Are Medicare Part B Payments Taxable Yes your monthly Medicare Part B premiums are tax deductible However you can only benefit from the medical expense deduction by following specific rules You ll need to file your taxes in a certain way itemizing your deductions instead of choosing the standard deduction

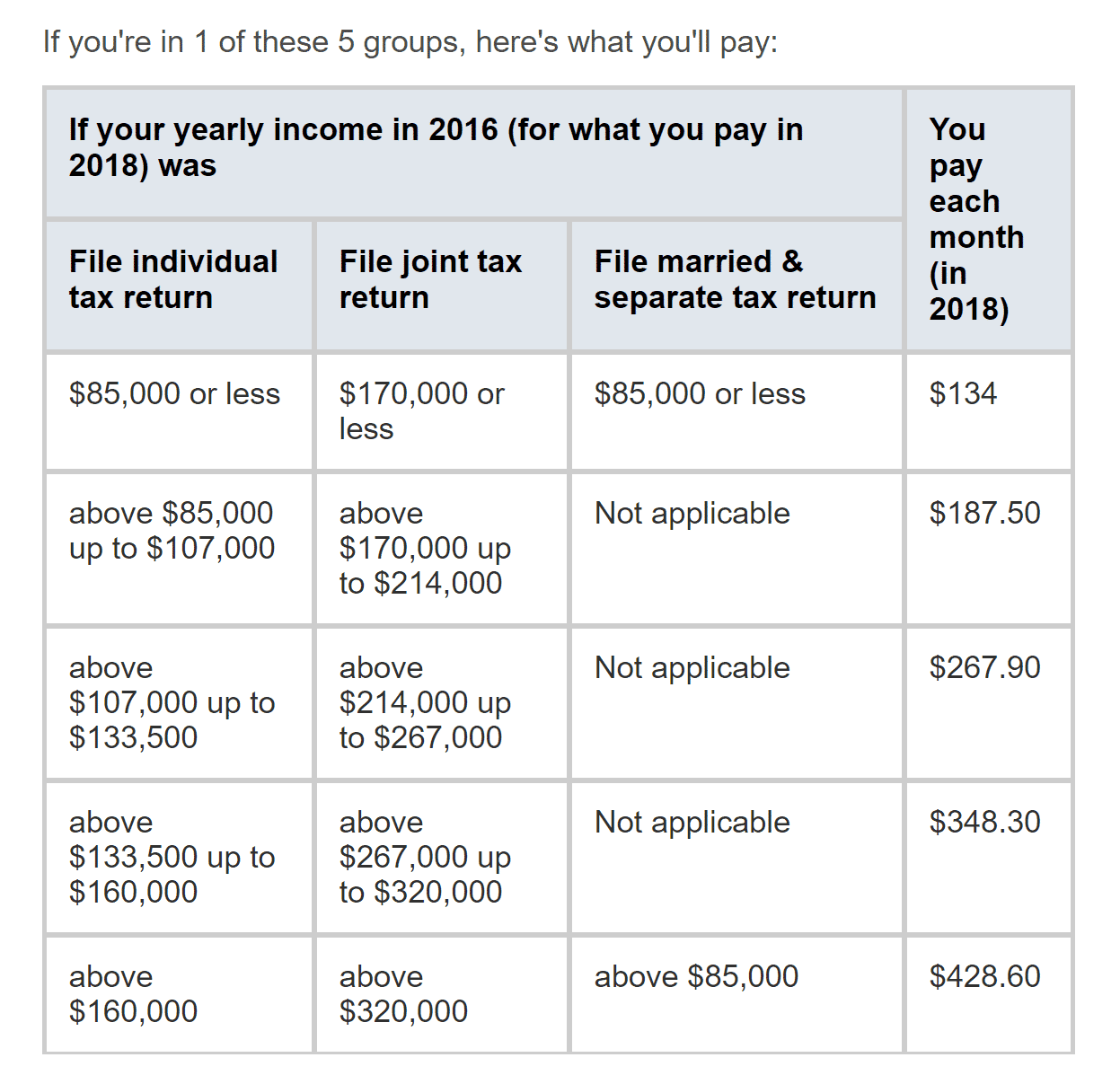

However a person may deduct from their taxes the Part B monthly premium of at least 174 70 depending on their annual income The alternative to original Medicare is Part C Medicare You can deduct the amount if you do pay a Part A premium and aren t getting Social Security benefits Part B premiums Part B premiums are tax deductible if you meet the income rules

Are Medicare Part B Payments Taxable

Are Medicare Part B Payments Taxable

http://www.medicaresupplementshop.com/wp-content/uploads/2013/08/medicare-payments.jpg

I R S Decides Most Special State Payments Are Not Taxable The New

https://static01.nyt.com/images/2023/02/10/multimedia/10irs-gzbj/10irs-gzbj-videoSixteenByNine3000.jpg

CMS Open Payments And Pharmacy B Payments How Do They Work Symplr

https://www.symplr.com/hubfs/Imported_Blog_Media/blog-graphic-default-Jul-16-2021-02-12-22-15-AM.png

Medicare premiums are tax deductible along with other certain Medicare costs if you itemize deductions on your income taxes and if they exceed a certain percentage of your income If you are enrolled in both Social Security and Part B Medicare the Social Security Administration automatically deducts your Medicare premium from monthly benefits

Can you deduct Medicare Part B payments on your taxes You can but only if medical expenses exceed 7 5 of your adjusted gross income and you re itemizing Yes Medicare premiums are tax deductible as a medical expense as long as you meet two requirements First you must itemize your deductions on your tax return to deduct them from your taxable income Second only medical expenses that exceed 7 5 of your adjusted gross income AGI are deductible Let s break that down a bit

Download Are Medicare Part B Payments Taxable

More picture related to Are Medicare Part B Payments Taxable

How To Pay For Part B Medicare MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/medicare-part-b-what-does-it-cover-my-medicare-supplement-plan.png

Are Annuity Payments Taxable How Are Annuities Taxed Medicare Hope

https://medicarehope.com/wp-content/uploads/2023/06/Depositphotos_140633166_S.jpg

MACRA In 2017 And Medicare Part B Payments Practice Fusion

https://www.practicefusion.com/assets/images/resized/770/medicare-part-b-payments.jpg

Generally premiums you pay for Medicare Part B Part D and Medicare supplement plans are considered allowable Most Medicare enrollees do not pay a premium for Medicare Part A if they paid Medicare taxes for 40 qualifying quarters 10 years during their working years Medicare premiums may be tax deductible but there are specific guidelines you must meet before you file your taxes Here s what you need to know Key Points Medical and dental expenses including premiums can only be deducted if they add up to 7 5 or more of your adjusted gross income AGI as it appears on your tax returns 1

As long as you use them for a qualified medical expense which includes premiums for Medicare Parts A B C and D you don t have to pay taxes on the money Note that other types of health insurance premiums cannot be paid for with tax free HSA money unless you re receiving unemployment benefits or enrolled in COBRA coverage The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020 The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act 2021 and Other Extensions Act H R 8337

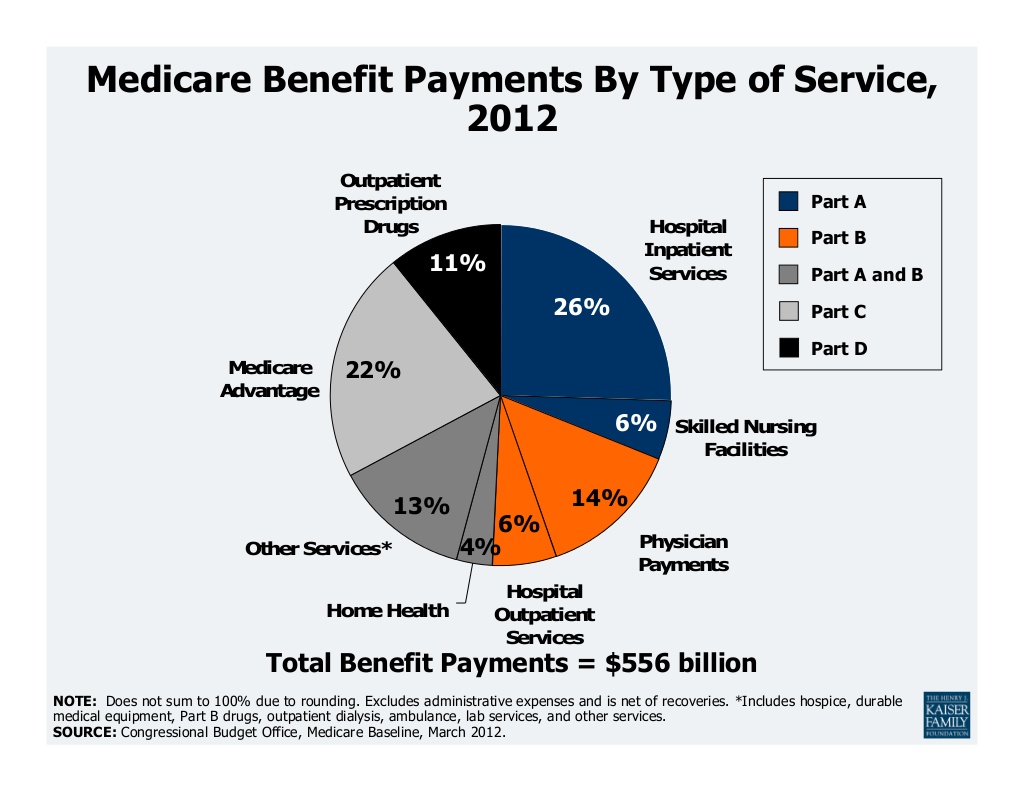

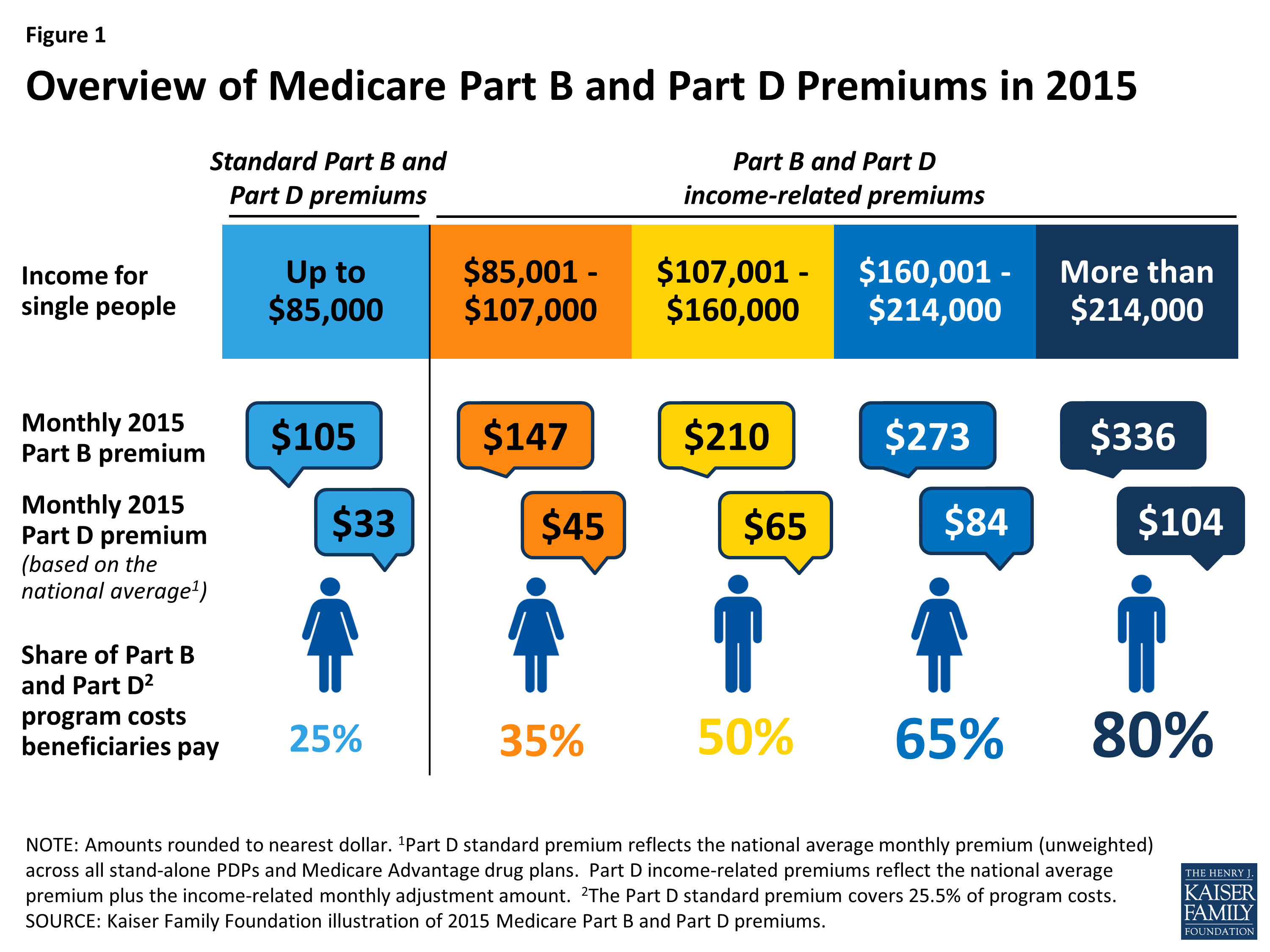

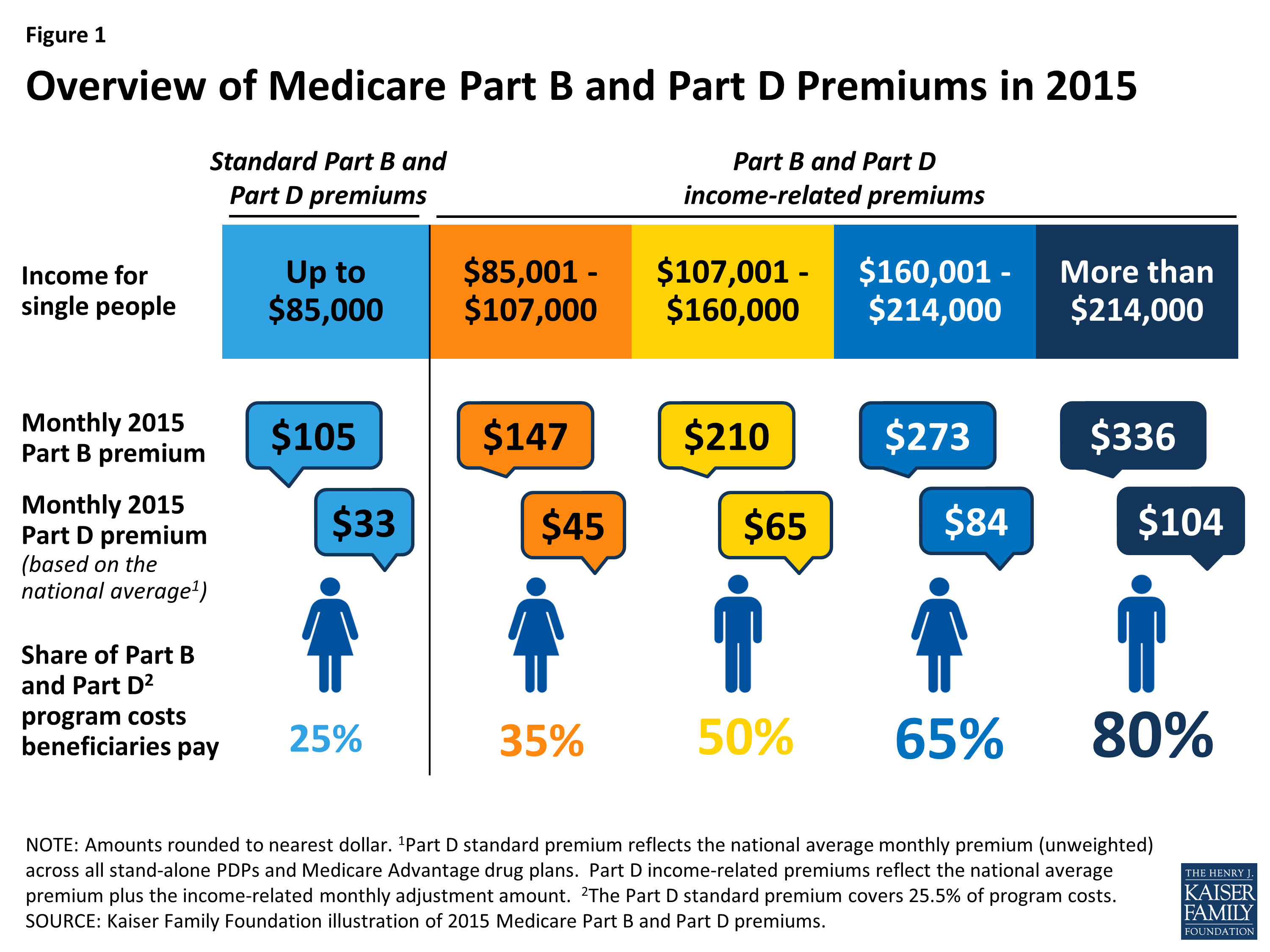

Medicare s Income Related Premiums A Data Note KFF

https://www.kff.org/wp-content/uploads/2015/05/8706-figure-1.png?resize=2048

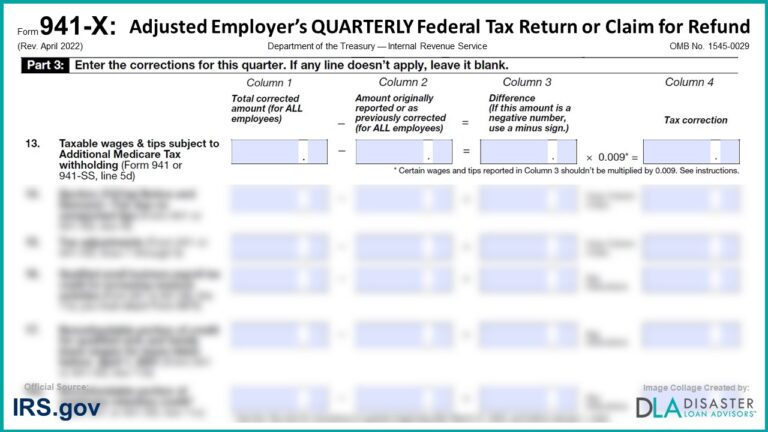

941 X 13 Taxable Wages And Tips Subject To Additional Medicare Tax

https://www.disasterloanadvisors.com/wp-content/uploads/2022/08/941-x-13-taxable-wages-and-tips-subject-to-additional-medicare-tax-withholding-3-768x432.jpg

https://medicareguide.com

Yes your monthly Medicare Part B premiums are tax deductible However you can only benefit from the medical expense deduction by following specific rules You ll need to file your taxes in a certain way itemizing your deductions instead of choosing the standard deduction

https://www.medicalnewstoday.com › articles › is-the...

However a person may deduct from their taxes the Part B monthly premium of at least 174 70 depending on their annual income The alternative to original Medicare is Part C Medicare

Medicare Part B Premium 2024 Chart

Medicare s Income Related Premiums A Data Note KFF

What Is Calculated In Medicare Taxable Income

MACRA s Medicare Part B Payments Under MIPS Coker

Online Payments And Account Set up Colorado District Church Of The

Medicare Part D Costs 2019

Medicare Part D Costs 2019

Maximize Your Paycheck Understanding FICA Tax In 2023

Ssa 795 Form Printable

Payroll Taxes Cover About A Third Of Medicare Costs Tax Policy Center

Are Medicare Part B Payments Taxable - How to Pay Part A Part B premiums Most people don t get a premium bill from Medicare because they get their Medicare Part B Medical Insurance premium deducted automatically from their Social Security benefit payment or Railroad Retirement Board benefit payment