Are Redundancy Payments Tax Deductible Web S 1 350 000 as taxable employment income being the ex gratia payment due in accordance with the employment agreement and S 1 125 000 as a non taxable capital

Web Any redundancy pay over 163 30 000 When you get it your employer will usually have deducted the tax but it s likely they won t have taken off the right amount So you Web 5 Nov 2020 nbsp 0183 32 Employers need to be aware of the rules surrounding tax relief for payments made during the redundancy process This article

Are Redundancy Payments Tax Deductible

Are Redundancy Payments Tax Deductible

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

How Are Redundancy Payments Taxed Money Magazine

https://media.moneymag.com.au/prod/media/library/Money_Mag/2015/10/tax-tip-November_tablet.jpg

REDUNDANCY UK Tax Planning With Your Redundancy Payment YouTube

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

Web Any statutory redundancy payment is automatically allowable but there is no special rule relating to termination payments made in excess of the statutory amount As a general Web If your redundancy payment is made before you leave your job and before your employer issues you with form P45 any taxable amounts such as unpaid wages and any part of a redundancy payment over 163 30 000

Web Statutory redundancy pay under 163 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Previous Web the redundancy payments are made within nine months of the end of the period of account as required by the rule at BIM47135 onwards It is unlikely that any deduction

Download Are Redundancy Payments Tax Deductible

More picture related to Are Redundancy Payments Tax Deductible

Are Redundancy Payments Taxable Springhouse Solicitors

https://www.springhouselaw.com/wp-content/uploads/01-handshake-768x358.jpg

What Tax Do I Pay On Redundancy Payments Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2023/04/tax-on-redundancy-payments.png

How Does Tax On Redundancy Payments Work Lawpath

https://images.lawpath.com/2019/07/stencil.new-blog-image-40-768x288.jpg

Web Restriction on deduction under general principles A payment that is genuinely made on account of redundancy will normally be allowable as part of the staff costs of a Web 17 Juli 2023 nbsp 0183 32 Hi The first 163 30000 00 of the redundancy payment is tax free Anything over this sum is shown in box 5 of SA101 page Ai2 The guidance advises quot This

Web A statutory deduction is allowable for additional payments to redundant employees up to a maximum of three times the amount of the statutory redundancy payment or where Web 11 Okt 2023 nbsp 0183 32 Section 309 of the Income Tax Earnings and Pensions Act 2003 ITEPA 2003 provides that no liability to income tax in respect of employment income other

Redundancy Calculator How Much Are Employees Entitled To Factorial

https://factorialhr.co.uk/wp-content/uploads/2022/04/27174159/InfographicRedundancyPay.-scaled.jpg

How Is A Redundancy Payment Taxed Wingate Financial Planning

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

https://www.pwc.com/gx/en/services/people-organisation/publi…

Web S 1 350 000 as taxable employment income being the ex gratia payment due in accordance with the employment agreement and S 1 125 000 as a non taxable capital

https://www.moneyhelper.org.uk/en/work/losing-your-job/do-you-have-to...

Web Any redundancy pay over 163 30 000 When you get it your employer will usually have deducted the tax but it s likely they won t have taken off the right amount So you

Redundancy Payment Guide And Tips Low Income Loans Australia

Redundancy Calculator How Much Are Employees Entitled To Factorial

Redundancy Payment What To Do With It

Is Redundancy Pay Taxable Essential Knoweldge UK 2023

Redundancy Payments Deduction For Tax Institute Of Financial

PPT Redundancy And Restructuring PowerPoint Presentation Free

PPT Redundancy And Restructuring PowerPoint Presentation Free

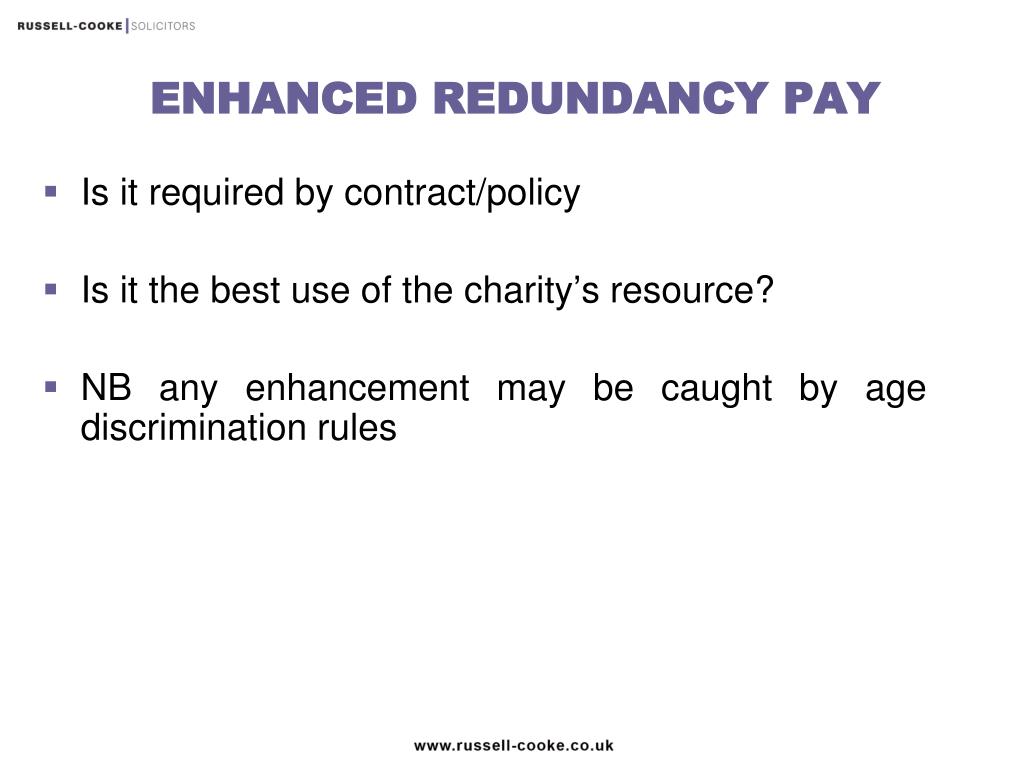

Redundancy Pay Calculations

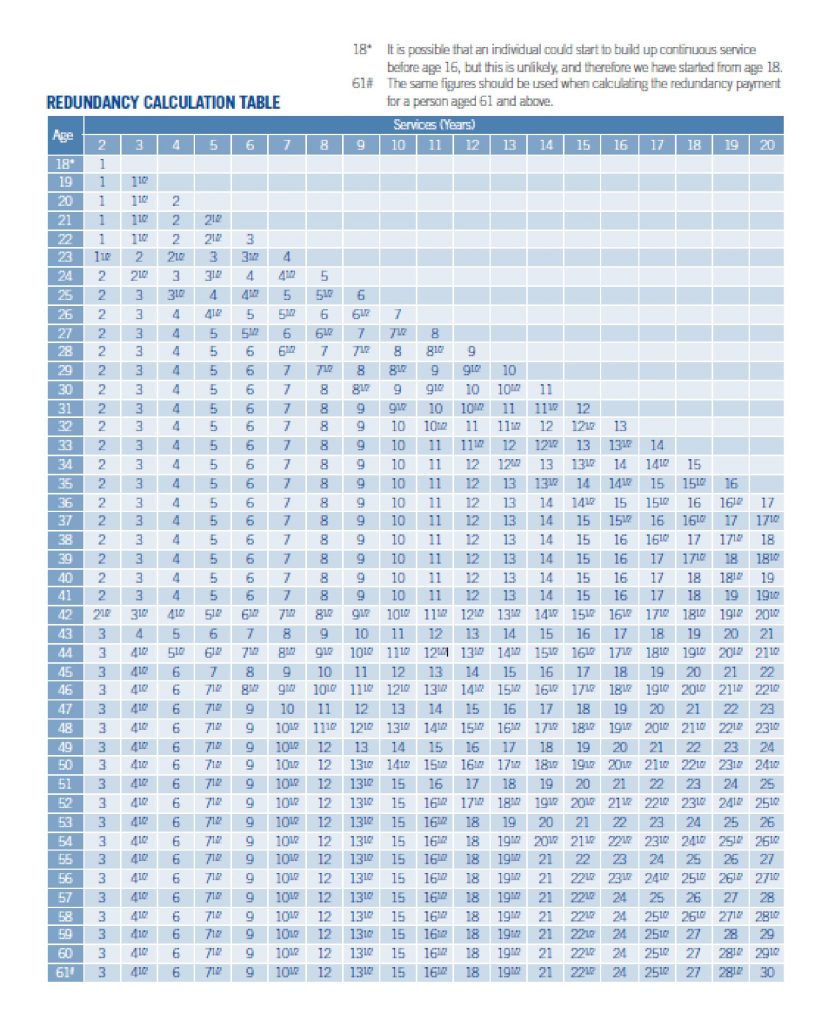

How To Process Redundancy Pay IRIS

A Guide To Statutory Redundancy Payments Cashfloat

Are Redundancy Payments Tax Deductible - Web 20 Dez 2018 nbsp 0183 32 Tax concessions on redundancy payments will vary depending on whether the redundancy was genuine or non genuine To distinguish between the two see here