Are Lawsuit Settlement Payments Deductible Any legal fees or court costs incurred will be deductible as well as the cost of resolving the suit whether the company pays damages to the plaintiff or agrees to settle the dispute

On January 19 2021 the Internal Revenue Service IRS published a second amendment to 162 f of the Internal Revenue Code clarifying when a taxpayer may deduct certain amounts paid to or at the The tax treatment of a settlement or award payment will be determined by the origin of the claim doctrine Under this doctrine if a settlement or award payment represents damages for lost profits it is

Are Lawsuit Settlement Payments Deductible

Are Lawsuit Settlement Payments Deductible

https://www.cpajournal.com/wp-content/uploads/2018/11/GettyImages-859318116-Law-Litigation-Prosecution-Judge-Court-1.jpg

Estimated Tax Payments YouTube

https://i.ytimg.com/vi/eMxTgPtpvmE/maxresdefault.jpg

.png)

Payments For Regenerative Practices

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjBVkddbIa8dpxTBAGErz6PliZ6kATav0uofQD1GivdDvDtgIdeyvAPI7CM0PkKHM-VHxclCoFY67kt0R6N8g2JyHcX5-TYHKOOdDhshl5JOk42lhSbh8dpfZw8_ztgFVF81O5U94BGWyIlg8hVMa96Ib_3rqq2fj2y36GuVif8-KMo1xopTO7Nf9j6Oow/s16000/Untitled design (13).png

You might receive a tax free settlement or judgment but pre judgment or post judgment interest is always taxable and can produce attorney fee problems That can make it attractive to If you receive money from a lawsuit judgment or settlement you may have to pay taxes on that money It depends on the circumstances of the lawsuit and as is typically the case with taxes can be confusing to sort out

Any lawsuit a company faces is disruptive to business The costs associated with hiring attorneys defending a case and paying for damages or a settlement can be If you receive a settlement in an employment related lawsuit for example for unlawful discrimination or involuntary termination the portion of the proceeds that is for lost wages i e

Download Are Lawsuit Settlement Payments Deductible

More picture related to Are Lawsuit Settlement Payments Deductible

Are Legal Settlements Taxable What You Need To Know 2024

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e1f25c4ff44359cf3cdf3f_are-legal-settlements-taxable-1099-misc-box-3.png

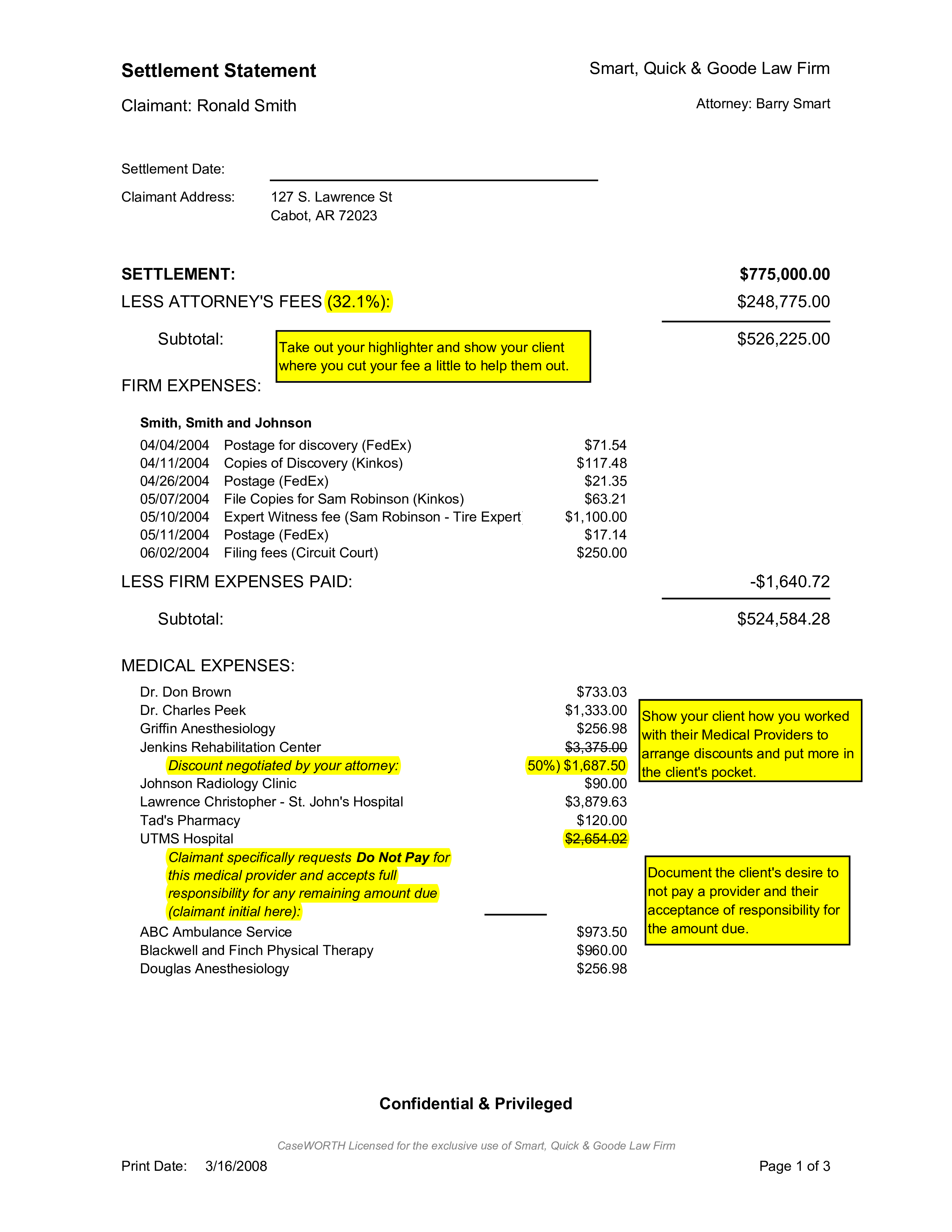

Libreng Legal Settlement Statement

https://www.allbusinesstemplates.com/thumbs/fe23e4b6-9948-4bd6-ac52-6be9ee32cfd4_1.png

Do You Have To Pay Taxes On A Settlement Check Rose Sanders Law

https://rosesanderslaw.com/wp-content/uploads/2022/06/fWDIfb8.png

The amended Section 162 f generally makes deducting judgment and settlement payments in government disputes harder for taxpayers than was the case under When a taxpayer makes a payment pursuant to a judgment or settlement the payment may be deductible as a business expense under IRC 162 or as an income

The tax reform adopted at the end of 2017 includes a new litigation settlement which means that legal fees are not tax deductible This is a particularly strange and unpleasant surprise for Even worse in some cases now there s a tax on lawsuit settlements with legal fees that can t be deducted That can mean paying tax on 100 even if 40 off the top goes

Do I Have To Pay Taxes On A Lawsuit Settlement SH Block Tax Services

https://www.mdtaxattorney.com/wp-content/uploads/2023/02/ShBlock_TaxesOnLawsuitSettlement_header.jpg

How To Get Cash For My Structured Settlement Payments DRB Capital

https://www.drbcapital.com/wp-content/uploads/2020/11/iStock-1145371340-scaled.jpg

https://www.jdsupra.com › legalnews

Any legal fees or court costs incurred will be deductible as well as the cost of resolving the suit whether the company pays damages to the plaintiff or agrees to settle the dispute

https://www.eckertseamans.com › lega…

On January 19 2021 the Internal Revenue Service IRS published a second amendment to 162 f of the Internal Revenue Code clarifying when a taxpayer may deduct certain amounts paid to or at the

4 Reasons To Digitize HOA Payments

Do I Have To Pay Taxes On A Lawsuit Settlement SH Block Tax Services

Employer Paid Moving Expenses Deductible Taxes

Sale Of Structured Settlement Payments By Still Brimpson Issuu

Is Interest Rate Tax deductible Jan 04 2022 Johor Bahru JB

Nationwide Tax Preparation Tax Debt Help Debt Settlement

Nationwide Tax Preparation Tax Debt Help Debt Settlement

Are Personal Injury Lawsuit Settlements Taxable

Negotiated Settlement Agreement Sample

The Payment Settlement Process How Settlement Occurs

Are Lawsuit Settlement Payments Deductible - Any lawsuit a company faces is disruptive to business The costs associated with hiring attorneys defending a case and paying for damages or a settlement can be