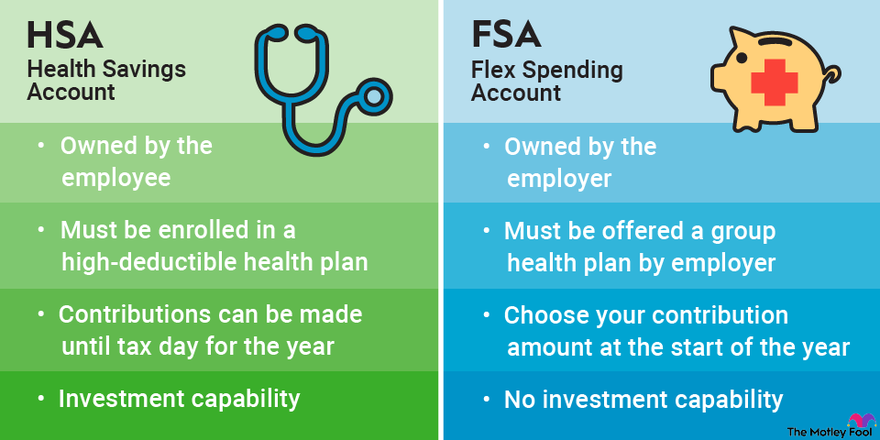

Are Hsa Earnings Taxable Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 2 850

Contributing to an HSA helps you save more over time with a triple tax advantage tax advantaged contributions tax deferred earnings if invested and tax free withdrawals for qualified health care expenses 1 Many people contribute to HSAs through payroll deductions which means the money is set aside before it s subject to income taxes No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA while owned by an employee can be funded by the employee

Are Hsa Earnings Taxable

Are Hsa Earnings Taxable

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=2048&name=HSA Contribution Limits Table.png

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

Tips For Young Investors

https://www.investopedia.com/thmb/jKymZNXinopaeYBFqFn7GiNl2ew=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png

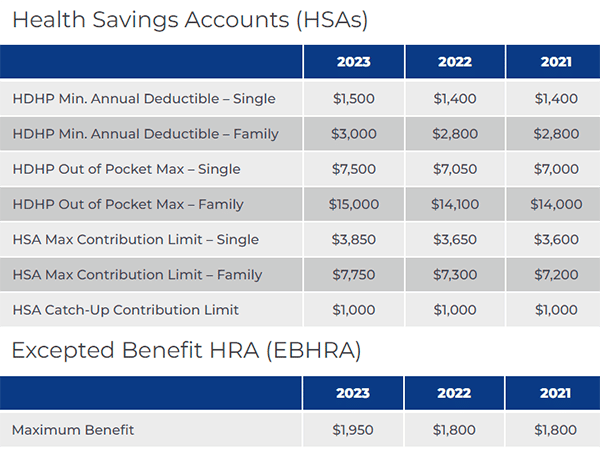

IRS Announced 2023 Health Savings Account HSA Contribution Limits HRPro

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded from your income on your W 2 So the HSA deduction rules don t allow an additional deduction for those contributions Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income

Are HSA contributions taxable No Payroll deferral or employer pre tax HSA contributions up to the applicable limit reported on Form W 2 as non taxable are excluded from your gross income You can claim a tax deduction for HSA contributions up to the applicable limit made outside of payroll deferral even if you don t itemize your HSA contributions are tax free For example if your tax rate is 22 percent and you contribute the maximum amount for 2023 which is 3 850 for an individual or 7 750 for a family you could save 847 and 1 705 respectively in tax payments

Download Are Hsa Earnings Taxable

More picture related to Are Hsa Earnings Taxable

FSA Vs HSA Which Is Best For Your Employees Hsa Positive Work

https://i.pinimg.com/originals/b1/08/fb/b108fb93bb64781dbb902533060c10aa.jpg

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

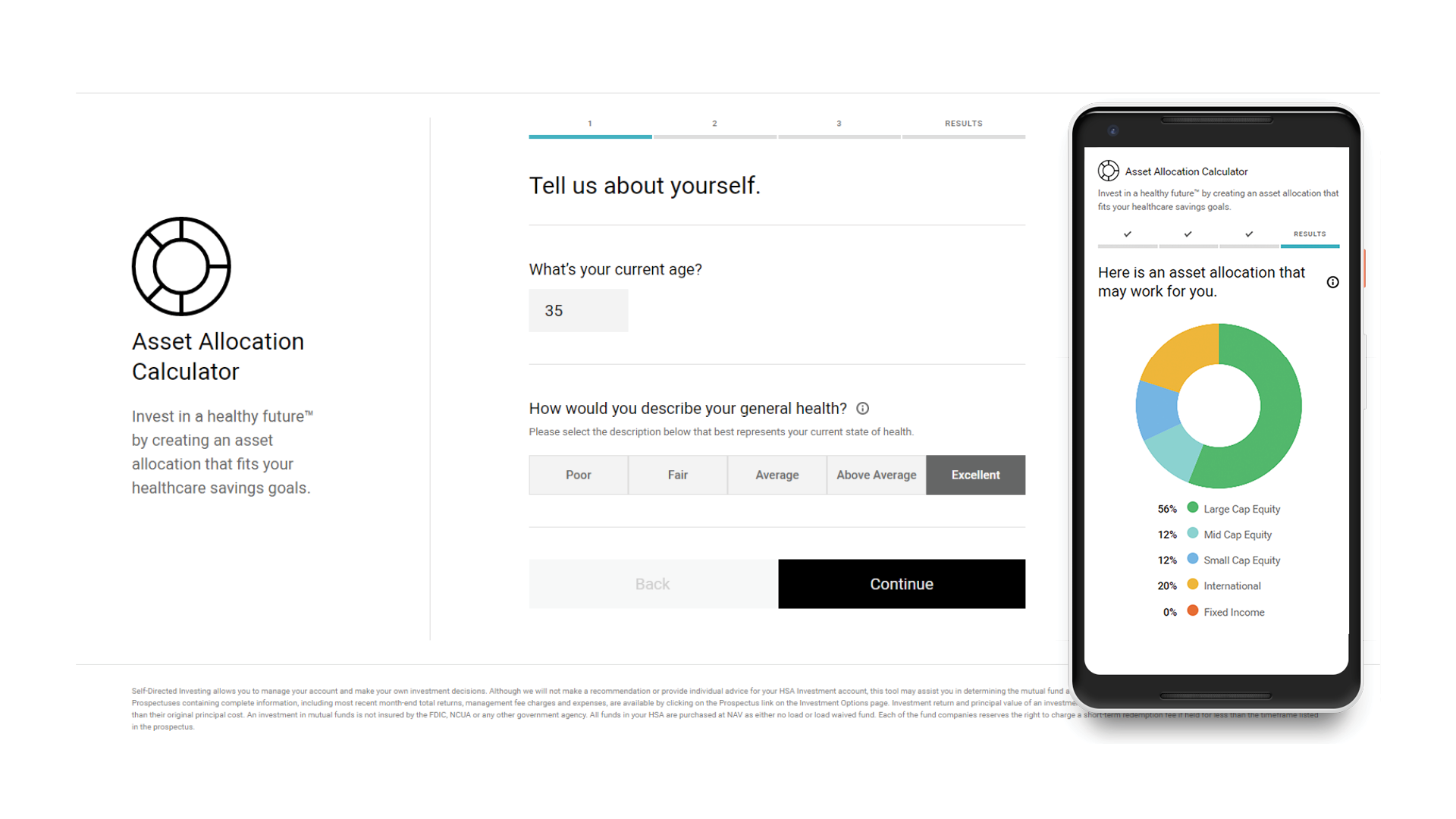

New HSA Asset Allocation Calculator Devenir

https://www.devenir.com/wp-content/uploads/AssetAllocation_Screenshots.png

One of the great things about an HSA is that no matter how much your account increases in value over time your earnings normally aren t subject to tax Since you re not required to tap your HSA until you need it you can sit back and watch your money grow without having to worry about a tax penalty Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on your tax return

[desc-10] [desc-11]

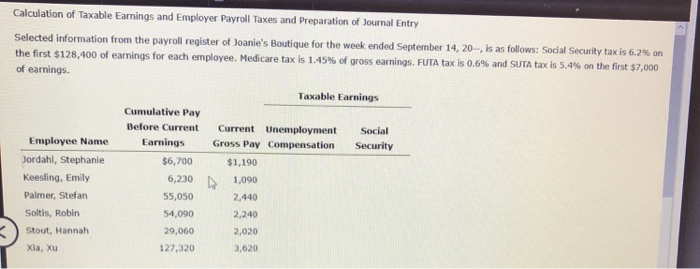

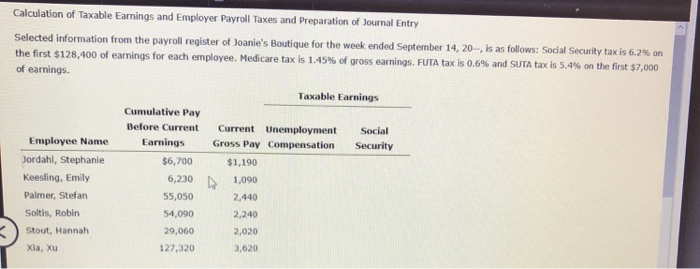

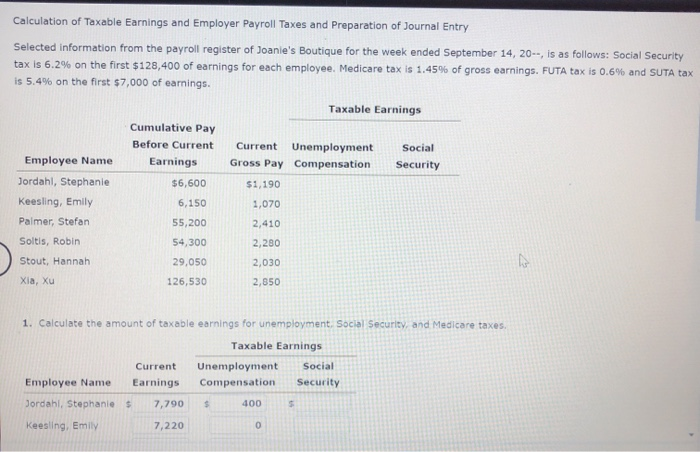

Solved Calculation Of Taxable Earnings And Employer Payroll Chegg

https://media.cheggcdn.com/study/1bb/1bb96641-7c82-4210-a2b1-878d20f5f73d/image.png

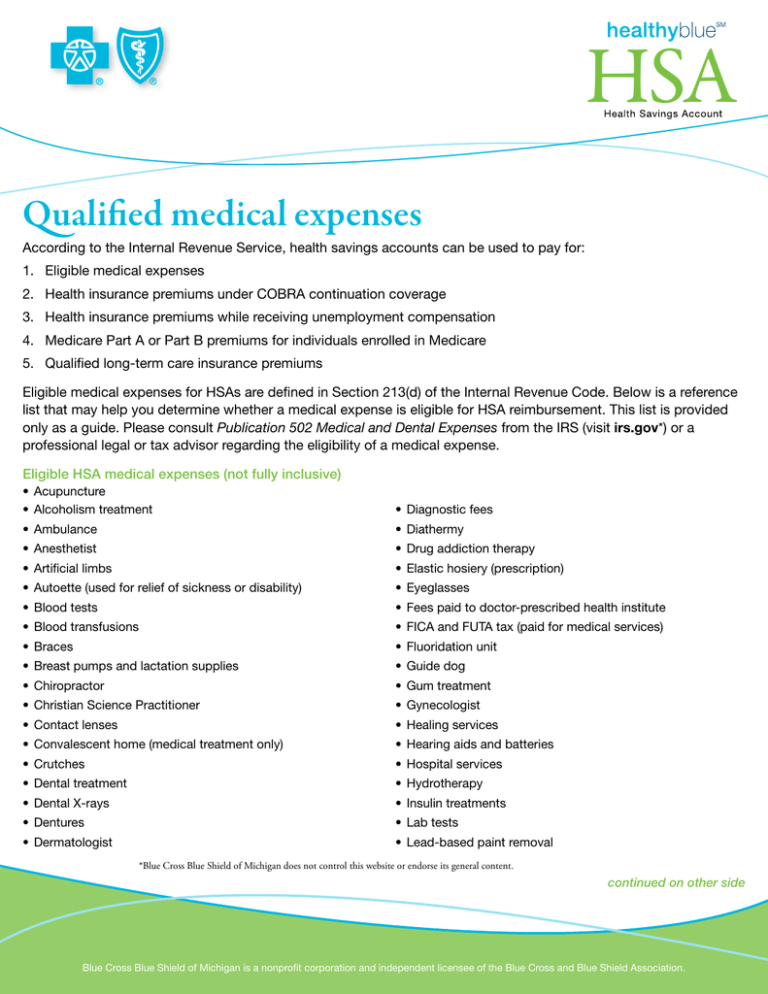

IRS HSA Eligible Expenses

https://www.zrivo.com/wp-content/uploads/2021/10/IRS-HSA-Eligible-Expenses-768x433.jpg

https://www.irs.gov/publications/p969

Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 2 850

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png?w=186)

https://www.fidelity.com/learning-center/personal-finance/hsa-tax-form

Contributing to an HSA helps you save more over time with a triple tax advantage tax advantaged contributions tax deferred earnings if invested and tax free withdrawals for qualified health care expenses 1 Many people contribute to HSAs through payroll deductions which means the money is set aside before it s subject to income taxes

HSA Qualified Medical Expenses

Solved Calculation Of Taxable Earnings And Employer Payroll Chegg

2022 Benefits Enrollment Health Accounts HSA FSA HRA Intrepid

Solved Calculation Of Taxable Earnings And Employer Payroll Chegg

Comparison Of HSA health Savings FSA Flexible Spending HRA

IRS Announces 2021 HSA Limits

IRS Announces 2021 HSA Limits

YiZYiF Ba A D B Ga Ld V B B M J Ud Dr A Tuta S Lr Ra Ao 9 89 Truck au

Personal Injury Compensation How Does It Work Earnings Options

The Benefits Of Health Savings Accounts Money

Are Hsa Earnings Taxable - Are HSA contributions taxable No Payroll deferral or employer pre tax HSA contributions up to the applicable limit reported on Form W 2 as non taxable are excluded from your gross income You can claim a tax deduction for HSA contributions up to the applicable limit made outside of payroll deferral even if you don t itemize your