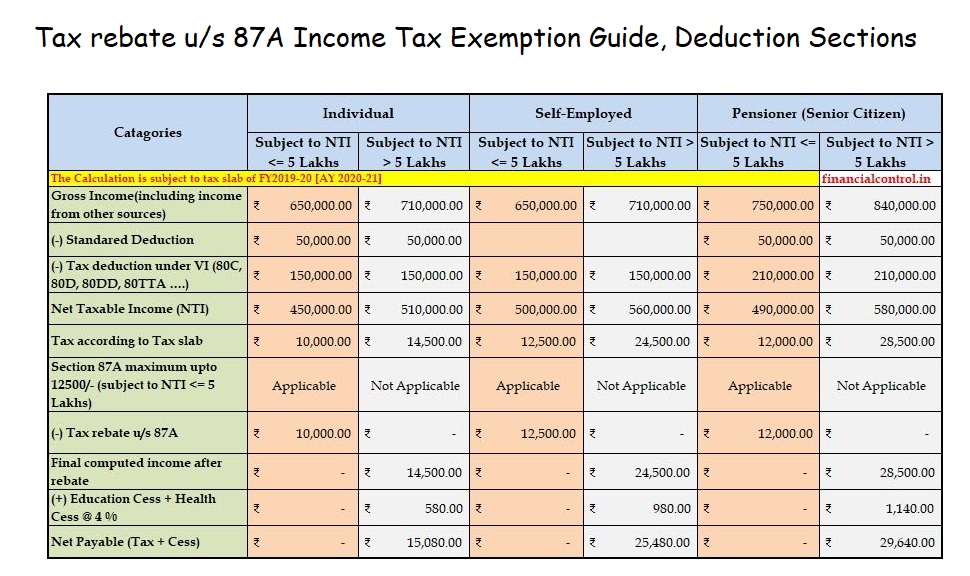

Rebate On Income Tax For Ay 2024 23 Declare your gross income and tax deductions in ITR Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh The maximum rebate under section 87A for the AY 2022 23 is Rs 12 500 See the example below for rebate calculation under Section 87A For individuals below 60 years of age for AY 2022 23

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Rebate On Income Tax For Ay 2024 23

Rebate On Income Tax For Ay 2024 23

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs Surcharge and cess will be applicable as discussed above Income tax slab for individual aged above 60 years to 80 years NOTE Income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Local Authority For the Assessment Years 2023 24 2024 25 a local authority is taxable at 30 Add a Surcharge The amount of income tax shall be increased by a surcharge at the rate of 12 of such tax where total income exceeds one crore rupees

Personal Income Tax Return please write Included as Interest Income on PA 40 across the top of any Form 1099 R for such distributions and include copies of all your Forms 1099 R with your claim form Line 7 Report interest and dividends received or credited during the year whether or not you actually received the cash 2024 tax refund calculator One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator which are offered by tax prep companies such as H R Block as

Download Rebate On Income Tax For Ay 2024 23

More picture related to Rebate On Income Tax For Ay 2024 23

2020 Tax Brackets Capital Gains

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

https://www.staffnews.in/wp-content/uploads/2023/02/budget-2023-24-finance-bill-2023-rates-of-income-tax.jpg

Section 87A of the Income Tax Act 1961 provides 100 tax relief for residents with taxable income up to Rs 12 500 and up to Rs 500 000 from 2023 24 It should be noted that if the total income exceeds Rs 500 000 there will be no marginal relief unlike the tax relief in the new tax regime from 2024 25 Of the child tax credit for inflation in tax years 2024 and 2025 rounded down to the nearest 100 Rule for Determination of Earned Income For tax years 2024 and 2025 taxpayers may at their election use their earned income from the prior taxable year in calculating their maximum

The document provides valuable insights into the income tax benefits available to salaried individuals for the assessment year AY 2024 25 and document includes brief introduction and tax treatment of various allowances and perquisites available to an employee inter alia house rent allowance gratuity provident fund and so forth Income Tax Exemptions list for Assessment Year 2024 25 Income Tax Deductions List FY 2023 24 Old New Tax Regimes Tax Saving options 80c Tax Rebates Benefits Latest Income Tax Slab Rates FY 2023 24 AY 2024 25 Up to FY 2022 23 there was no tax exemption ceiling limit u s 54

INCOME TAX AY 21 22 SLAB RATES AND REBATE INCOME TAX IN TAMIL BASIC CONEPTS PART 2 YouTube

https://i.ytimg.com/vi/bveHl19cUs0/maxresdefault.jpg

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections TeachersBuzz

https://teachersbuzz.in/wp-content/uploads/2023/01/Tax-rebates-under-section-87A-Illustrations..jpg

https://cleartax.in/s/income-tax-rebate-us-87a/

Declare your gross income and tax deductions in ITR Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh The maximum rebate under section 87A for the AY 2022 23 is Rs 12 500 See the example below for rebate calculation under Section 87A For individuals below 60 years of age for AY 2022 23

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Income Tax Calculator FY 2022 23 AY 2023 24 Excel Download

INCOME TAX AY 21 22 SLAB RATES AND REBATE INCOME TAX IN TAMIL BASIC CONEPTS PART 2 YouTube

Income Tax Rebate U s 87A For The FY 2020 21 AY 2021 22 FY 2019 20 AY 2020 21 YouTube

Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Senior Citizen Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

Senior Citizen Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

Income Tax Calculation Ay 2023 24 In Hindi PELAJARAN

Section 87A Of Income Tax Act For AY 2023 24 AUBSP

What Will Be The Tax Allowance For 2020 21 Tutorial Pics

Rebate On Income Tax For Ay 2024 23 - Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs Surcharge and cess will be applicable as discussed above Income tax slab for individual aged above 60 years to 80 years NOTE Income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years