Are Medical Insurance Reimbursements Taxable Before we discuss insurance reimbursement tax treatment the answer is no Health insurance reimbursement through a health reimbursement arrangement or reimbursing employees for health insurance is not taxable

Is health insurance reimbursement considered income No Unlike a healthcare stipend with a health insurance reimbursement employers don t have to pay payroll taxes and employees don t have to So are health insurance reimbursement plans taxable Generally speaking no HRAs are employer sponsored plans that reimburse employees for qualified medical expenses and the IRS

Are Medical Insurance Reimbursements Taxable

Are Medical Insurance Reimbursements Taxable

https://navi.com/blog/wp-content/uploads/2022/06/Medical-Reimbursement_1267w-e1662661707980.jpg

5 Ways Your Practice Can Improve Health Insurance Reimbursements

https://gentem.com/wp-content/uploads/2022/08/5-ways-to-maximize-reimbursement-blog-graphic-1800-×-1000-px.jpg

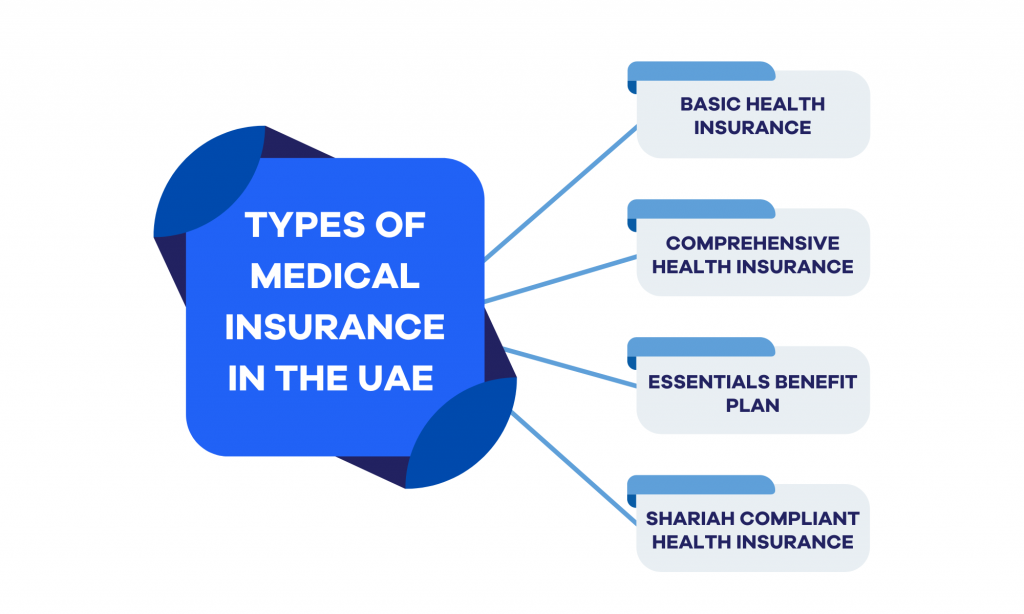

Medical Insurance Cost Compare Buy Health Insurance Plans In UAE

https://www.buyanyinsurance.ae/blog/wp-content/uploads/2022/11/6-1-1024x614.png

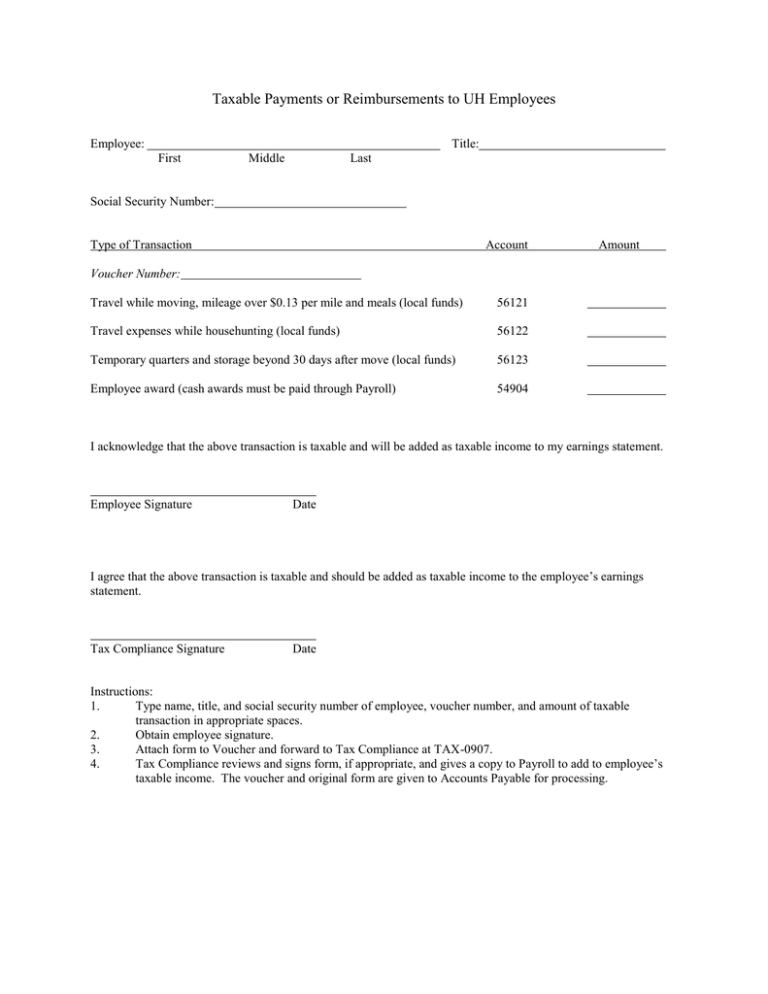

The medical expenses must not be reimbursable by insurance or other sources and their payment from HSA funds distribution won t give rise to a medical expense deduction on the individual s federal income tax return Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and generally is subject to federal income tax

So are reimbursements taxable It depends on the situation If the employer does not have an accountable plan then any reimbursements even those that are ordinary and necessary are taxable income You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income AGI For example if your AGI is 100 000 and you have 10 000 in

Download Are Medical Insurance Reimbursements Taxable

More picture related to Are Medical Insurance Reimbursements Taxable

What Does RVU Mean In Medical Billing MBA Medical

https://mbamedical.com/wp-content/uploads/2020/03/What-Is-An-RVU-In-Medical-Billing_MBA-Medical-scaled.jpg

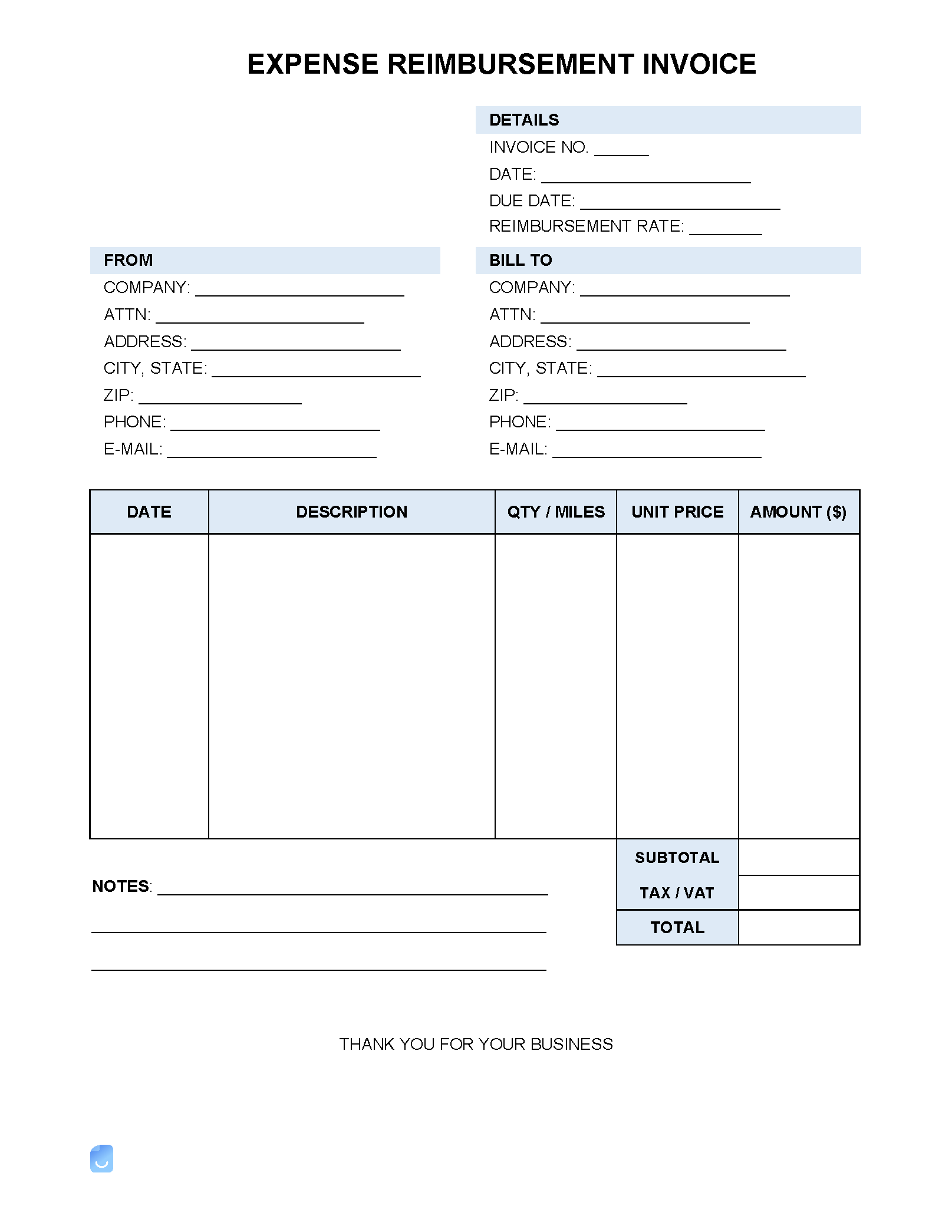

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

What Is The Medicare Reimbursement Rates By Cpt Code

https://i1.wp.com/therathink.com/wp-content/uploads/2019/10/Untitled.png?w=1135&ssl=1

Luckily there are options that allow you to reimburse employees for individual health insurance coverage such as a taxable stipend or a health reimbursement arrangement HRA However there If an employee pays the premiums on personally owned health insurance or incurs medical costs and is reimbursed by the employer the reimbursement generally is excluded from the employee s gross income and not

Since amounts received for personal injuries and sickness are generally not includable in gross income benefits received under qualified long term care insurance are generally not taxable But there is a limit on the amount of qualified long term care benefits that may be excluded from income Health plans If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding

Are Health Care Reimbursements Taxable AZexplained

https://azexplained.com/wp-content/uploads/2022/06/are-health-care-reimbursements-taxable_1459.jpg

Is Health Insurance Reimbursement Taxable

https://www.peoplekeep.com/hubfs/Is health insurance reimbursement taxable_fb.jpg#keepProtocol

https://www.takecommandhealth.com/blog/is-health...

Before we discuss insurance reimbursement tax treatment the answer is no Health insurance reimbursement through a health reimbursement arrangement or reimbursing employees for health insurance is not taxable

https://www.takecommandhealth.com/bl…

Is health insurance reimbursement considered income No Unlike a healthcare stipend with a health insurance reimbursement employers don t have to pay payroll taxes and employees don t have to

Health Insurance Premiums To Rise 8 Next Year CommonWealth Magazine

Are Health Care Reimbursements Taxable AZexplained

Taxable Payments Or Reimbursements To UH Employees

GROUP MEDICAL INSURANCE Jaggi Co Jaggi Co

Changes To Reimbursement Rates Cornerstone Rehab

Medical Reimbursement With Health Insurance Claim Form And Stethoscope

Medical Reimbursement With Health Insurance Claim Form And Stethoscope

Healthcare Reimbursement How It Works For Providers

Are Insurance Reimbursements Taxed As Income

Are Health Insurance Reimbursements Taxable HealthPlanRate

Are Medical Insurance Reimbursements Taxable - Generally speaking reimbursements for health insurance are taxable if they were made in excess and contributed to the amount of income generated during the year In addition Health Reimbursement Accounts often referred to Health Reimbursement Arrangements or HRAs are tax free