Are Hsa Distributions Taxable In Pa Amounts paid or distributed out of an HSA that are not used to pay qualified medical expenses are includible in income and are subject to tax Excess contributions to an

Pennsylvania follows federal rules for contributions to Medical Savings Accounts and Health Savings Accounts You may not claim these deductions if you Yes The Health Savings Account Act provides no exemption for employee contributions made to a health savings account FACTS The Health Savings Account Act 1 the HSA

Are Hsa Distributions Taxable In Pa

Are Hsa Distributions Taxable In Pa

https://www.zbpforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-C-Trustee-Payer-State-LSAC-FINAL-min.jpg

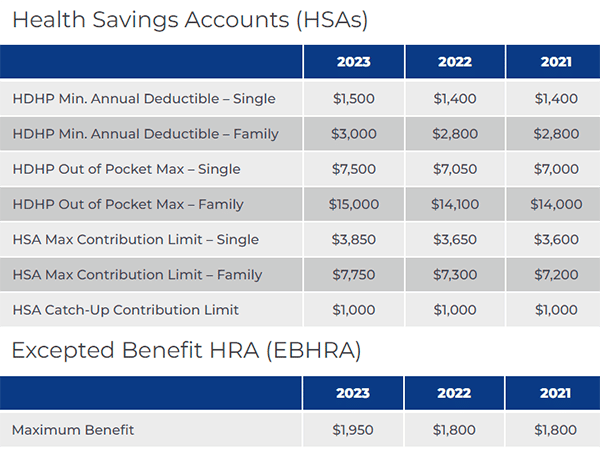

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=2048&name=HSA Contribution Limits Table.png

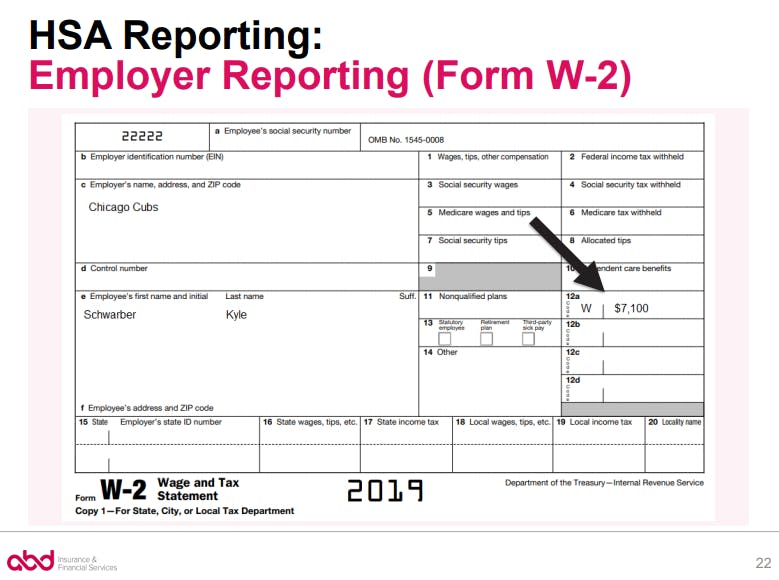

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

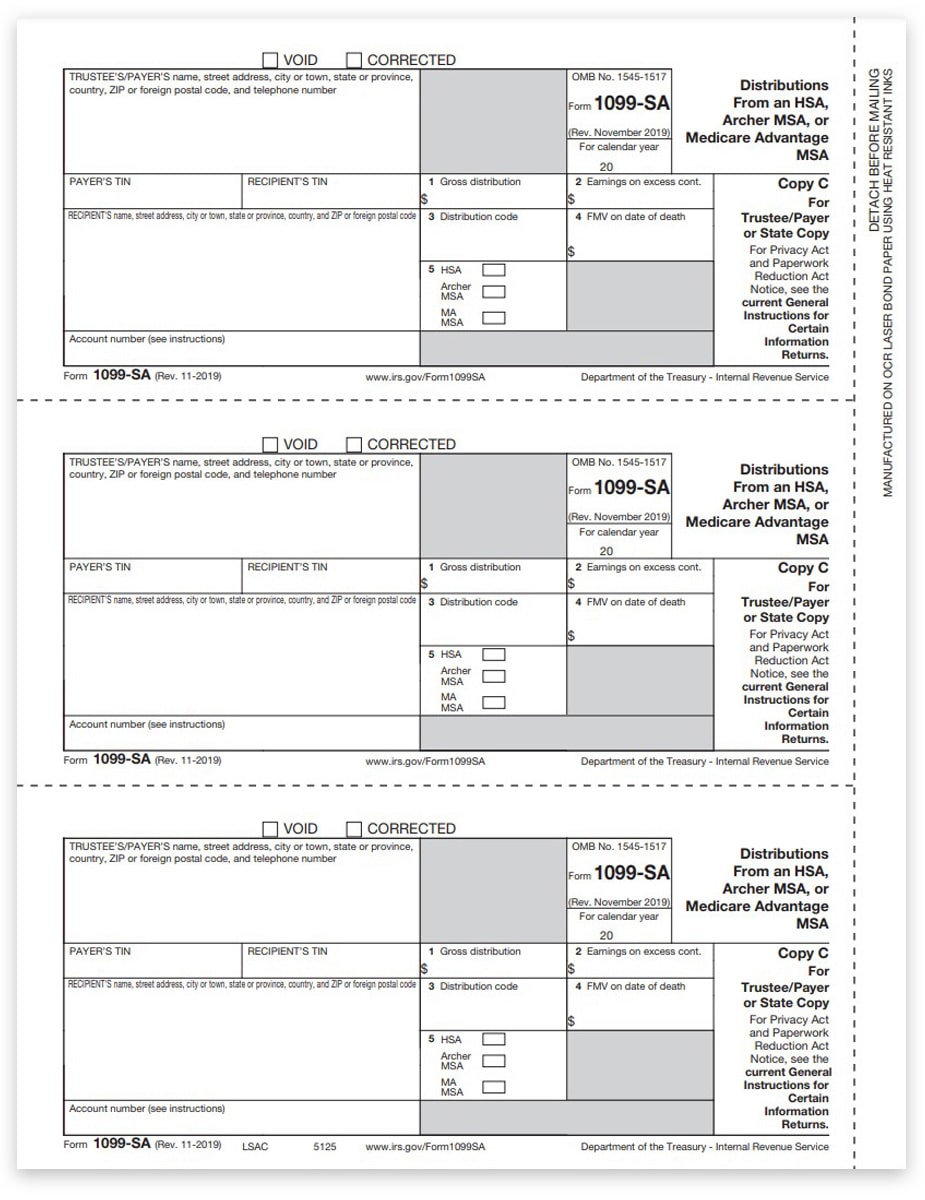

An HSA distribution is a withdrawal from your health savings account HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be Pennsylvania Income Tax Treatment on HSA Contributions Residents of Pennsylvania can deduct HSA contributions on their Pennsylvania personal income taxes Source data

Use PA 40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac counts and or the amount of contributions to an IRC Dividends and Interest Tax on HSA Accounts These states do not tax income and thus there is no state income tax deduction when contributing to an HSA They do tax

Download Are Hsa Distributions Taxable In Pa

More picture related to Are Hsa Distributions Taxable In Pa

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

Tips For Young Investors

https://www.investopedia.com/thmb/jKymZNXinopaeYBFqFn7GiNl2ew=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png

Navigating HSA Distributions Your Essential Guide RFG Wealth Advisory

https://www.rfgwealthadvisory.com/wp-content/uploads/AdobeStock_118050530-scaled.jpeg

IRS Announced 2023 Health Savings Account HSA Contribution Limits HRPro

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

For PA purposes the amounts of the distributions received are recorded on PA 40 Schedule W 2S Part B However the amount taxable for federal income tax You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for

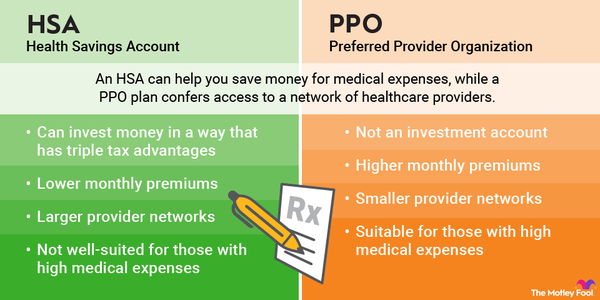

When qualified medical expenses are reimbursed or paid directly from an HSA the distributions are not taxable Distributions that are not taxable include HSA The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

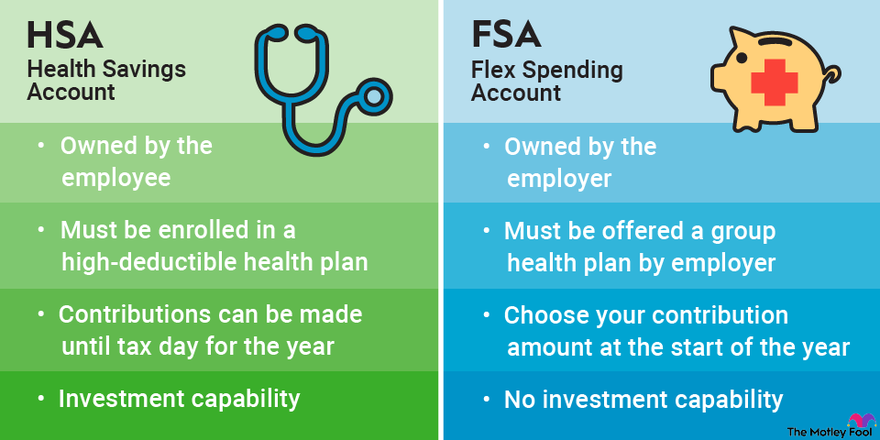

Health Savings Vs Flexible Spending Account What s The Difference

https://www.investopedia.com/thmb/PE1dbX0Tuo1ohlHmjw_RcTUcvNw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg

Qualified Vs Non Qualified Roth IRA Distributions

https://www.carboncollective.co/hs-fs/hubfs/Roth_IRA_Distributions.png?width=3840&name=Roth_IRA_Distributions.png

http://pahealthcoverage.com/healthsavings/Pennsylvani…

Amounts paid or distributed out of an HSA that are not used to pay qualified medical expenses are includible in income and are subject to tax Excess contributions to an

https://revenue-pa.custhelp.com/app/answers/detail/a_id/2596

Pennsylvania follows federal rules for contributions to Medical Savings Accounts and Health Savings Accounts You may not claim these deductions if you

HSA Vs PPO Which Is Better The Motley Fool

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What s The Difference

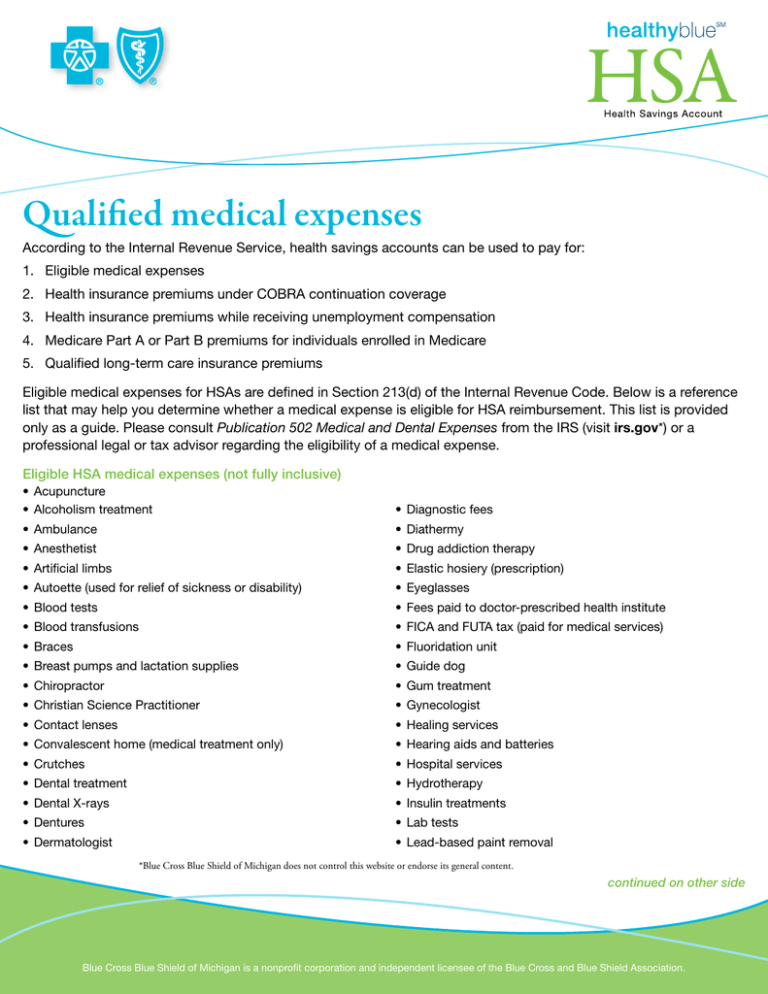

HSA Qualified Medical Expenses

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

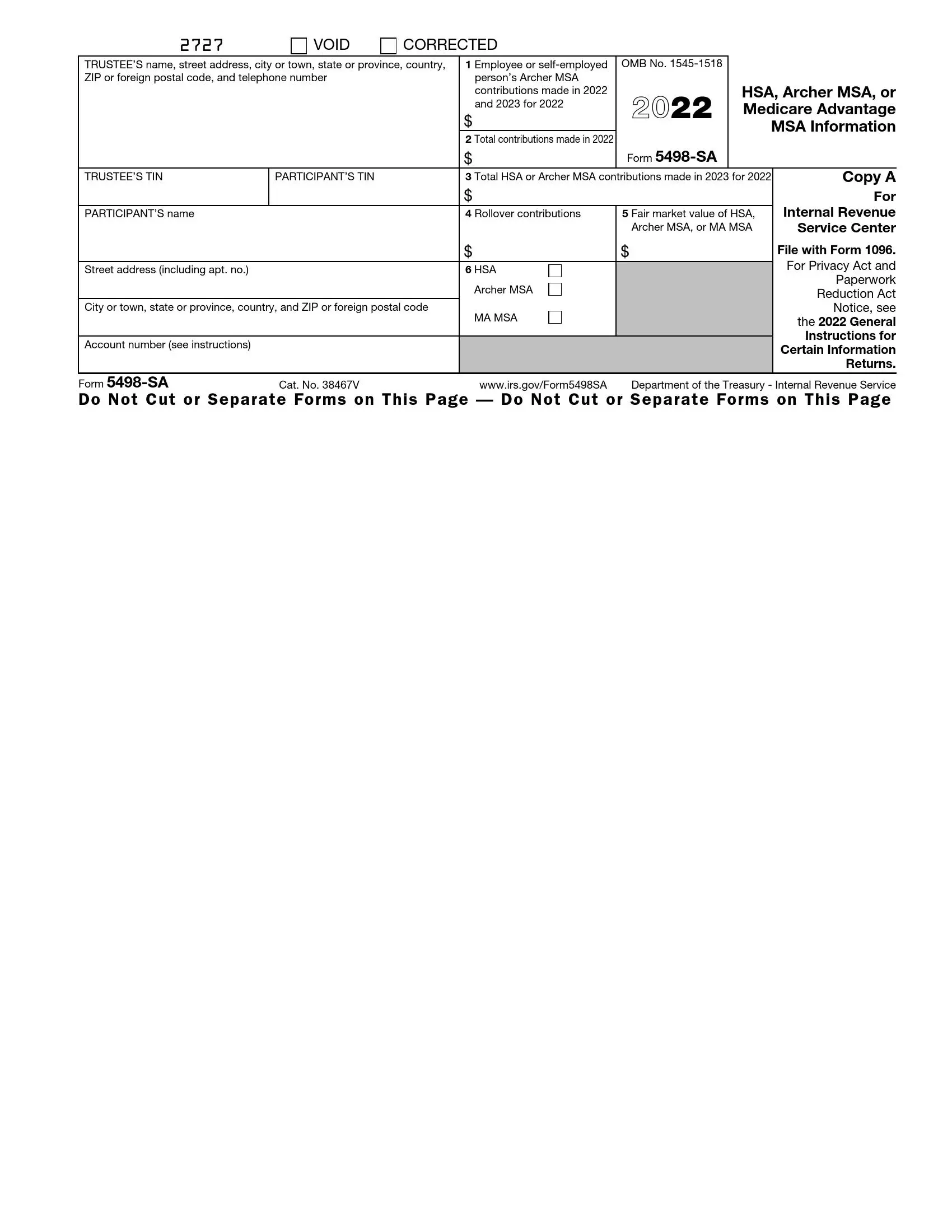

IRS Form 5498 SA Fill Out Printable PDF Forms Online

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

What Is A Normal Distribution From An HSA BRI Benefit Resource

Social Security Benefit Worksheets 2021

HSA Contributions Deadline Hasn t Passed Yet But Act Soon Kiplinger

Are Hsa Distributions Taxable In Pa - Pennsylvania follows federal rules for contributions to Medical Savings Accounts and Health Savings Accounts You may not claim these deductions if you cannot claim them