Farm Property Tax Rebate Web Minimize Your Property Taxes As a farmland owner in Ontario you may be eligible to apply for a property tax reduction through the Farm Property Class Tax Rate Program Your

Web If you are eligible for the Farm Tax Program your farmland is taxed at no more than 25 of your municipality s residential property tax rate Farmland does not include land and Web The small business tax rate will benefit small to moderate farming operations in Ontario The small business tax rate applies to Ontario

Farm Property Tax Rebate

Farm Property Tax Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Farms Business Cut Out Of Jack Franks Valley Hi Property Tax Rebate

http://159.89.184.83/wp-content/uploads/2018/09/Valley-Hi-100-dollar-rebate-resolutio-memo-p1.png

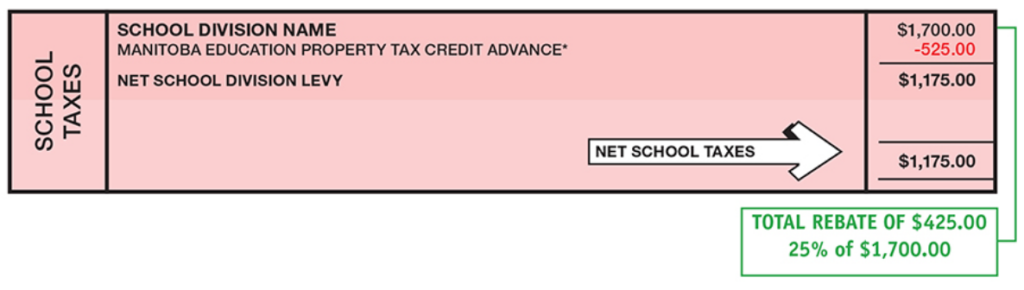

2021 Property Tax Bill Guide Rural Municipality Of St Clements

https://rmofstclements.com/wp-content/uploads/2021/08/residential-and-farm-education-rebate-example-1024x290.png

Web Property tax year 2022 For properties farmed by a tenant the tenant must have a valid Farm Business Registration FBR number or an exemption for the property to be Web 11 lignes nbsp 0183 32 Farm Property Class Tax Rate Program Home Overview Eligibility Exemptions How it works Related programs Deadlines Forms Publications Sign up Renew Update

Web MPAC assesses your farmed property as eligible for the farm forestry exemption under Section 3 19 of the Assessment Act It provides a tax exemption for portions of your Web Property taxes for farm properties are calculated on 26 of their fair market value 45 for residential property The Farmland School Tax Rebate FSTR provides Manitoba

Download Farm Property Tax Rebate

More picture related to Farm Property Tax Rebate

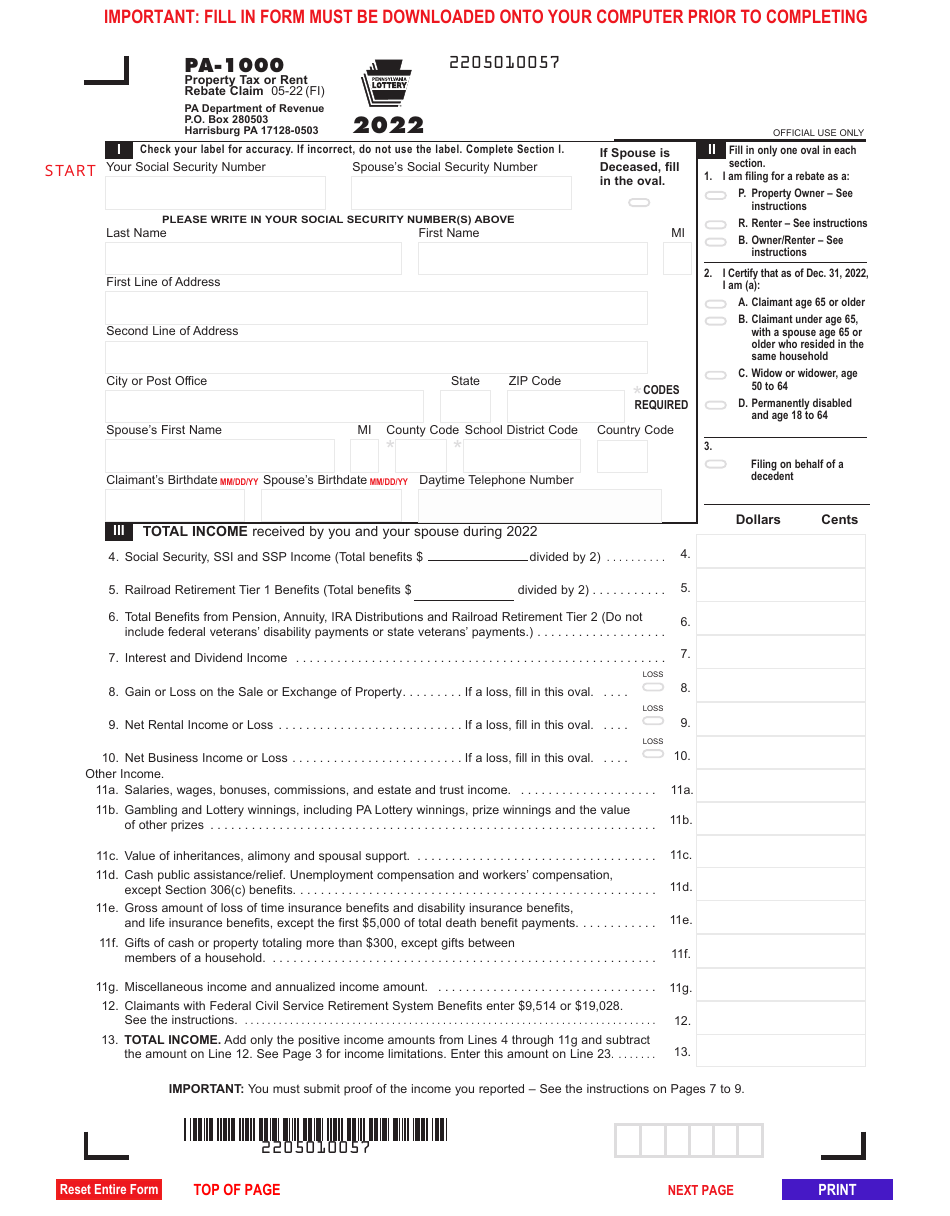

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

https://data.templateroller.com/pdf_docs_html/2587/25879/2587963/page_1_thumb_950.png

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

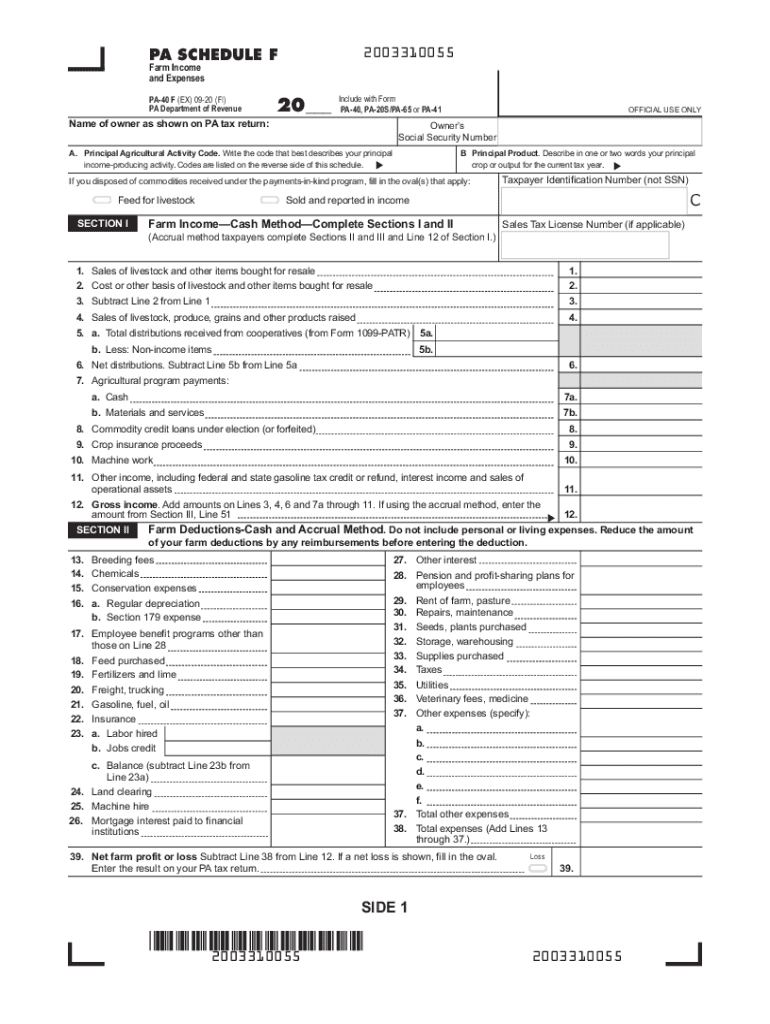

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/563/641/563641337/large.png

Web Information about the Farm Property Class Tax Rebate Program is sent to customers throughout the year Individual deadlines are noted in these packages For more Web Your property is used for a farm business Your property is actively being farmed by yourself a tenant farmer or both and generates an annual gross farm income of at least

Web 9 juin 2023 nbsp 0183 32 Farm Property Class Tax Rate Program Process The Ontario Ministry of Agriculture Food and Rural Affairs administers the Farm Property Class Tax Rate Web 24 janv 2022 nbsp 0183 32 Description The Farm Property Class Tax Rate Program is for Ontario farm businesses that gross 7 000 or more in annual farm income Under this program

Il 1040 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

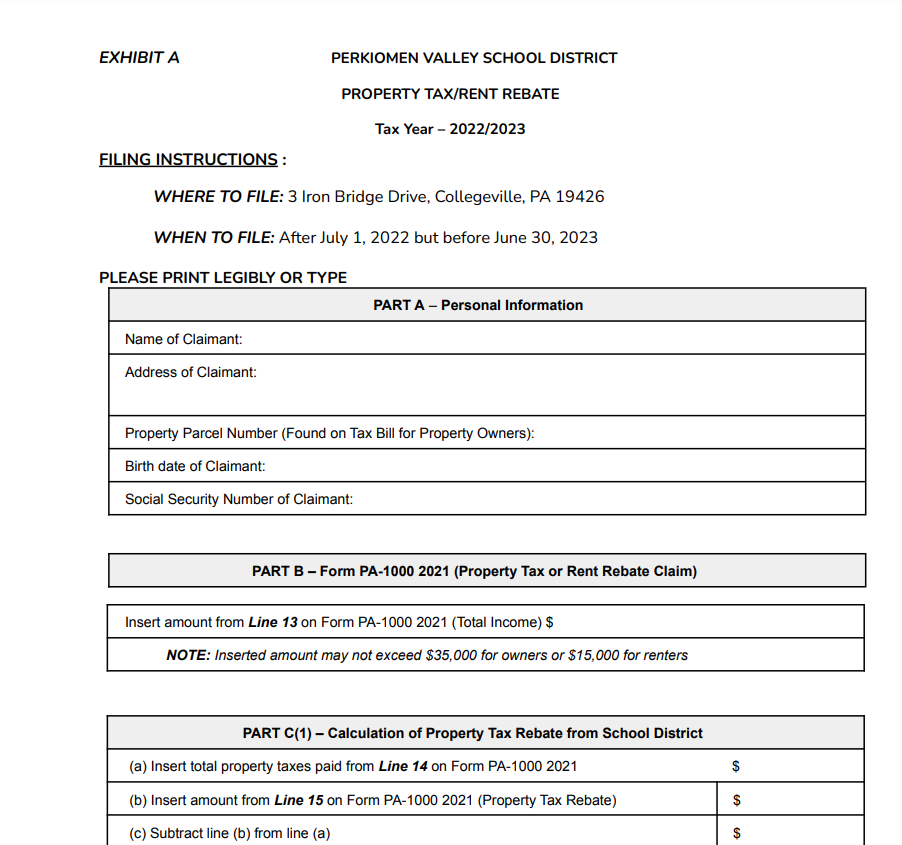

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pennsylvania-property-tax-rent-rebate-5-free-templates-in-pdf-word-4.png

https://www.omafra.gov.on.ca/english/policy/ftaxfacts.htm

Web Minimize Your Property Taxes As a farmland owner in Ontario you may be eligible to apply for a property tax reduction through the Farm Property Class Tax Rate Program Your

https://www.agricorp.com/en-ca/Programs/FarmTaxProgram

Web If you are eligible for the Farm Tax Program your farmland is taxed at no more than 25 of your municipality s residential property tax rate Farmland does not include land and

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Il 1040 Fill Out Sign Online DocHub

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

FARM Turf Rebate Programs First Tuesday Journal

Property Tax Rebate New York State Printable Rebate Form

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rebate Fillable Form Printable Rebate Form

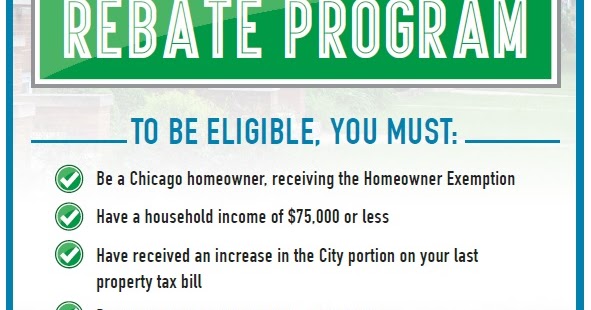

Uptown Update Property Tax Rebate Program Open Through November

Vt Property Tax Rebate Calculator PropertyRebate

Farm Property Tax Rebate - Web MPAC assesses your farmed property as eligible for the farm forestry exemption under Section 3 19 of the Assessment Act It provides a tax exemption for portions of your