Schemes For Income Tax Rebate Web 14 mars 2022 nbsp 0183 32 Here is the list of best income tax saving schemes and plans this year to be known by the tax payers

Web 10 juil 2023 nbsp 0183 32 Invest in best tax saving schemes in 2023 to save tax and earn returns in India Know more about each investment option with Scripbox Web 12 oct 2022 nbsp 0183 32 Home Money Business tax Guidance Tax reliefs and allowances for businesses employers and the self employed English Cymraeg Find out about tax

Schemes For Income Tax Rebate

Schemes For Income Tax Rebate

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

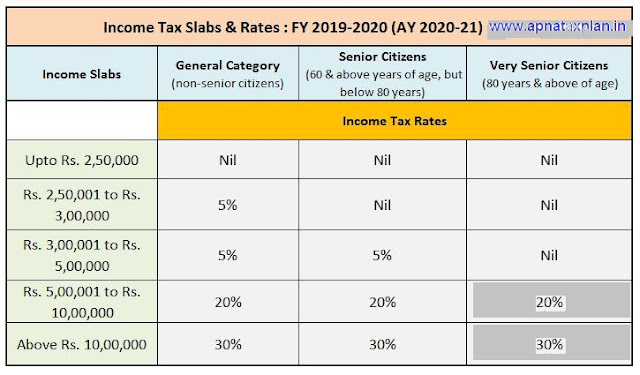

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Web 6 lignes nbsp 0183 32 Tax Exemption Schemes The tax exemption scheme for new start up companies and partial tax Web You cannot claim more than the 50 of the amount on which you receive SEIS Income Tax relief for the tax year 2019 to 2020 The maximum amount of SEIS Income Tax relief

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of Web 3 f 233 vr 2023 nbsp 0183 32 To make the new income tax regime more attractive the Budget 2023 has announced certain deductions that will be available from FY 2023 24 The deductions

Download Schemes For Income Tax Rebate

More picture related to Schemes For Income Tax Rebate

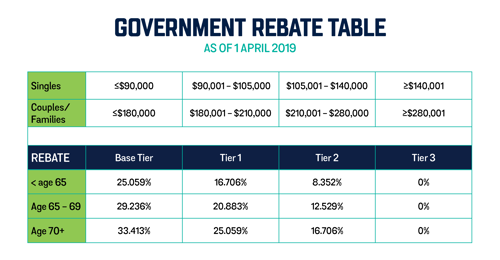

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

10 Ways I Declutter My Finances For The New Year Figuringgitout

https://figuringgitout.com/wp-content/uploads/2020/12/Tax-Reliefs-2020.jpg

Web Learn about various tax saving options that can help you reduce your tax liability This guide provides insights into different tax saving schemes including investments deductions Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web Post office tax saving schemes are reliable and risk free investment tools that assure investors of a secure return Operated by post offices all over the country these Web 21 sept 2022 nbsp 0183 32 1 Understanding NPS Tax Benefits NPS offers investors two types of accounts to invest in Tier I and Tier II Tier I is a mandatory account for all NPS investors

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

https://www.indiatoday.in/information/story/10-best-income-tax-saving...

Web 14 mars 2022 nbsp 0183 32 Here is the list of best income tax saving schemes and plans this year to be known by the tax payers

https://scripbox.com/tax/tax-saving-options

Web 10 juil 2023 nbsp 0183 32 Invest in best tax saving schemes in 2023 to save tax and earn returns in India Know more about each investment option with Scripbox

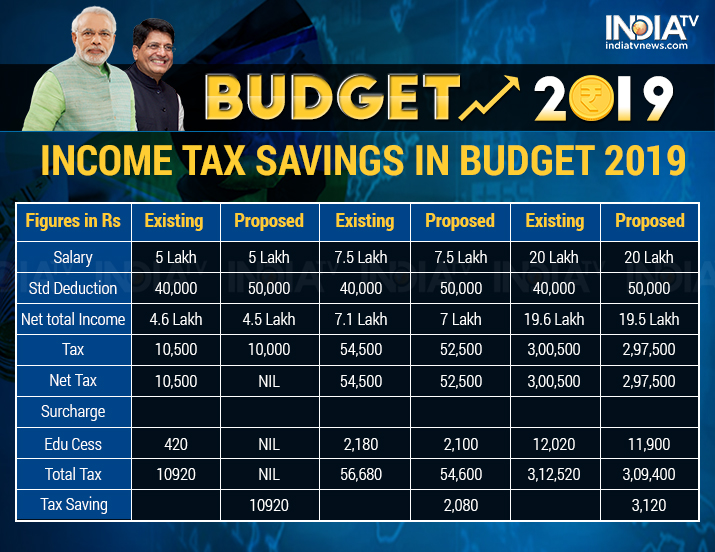

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Incometax Individual Income Taxes Urban Institute This Service

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Income Tax And Rebate For Apartment Owners Association

Schemes For Income Tax Rebate - Web Income Tax Saving Schemes Income tax savings schemes are offered as per the relevant sections of the Income Tax Act 1961 The chief among these is the Section 80C which offers potential tax savings options of up