Are Franking Credits Tax Deductible When a corporate tax entity receives a franked dividend the receipt is effectively neutral from a tax perspective This is because it is entitled to a franking tax offset for the franking credit

Franking credits Franking credits attached to franked dividends received by the following organisations may be refundable provided the eligibility criteria are met registered When a company pays income tax the ATO provides the company with a credit of the same value known as an imputation credit or franking credit Later this tax credit can be

Are Franking Credits Tax Deductible

Are Franking Credits Tax Deductible

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Home Awnings Tax Deductible Or Tax Credit Qualified AZ Awnings

https://lirp.cdn-website.com/739d0cb2/dms3rep/multi/opt/are+awnings+tax+deductible-1920w.jpeg

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

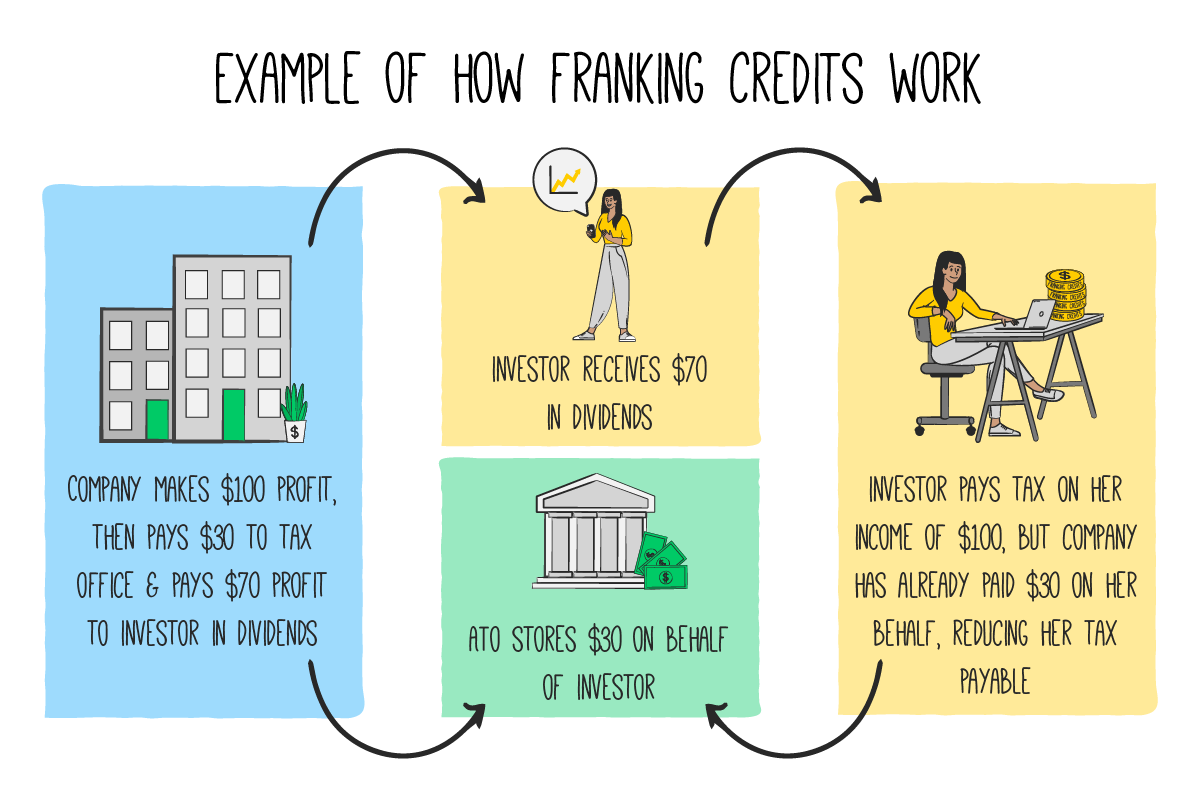

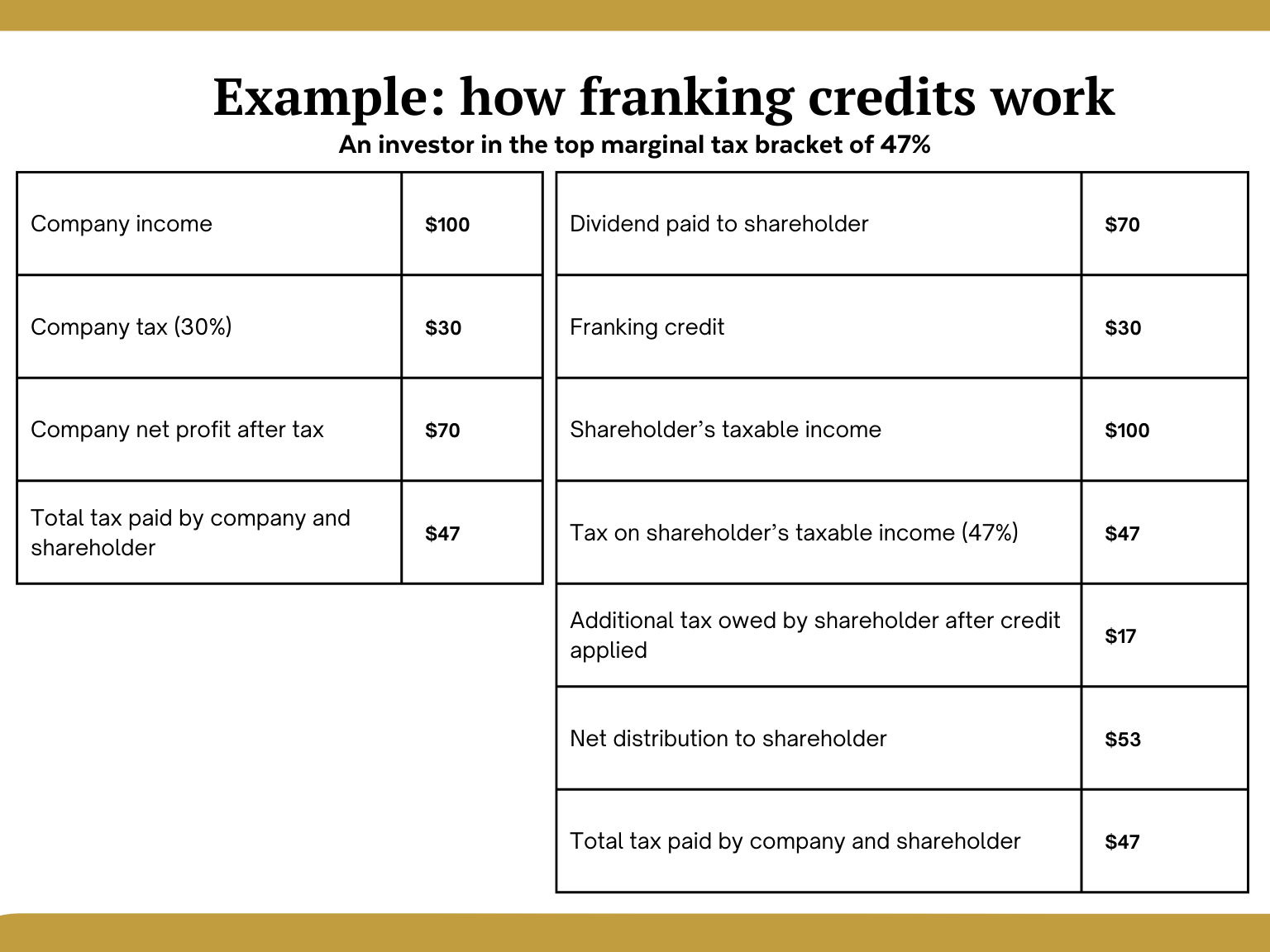

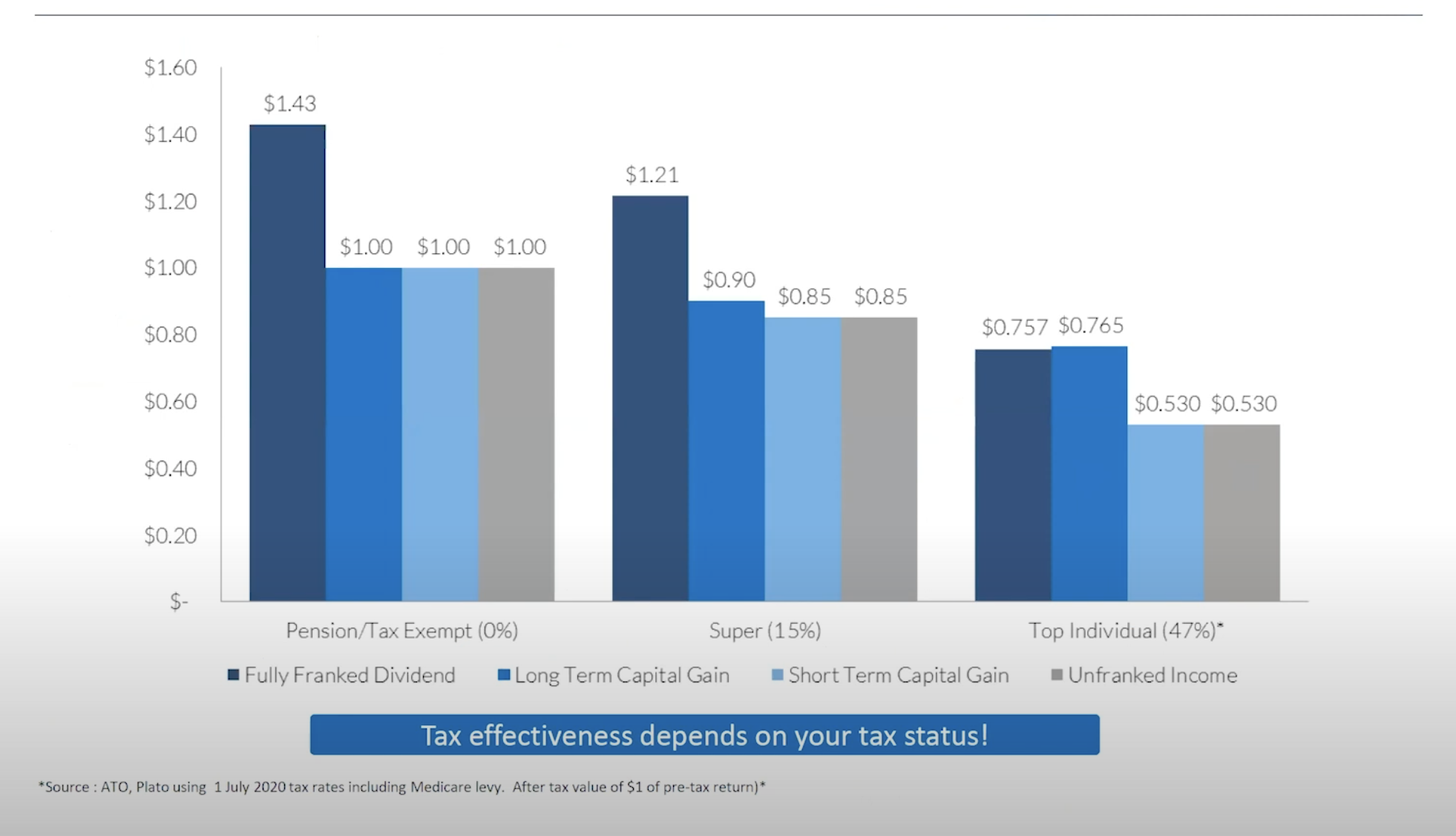

When you receive a fully franked dividend you get a credit for the 30 company tax already paid Investors dividend income is taxed at their personal marginal tax rate Any tax payable however is reduced by the In Australia the corporate tax system allows certain companies to attribute some or all of the tax paid on their profits to their shareholders by way of a tax credit or franking credits A dividend is considered franked when a

A franking credit is usually recorded in the account if the entity gets a franked distribution pays PAYG instalments or income tax or is liable for franking deficit tax FDT The credit is equivalent to the tax amount or PAYG Companies are not entitled to a refund of franking tax offsets however they may be able to convert them to carried forward losses in subsequent years Companies are able to

Download Are Franking Credits Tax Deductible

More picture related to Are Franking Credits Tax Deductible

How Do Franking Credits Work Stimulate Accounting

https://stimulateaccounting.com.au/wp-content/uploads/2021/05/franking-credits-imputation.jpg

What Are Franking Credits And How Do They Work Financial Autonomy

https://financialautonomy.com.au/wp-content/uploads/2022/10/Tax-2.jpg

Ergeon How Your Fence Can Be Tax Deductible

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

Franking credits are provided to shareholders when companies pay income tax on their taxable income and distribute their after tax profits These credits are attached to franked If you have more than 5 000 in franking credits from a single parcel of shares and did not satisfy the holding period rule for those franking credits you have no entitlement to a

While the entire franking credit of the over franked distribution remains valid for the shareholder the company must pay the 900 over franking tax by 31 July a month after the income year end This tax payment doesn t Franking credits can significantly reduce tax liability offering a tax advantage that enhances financial planning By offsetting tax payable on grossed up dividend income they

Do cash Payments Count Toward My Health Insurance Deductible

https://www.pocketero.com/blog/content/images/size/w2000/2022/07/cash-discount-payments-count-toward-insurance-deductible.jpg

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

https://assets.livewiremarkets.com/rails/active_storage/blobs/proxy/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBMnI0QVE9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--e8fb80da9cdf3a23040080ca6ccd6820f3e31b69/Vanguard US Total Market Shares ETF (ASX code VTS).png

https://www.ato.gov.au › businesses-and...

When a corporate tax entity receives a franked dividend the receipt is effectively neutral from a tax perspective This is because it is entitled to a franking tax offset for the franking credit

https://www.ato.gov.au › ... › franking-credits

Franking credits Franking credits attached to franked dividends received by the following organisations may be refundable provided the eligibility criteria are met registered

Corporation Prepaid Insurance Tax Deduction Financial Report

Do cash Payments Count Toward My Health Insurance Deductible

What Are Franking Credits HD YouTube

How Retirees Benefit From Franking Credits Plato Investment Management

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Tax Deductions

Franking Credits Explained What Are They And How Do They Work

Franking Credits Explained What Are They And How Do They Work

Franking Credits Guidelines Expat US Tax

Time For Facts On Franking Credits The Australia Institute

Why The Government Doesn t Want You To Understand How Franking Credits

Are Franking Credits Tax Deductible - Franking credits are an income tax deduction that refunds the portion of the dividend where the company has paid tax Also known as an imputation credit shareholders