Are Relocation Expenses Taxable Before the Tax Cuts and Jobs Act of 2017 relocation benefits were not considered taxable income for employees Employers could also deduct

Moving expense deduction eliminated except for certain Armed Forces members For tax years beginning after 2017 you can no longer deduct moving A1 Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the

Are Relocation Expenses Taxable

Are Relocation Expenses Taxable

https://www.contrapositionmagazine.com/wp-content/uploads/2021/01/relocation-expenses-template.jpg

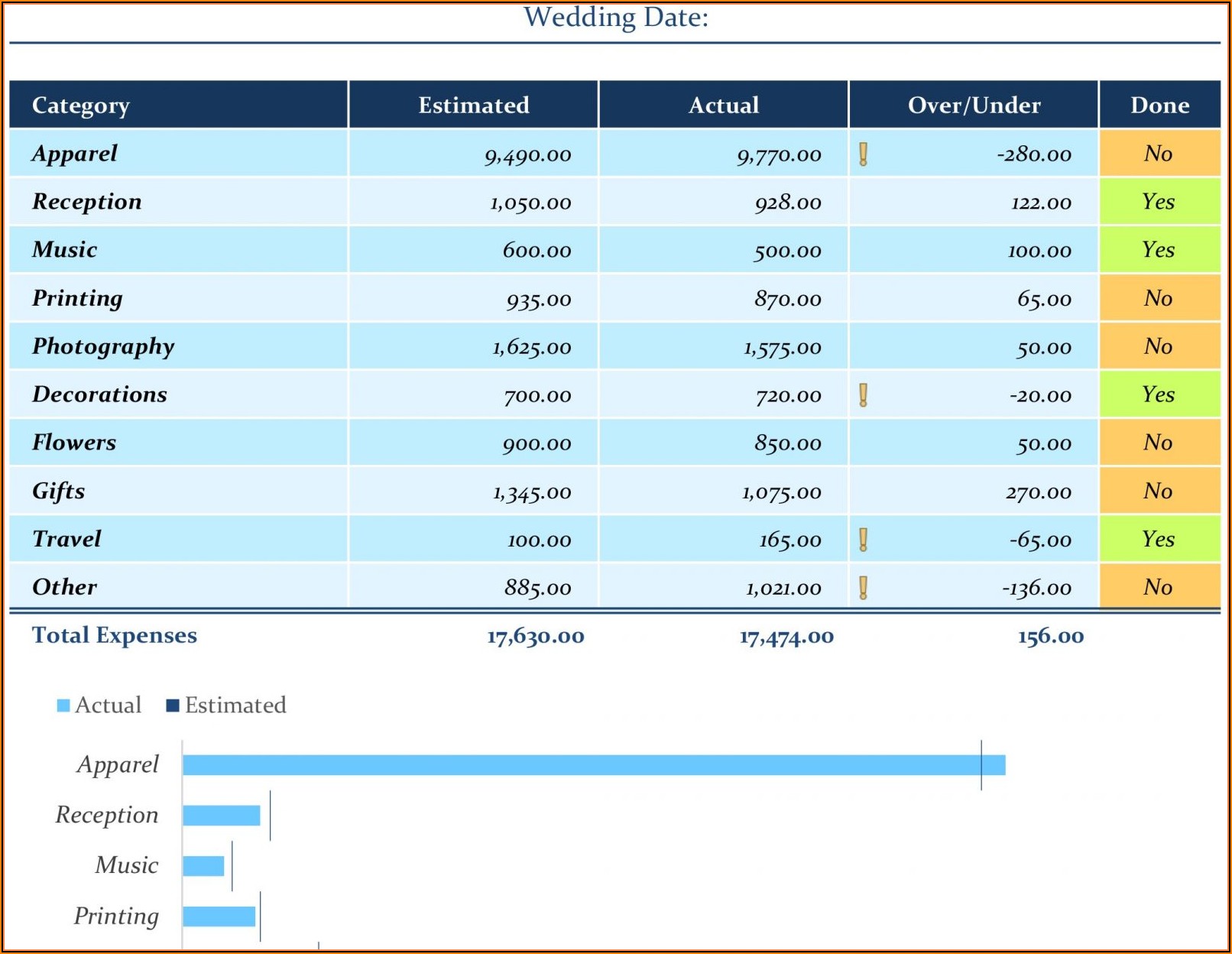

Moving For A Job Tax Deductible Expenses Relocation Assistance Tax

https://i.pinimg.com/originals/01/d0/b4/01d0b49fe3dd565a873f14dcc3126578.png

Shyft On LinkedIn Are Relocation Expenses Taxable In Short Yes As

https://media.licdn.com/dms/image/C5622AQEyirqZ3KyH5w/feedshare-shrink_800/0/1661963250371?e=1697673600&v=beta&t=vwPkxdI3zZ4FAjHMQoDAqomB6Asam1SwuLepPZpRcwY

The RITA reimburses an employee for federal state and local income taxes incurred on taxable relocation travel reimbursements reportable on Form W 2 Wage Yes moving expenses are tax deductible for employers as a business expense if they include the reimbursement in the employee s taxable wages What are

The Act which went into effect in 2018 and will remain until 2025 reimbursed moving expenses are taxable and unreimbursed moving expenses are no So to answer the question are relocation expenses taxable the answer is yes Moving expenses including lump sum payments are considered taxable income which means the employee

Download Are Relocation Expenses Taxable

More picture related to Are Relocation Expenses Taxable

Relocation Consultants Improved Employee Experience UrbanBound

https://www.urbanbound.com/hubfs/Social Blog - 012623.png#keepProtocol

Relocation Bonus Taxes Shyft Moving

https://assets.website-files.com/608bcac6a63a8805d6905fb2/62e1254332782851f9b83e7d_1-p-800.jpg

Are Relocation Expenses Taxable Ultimate Guide For 2023

https://arcrelocation.com/wp-content/uploads/2020/08/budgetallowance-1536x1024.jpeg

Some relocation costs up to 8 000 are exempt from reporting and paying tax and National Insurance These are called qualifying costs and include the costs of buying Yes Paid Relocation Expenses Are Taxable to Employees Back in the good ol days before the Tax Cuts and Jobs Act of 2017 employer paid relocation

Each time your agency pays a covered taxable relocation expense regardless of whether it is a reimbursement allowance or direct payment to a vendor it is considered The short answer is yes Relocation expenses for employees paid by an employer aside from BVO GBO homesale programs are all considered taxable income to the employee

Is My Relocation Package Taxable Experian

https://s28126.pcdn.co/blogs/ask-experian/wp-content/uploads/young-male-and-female-couple-determining-relocation-expenses.jpg

Are Relocation Expenses Taxable Ultimate Guide For 2023

https://arcrelocation.com/wp-content/uploads/2020/08/tax-1536x1024.jpeg

https://arcrelocation.com/relocation-tax

Before the Tax Cuts and Jobs Act of 2017 relocation benefits were not considered taxable income for employees Employers could also deduct

https://www.irs.gov/individuals/international...

Moving expense deduction eliminated except for certain Armed Forces members For tax years beginning after 2017 you can no longer deduct moving

Are Relocation Expenses Taxable Ultimate Guide For 2023

Is My Relocation Package Taxable Experian

Are Relocation Expenses For Employees Taxable When Co s Pay

/employer-guide-employee-moving-expenses-4141194-color-2-22282f9c075b4ed09b81564deb33455e.jpg)

Tax Treatment Of Employer Paid Relocation Expenses

Relocation Expenses In 2017 Not Taxable Global Mobility Solutions

Relocation Expenses Success Tax Professionals

Relocation Expenses Success Tax Professionals

Are Relocation Expenses Taxable

Are Relocation And Moving Expenses Taxable In France The Forum For

What Is Taxable Income And How To Calculate Taxable Income

Are Relocation Expenses Taxable - Answer Since 2018 when new legislation was passed relocation expenses have been taxable and employees can no longer deduct these expenses from their federal income