Are Insurance Proceeds Taxable For Rental Property Income of any type received from any source for residential rental real estate is reportable income It s taxable to the extent it exceeds your cost basis If you

Need to ask for advice on my calculation of FMV before casualty losses and FMV after casualty loss and reported on insurance deductible 6K on my rental No landlord insurance claims proceeds on rental properties are NOT taxable Some coverages available on Rental Property could be taxable such as Loss

Are Insurance Proceeds Taxable For Rental Property

Are Insurance Proceeds Taxable For Rental Property

https://assets.fidelitylife.com/uploads/2020/06/52729761-fl-social-fb.jpeg

Are Insurance Proceeds You Receive For Repairs Taxable Tax Smart

https://i.ytimg.com/vi/-J5qNLdBFTw/maxresdefault.jpg

Are Property Insurance Proceeds Taxable Reliant Insurance Services

https://www.myreliantinsurance.com/wp-content/uploads/sites/68/2023/04/houses-with-damaged-tiled-roof-covered-with-blue-t-2023-03-09-16-00-21-utc-1024x685.jpg

Insurance proceeds resulting from property damage claims on rental properties are generally tax exempt because they represent compensation rather than Just like with a normal insurance settlement compensation for medical bills and repair of property are not taxed in a lawsuit However some types of payouts that

These rules also apply to renters who receive insurance proceeds for damaged or destroyed property in a rented home that is their main home No gain is recognized on Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to amounts

Download Are Insurance Proceeds Taxable For Rental Property

More picture related to Are Insurance Proceeds Taxable For Rental Property

Are Life Insurance Proceeds Income Taxable Trace Dennis

https://static.fmgsuite.com/media/images/3b1826d5-87e6-4796-aa00-23ca37a9724a.png

Are Proceeds From A Lawsuit Settlement Taxable

https://static.wixstatic.com/media/7af5d8_64e5084b97e24002a2179c22a10db956~mv2.jpg/v1/fit/w_1000%2Ch_768%2Cal_c%2Cq_80/file.jpg

How Are Life Insurance Proceeds Treated In Divorce Cape Fear Family Law

https://capefearfamilylaw.com/wp-content/uploads/life-insurance-proceeds-divorce.jpg

Whether a deduction is taken under Sec 162 or Sec 165 is important because a business expense is deductible when paid or incurred while a casualty loss is deductible only when sustained and if not Insurance proceeds from property losses are gains to the extent the proceeds exceed the adjusted basis in the property Taxpayers can however defer any gain by

Generally if you re paying premiums yourself such as for homeowners insurance and auto insurance then your insurance benefits are not a taxable event Most business owners are shocked to learn that the receipt of an insurance claim payment for a fire or other loss may result in taxable income This can happen where the amount

Are Insurance Proceeds Taxable To A Business AZexplained

https://azexplained.com/wp-content/uploads/2022/05/are-insurance-proceeds-taxable-to-a-business_781.jpg

Are Accident Insurance Proceeds Taxable Rose Sanders Law

https://rosesanderslaw.com/wp-content/uploads/2022/06/hb5hJu2.jpg

https://ttlc.intuit.com/community/investments-and...

Income of any type received from any source for residential rental real estate is reportable income It s taxable to the extent it exceeds your cost basis If you

https://ttlc.intuit.com/community/investments-and...

Need to ask for advice on my calculation of FMV before casualty losses and FMV after casualty loss and reported on insurance deductible 6K on my rental

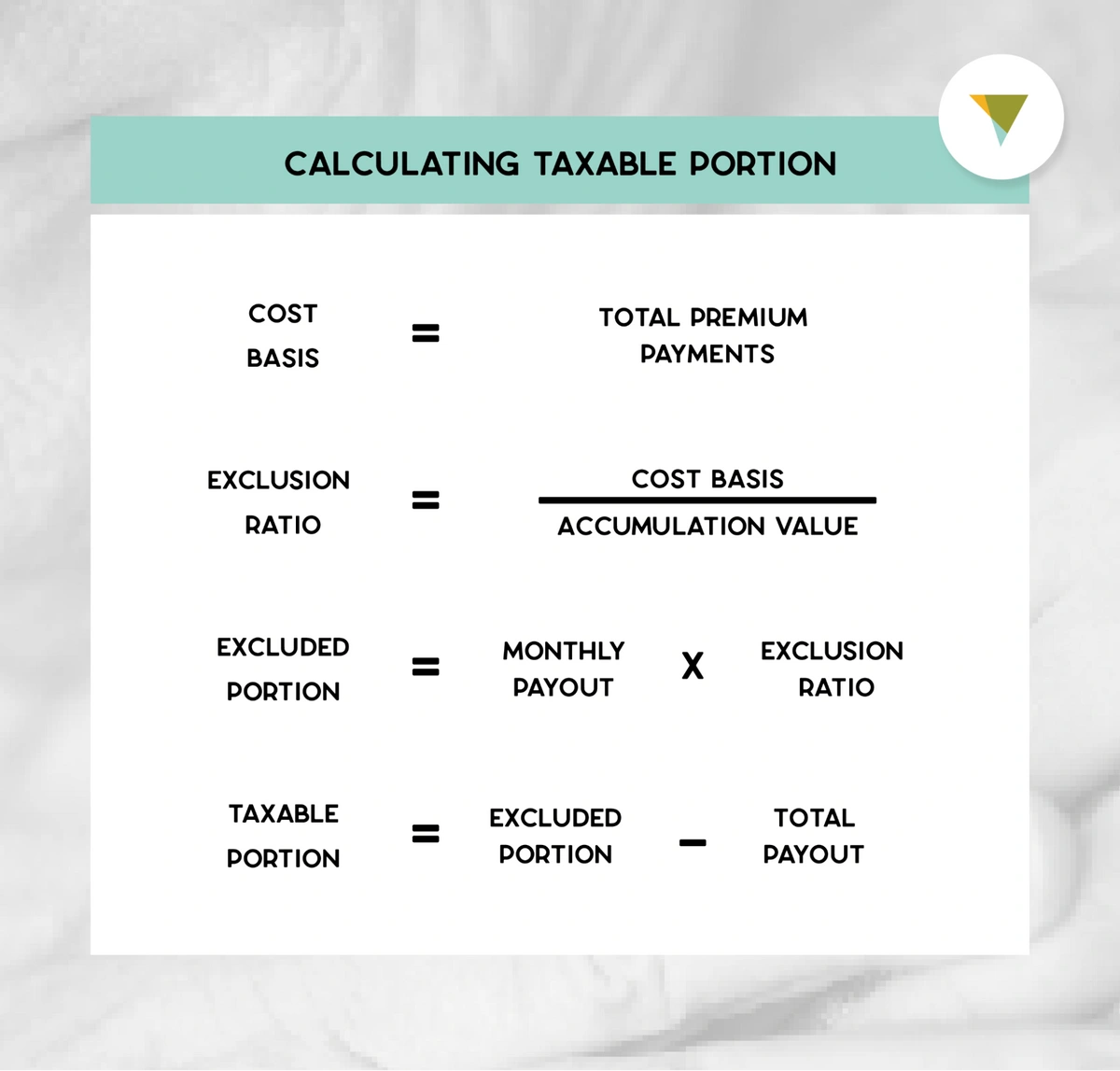

How To Calculate The Taxable Income Of An Annuity

Are Insurance Proceeds Taxable To A Business AZexplained

Are Life Insurance Proceeds Taxable Uk Cuztomize

Are Life Insurance Proceeds Taxable Insurance Noon

Are Life Insurance Proceeds Taxable Life Insurance Tips Online

Are Life Insurance Proceeds Taxable A Complete Guide Story Young And

Are Life Insurance Proceeds Taxable A Complete Guide Story Young And

Sample Printable Disposition Of Insurance Or Of Proceeds Thereof Forms

Are Property Insurance Proceeds Taxable In Canada The Pinnacle List

Are Insurance Proceeds Taxable Income A Look At Tax Rules On Insurance

Are Insurance Proceeds Taxable For Rental Property - Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to amounts