W1 Tax Code Rebate Web Emergency tax codes If you re on an emergency tax code your payslip will show 1257L W1 1257L M1 1257L X These mean you ll pay tax on all your income above the basic

Web 5 janv 2022 nbsp 0183 32 If you see W1 or M1 attached to your tax code it means your tax is calculated only on your earnings in that individual pay period The tax due on each Web 8 juin 2023 nbsp 0183 32 Le salaire imposable comprend le salaire de base Les revenus appel 233 s accessoires du salaire avantages en nature indemnit 233 s pour frais professionnels

W1 Tax Code Rebate

W1 Tax Code Rebate

https://support.yourpayroll.com.au/hc/article_attachments/5015325505935/mceclip3.png

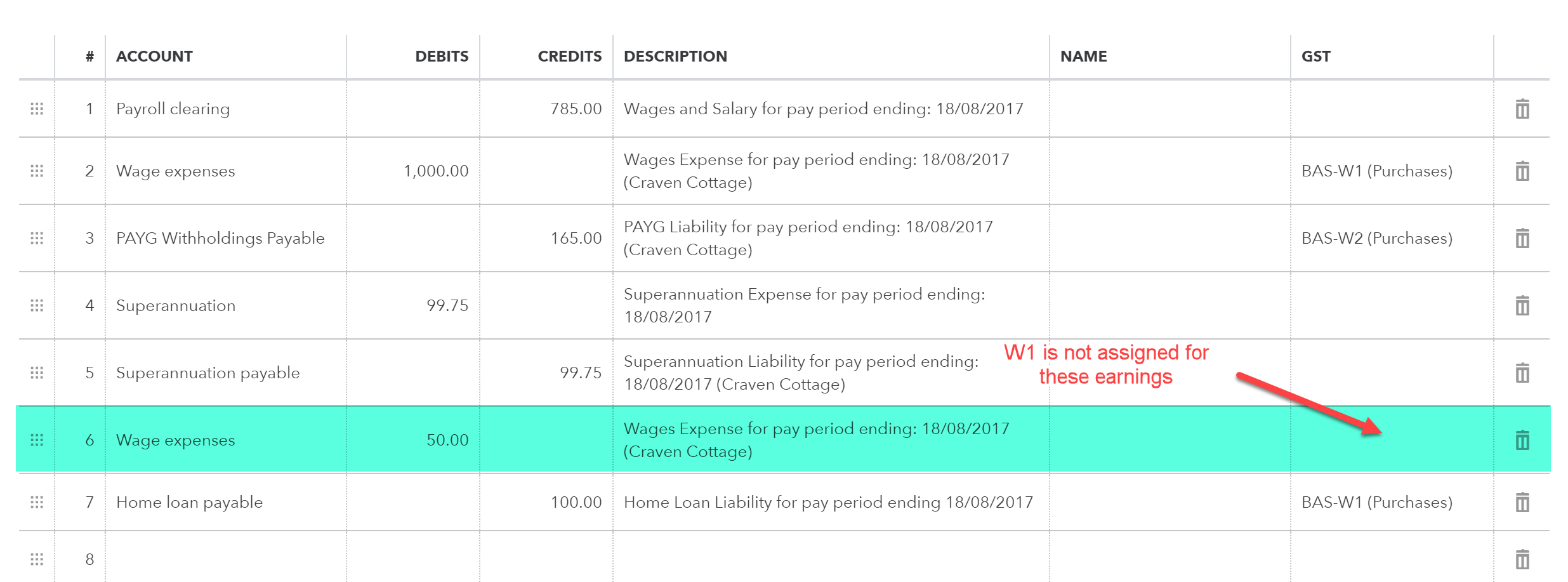

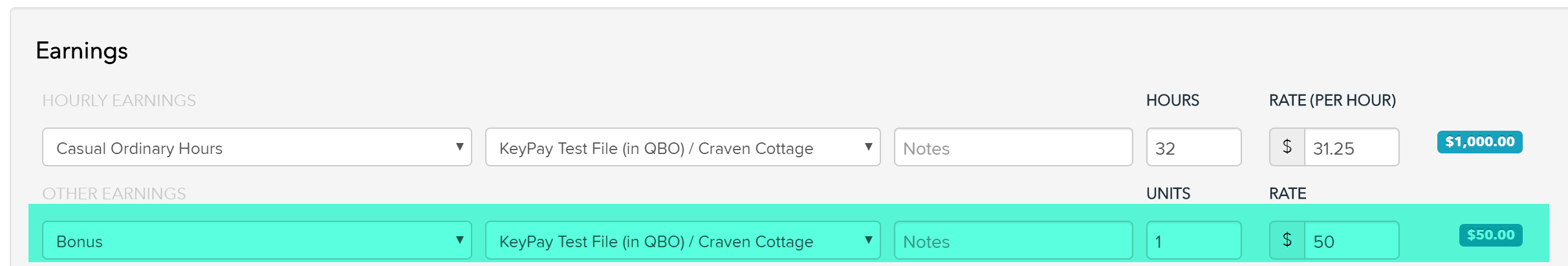

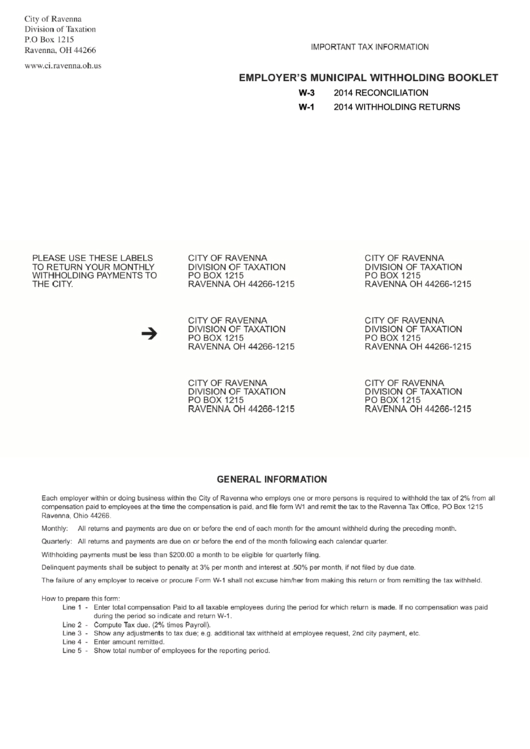

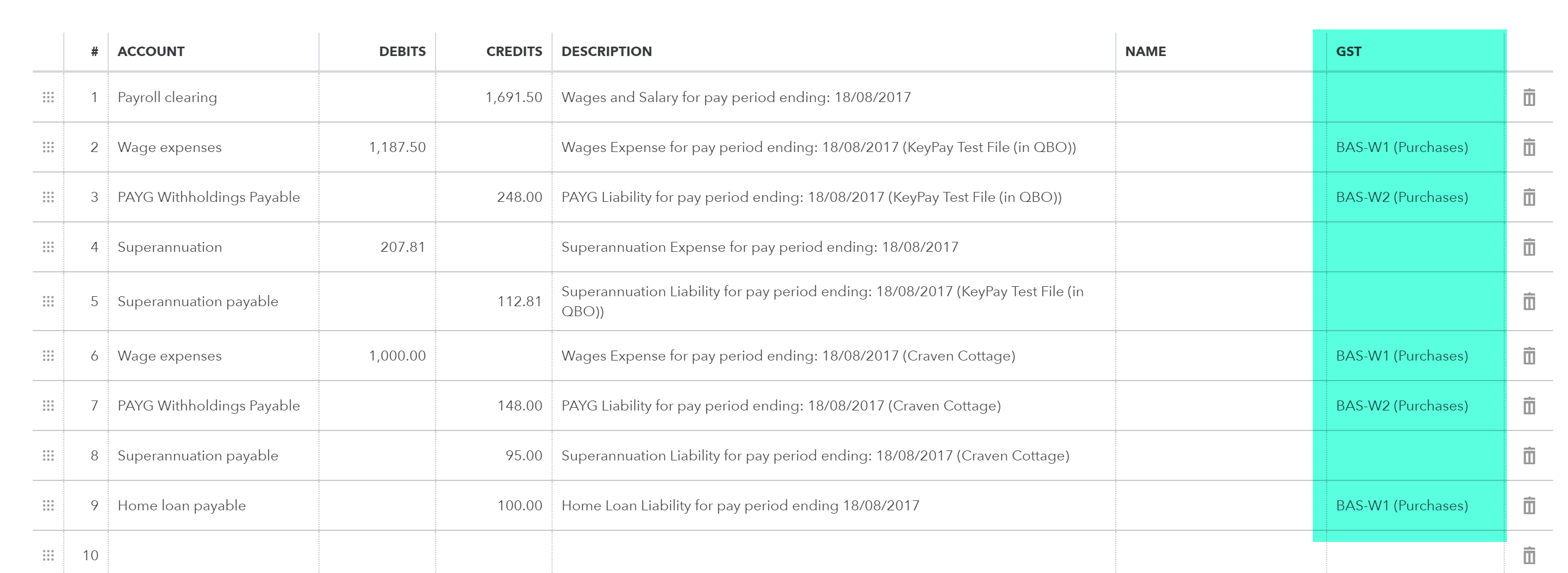

Understanding W1 And W2 Tax Codes In QBO Your Payroll AU

https://support.yourpayroll.com.au/hc/article_attachments/5015404175759/mceclip0.png

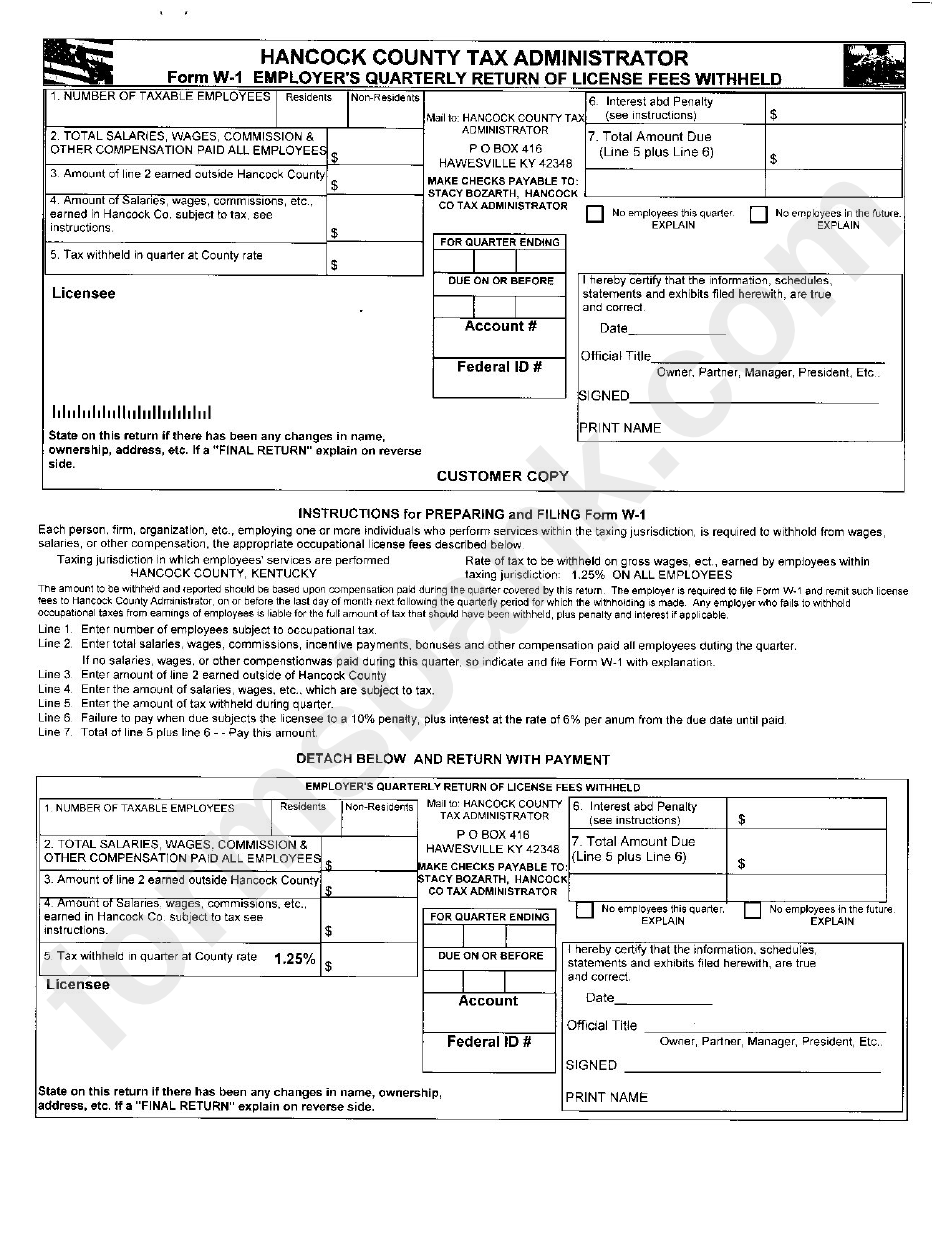

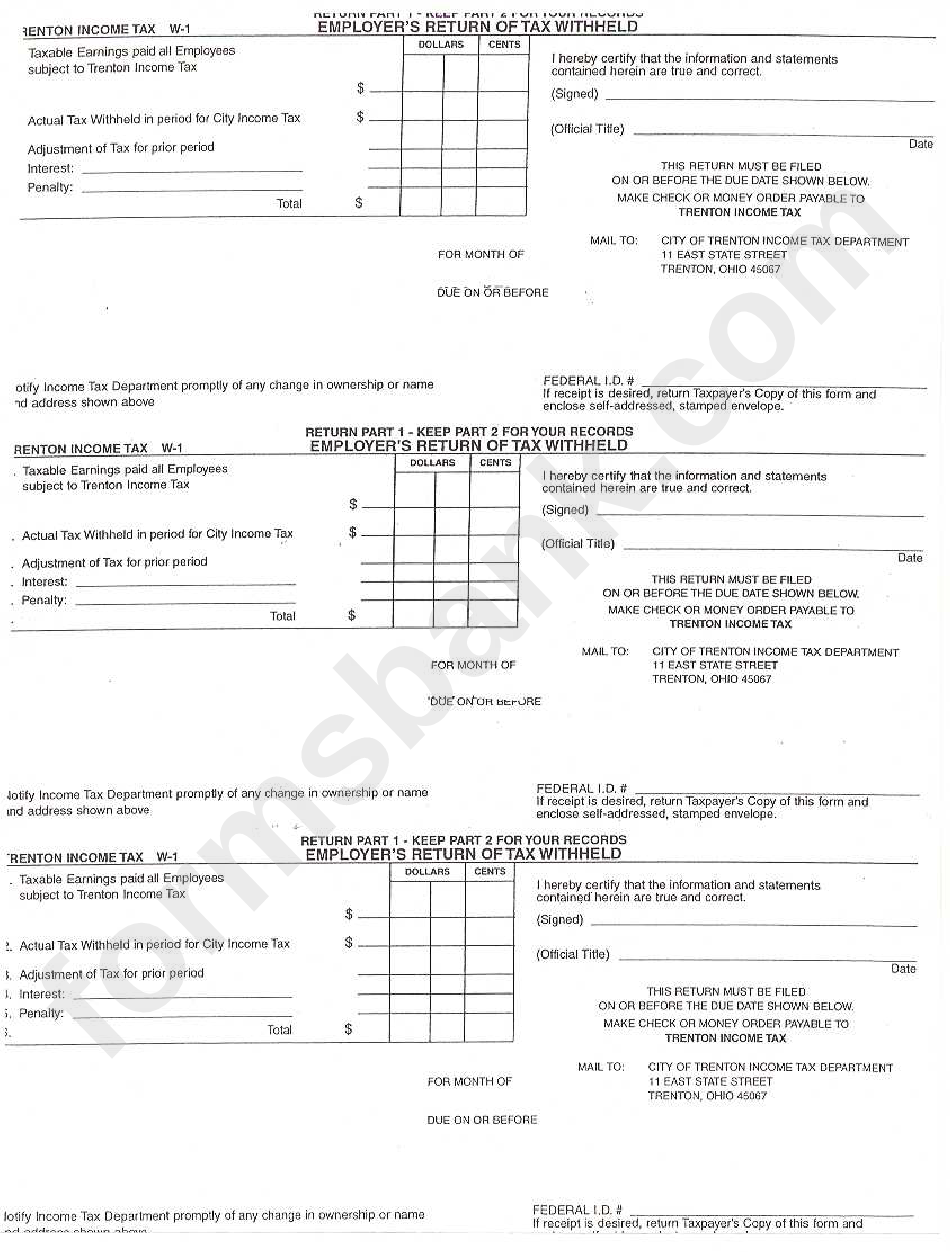

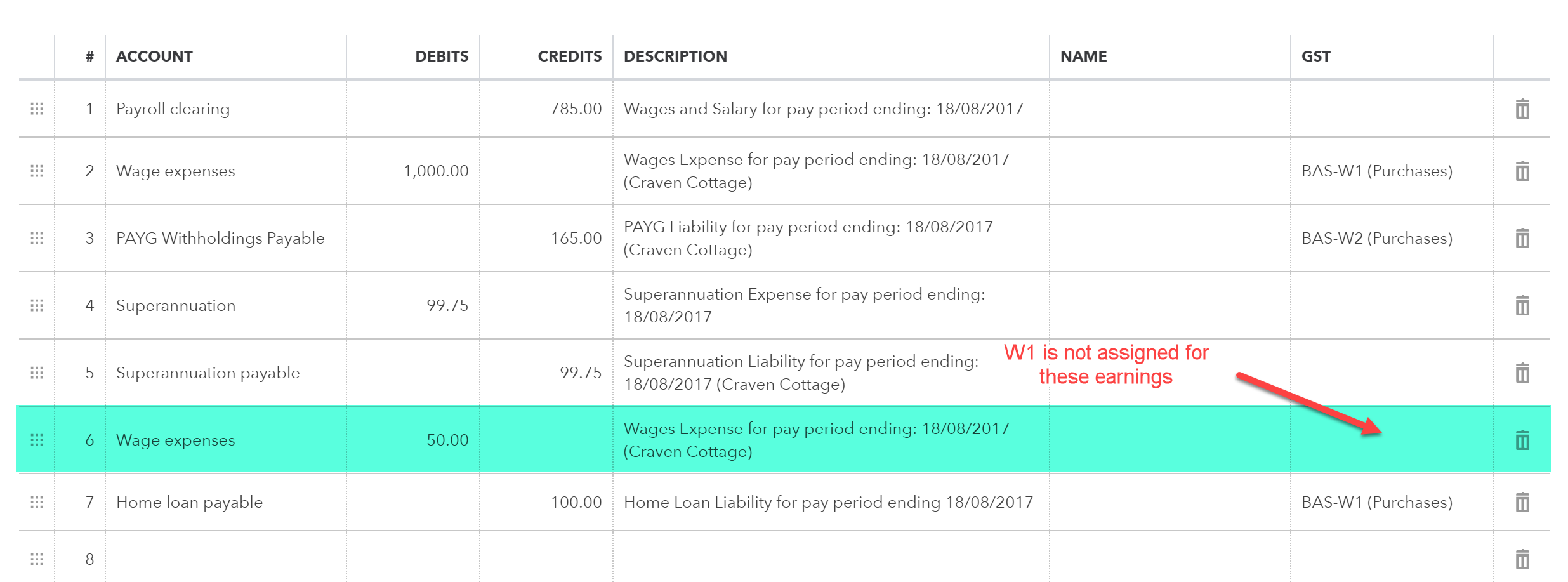

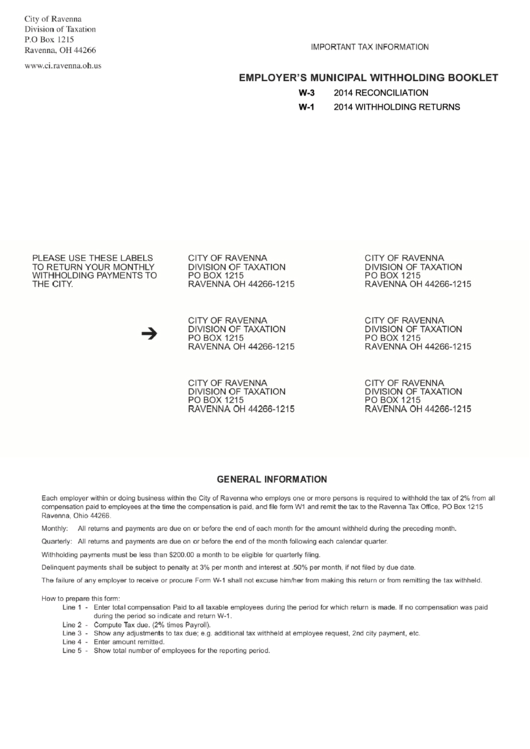

Form W 1 Employer S Quarterly Return Form Of License Fees Withheld

https://data.formsbank.com/pdf_docs_html/231/2315/231540/page_1_bg.png

Web Example of PAYE on tax code W1 Assuming you re entitled to the standard tax free Personal Allowance of 163 12 570 your W1 tax code will be 1257 W1 Because this is a Web 29 d 233 c 2010 nbsp 0183 32 Code 647L W1 is not really correct W1 stands for week 1 basis and we can come back to that if we need to Code 0T W1 is wholly inappropriate It means you pay

Web Tax codes and Week 1 Month 1 What does this mean If you have an employee with Week1 Month1 attached to their tax code Usually shown as M1 after the tax code on Web 30 mars 2022 nbsp 0183 32 1257L is an emergency tax code only if followed by W1 M1 or X Emergency codes can be used when a new employee does not have a P45 Emergency

Download W1 Tax Code Rebate

More picture related to W1 Tax Code Rebate

Understanding W1 And W2 Tax Codes In QBO Your Payroll AU

https://support.yourpayroll.com.au/hc/article_attachments/5015340017039/mceclip2.png

Form W1 Employer S Retun Of Tax Withheld Form Brooklyn Tax Office

https://data.formsbank.com/pdf_docs_html/240/2406/240655/page_1_thumb_big.png

Form W 1 Employer S Return Of Tax Withheld City Of Trenton Income

https://data.formsbank.com/pdf_docs_html/230/2308/230834/page_1_bg.png

Web 13 avr 2023 nbsp 0183 32 Most commonly an emergency tax code will end with M1 or W1 indicating that your tax is non cumulative meaning your tax will be calculated based on your pay Web 4 mai 2021 nbsp 0183 32 The most common tax code for tax year 2021 to 2022 is 1257L It s used for most people with one job and no untaxed income unpaid tax or taxable benefits 1257L

Web Ce formulaire doit 234 tre d 233 pos 233 par les entreprises soumises 224 l imp 244 t sur le revenu dans la cat 233 gorie des BIC Formulaire 224 accompagner de l un des documents suivants Liasse Web 20 f 233 vr 2023 nbsp 0183 32 Tax code What it means L You are entitled to the standard tax free allowance M You ve received 10 of your partner s Personal Allowance N You ve

Form W1 Employer S Return Of Tax Withheld Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/285/2859/285951/page_1_thumb_big.png

https://www.unlockmen.com/wp-content/uploads/2021/06/b8fab1582ebd11ebba4710ddb1aba44f.jpeg

https://www.gov.uk/tax-codes/emergency-tax-codes

Web Emergency tax codes If you re on an emergency tax code your payslip will show 1257L W1 1257L M1 1257L X These mean you ll pay tax on all your income above the basic

https://claimmytaxback.co.uk/guide-uk-emergency-tax-codes

Web 5 janv 2022 nbsp 0183 32 If you see W1 or M1 attached to your tax code it means your tax is calculated only on your earnings in that individual pay period The tax due on each

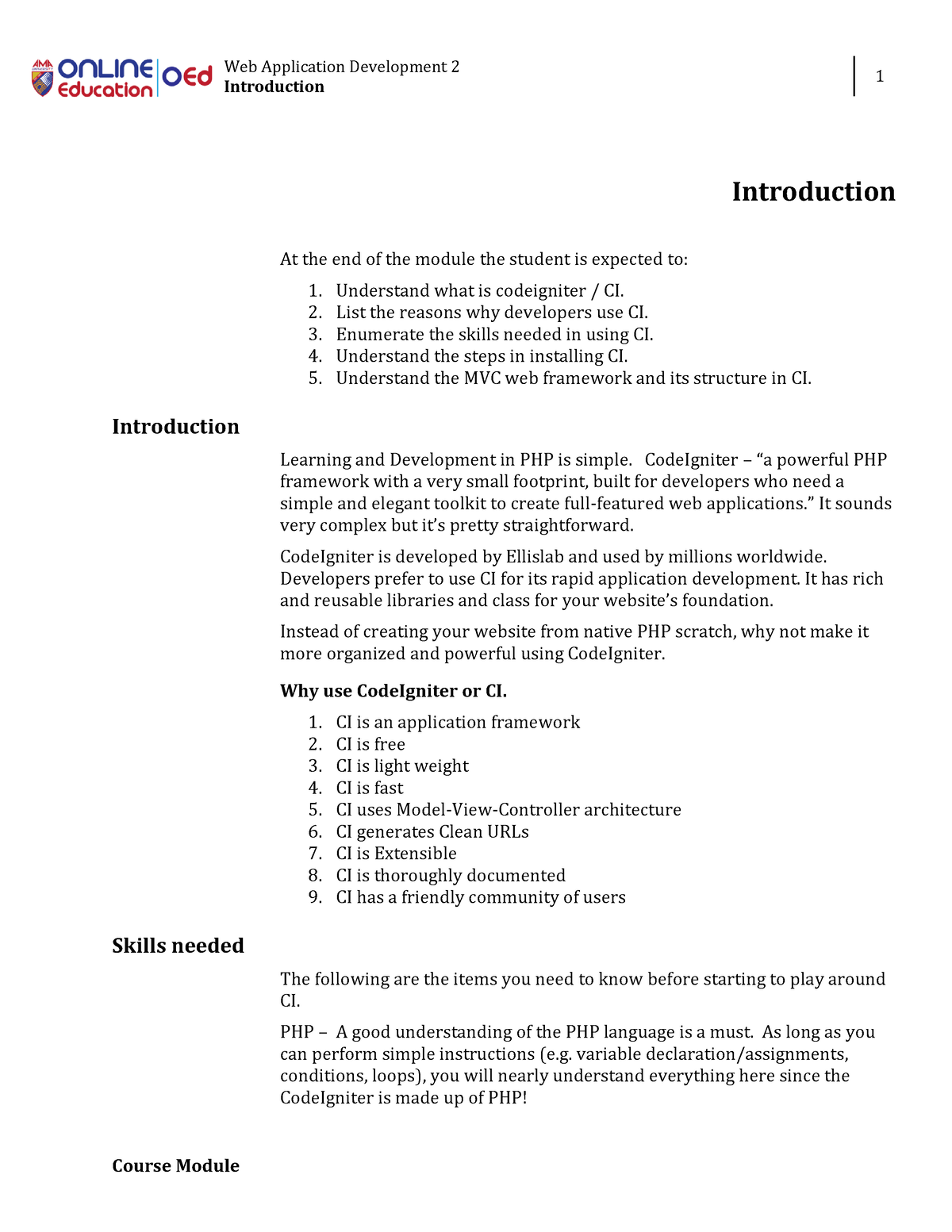

W1 Intoduction To Code Igniter Web Application Development 2

Form W1 Employer S Return Of Tax Withheld Printable Pdf Download

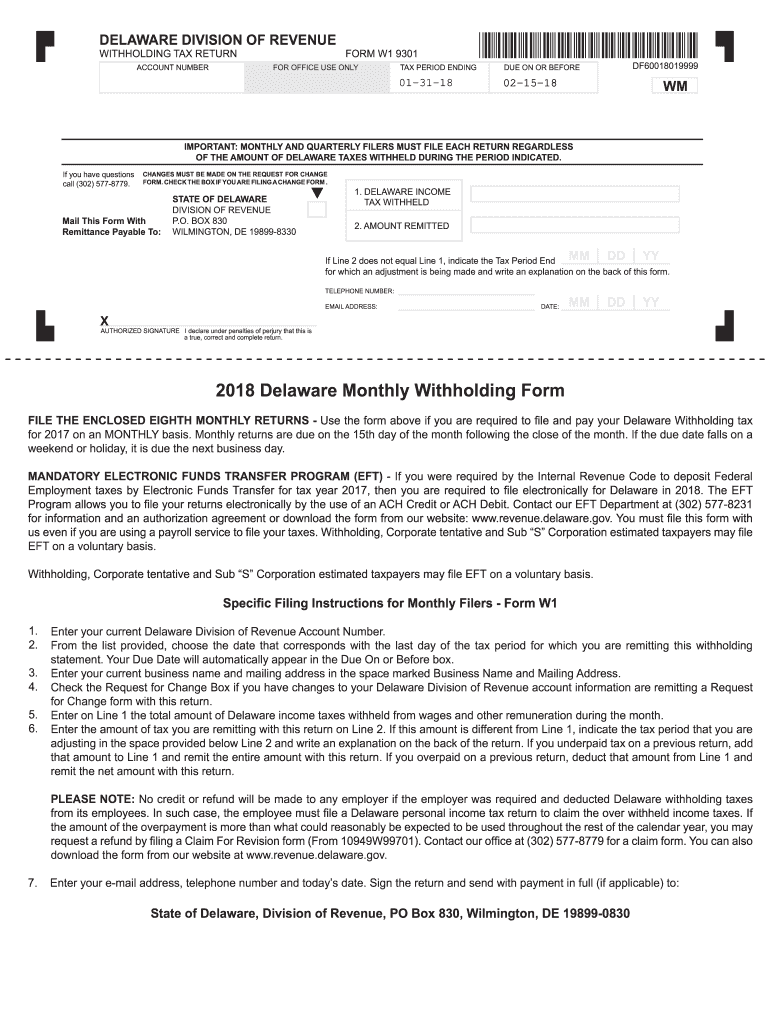

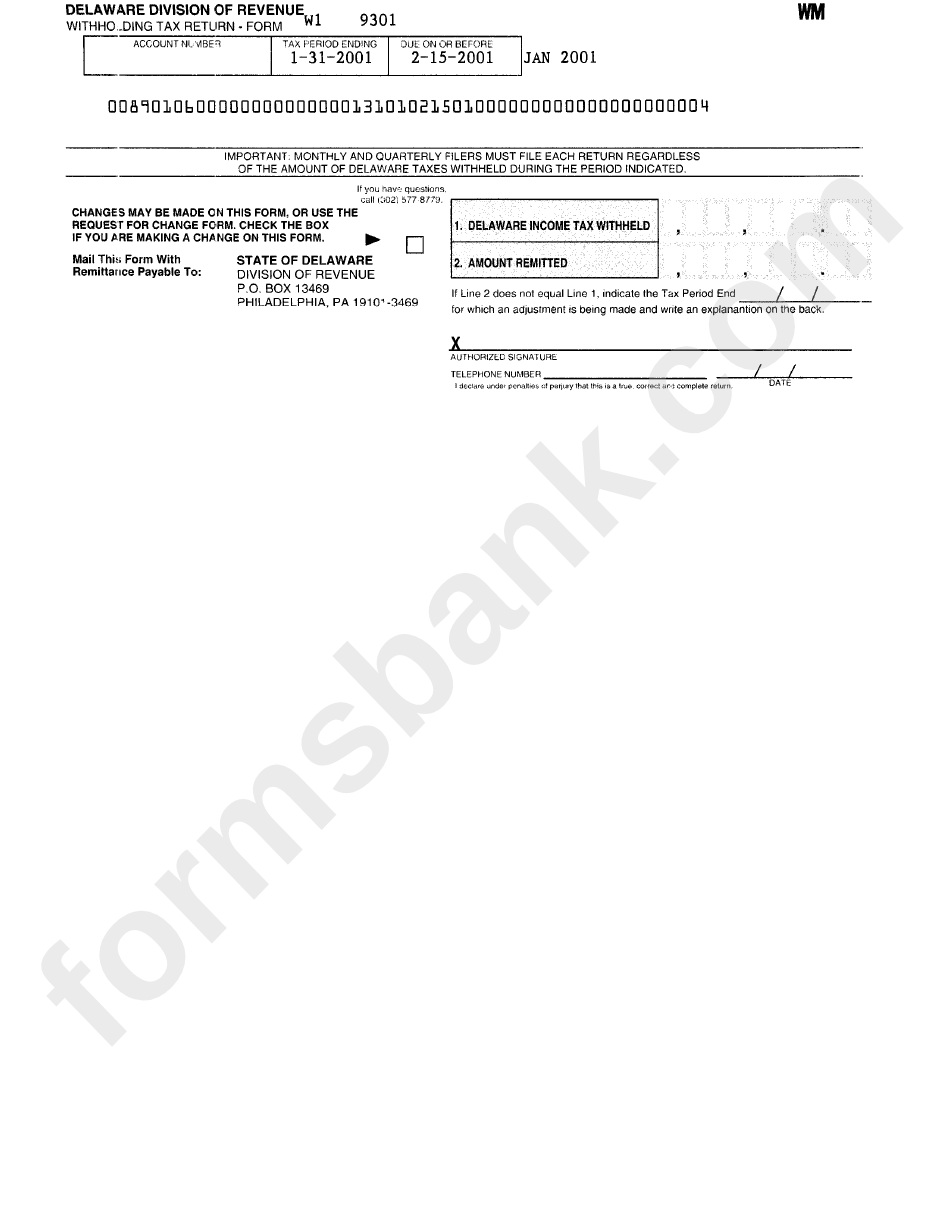

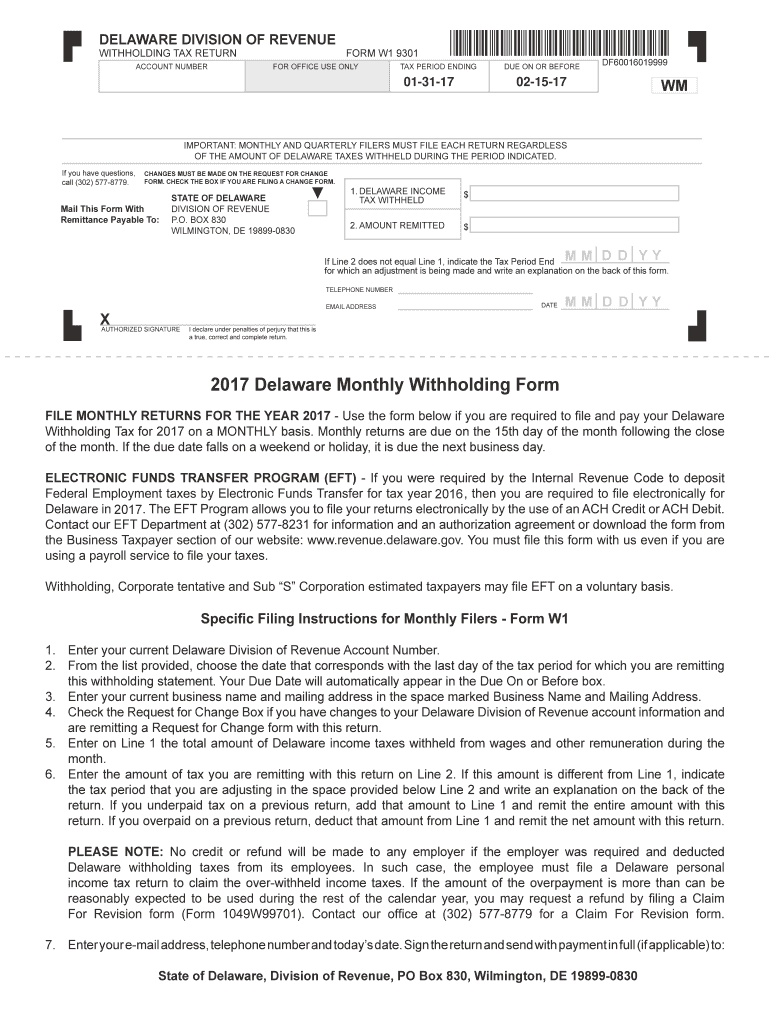

DE W1 9301 2018 Fill Out Tax Template Online US Legal Forms

Form W1 Withholding Tax Return Delaware Division Of Revenue

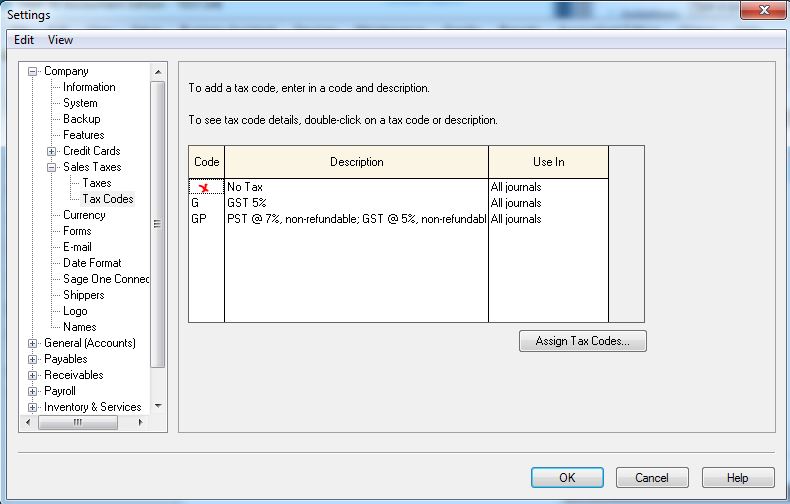

How To Update Sales Tax Codes Manually

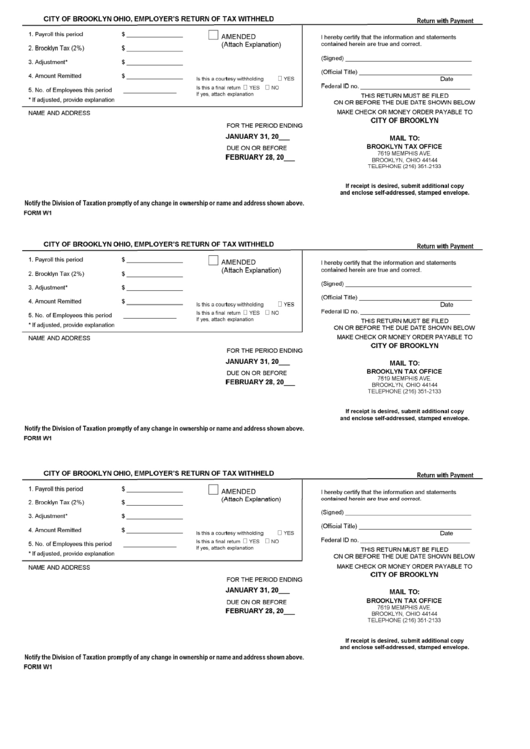

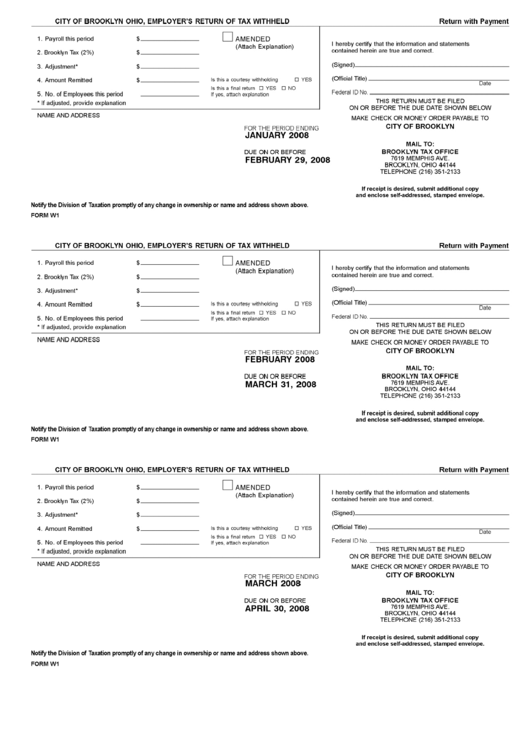

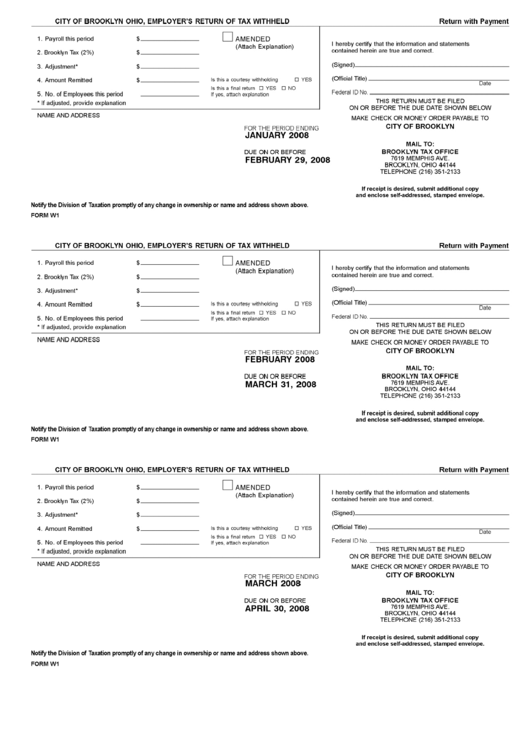

Form W1 Employer S Return Of Tax Withheld City Of Brooklyn State

Form W1 Employer S Return Of Tax Withheld City Of Brooklyn State

DE W1 9301 2017 Fill Out Tax Template Online US Legal Forms

Fillable Form W1 Employer S Return Of Tax Withheld Xenia 2015

Fillable Pa 40 Fill Out Sign Online DocHub

W1 Tax Code Rebate - Web 3 mars 2023 nbsp 0183 32 This will be used until HMRC have sufficient information to work out your correct tax code How to tell if you have an emergency tax code You can tell if you