Are Health And Dental Premiums Tax Deductible Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related Dental insurance premiums may be tax deductible The Internal Revenue Service IRS says that to be deductible as a qualifying medical expense the expenditures must be for

Are Health And Dental Premiums Tax Deductible

Are Health And Dental Premiums Tax Deductible

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

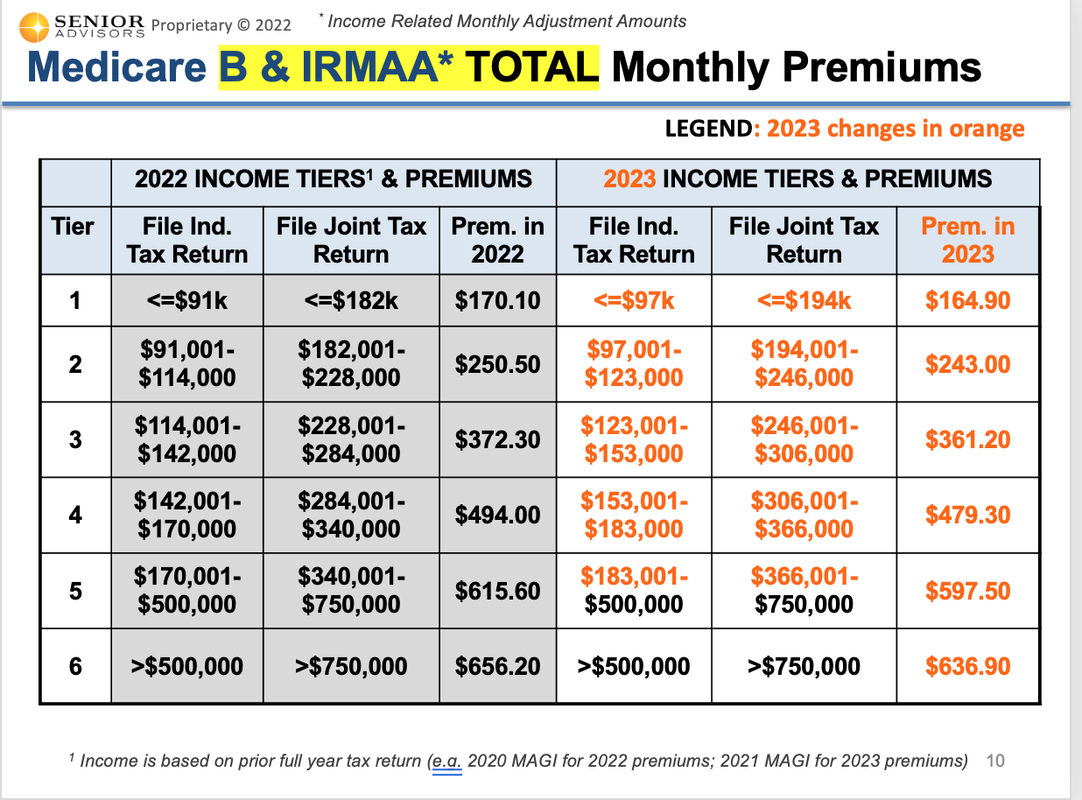

2023 Medicare Part B Premium And Deductible UPDATE YouTube

https://i.ytimg.com/vi/8KjdZJui-u0/maxresdefault.jpg

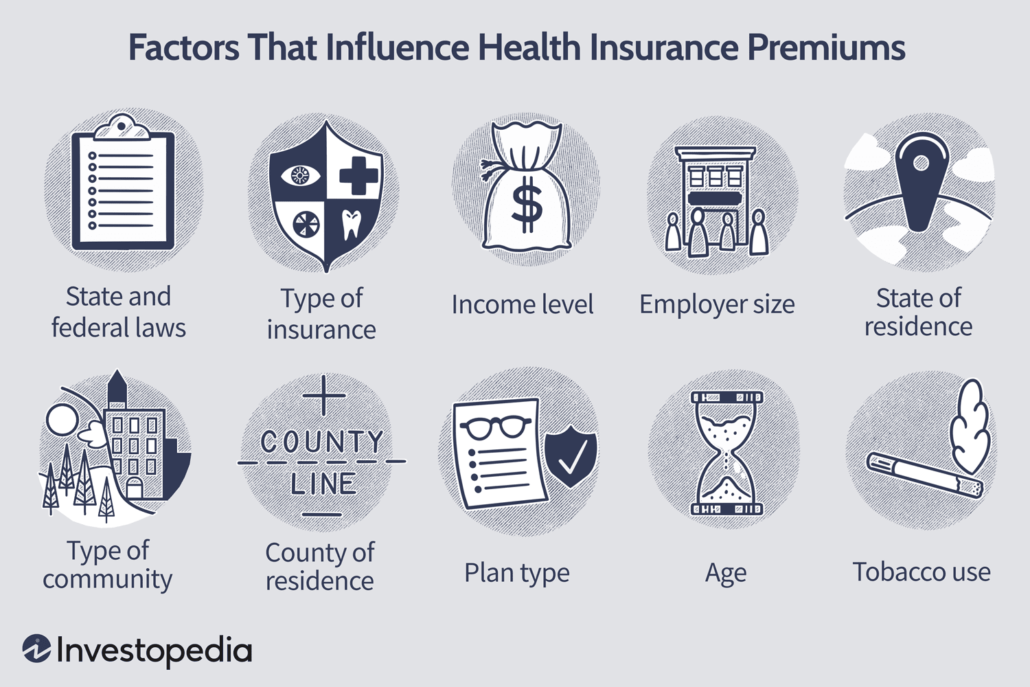

Expenses that qualify for this deduction include premiums paid for a health insurance policy as well as any out of pocket expenses for things like doctor visits surgeries dental care vision Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical

If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they exceed 7 5 of your Health insurance premiums can generally be paid with pre tax dollars For most people this means that their employer sponsored health insurance is deducted from their

Download Are Health And Dental Premiums Tax Deductible

More picture related to Are Health And Dental Premiums Tax Deductible

:max_bytes(150000):strip_icc()/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Is Dental Insurance Tax Deductible

https://www.investopedia.com/thmb/eGl6pCDUnpBmsiMrrmrKgnntVpQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg

Are Dental Expenses Tax Deductible Maybe

https://www.deltadentalia.com/webres/image/blog/Taxes-iStock.jpg

Medicare Blog Moorestown Cranford NJ

http://www.senior-advisors.com/uploads/3/8/4/6/38465265/screen-shot-2022-09-27-at-12-14-39-pm_orig.png

Yes dental insurance premiums you paid in the current year are deductible on your taxes This is also true for the premiums of your spouse dependents or children under 27 But you need to itemize the Health insurance premiums as well as expenditures for medical and dental care such as doctor visits and prescriptions may be deductible if you itemize deductions on your tax

Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5 of your Even with tax subsidies health insurance premiums are often costly You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and

Are Medigap Premiums Tax Deductible 65Medicare

https://65medicare.org/wp-content/uploads/2017/04/Man-doing-taxes.jpg

Are Group Health Insurance Premiums Tax Deductible Loop

https://global-uploads.webflow.com/61b1902b9f28a2a852f7012f/61d6883ae9963c5cd6652a8d_Are-Group-Health-Insurance-Premiums-Tax-Deductible-M.jpg

https://www.forbes.com/advisor/health-insurance/is...

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related

Are Insurance Premiums Tax Deductible AZexplained

Are Medigap Premiums Tax Deductible 65Medicare

Health Insurance 101 IATSE 26

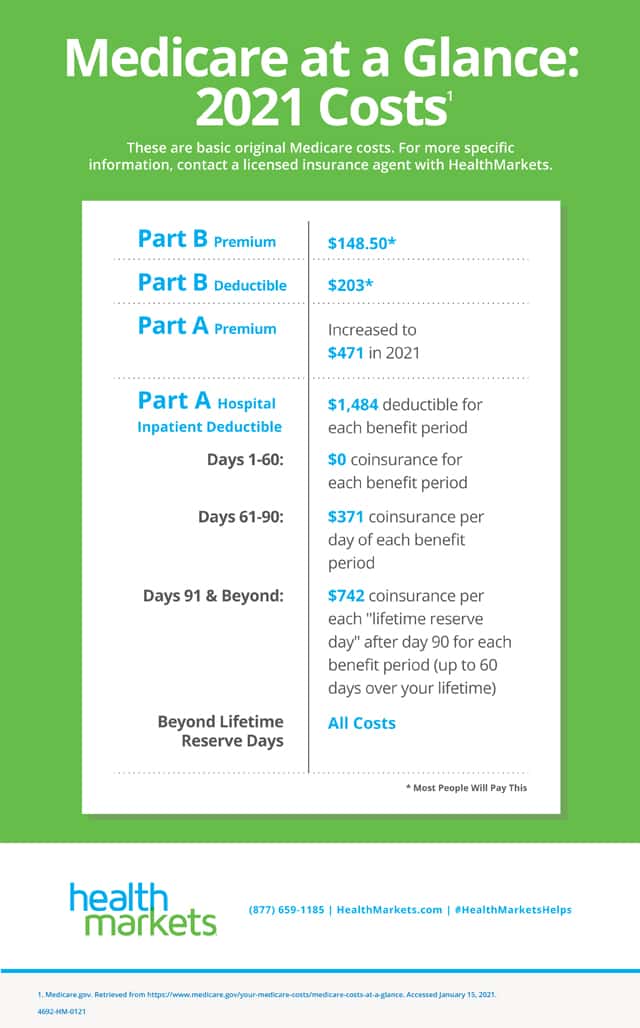

Medicare Costs At A Glance INFOGRAPHIC

Are Health Insurance Premiums Tax Deductible Insurance Deductible

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

Do Dental Work And Implants Is Tax Deduction Dental News Network

Tax Deductions You Can Deduct What Napkin Finance

February 01 2017

Are Health And Dental Premiums Tax Deductible - Health insurance premiums can count as a tax deductible medical expense along with other out of pocket medical expenses if you itemize your deductions You can only deduct medical