Are Home Energy Tax Credits Refundable Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property

The Inflation Reduction Act IRA created a new monetization regime under Section 6417 that allows tax exempt entities to elect to claim 12 of the IRA s energy credits as Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will be treated as a

Are Home Energy Tax Credits Refundable

Are Home Energy Tax Credits Refundable

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

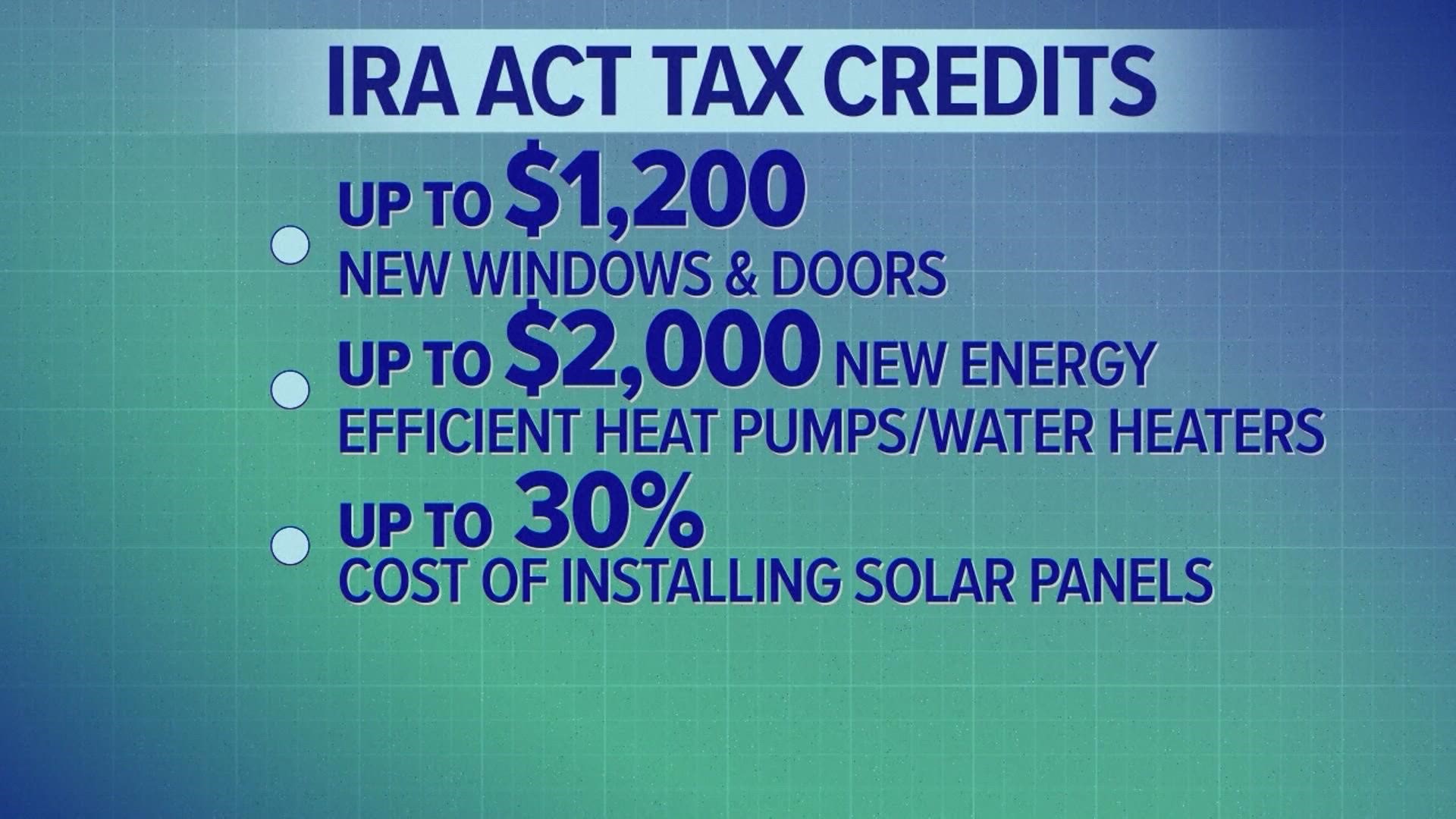

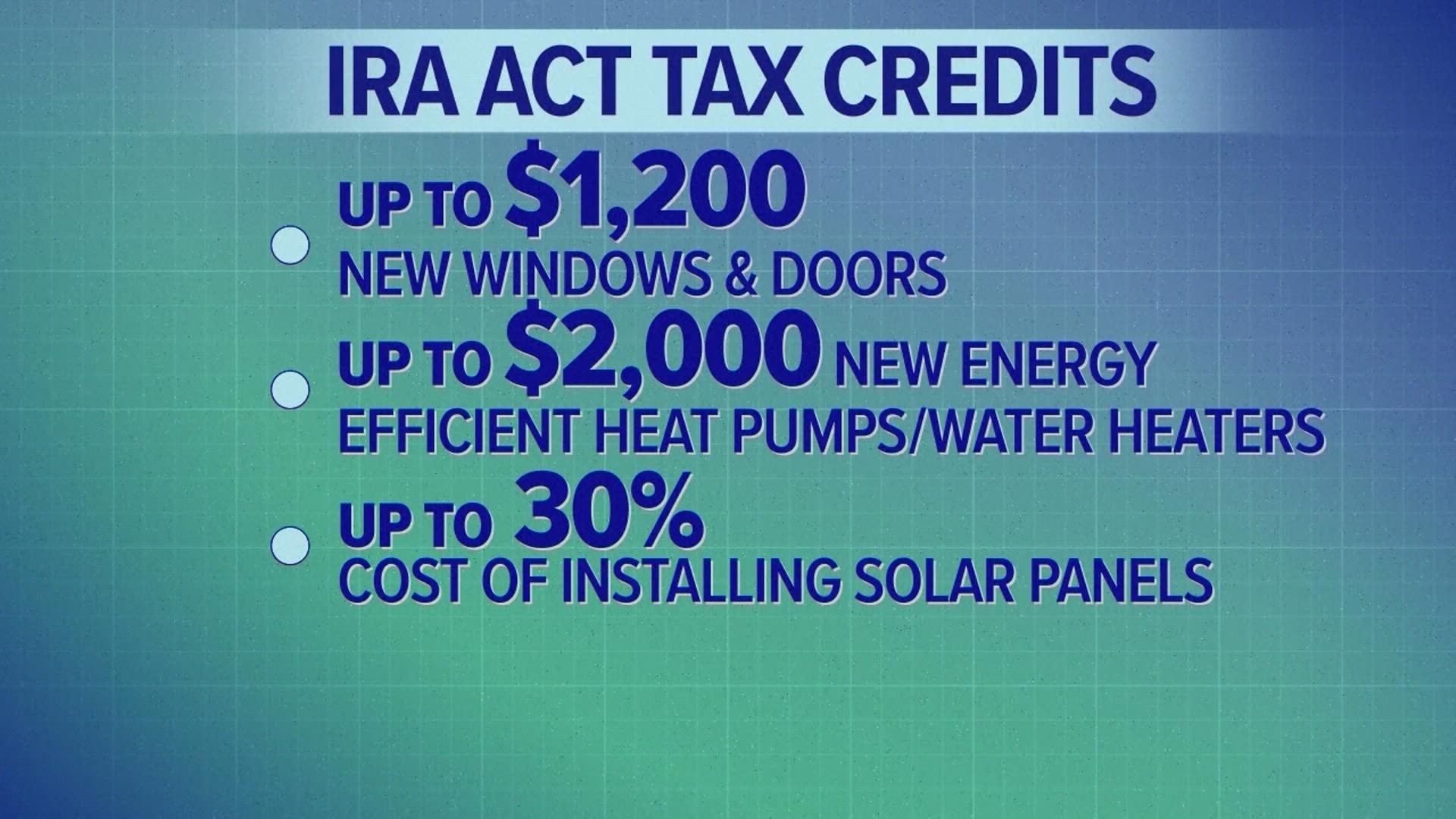

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

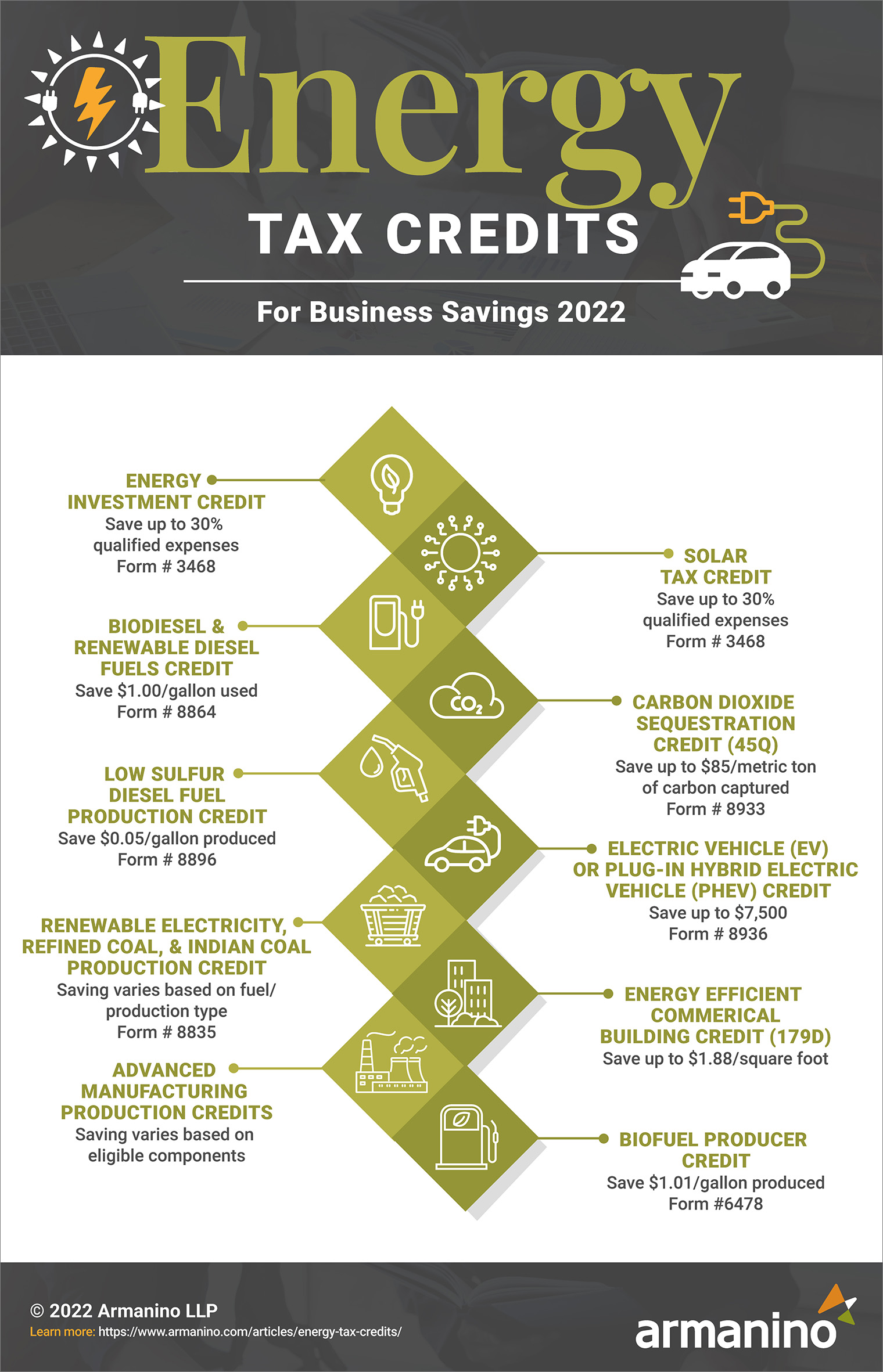

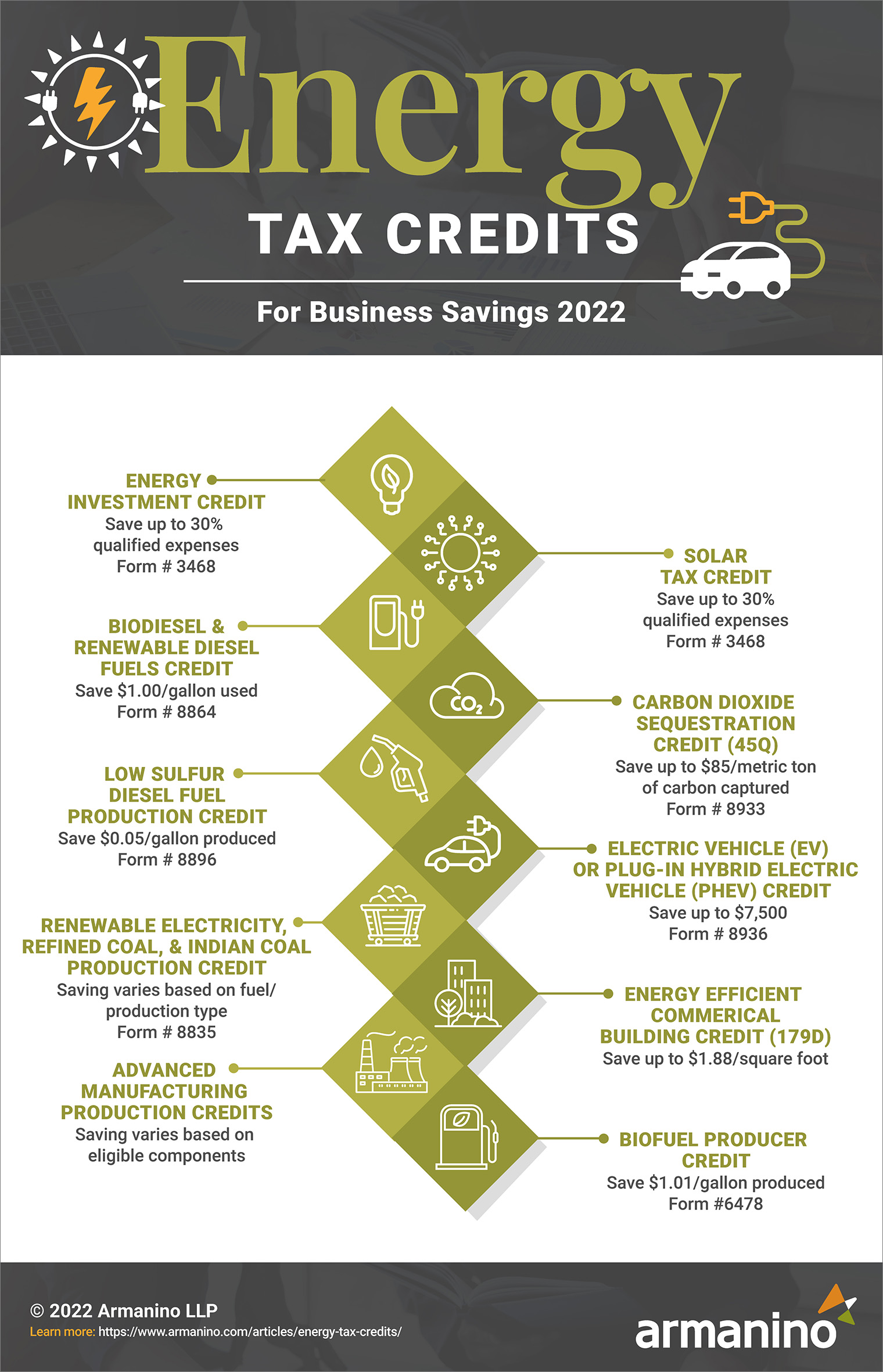

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Making Our Homes More Efficient Clean Energy Tax Credits for Consumers UPDATED JULY 2024 Visit our Energy Savings Hub to learn more about saving money on All of the clean energy tax credits made available for consumers through the Inflation Reduction Act are non refundable A non refundable tax credit can decrease your taxes owed to zero but will not result in a refund for any

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property Homeowners may claim the maximum annual credit every year that eligible improvements are made through 2032 The credits are nonrefundable so you cannot get back more on the credit than you owe in taxes You may not apply

Download Are Home Energy Tax Credits Refundable

More picture related to Are Home Energy Tax Credits Refundable

.jpg#keepProtocol)

Home Energy Tax Credits IR 2023 97 PA NJ MD

https://www.herbein.com/hubfs/Untitled design (1).jpg#keepProtocol

Home Energy Tax Credits Inflation Reduction Act Phoenix Arizona

https://www.azenergyefficienthome.com/wp-content/uploads/2022/12/home-energy-tax-credits-phoenix-arizona-1-1024x293.jpg

Residential Energy Tax Credits Overview And Analysis

https://s3.studylib.net/store/data/008642402_1-c65a84badb3a383868d26c1425fc3e1b-768x994.png

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were Energy tax credits aren t refundable tax credits This means that you can reduce your total tax to zero if you have a large enough credit But you can t get any excess credit amount as a payment to you on your tax return if you have more

When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset The energy efficient home improvement credit is nonrefundable and you can t put any leftover credit toward a future tax bill A nonrefundable credit means that if the credit dips

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

https://www.irs.gov › newsroom › irs-up…

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property

https://www.grantthornton.com › insights › alerts › tax › ...

The Inflation Reduction Act IRA created a new monetization regime under Section 6417 that allows tax exempt entities to elect to claim 12 of the IRA s energy credits as

Renewable Energy Tax Credits Iowa Utilities Board

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Do You Qualify For A Home Energy Tax Credit Benefyd

What Is The Difference Between Non refundable And Refundable Tax

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Receive Your Tax Credits

Tax Credits Save You More Than Deductions Here Are The Best Ones

IRS Updates On Residential Energy Credits Key Insights

Are Home Energy Tax Credits Refundable - Homeowners may claim the maximum annual credit every year that eligible improvements are made through 2032 The credits are nonrefundable so you cannot get back more on the credit than you owe in taxes You may not apply