Are Personal Reimbursements Taxable When employees are reimbursed under a non accountable plan the payments will be included as taxable income but may be deductible as an itemized deduction on their personal income tax return

Personal vs Business Personal travel expenses are always taxable while strictly business related travel can be tax free if supported by proper records Excessive Reimbursements If Reimbursements under a nonaccountable plan are wages and are subject to taxes You must report these wages and deposit taxes on them

Are Personal Reimbursements Taxable

Are Personal Reimbursements Taxable

https://149308.fs1.hubspotusercontent-na1.net/hub/149308/file-2374819943.jpg#keepProtocol

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

Fidel In Focus Introducing Reimbursements

https://blog.fidel.uk/content/images/size/w2400/2021/10/ReimbursementsAPI_article.PNG

Do expense reimbursements count as income And are reimbursed expenses taxable To answer both questions No For the employee expense reimbursements are not Depending on the type of plan an organization uses expense reimbursements may be considered taxable income for the employee and the employer may be required to report it on the employee s W 2 form There are

How to determine whether specific types of benefits or compensation are taxable Procedures for computing the taxable value of fringe benefits Rules for withholding federal income Social Reimbursements made under accountable plans are tax free for both the employer and the employee whereas allowances given under non accountable plans are considered taxable income and must be declared

Download Are Personal Reimbursements Taxable

More picture related to Are Personal Reimbursements Taxable

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

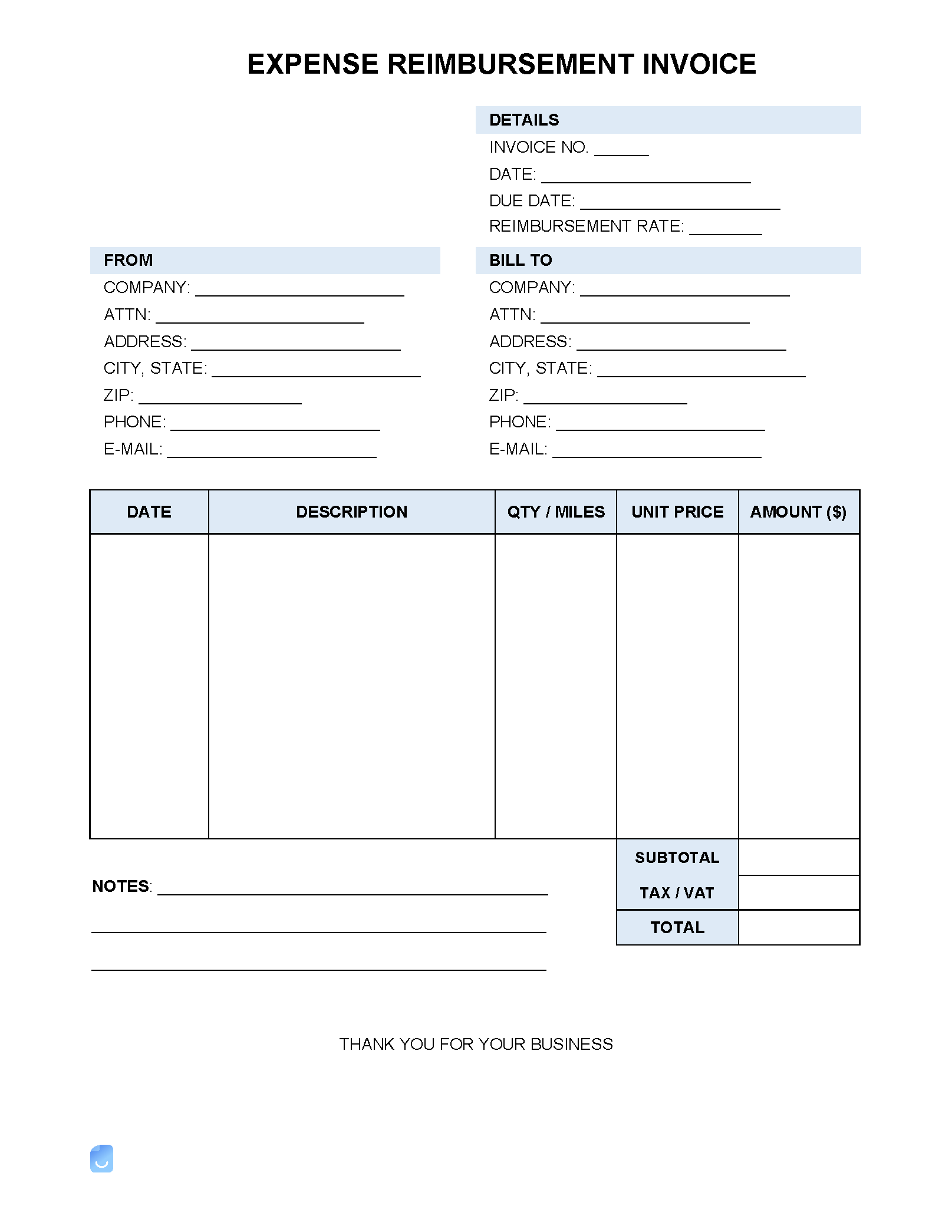

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

Reimbursement Of Personal Funds Spent For Travel Expenses

https://www.fec.gov/resources/cms-content/images/Travel_reimbursement_fe308.original.jpg

In general reimbursements are not taxable to the employee because you re simply paying back them back for money they spent on company related expenses It s often The business mileage rate for 2024 is 67 cents per mile You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use

Reimbursements under an accountable plan are not considered taxable income since they re strictly for substantiated business related expenses within reasonable limits This Are reimbursements taxable for the employee Can expenses be reimbursed through payroll How do accountable and non accountable plans work How do you report

Are Per Diem Or Flat Sum Payments Considered Taxable Wages In

https://ferrarovega.com/wp-content/uploads/2022/03/Are-Per-Diem-or-Flat-Sum-Payments-Considered-Taxable-Wages-in-California-1024x683.jpeg

Are Health Care Reimbursements Taxable AZexplained

https://azexplained.com/wp-content/uploads/2022/06/are-health-care-reimbursements-taxable_1459.jpg

https://www.paychex.com/articles/finan…

When employees are reimbursed under a non accountable plan the payments will be included as taxable income but may be deductible as an itemized deduction on their personal income tax return

https://blog.peakflo.co/en/travel-expense/tax...

Personal vs Business Personal travel expenses are always taxable while strictly business related travel can be tax free if supported by proper records Excessive Reimbursements If

Are Health Insurance Reimbursements Taxable HealthPlanRate

Are Per Diem Or Flat Sum Payments Considered Taxable Wages In

What Is Taxable Income And How To Calculate Taxable Income

IncentFit Lifestyle Reimbursements

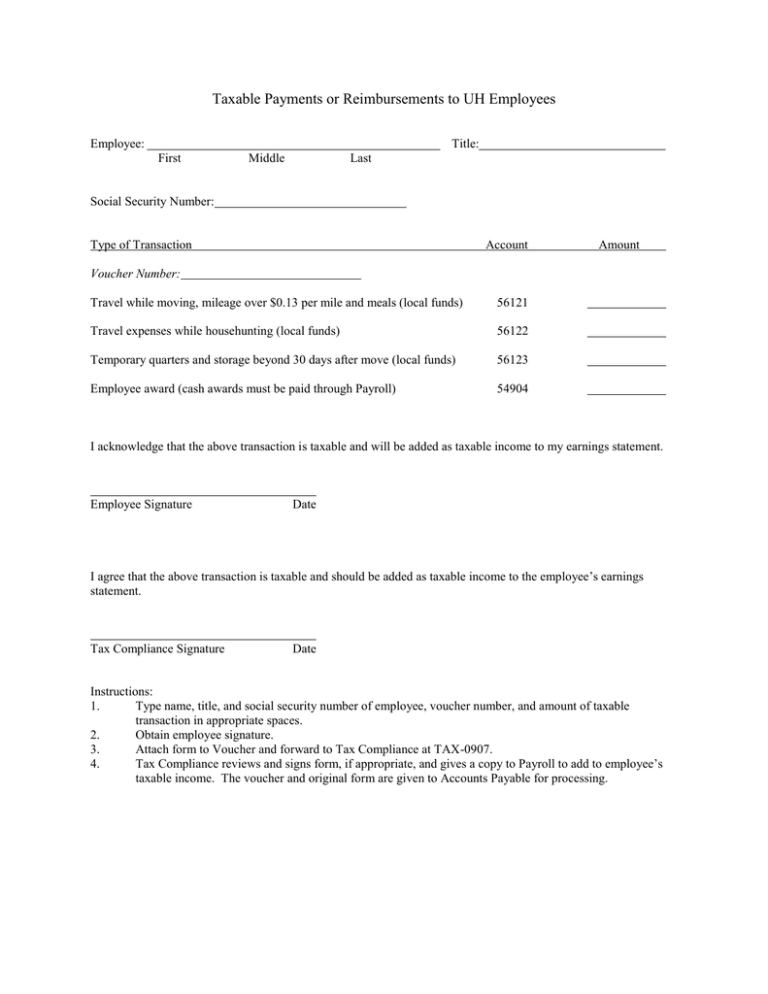

Taxable Payments Or Reimbursements To UH Employees

Are QSEHRA Reimbursements Taxable

Are QSEHRA Reimbursements Taxable

Enhancing Claim Reimbursements Imburse

Employee Business Reimbursement

Expense Reimbursements What s The Best Way To Handle Them

Are Personal Reimbursements Taxable - How to determine whether specific types of benefits or compensation are taxable Procedures for computing the taxable value of fringe benefits Rules for withholding federal income Social