Are Lease Payments Tax Deductible If the agreement is a lease you may deduct the payments as rent If the agreement is a conditional sales contract you consider yourself as the outright purchaser of the equipment You may generally recover the cost of such property used in a trade or business through depreciation deductions

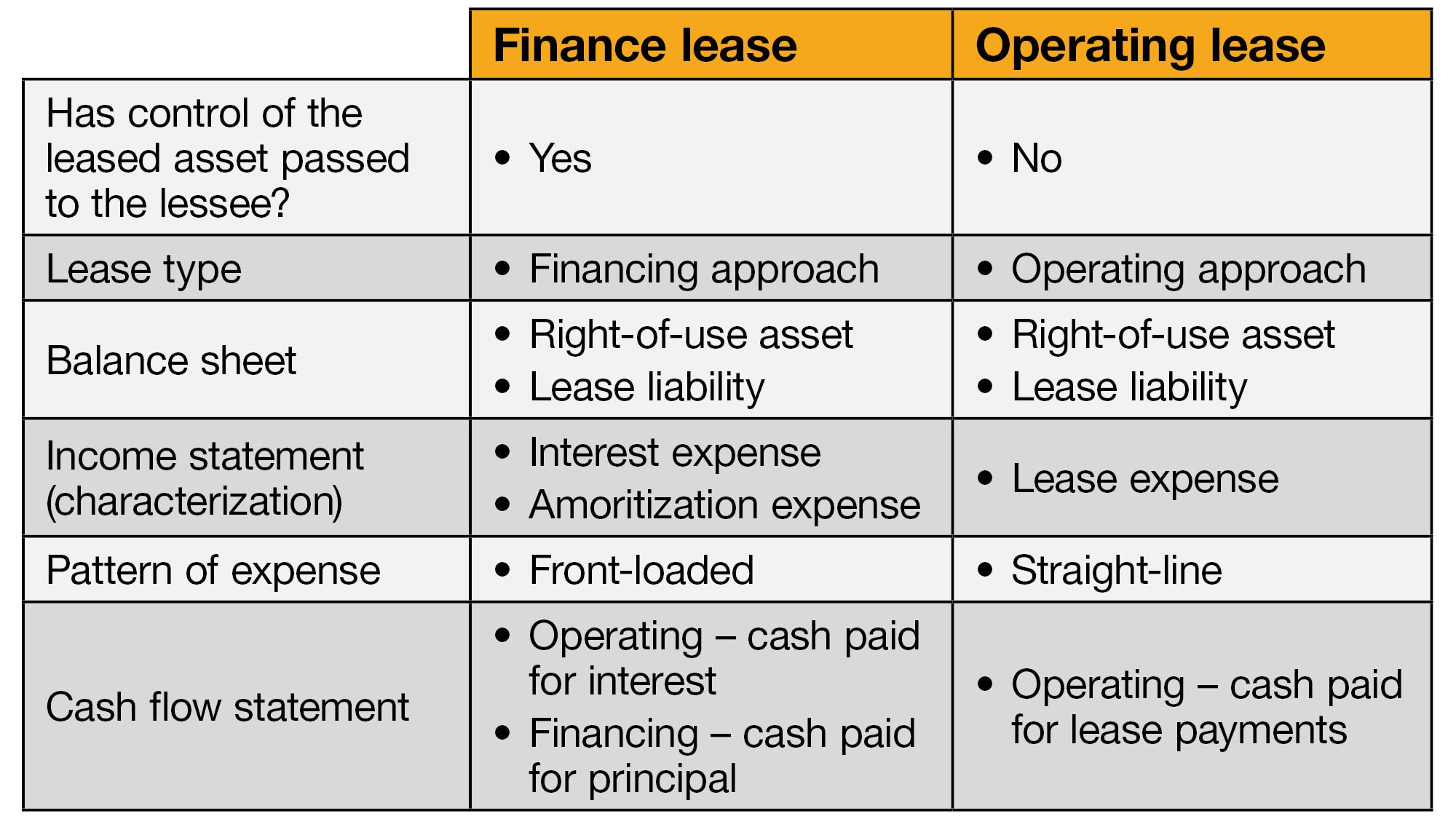

Operating lease The lessee in this instance would be allowed to deduct the lease rental payments made to the lessor The lessor was allowed to claim capital allowances in respect of the leased property The lease rental income received from the lessee formed part of its taxable income Claim actual expenses which would include lease payments If you choose this method only the business related portion of the lease payment is deductible An income inclusion amount reduces both of these deductions

Are Lease Payments Tax Deductible

Are Lease Payments Tax Deductible

https://www.towerleasing.co.uk/wp-content/uploads/2022/01/equipment-lease-750.jpg

How To Deduct Car Lease Payments In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cae7e9c465079cefe358_60d8c6557a8c3d545307e3be_car-lease-payment-savings.jpeg

Present Value Of Lease Payments Formula TerenceDevin

https://lh6.googleusercontent.com/zSEXcGiXvPBW5885HlHbeibQZIF6gauvDqka5seJNlOexKPGTgqtym5WV2egvYBUhugWL_cl_xF9RG_JMR3y1AWPf6RJkoq0Q_buGn8MKN2UECU2xn4TbsxEEUPoexRAFbGcgFan

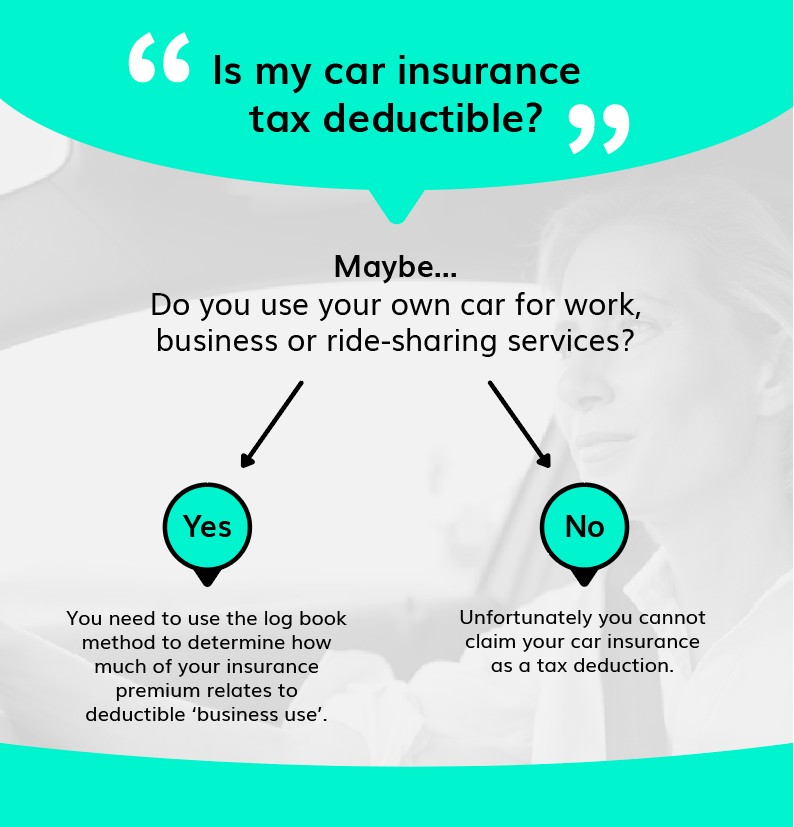

If you are using a leased car for business you can deduct a portion of your expenses Learn which car lease tax write off method offers the highest deduction Are car lease payments tax deductible In short yes Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off this common business expense First and foremost you must be self employed or a business owner to qualify

Whether the tenant s lease termination payment is deductible depends on the reason for early termination If the lease was terminated because the lease agreement has become unprofitable the payment is fully deductible under Sec 162 Cassatt 137 F 2d 745 3d Cir 1943 If your business leases equipment under a typical lease you generally are entitled to currently deduct your rental payments as long as you are using the leased property in your business

Download Are Lease Payments Tax Deductible

More picture related to Are Lease Payments Tax Deductible

How Are Lease Payments Calculated YouTube

https://i.ytimg.com/vi/IoNn0OUTyVY/maxresdefault.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

What Are Non Deductible Expenses In Business

https://www.freshbooks.com/wp-content/uploads/2022/01/non-deductible-expenses.jpg

You may deduct the cost of monthly lease payments by using the actual expense deduction on your federal tax returns The specific amount of the lease payment you can deduct depends on how much Rent paid for a business is usually deductible in the year it is paid If a business pays rent in advance it can deduct only the amount that applies to the use of the rented property during the tax year The business can deduct the rest of the payment over the period to which it applies

[desc-10] [desc-11]

Are Car Lease Payments Tax Deductible Lease Fetcher

https://images.prismic.io/leasefetcher/42a783fa-eba8-4c0c-93a8-253f80c11eac_car-lease-tax-deduction.jpg?auto=compress,format

Sars 2022 Weekly Tax Tables Brokeasshome

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

https://www.irs.gov/faqs/small-business-self...

If the agreement is a lease you may deduct the payments as rent If the agreement is a conditional sales contract you consider yourself as the outright purchaser of the equipment You may generally recover the cost of such property used in a trade or business through depreciation deductions

https://www.pwc.com/ug/en/assets/pdf/tax...

Operating lease The lessee in this instance would be allowed to deduct the lease rental payments made to the lessor The lessor was allowed to claim capital allowances in respect of the leased property The lease rental income received from the lessee formed part of its taxable income

Investment Expenses What s Tax Deductible Charles Schwab

Are Car Lease Payments Tax Deductible Lease Fetcher

Business Credit Card Payments Payments Tax Deductible Creadit Card

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

Are Equipment Lease Payments Tax Deductible Finco Financial Group

Are Mortgage Payments Tax Deductible AZexplained

Are Mortgage Payments Tax Deductible AZexplained

Are Car Payments Tax Deductible All About Wheels

Pre tax Deductions Intuit payroll

How To Find Average Income Tax Rate Parks Anderem66

Are Lease Payments Tax Deductible - Whether the tenant s lease termination payment is deductible depends on the reason for early termination If the lease was terminated because the lease agreement has become unprofitable the payment is fully deductible under Sec 162 Cassatt 137 F 2d 745 3d Cir 1943