Are Reimbursement Taxable In India Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

Money received through a claim under a medical policy is only a reimbursement of expenditure already incurred by the policyholder As this does not amount to profit or income for the insured person this money is not taxable With respect to reimbursement of taxes of employees paid outside India the Tribunal held that the taxpayer had not claimed the said taxes recovered from the employee in its profit and loss

Are Reimbursement Taxable In India

Are Reimbursement Taxable In India

https://www.fec.gov/resources/cms-content/images/Travel_reimbursement_fe308.original.jpg

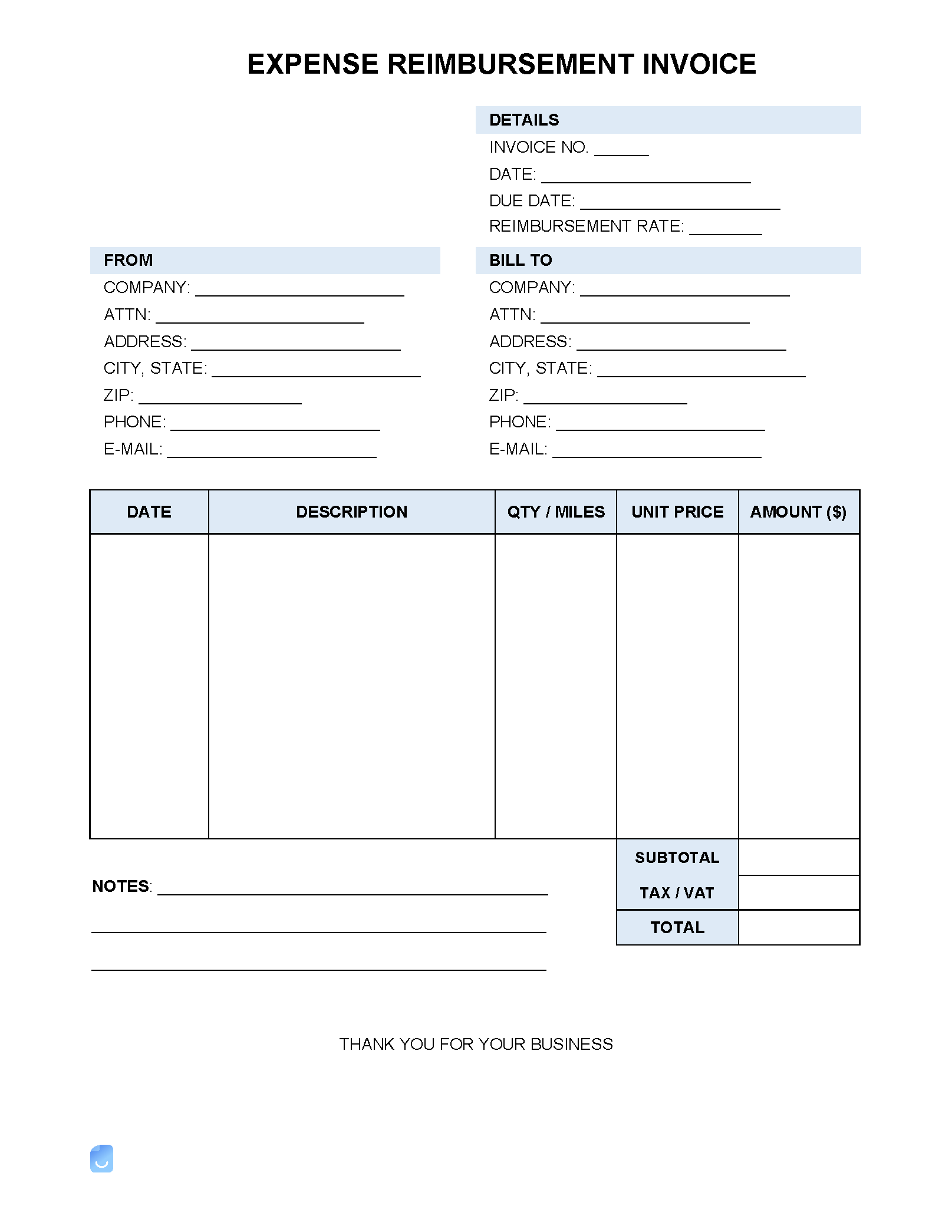

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

File India Para jpg Wikipedia The Free Encyclopedia

http://upload.wikimedia.org/wikipedia/commons/2/24/India_Para.jpg

Taxable Perquisites Employee provided benefits like water and electricity medical expense reimbursements rent free accommodation gas supply etc are perquisites taxable If these expenses would have been directly incurred or paid by Indian Company the same may be taxable in India depending on the applicable Domestic Law provisions DTAA provisions Some of these expenditures are

Learn the TDS implications on reimbursement of expenses Understand the rules applicability and compliance requirements in this detailed guide Tax Deducted at Source or TDS on reimbursement relies heavily on whether they are taxable or non taxable In India some reimbursements are subject to TDS On the other hand other types of reimbursements are exempted from tax deductions

Download Are Reimbursement Taxable In India

More picture related to Are Reimbursement Taxable In India

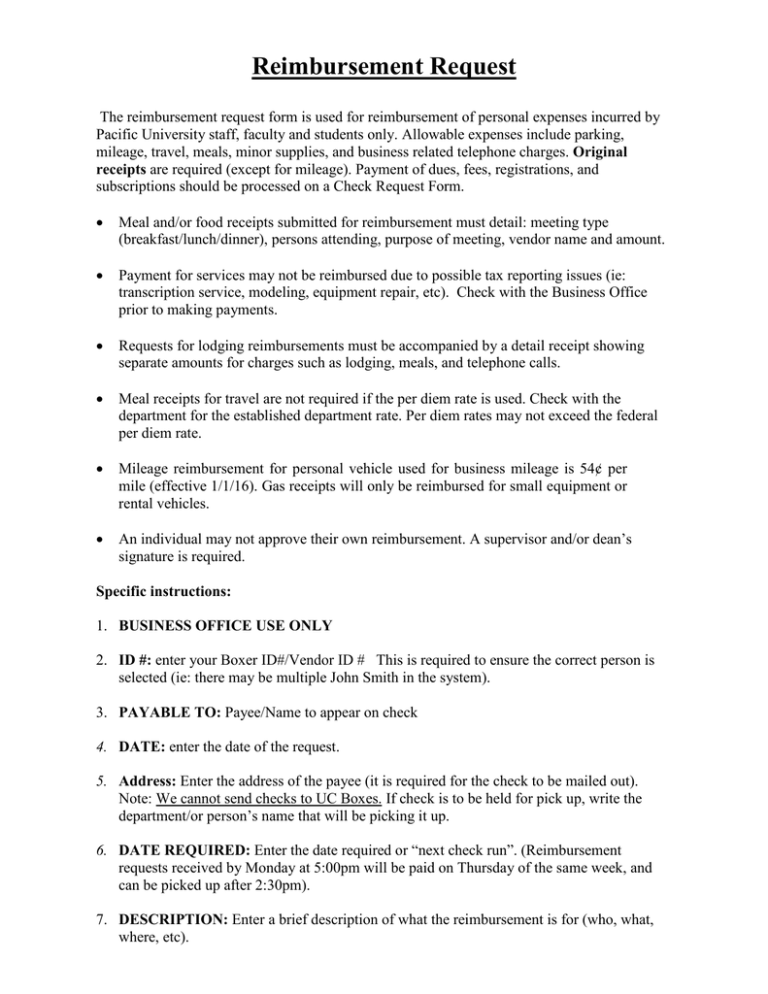

Reimbursement

https://uploads-ssl.webflow.com/62f1307825e801c7b111bb1b/6324a8af134c6e6a188803fc_MIMOSA SEO.png

Salary Reimbursement For Seconded Employee Not Taxable As FTS Under

https://www.taxscan.in/wp-content/uploads/2023/05/Salary-Reimbursement-for-Seconded-Employee-Taxable-FTS-under-India-US-DTAA-ITAT-TAXSCAN.jpg

Reimbursement

https://s2.studylib.net/store/data/010833731_1-aa59eaf108144916b94036ff4eb7c4f7-768x994.png

However in some cases even without profit element tax authorities and courts have held reimbursement of expenses as income of recipient liable for TDS and taxability in Reimbursement of expenses takes place when a supplier incurs expenditure on behalf of the recipient of supplies This article discusses the reimbursement of expenses to a

Taxability of reimbursement of expenses in the hands of Non resident recipient is extremely litigated issue The payers of the reimbursement is always in an extremely The Assessee Company had made an application at Annexure G to the WP u s 195 2 of the 1961 Act requesting for allowing the remittance to the Walmart Inc on cost to

REIMBURSEMENT Meaning In Urdu Urdu Translation

https://tr-ex.me/translation/english-urdu/reimbursement/reimbursement.jpg

Reimbursement For Lost Wages

https://www.dreishpoon.com/wp-content/uploads/2014/08/Queens-Reimbursement-for-Lost-Wages.jpg

https://www.pwc.in › assets › pdfs › publications › ...

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

https://taxguru.in › income-tax › taxability-m…

Money received through a claim under a medical policy is only a reimbursement of expenditure already incurred by the policyholder As this does not amount to profit or income for the insured person this money is not taxable

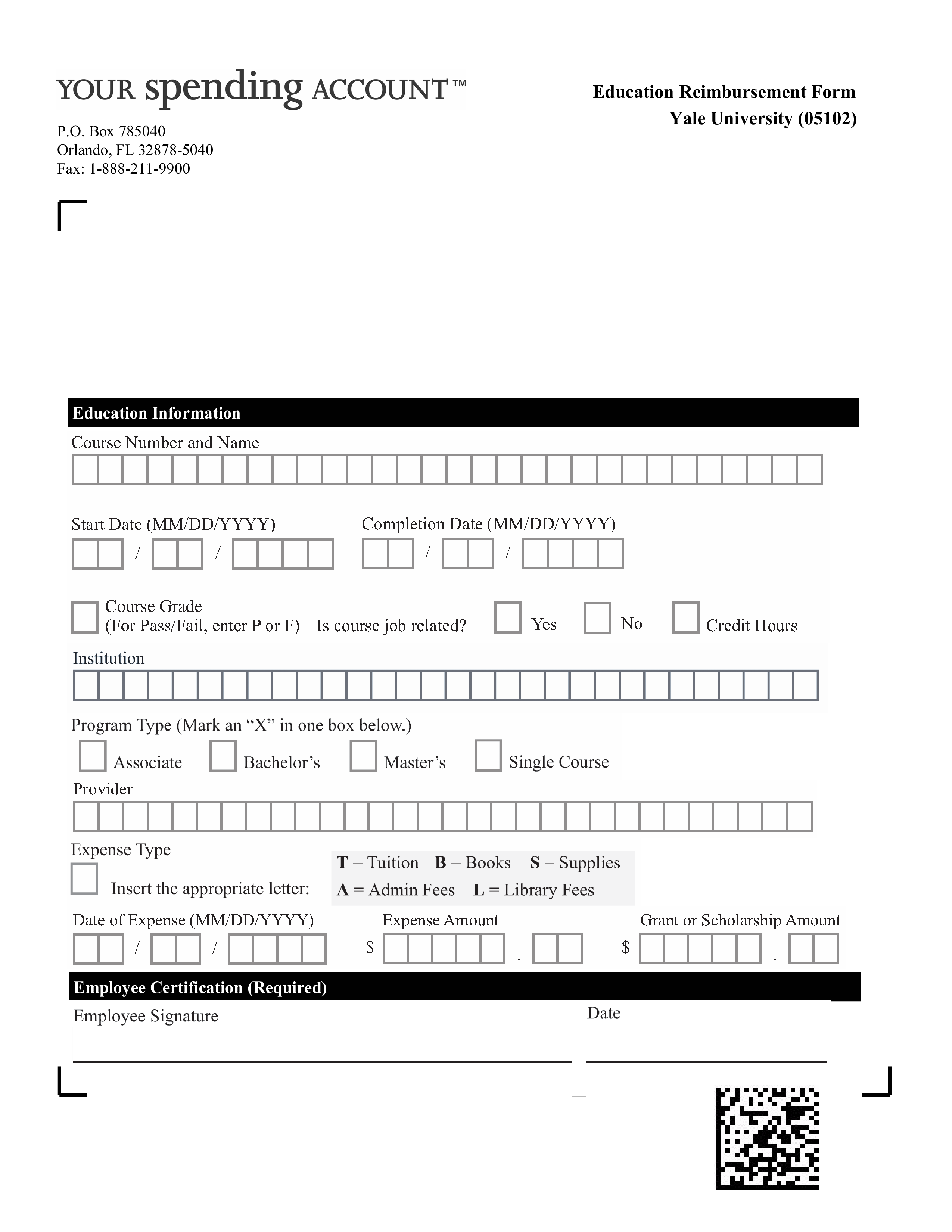

Is Tuition Reimbursement Taxable A Guide ClearDegree

REIMBURSEMENT Meaning In Urdu Urdu Translation

Education Reimbursement Form Templates At Allbusinesstemplates

Reimbursement Submit Fill Online Printable Fillable Blank PdfFiller

2 Types Of Reimbursement Claims SellerBench FAQ

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

India Tour India Travel India Tourism India Trip Planners

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Medicare Reimbursement Consultant About Us

Are Reimbursement Taxable In India - Further reimbursements are exempted from tax subject to the submission of bills If a taxpayer is opting for the old tax regime then it is important to know the limit to which certain