Are Late Payment Penalties Tax Deductible You must pay late payment interest on all taxes paid after the due date and on all penalty fees imposed on your taxes such as the punitive tax increase or late

When are penalty payments deductible for tax purposes Upper Tribunal clarifies the principles governing the deductibility of fines and penalties UT explains non Paragraph a of this section does not apply to amounts paid or incurred as otherwise deductible taxes or related interest However if penalties are imposed relating to such

Are Late Payment Penalties Tax Deductible

Are Late Payment Penalties Tax Deductible

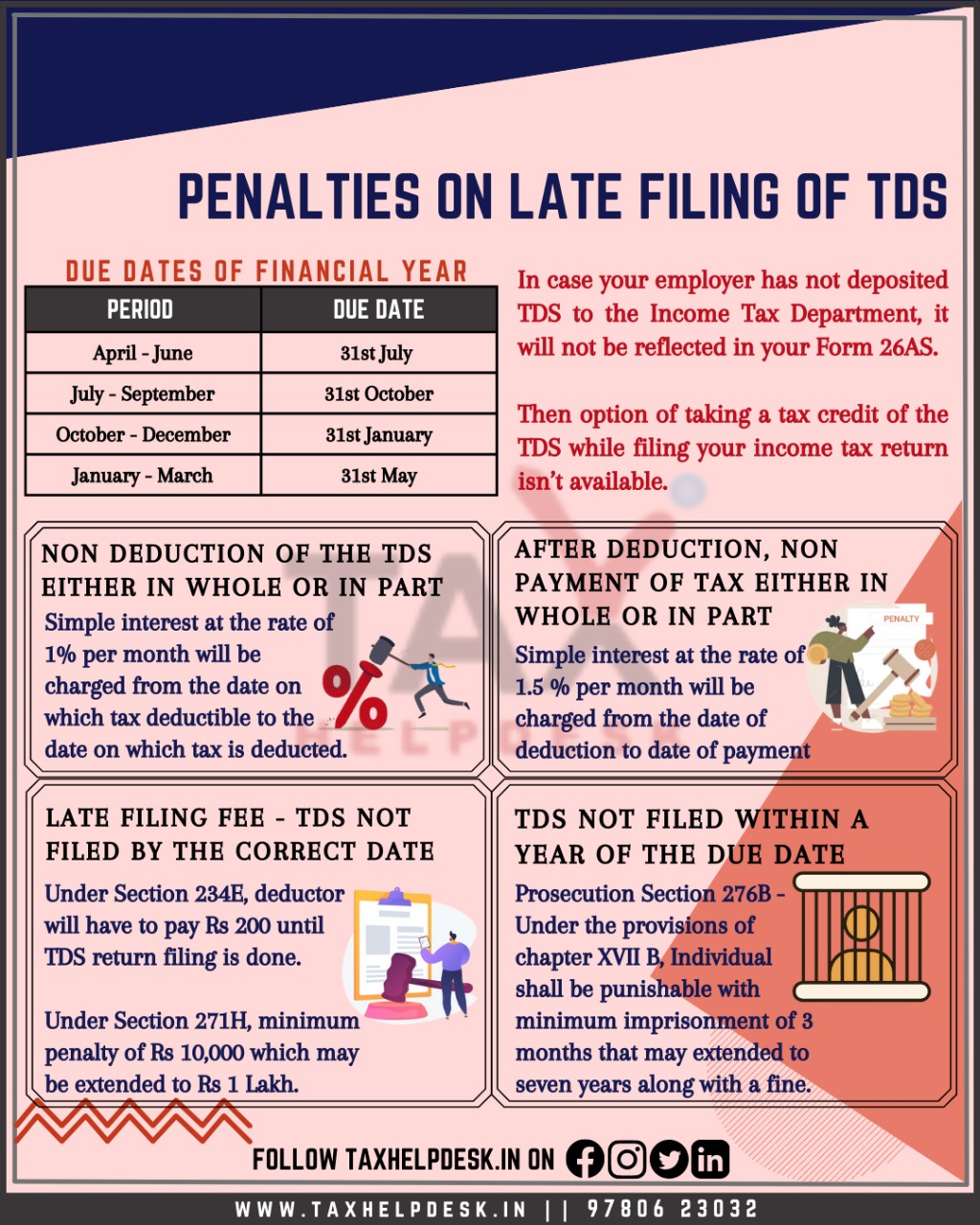

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Penalty-on-late-filing-of-TDS-Returns.jpeg

Are Fines And Penalties Tax Deductible Let s Know fines tax

https://i.pinimg.com/originals/a5/56/b9/a556b9bd5868b6a9356b7d38166b9c07.png

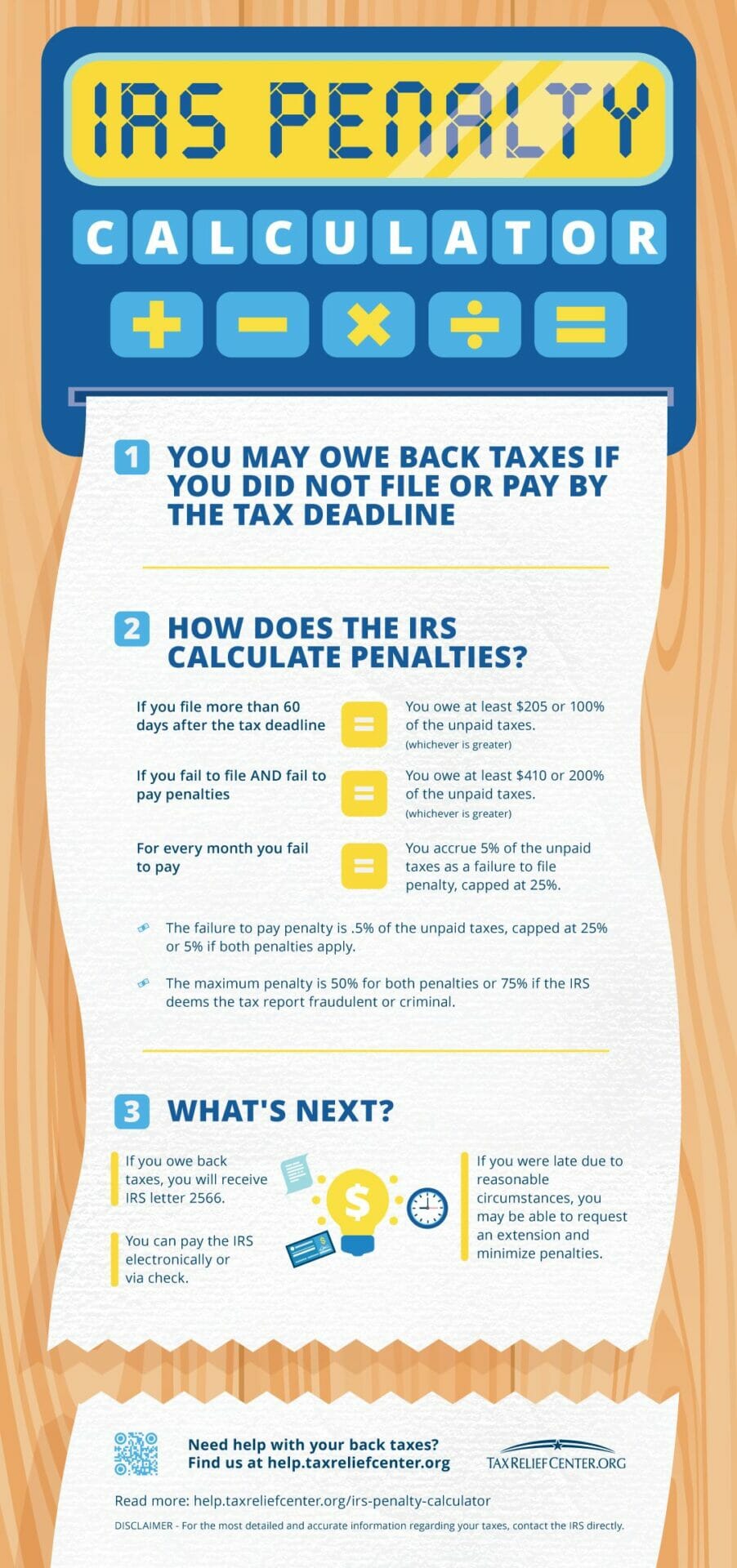

IRS Penalty Calculator INFOGRAPHIC Tax Relief Center

https://help.taxreliefcenter.org/wp-content/uploads/2019/06/20190610-Tax-Relief-Center-IRS-Penalty-Calculator.jpg

Learn how to determine whether fines and penalties paid to the government are tax deductible especially in False Claims Act cases See the Fresenius Medical Care The IRS has issued final regulations on the disallowance of a deduction for certain amounts paid to governmental entities under IRC Sections 162 f and 6050X The final regs

Learn why the IRS does not allow taxpayers to deduct penalties for violating tax laws such as late payment interest Find out how to qualify for penalty relief DEDUCTION DISALLOWANCE FOR CERTAIN FINES AND PENALTIES Prior to the Tax Cuts and Jobs Act of 2017 TCJA Section 162 f provided that fines

Download Are Late Payment Penalties Tax Deductible

More picture related to Are Late Payment Penalties Tax Deductible

Late Tax Payments How To Avoid Penalties After Legislation Changes

https://i0.wp.com/www.peakcashflow.co.uk/wp-content/uploads/2019/08/bigstock-The-Judge-Is-Obliged-To-Pay-A-304726003.jpg?fit=1600%2C1060&ssl=1

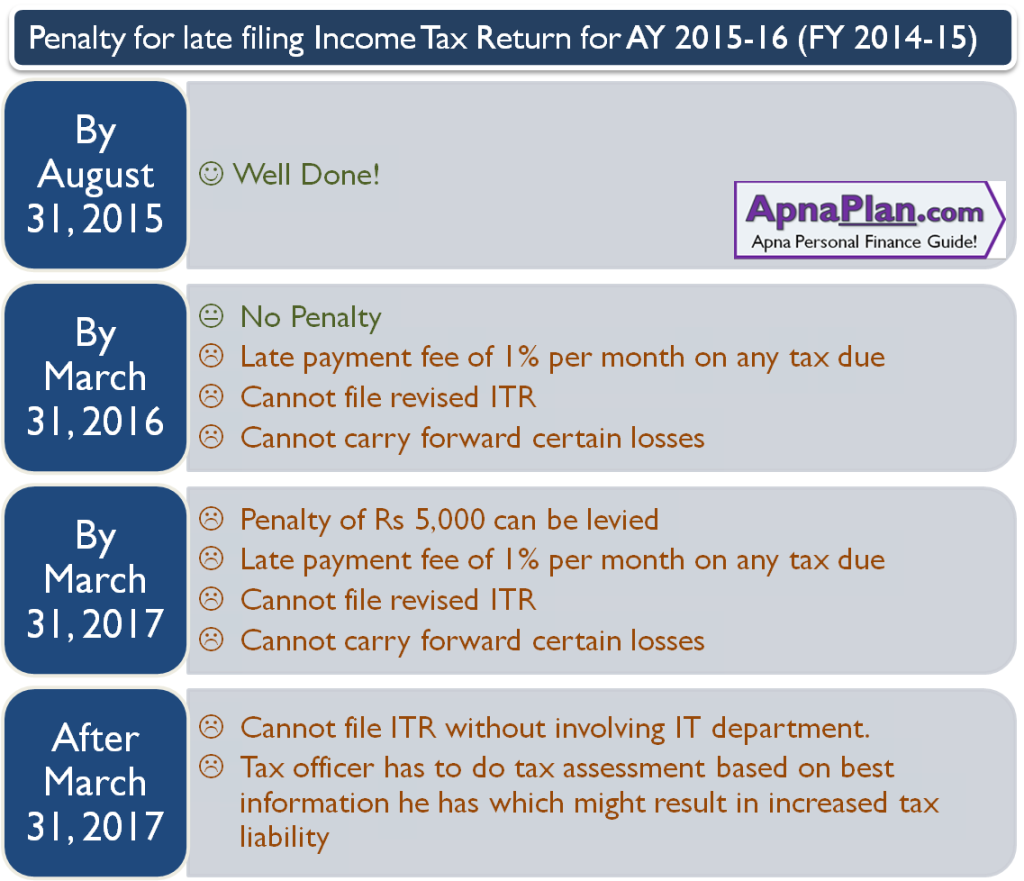

How Much Is Penalty For Late Tax Payment Payment Poin

https://www.apnaplan.com/wp-content/uploads/2015/07/Penalty-for-late-filing-Income-Tax-Return-for-AY-2015-16-FY-2014-15-1024x881.png

Penalties For Late Tax Filing 2022 CRA Rules Nehru Accounting

https://nehruinc.ca/wp-content/uploads/2022/02/Penalties-for-Late-Tax-Filing-2022-CRA-Rules-940x675.jpg

Hi all I have a question relating to late fees on business expenses When a client has late fees added to regular business expenses such as tolls invoices phone internet The IRS charges penalties for various reasons such as filing or paying taxes late preparing inaccurate returns or failing to report foreign income Learn about the types of

The U S Internal Revenue Service has released proposed regulations clarifying when fines penalties and other payments to the government are deductible under section 162 f of the Internal Revenue Code The IRS typically assesses penalties along with interest on the balance owed by a taxpayer and this interest is not tax deductible The federal income tax filing due date

Mortgage Prepayment And Late Payment Penalties Houseopedia

https://www.houseopedia.com/wp-content/uploads/2020/02/Mortgage-Prepayment-and-Late-Payment-Penalties-scaled-e1582316661871-770x433.jpeg

Late Filing And Payment Penalties

https://blog.eztaxreturn.com/wp-content/uploads/2015/01/tax-help-calculator.jpg

https://www.vero.fi/.../interest-on-late-payments

You must pay late payment interest on all taxes paid after the due date and on all penalty fees imposed on your taxes such as the punitive tax increase or late

https://kpmg.com/uk/en/home/insights/2023/09/tmd...

When are penalty payments deductible for tax purposes Upper Tribunal clarifies the principles governing the deductibility of fines and penalties UT explains non

IRS Late Payment Penalty Tax Penalties For Paying Late

Mortgage Prepayment And Late Payment Penalties Houseopedia

The Late Payment Estimated Tax Penalties Tax Debt Self Help Blog

IRS Penalty Rates Common Penalties And What It Will Cost You For

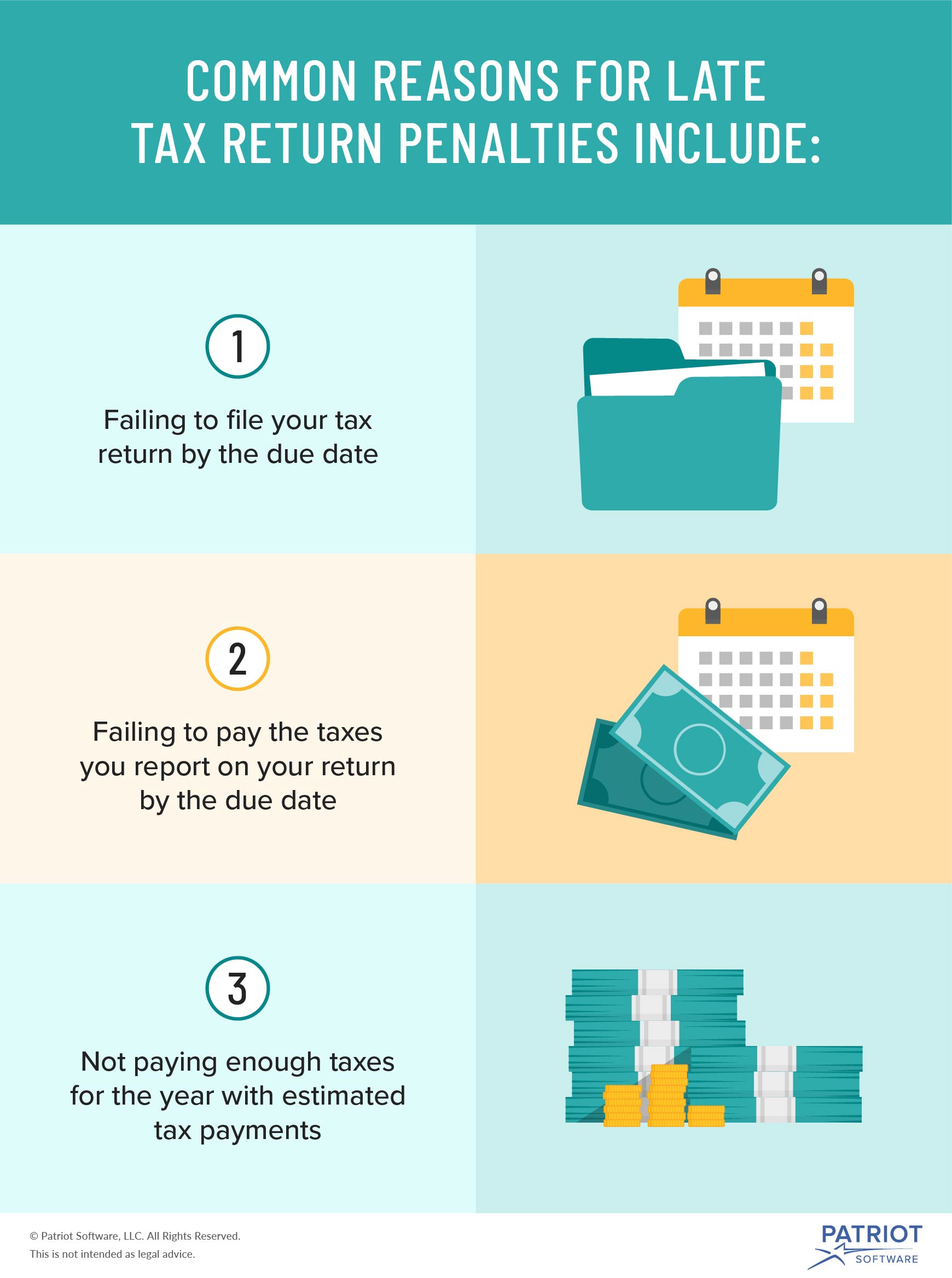

Penalty For Late Tax Return Fees Penalty Relief More

What Is Penalty Abatement And How Does It Work

What Is Penalty Abatement And How Does It Work

Are SARS Penalties Tax Deductible

:max_bytes(150000):strip_icc()/IRS-f29a0fe2468a4eb6bcf6582fa1881df8.jpg)

Are IRS Penalties Tax Deductible

IRS Waives Late Tax Payment Penalties Worry Free Tax Accounting

Are Late Payment Penalties Tax Deductible - Learn how to deduct state and local taxes you pay as an individual taxpayer subject to limitations Find out the categories methods and exceptions of