Mortgage Rebate Tax Web 14 juin 2022 nbsp 0183 32 A mortgage rebate is a cashback incentive that a borrower receives from a lender Mortgage rebates offset fees associated with closing costs A mortgage rebate

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage

Mortgage Rebate Tax

Mortgage Rebate Tax

https://images.squarespace-cdn.com/content/v1/58aca60d725e25aeb6a9a567/1617207187253-2YKI4VQM183GW1Z9LY9I/Rebates.jpg

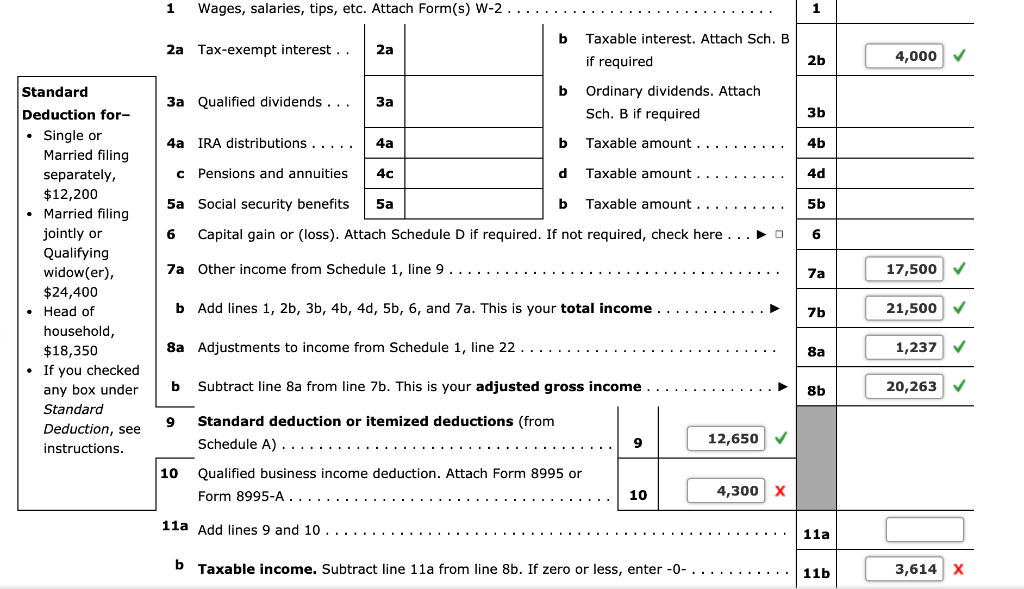

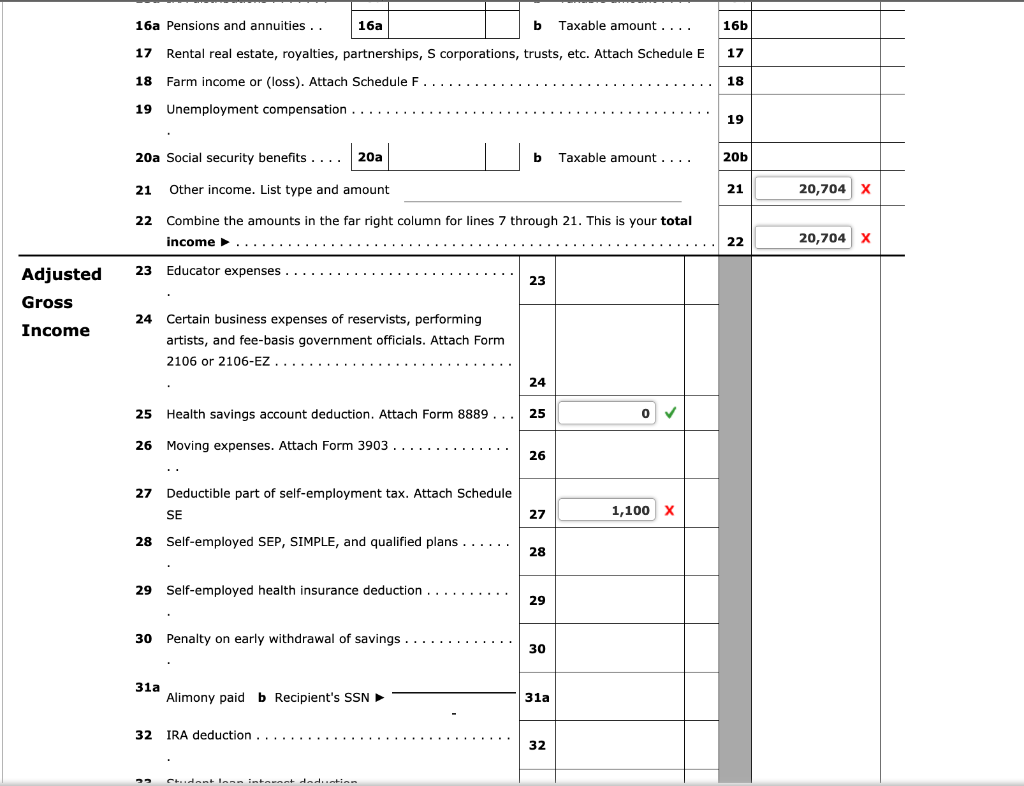

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who Web 21 ao 251 t 2023 nbsp 0183 32 The maximum forbearance is 12 months otherwise You can request up to 18 months of total forbearance if your mortgage is backed by HUD FHA USDA or the VA

Web 1 sept 2023 nbsp 0183 32 The standard deduction for tax year 2023 is 13 850 for single filers and 27 700 for married taxpayers filing jointly That means that the mortgage interest you paid plus any other tax Web Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes The interest paid on a mortgage along with any points

Download Mortgage Rebate Tax

More picture related to Mortgage Rebate Tax

NY To Homeowners Your Tax Rebate Check Is Almost In The Mail

https://www.newyorkupstate.com/resizer/PlgF14wroKbPrsz1X5X43t8TGZc=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.advance.net/home/adv-media/width2048/img/newyorkupstatecom_national_desk_blog/photo/2016/09/12/2016-ny-tax-checkjpg-5183adc97164032b.jpg

FREE AFTER REBATE Tax Software Exp 2 28 14 Tax Software Free

https://i.pinimg.com/originals/24/5d/6b/245d6b42162db94f6bd6ed8c0340ea4f.jpg

Mortgages 4 Military

https://assets.grooveapps.com/images/ea12483f-1d71-4868-b220-be9ba96a973f/1651450283_MortGageRateRebateProgram.png

Web 21 f 233 vr 2023 nbsp 0183 32 You can claim the deduction every year that you make payments on your loan However you can only deduct the interest that you paid during that year For example you might pay 1 000 in interest on Web 27 juil 2021 nbsp 0183 32 USDA Loans The USDA Covid 19 Special Relief Measure will reduce the monthly mortgage principal and interest payments by up to 20 for eligible borrowers There s also assistance available to

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes This Web 19 janv 2023 nbsp 0183 32 They ll get a tax credit of 163 1 440 163 7 200 x 20 A basic rate taxpayer will pay 163 840 no increase compared to the old rules A higher rate taxpayer will pay 163 3 120

Born Before 1965 Claim These Senior Rebates Now Reverse Mortgage

https://i.pinimg.com/originals/a0/74/0d/a0740d84c4e123dec211ab1f8802b49f.jpg

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

https://www.thebalancemoney.com/what-is-a-mortgage-rebate-5323529

Web 14 juin 2022 nbsp 0183 32 A mortgage rebate is a cashback incentive that a borrower receives from a lender Mortgage rebates offset fees associated with closing costs A mortgage rebate

https://www.nerdwallet.com/article/taxes/mort…

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Born Before 1965 Claim These Senior Rebates Now Reverse Mortgage

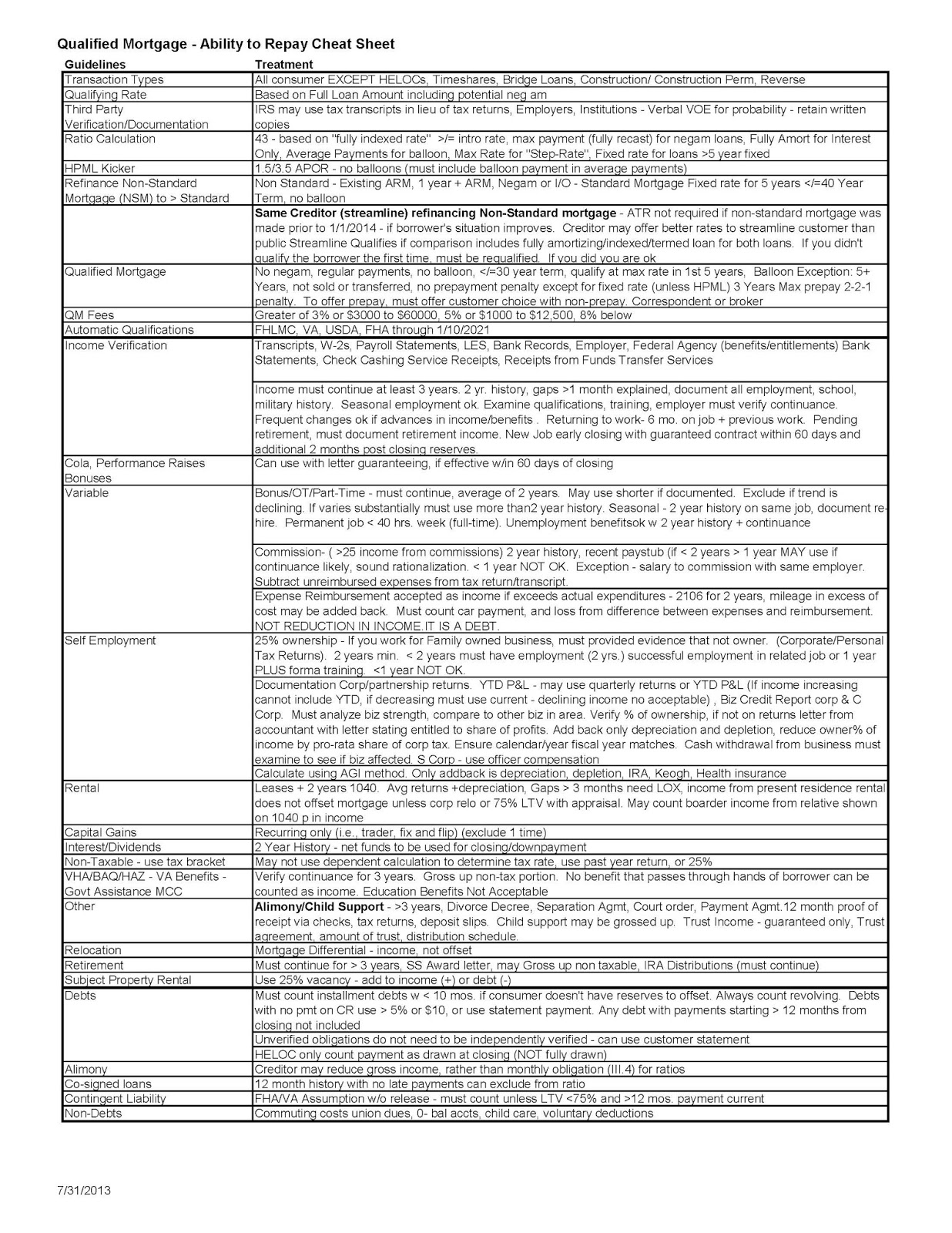

Mortgage News Digest Learning To Love Appendix Q Ability To Repay Part 2

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Remember When House Einstein

Broward County Rebate Broward County Broward The Borrowers

Broward County Rebate Broward County Broward The Borrowers

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

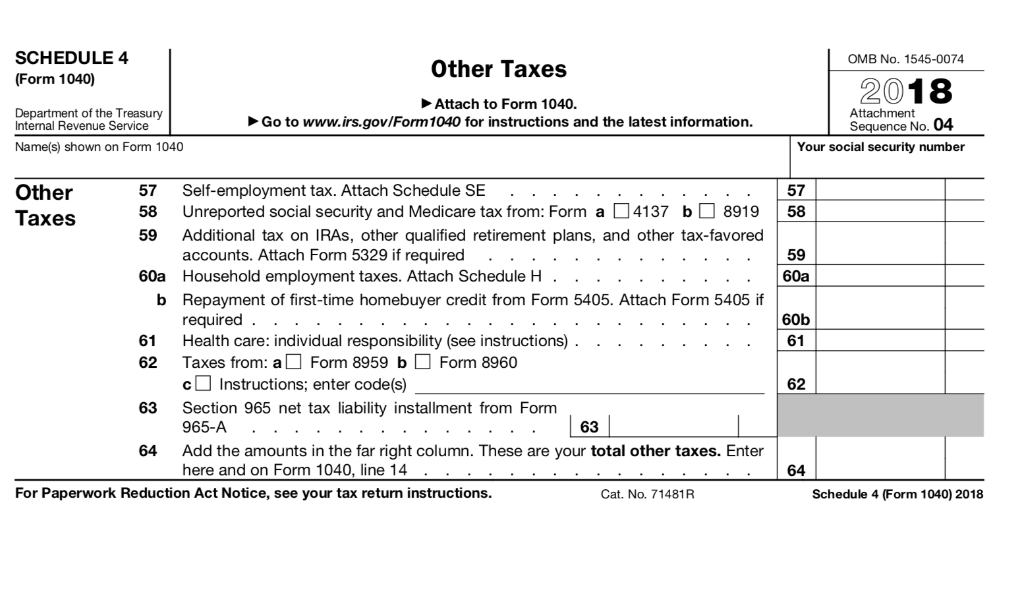

Note This Problem Is For The 2017 Tax Year Janic Chegg

Mortgage Rebate Tax - Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who