Are Home Renovations Tax Deductible In Canada The 2022 federal budget introduced a Multigenerational Home Renovation Tax Credit for up to 50 000 of renovations for adding a secondary unit to a home for an immediate or extended family

If you bought built sold or renovated a home in 2021 we re here to help you with your tax affairs Here are some helpful tips and information to get you ready for this tax filing season Claim 5 000 on your tax return The home buyers amount line 31270 is Among the 2023 tax changes that took effect for this year is the brand new Multigenerational Home Renovation Tax Credit MHRTC This refundable credit was introduced to assist Canadians

Are Home Renovations Tax Deductible In Canada

Are Home Renovations Tax Deductible In Canada

https://i0.wp.com/objectivefinancialpartners.com/wp-content/uploads/2022/08/Are-home-renovations-tax-deductible-in-Canada-900x550-1.jpg?fit=1000%2C611&ssl=1

Are Home Renovations Tax Deductible In Canada RooHome

https://roohome.com/wp-content/uploads/2022/01/Are-Home-Renovations-Tax-Deductible-in-Canada-.jpg

Are Home Renovations Tax Deductible In Canada Surex

https://cdn-brochure.surex.com/cdn-brochure-prod/cdn-files/styles/blog_image_retina_1110x413/public/2023-03/pexels-ksenia-chernaya-5691518.jpg.webp?VersionId=PlM.KKuUhgznLiHXCZeOrwfh.j_SLBt1&itok=3JUfVQLO

People with disabilities and those over the age of 65 can claim a deduction on their annual income tax return for certain renovations These must be done in their primary residence to improve accessibility and safety for example to get around better or to perform everyday tasks more easily An eligible individual can claim up to 50 000 in qualifying costs for one qualifying renovation that was completed in the tax year When renovation costs have been shared more than one eligible individual can each make a claim for the same renovation up to a combined total of 50 000

Explore the key tax deductions available for home renovations in Canada for 2024 Understand eligibility claim processes and how to maximize savings on your next renovation project While major renovations are generally not deductible certain expenses related to a home office such as renovations to create a dedicated workspace may be eligible

Download Are Home Renovations Tax Deductible In Canada

More picture related to Are Home Renovations Tax Deductible In Canada

Are Home Renovations Tax Deductible In Canada Calgary Home Renovations

https://www.calgaryhomerenovations.com/wp-content/uploads/2021/05/home-renovations-calgary-25.jpg

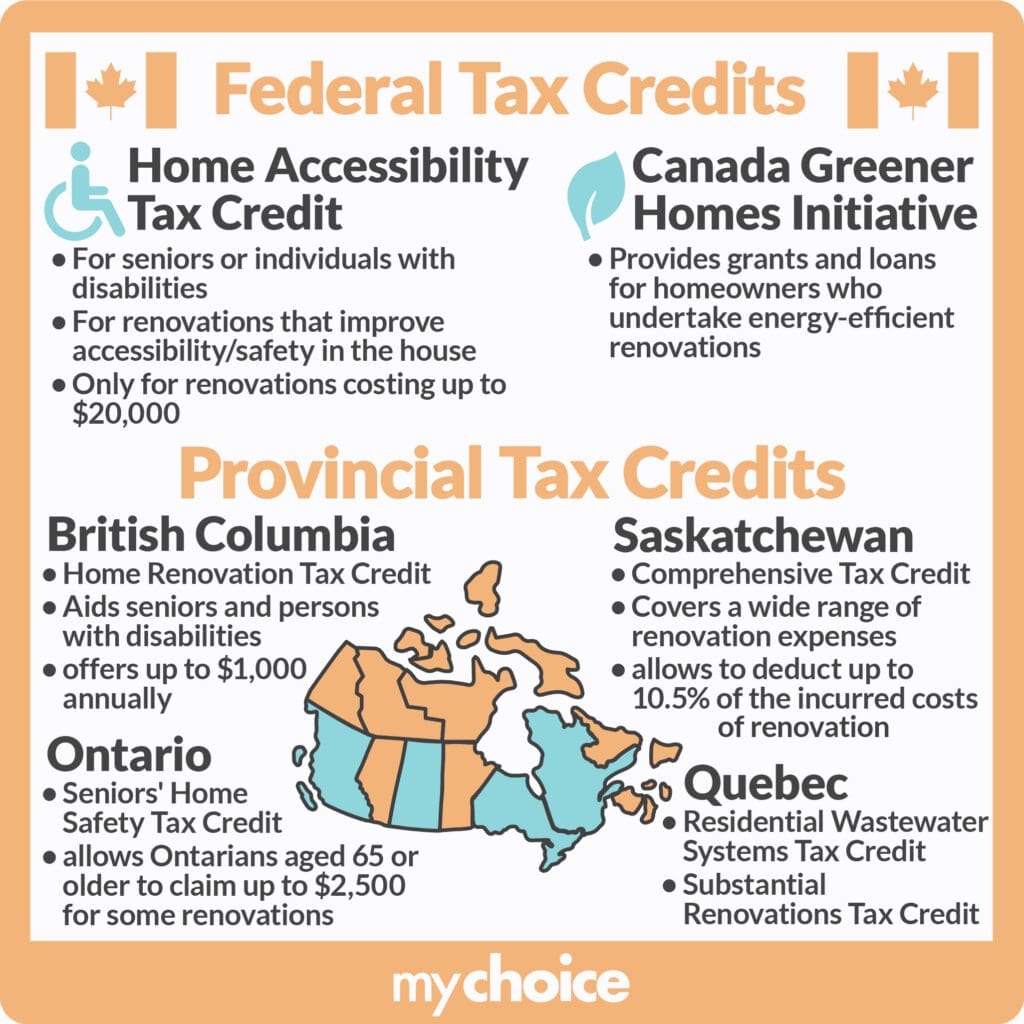

Are Home Renovations Tax Deductible In Canada MyChoice

https://www.mychoice.ca/wp-content/uploads/2023/11/[email protected]

Tax Deductible Home Renovations In Canada

https://masteredhomerenovations.ca/wp-content/uploads/2021/09/complete-home-renovations-calgary-1.jpg

Home renovation tax credits allow homeowners a tax credit for eligible renovation costs Some of these credits are non refundable so the tax credit can only be used to reduce taxes owing in the current taxation year Home renovation tax credits allow you to deduct a portion of your renovation expenses from your taxes They are a great way to reduce the cost of your renovations However you must meet specific eligibility requirements to receive the credit

A close to retirement couple wants to know how to offset a lump sum payout Their hope is that they can pay to renovate their home and get a tax deduction In some cases yes you can deduct a portion of your home renovation related expenses from your income tax However in order to do so you need to qualify for a home renovation tax credit

Are Home Renovations Tax Deductible In Canada

https://www.dreamlandsdesign.com/wp-content/uploads/2022/06/home-renos-tax-deductible-canada-complete-home-renoations.jpg

Are Home Renovations Tax Deductible In Canada RooHome

https://roohome.com/wp-content/uploads/2022/01/home-renovation.jpg

https://www.moneysense.ca › columns › ask-a-planner › ...

The 2022 federal budget introduced a Multigenerational Home Renovation Tax Credit for up to 50 000 of renovations for adding a secondary unit to a home for an immediate or extended family

https://www.canada.ca › ...

If you bought built sold or renovated a home in 2021 we re here to help you with your tax affairs Here are some helpful tips and information to get you ready for this tax filing season Claim 5 000 on your tax return The home buyers amount line 31270 is

Are Home Renovations Tax Deductible In Canada MyChoice

Are Home Renovations Tax Deductible In Canada

Are Home Renovations Tax Deductible In Canada Calgary Home Renovations

Home Renovations That Pay Off

What Home Renovations Are Tax Deductible In Canada Who sDreamHome Com

Is A Home Office Tax Deductible File Smarter In The US UK Or Canada

Is A Home Office Tax Deductible File Smarter In The US UK Or Canada

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

Can You Claim House Renovations On Tax RateCity

.png)

Are Moving Expenses Tax Deductible In Canada

Are Home Renovations Tax Deductible In Canada - While major renovations are generally not deductible certain expenses related to a home office such as renovations to create a dedicated workspace may be eligible