Are Medical Loss Ratio Rebates Taxable Are rebates taxable In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums you paid on

MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked The rebates are tied to the medical loss ratio the percentage of insurance premium dollars spent on actual health care

Are Medical Loss Ratio Rebates Taxable

Are Medical Loss Ratio Rebates Taxable

https://blog.nisbenefits.com/hs-fs/hubfs/blog-headers/rebate B.jpg?width=4800&name=rebate B.jpg

ACA s 2020 Medical Loss Ratio Rebates Healthinsurance

https://www.healthinsurance.org/wp-content/uploads/2020/09/2020-medical-loss-ratio-rebates.jpg

Medical Loss Ratio MLR Rebates BAIS Insurance

https://baisins.com/wp-content/uploads/2021/09/Medical-Loss-Ratio-MLR-Rebates.jpg

The ACA requires medical insurance companies Insurer or Insurers to pay annual Medical Loss Ratio MLR rebates to policyholders by each September 30 if the insurer On April 19 2012 the Internal Revenue Service IRS issued a set of Frequently Asked Questions FAQs explaining the tax treatment of premium rebates

If the employee premiums were deducted on a pretax basis then the rebate is treated as taxable wages subject to income and employment taxes If the employee premiums Insurers must perform annual reporting to the U S Department of Health and Human Services HHS by July 31 of their Medical Loss Ratio MLR and its calculation

Download Are Medical Loss Ratio Rebates Taxable

More picture related to Are Medical Loss Ratio Rebates Taxable

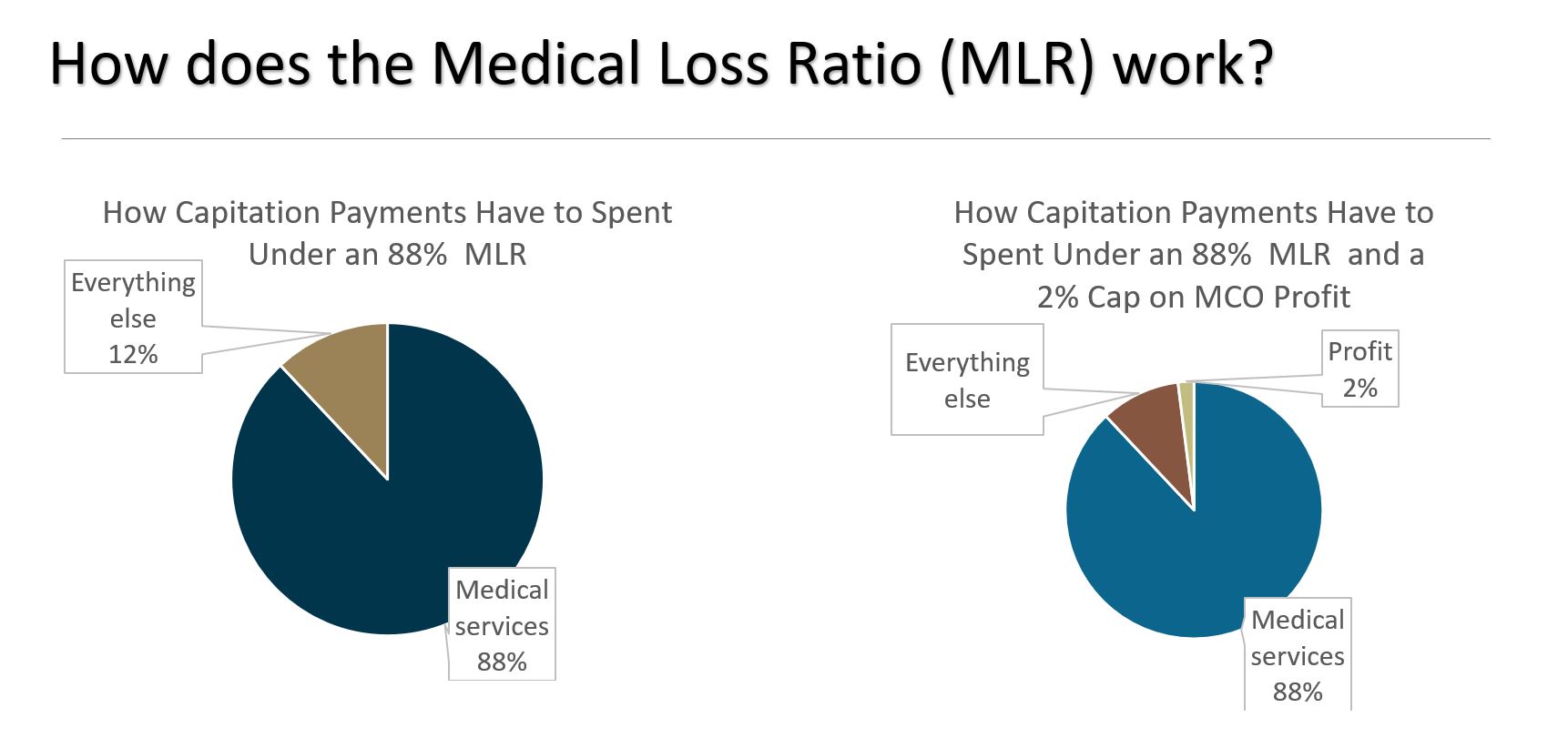

Medicaid Concepts Medical Loss Ratio Mostly Medicaid

https://www.mostlymedicaid.com/wp-content/uploads/2021/01/MLR.jpg

Medical Loss Ratio Rebates

https://www.lhdbenefits.com/wp-content/uploads/Blog-Thumbnail-1.png

Data Note 2021 Medical Loss Ratio Rebates 1CovidNews

https://1covidnews.com/wp-content/uploads/2021/04/TWITTER-Medical-Loss-Ratio-Rebates-2012-2021_1-2048x1149.png

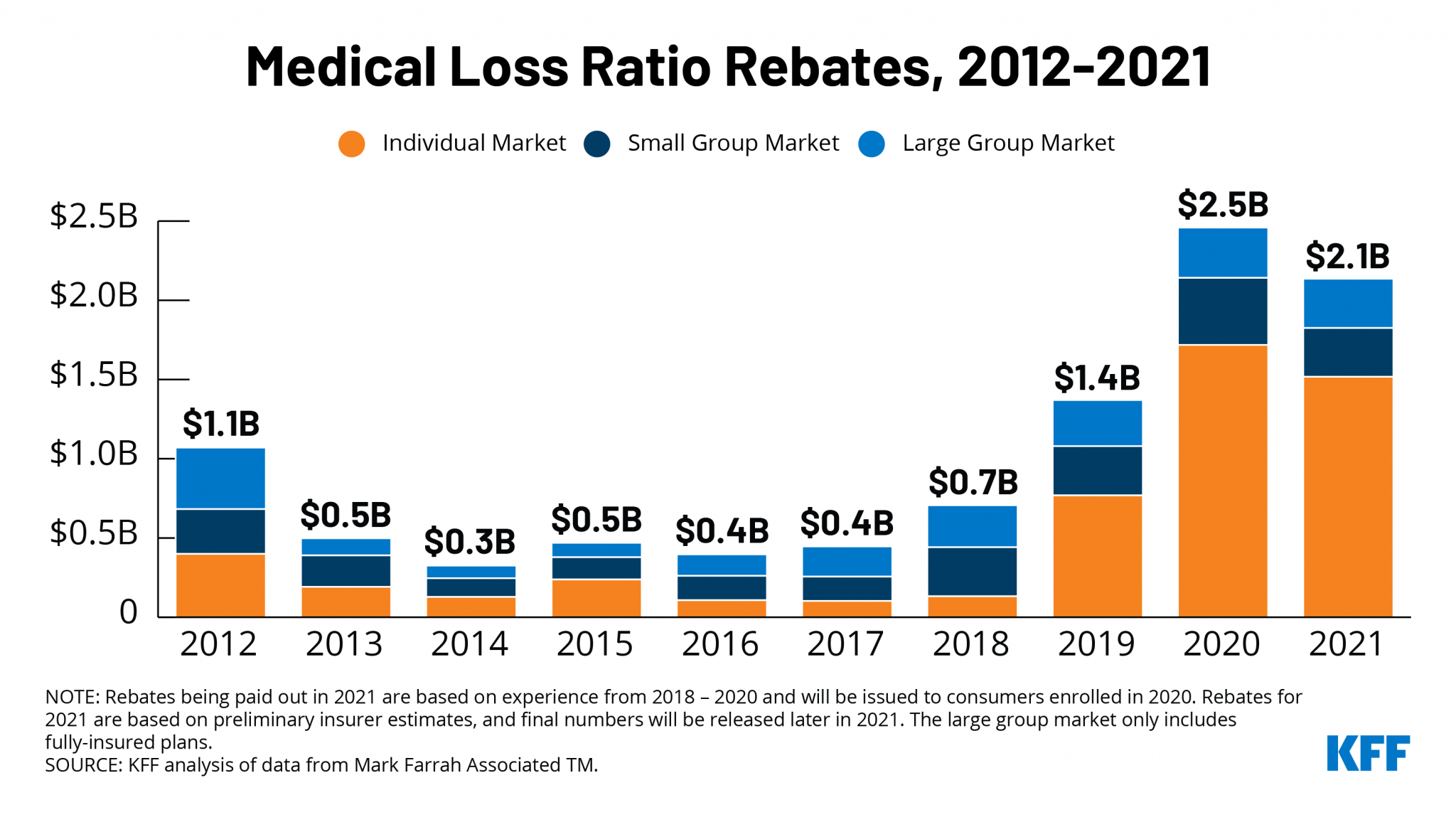

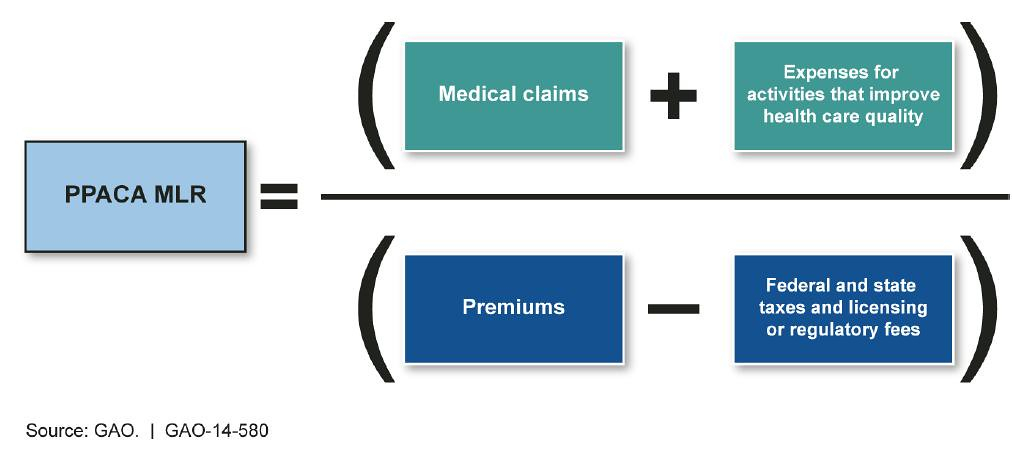

The Medical Loss Ratio provision of the ACA requires most insurance companies that cover individuals and small businesses to spend at least 80 of their What is the Medical Loss Ratio MLR rebate and how does it affect you Due to the Affordable Care Act enacted in May 2010 insurance companies are required to spend a

The Medical Loss Ratio MLR provision of the Affordable Care Act ACA limits the amount of premium income that insurers can keep for administration marketing and profits Insurers that Since the issuer s MLR is 70 which is less than the required MLR percentage of 80 85 depending on market segment under the ACA the issuer must provide a refund rebate

Data Note 2021 Medical Loss Ratio Rebates

https://www.healthplansociety.com/uploads/news-pictures/3-new-york-blog-post-image-20210413103316.png

Guide To Medical Loss Ratio MLR Rebates Precision Benefits Group

https://precisionbenefits.com/wp-content/uploads/2020/10/9-12-19_MW_PrivateInsurersPayRebates-1.jpg

https://www.cigna.com/.../mlr-rebate-faqs

Are rebates taxable In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums you paid on

https://www.dol.gov/.../faqs/mlr-insurance-rebate.pdf

MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked

Medical Loss Ratio Rebate 2023 Rebate2022

Data Note 2021 Medical Loss Ratio Rebates

The Federal Medical Loss Ratio Rule

Medical Loss Ratio Rebates Alera Group

Julia C Copeland Moore On LinkedIn Medical Loss Ratio MLR Rebates

2023 Medical Loss Ratio Rebates KFF

2023 Medical Loss Ratio Rebates KFF

Medical Loss Ratio MLR Rebates GSA National

Medical Loss Ratio MLR Rebates Mineral

Medical Loss Ratio What It Is And How It Works

Are Medical Loss Ratio Rebates Taxable - The ACA requires medical insurance companies Insurer or Insurers to pay annual Medical Loss Ratio MLR rebates to policyholders by each September 30 if the insurer