Are Moving Expense Reimbursements Taxable In California No You cannot deduct your moving expenses If line 3 is less than line 4 subtract line 3 from line 4 and include the result on Schedule CA 540 Part I Section A line 1h

Just to be clear from 2018 through 2025 all employee moving expenses paid to employees by your business are taxable to the employee Unreimbursed Employer paid moving expenses are taxable Here s an example If Ben s new salary is 50 000 per year and his employer reimburses him 3 000 for his moving

Are Moving Expense Reimbursements Taxable In California

Are Moving Expense Reimbursements Taxable In California

https://www.flokzu.com/wp-content/uploads/2016/03/Workflow_Expense_Report.png

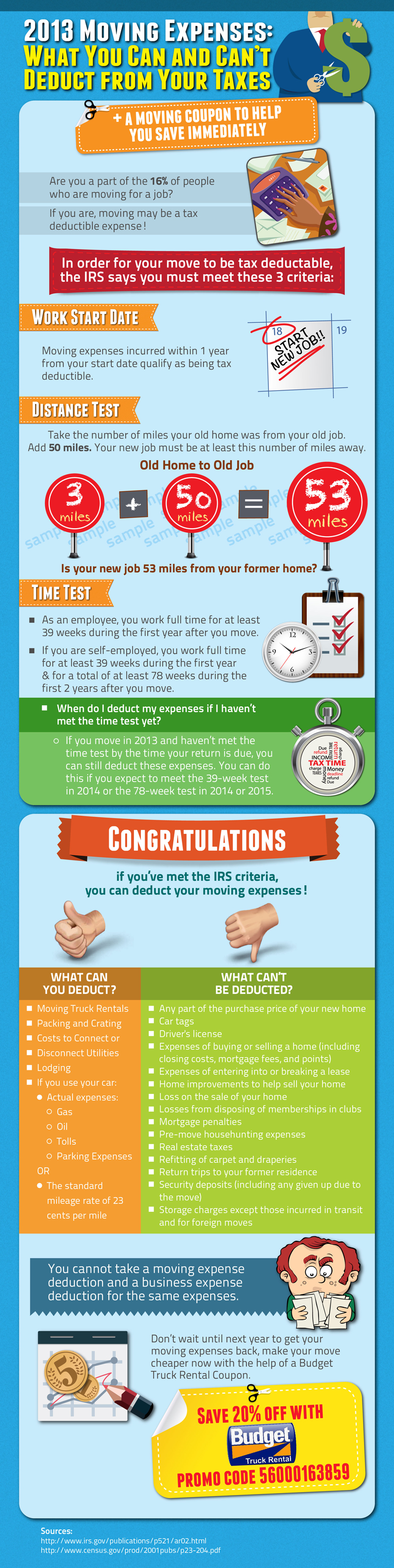

Tax Tip Find Out Which Moving Expenses Are Tax Deductible In

https://www.sacbee.com/reviews/wp-content/uploads/2023/03/Sacramento-vehicle-shipping-Sacramento-vehicle-shipping.jpg

Reimbursement Of Personal Funds Spent For Travel Expenses

https://www.fec.gov/resources/cms-content/images/Travel_reimbursement_fe308.original.jpg

In addition under California law employers don t have to reimburse expenses incurred because an employee chooses to work from home That means if you take part in an MOVING EXPENSES Employer paid or reimbursed expenses for moving household goods personal effects and traveling expense Not Subject Not Subject Not Subject

Qualified moving expense reimbursements will remain nontaxable for California state tax and taxable for federal tax for tax years 2018 2025 or until state or federal law changes ANSWER The Tax Cuts and Jobs Act suspended the moving expense deduction for individuals and the exclusion for amounts employers pay for deductible moving expenses qualified moving

Download Are Moving Expense Reimbursements Taxable In California

More picture related to Are Moving Expense Reimbursements Taxable In California

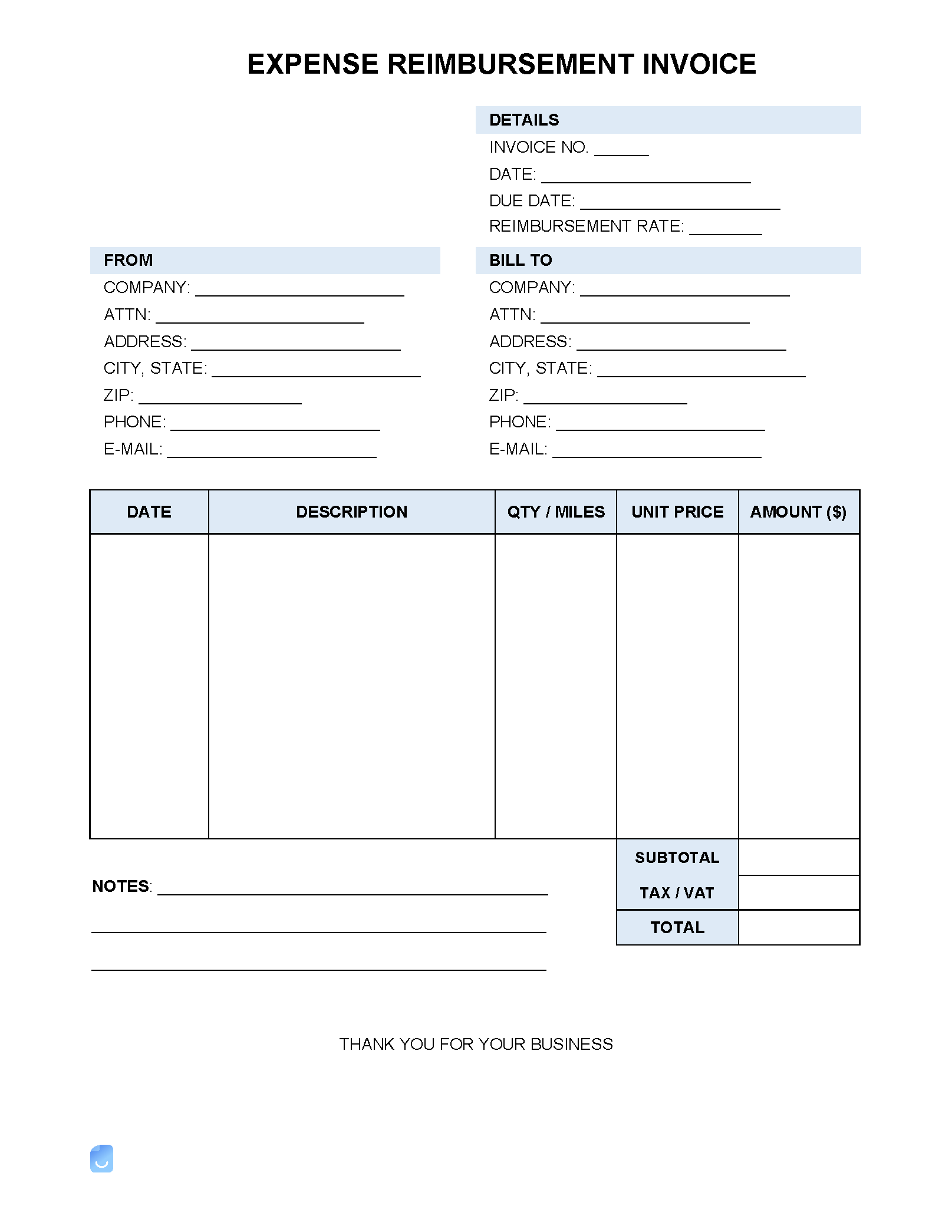

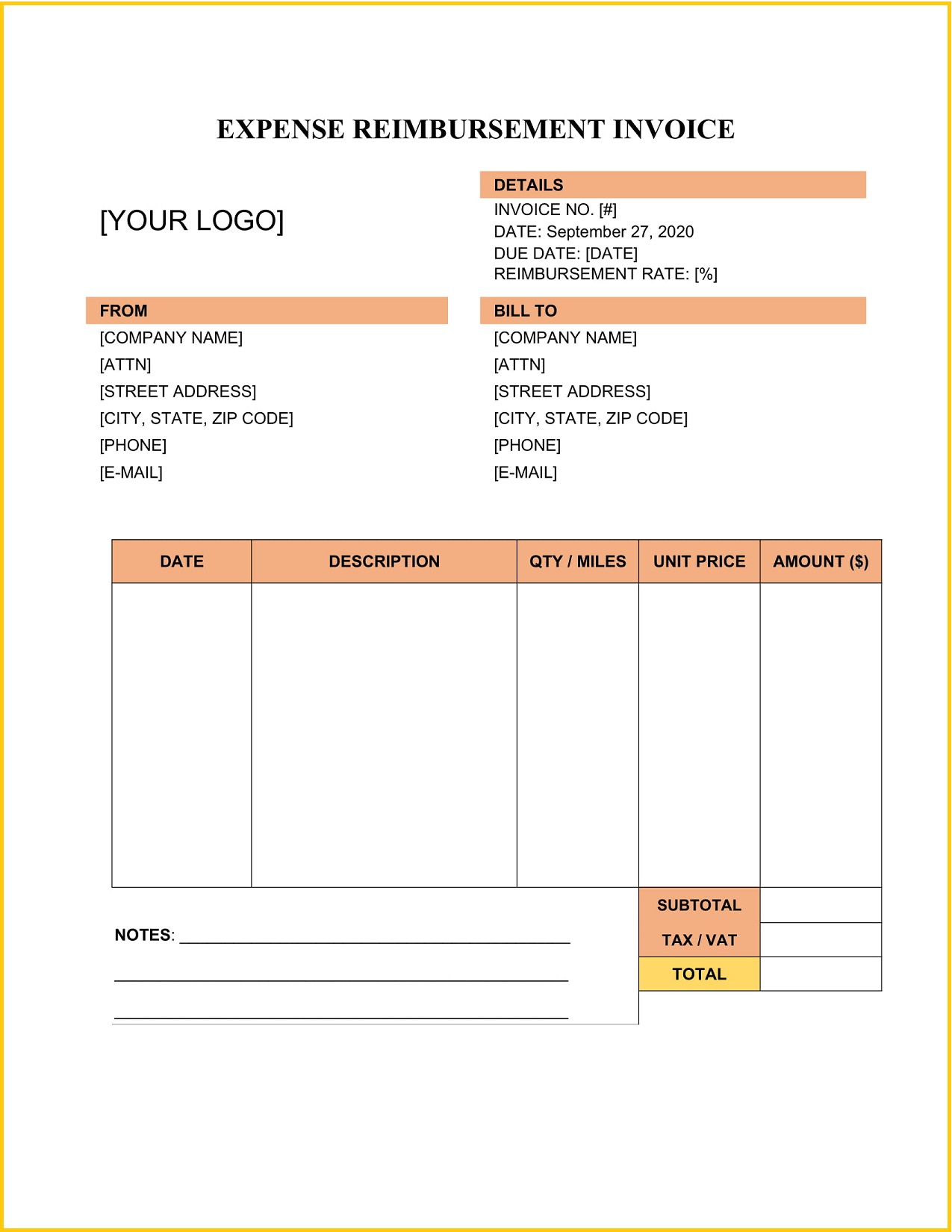

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

.png)

Expense Management With Digital HRMS Discover A Seamless Way To Manage

https://blog.thedigitalgroup.com/assets/uploads/Expense_Management_with_Digital_HRMS_Manage_Expense__Reimbursements_Seamlessly_18_Aug_Insta__(2).png

Types Of Employee Reimbursements

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Types of employee reimbursements_fb.jpg#keepProtocol

Qualified moving expense reimbursements will remain nontaxable for California state tax and taxable for federal tax for tax years 2018 2025 or until state or April 2019 California Law Addresses Employee Business Expense Reimbursement While not mandatory in every state California employers are required to reimburse their employees for reasonable business

Expenses for an employee move relocation may be eligible for payment or reimbursement by UC San Diego NOTE Move Relocation expenses are taxable California is one of a few states that still allow the moving expense deduction That doesn t tell the whole story CA also conforms to IRC 312 g effective

Are Expense Reimbursements Taxable Paper Trails HR Payroll

https://www.papertrails.com/wp-content/uploads/2022/09/Blog-Post-Background-59-768x384.png

IRS Increases Standard Mileage Rates Starting July 1 2022 Stinson LLP

https://www.stinson.com/assets/htmlimages/Picture6.png

https://www.ftb.ca.gov/forms/2022/2022-3913.pdf

No You cannot deduct your moving expenses If line 3 is less than line 4 subtract line 3 from line 4 and include the result on Schedule CA 540 Part I Section A line 1h

https://www.thebalancemoney.com/employer-guide...

Just to be clear from 2018 through 2025 all employee moving expenses paid to employees by your business are taxable to the employee Unreimbursed

PDF Pwc Cfa Reimbursement PDF T l charger Download

Are Expense Reimbursements Taxable Paper Trails HR Payroll

IRS Moving Expense Tax Deduction Guide BrandonGaille

A Primer On Employee Expense Reimbursements In California Lewis

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

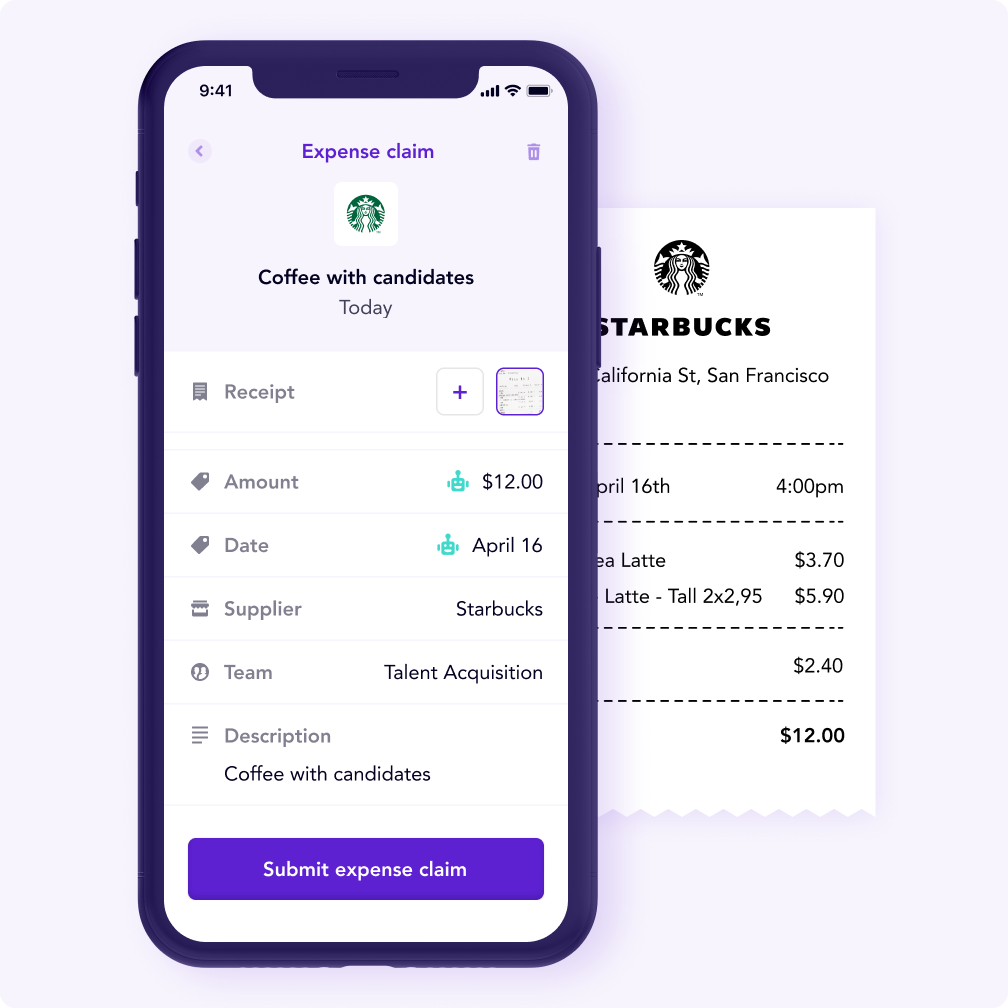

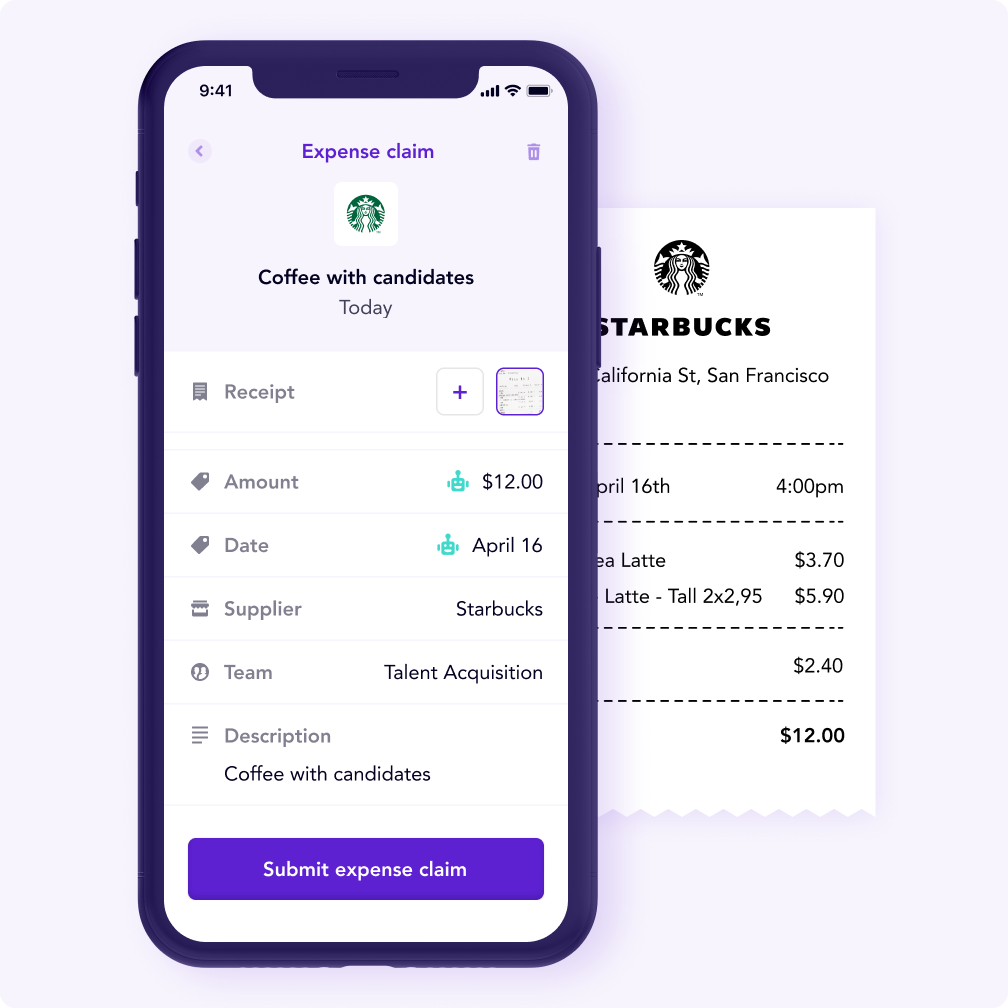

Spendesk Fast Employee Expense Reimbursements

Spendesk Fast Employee Expense Reimbursements

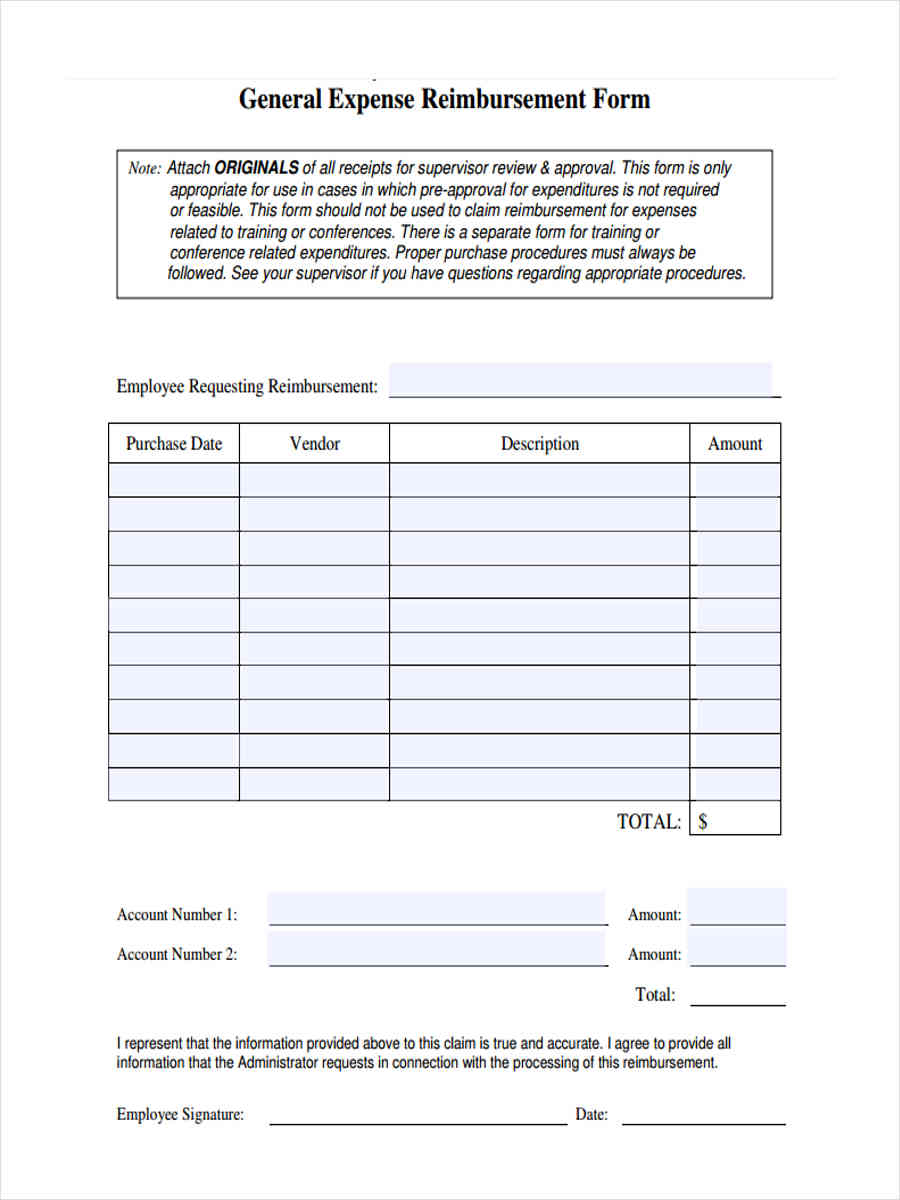

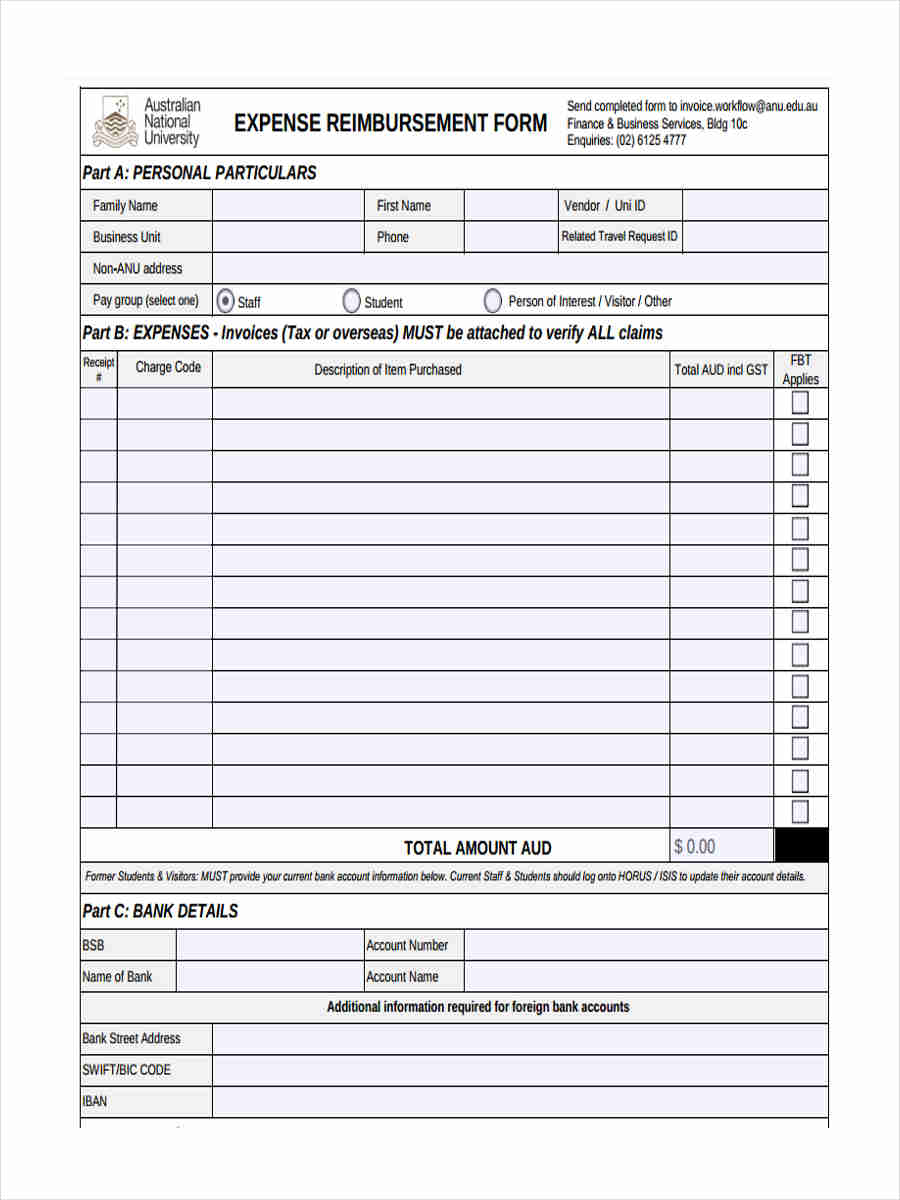

Expense Reimbursement Form Example Sample Templates Vrogue

Expense Reimbursements And GST HST Welch LLP

Expense Reimbursement Invoice Template Sample

Are Moving Expense Reimbursements Taxable In California - Moving expenses are an adjustment to your taxable income You will however need to also attach IRS Form 3903 Moving Expenses to complete claiming