Are Hsa Withdrawals Tax Free Any HSA withdrawal you make without a qualified medical expense will be subject to income taxes In addition to the income tax you ll have to pay an additional 20 tax on the withdrawal The taxes

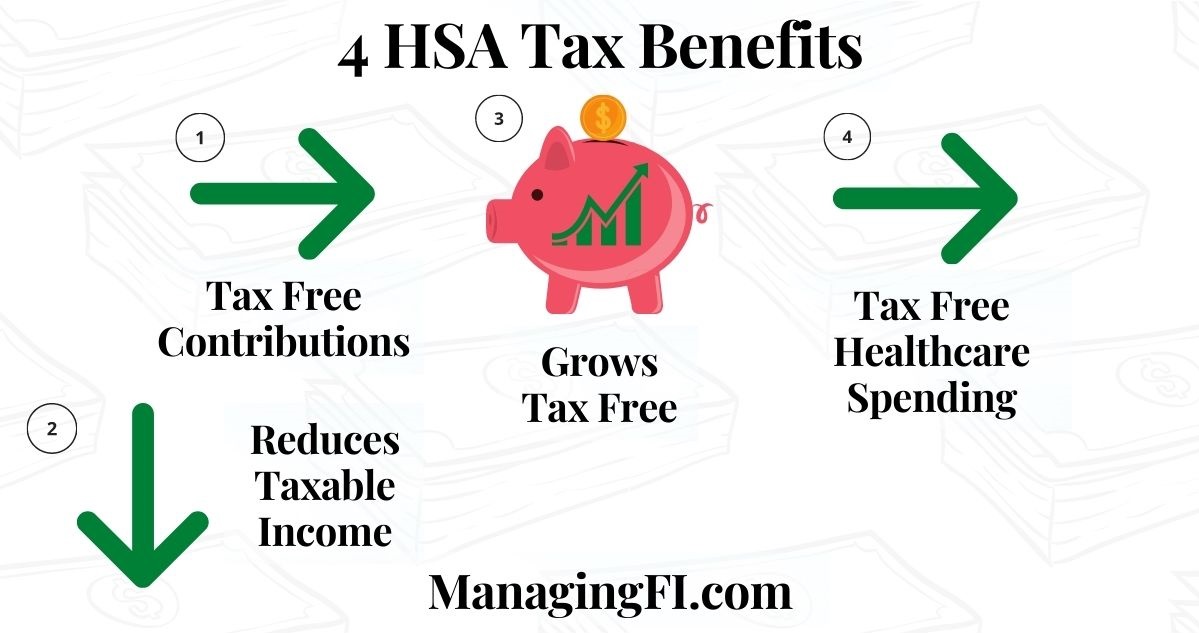

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses HSA distributions are tax free when used for IRS approved medical expenses Distributions for non medical purposes are typically subject to taxes and a 20 penalty

Are Hsa Withdrawals Tax Free

Are Hsa Withdrawals Tax Free

https://mainstartrust.com/portals/0/adam/blog4/elqlzq-phkwjhpkyoqfbva/image/mainstar_hsa_tax_withdrawls.png?w=1200&h=630&mode=crop&scale=both&quality=70

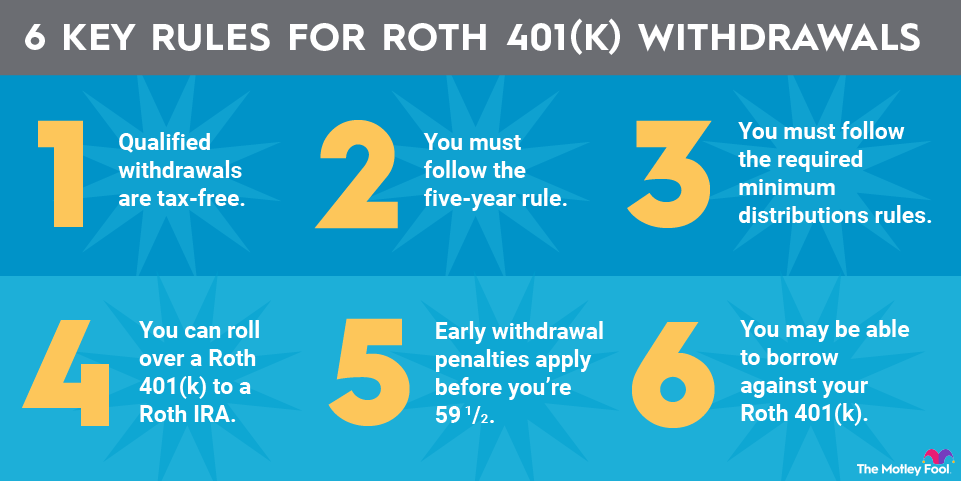

Are All Roth IRA Withdrawals Tax Free Part 3

https://media.licdn.com/dms/image/D4E12AQFyAqzEtXCpZA/article-cover_image-shrink_720_1280/0/1699981547950?e=2147483647&v=beta&t=cI_Ok0xwiuQXdfRPYlZivaGM9q2Z3ZICQ9Q1QkEXLq8

HSAs Beyond The Triple Tax Advantage Retirement Daily On TheStreet

https://www.thestreet.com/.image/t_share/MTc1ODIxMjgzMzE1OTUwNjQ3/use-your-hsa-to-pay-for-medicare-premiums.jpg

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for Contributing to an HSA helps you save more over time with a triple tax advantage tax advantaged contributions tax deferred earnings if invested and tax

Withdrawals from an HSA are tax free provided the money is used to pay for qualified medical expenses These expenses can include payments for dental and vision care which some medical You can submit a withdrawal request form to receive funds cash from your HSA If the cash is used to pay for ineligible purchases it must be reported when you re

Download Are Hsa Withdrawals Tax Free

More picture related to Are Hsa Withdrawals Tax Free

New HSA Account Rules For 2020 The New Dispatch

https://www.thenewdispatch.com/wp-content/uploads/2020/08/hsa3-1536x934.png

Tax Free HSA Withdrawals For 2021 Mainstar Trust

https://mainstartrust.com/Portals/0/adam/Blog4/ElQLZQ-PHkWJhpkYoqFBVA/Image/mainstar_hsa_tax_withdrawls.png?w=1200&h=630&mode=crop&scale=both&quality=90&anchor=middlecenter

How To Take Tax Free And Penalty Free Withdrawals From Roth IRA

https://onelifefg.com/wp-content/uploads/2022/09/withdrawals-1024x480.png

Qualified withdrawals meaning withdrawals for eligible medical expenses are tax free Contributions to an HSA can be made via payroll deductions or from your own funds if you re HSA rules for withdrawals If you withdraw money from an HSA for any reason other than to cover eligible medical expenses you will be subject to a 20

Ed Zurndorfer discusses the tax savings when HSA distributions are made to pay medical expenses including which expenses are qualified IRS reporting Learn how to take advantage of one of most tax efficient savings vehicle around open a Health Savings Account HSA where you can contribute pre tax dollars

Can I Use My Hsa To Pay Insurance Premiums

https://vtalkinsurance.com/wp-content/uploads/2022/12/can-i-use-my-hsa-to-pay-insurance-premiums_22893.jpg

How To Avoid Penalties On An HSA Withdrawal BRI Benefit Resource

https://www.benefitresource.com/wp-content/uploads/2019/09/blog_hsawithdrawal_large.png

https://smartasset.com/insurance/hsa-withdra…

Any HSA withdrawal you make without a qualified medical expense will be subject to income taxes In addition to the income tax you ll have to pay an additional 20 tax on the withdrawal The taxes

https://www.nerdwallet.com/article/taxes/fs…

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

Do I Have To Report A Loan From My 401k Leia Aqui Do I Have To Report

Can I Use My Hsa To Pay Insurance Premiums

Understanding Hsa Withdrawal Rules Health Savings Account

Understanding Tax Free Withdrawals For Retirees A Comprehensive Guide

2019 HSA Contribution Limits Released IRS

15 Signs Your Retirement Savings Puts You In A Better Position Than The

15 Signs Your Retirement Savings Puts You In A Better Position Than The

2024 Tax Limits Hayley Auberta

Health Savings Account HSA The Best Tax Advantaged Account Managing FI

Gift Tax Exemption Rules Who Can Receive Gifts That Are Tax free

Are Hsa Withdrawals Tax Free - HSA withdrawal rules You can receive tax free HSA distributions to pay for qualified medical expenses as defined by the IRS