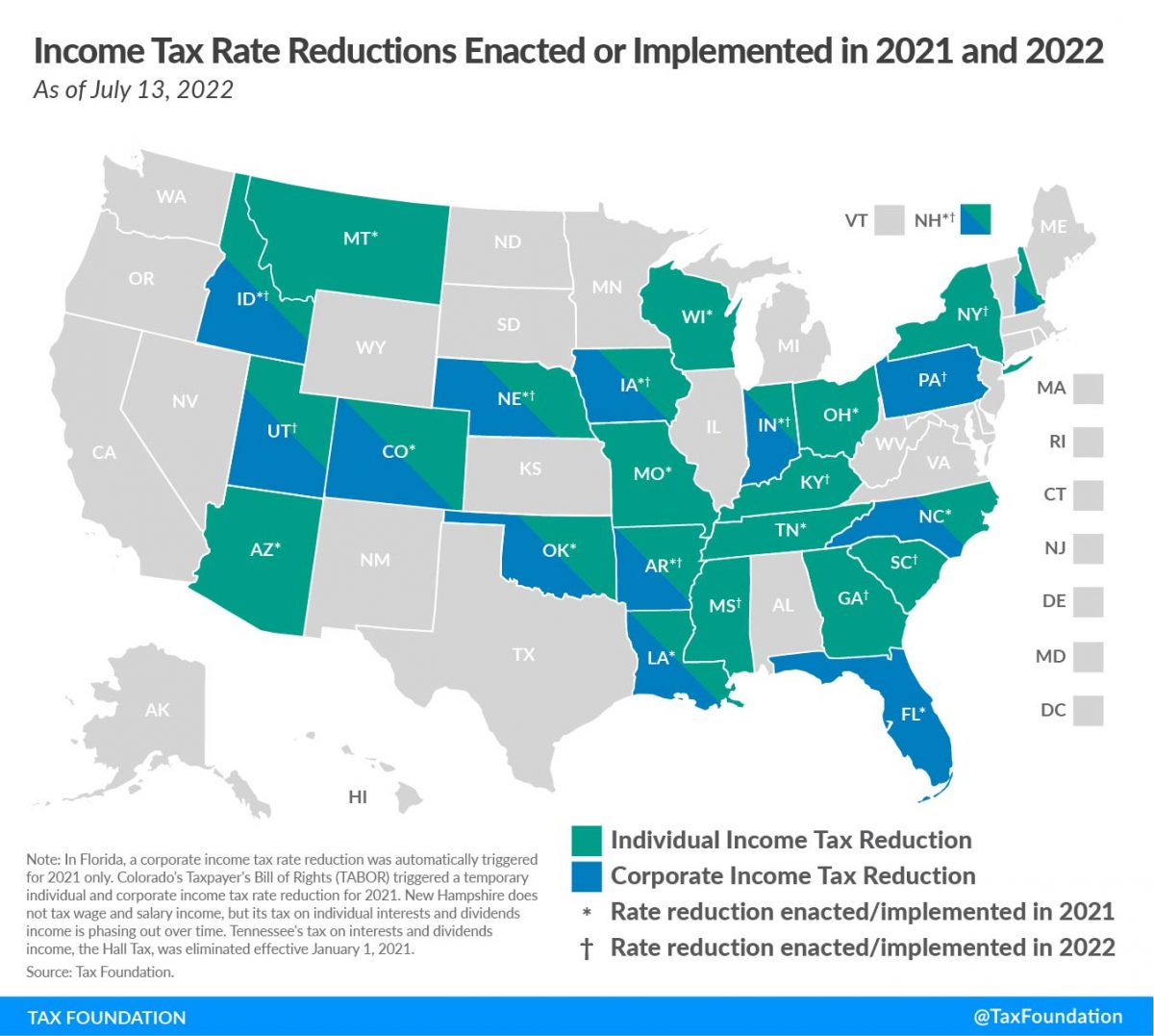

2022 State Tax Reform State Tax Relief Rebate Checks

https://files.taxfoundation.org/20220713163857/2022-state-tax-reform-and-2022-state-tax-relief-enacted-in-2022-state-gas-tax-holiday-state-sales-tax-holiday-state-tax-cuts-state-income-tax-cuts-state-rebate-checks-1200x1077.jpg

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

Property tax Are You Getting Relief Checks From Illinois Here s How to Check Your Rebate Status Under Gov J B Pritzker s Illinois Family Relief Plan one time individual income tax and How Do I Check the Status of my Rebates For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing can also call 1 800 732 8866 or

The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Illinois tax Homeowners who were able to claim the property tax credit on their 2021 tax returns will receive an additional rebate equal to the credit they claimed up to a maximum of 300 Those rebates will go to filers who earned less than 250 000 or 500 000 for a couple filing jointly No further action is needed from eligible Illinoisans who filed

Download State Of Illinois Rebate Checks 2024

More picture related to State Of Illinois Rebate Checks 2024

State Of New Mexico Rebate Checks 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Mexico-Renters-Rebate-2023.jpg

New York State Star Rebate Checks LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/new-york-state-star-rebate-checks-2-1536x868.jpg

Gov Murphy Signs NJ 2022 Budget With 500 Rebate Checks Holmdel NJ Patch

https://patch.com/img/cdn20/users/1062528/20210629/102319/styles/patch_image/public/money-3___29102258633.jpg

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but You can check the status of your rebate by going to this site You will need your social security number and either Illinois tax PIN or 2021 Adjusted Gross Income as it appeared on your tax forms

The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the rebate you must be an Illinois Individuals who filed income taxes as an Illinois resident in 2021 are eligible for the income tax rebate permitting they have an adjusted gross income of less than 200 000 double if filed jointly The rebate is 50 a person the amount is also double for joint filers There s also a 100 rebate each for up to three dependents

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

New York State To Send STAR Rebate Checks To More Than 2 Million Homeowners This Fall Syracuse

https://www.syracuse.com/resizer/iVEbcLLiSpBxD5qBWwsRxoo2lDA=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/S5PXB2KOABDLTBXLZC55TVQRCI.jpg

https://tax.illinois.gov/research/publications/bulletins/fy-2024-18.html

The extended due date for filing your return is October 15 2024 Quarterly 2024 estimated payments can be made in four equal installments based upon 90 percent of the expected liability for year 2024 or 100 percent of the liability of year 2023 to avoid penalty if the payments are made timely

https://epa.illinois.gov/topics/energy/energy-rebates.html

Allowance of retroactive rebates for the Home Efficiency Rebate Program Section 50121 that are initiated on or after August 16 2022 meet all USDOE requirements and all state program requirements Allowance of virtual inspections for the Home Electrification and Appliance Rebate Program Section 50122

A Relative Handful Waiting On Illinois Tax Rebate Checks

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

Stimulus Check 2023 Which States Are Sending Rebate Payments Kiplinger

State To Issue New Round Of Rebate Checks YouTube

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

State Mailing Out 2 5M Property Tax Rebate Checks Newsday

Tax Rebate Check Is On The Table As State Eyes Budget Cuts Newsday

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

Illinois Tax Rebate 2022 Cray Kaiser

State Of Illinois Rebate Checks 2024 - How Do I Check the Status of my Rebates For additional information or to check on the status of a rebate visit tax illinois gov rebates Those needing can also call 1 800 732 8866 or