Are School Fees Tax Deductible In Canada To qualify the fees you paid to attend each educational institution must be more than 100 For example if you attended two educational institutions in the year the amount on

The most common deductions that apply to students are child care expenses moving expenses The most common non refundable tax credits that apply to students are The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs under certain conditions you can let the

Are School Fees Tax Deductible In Canada

Are School Fees Tax Deductible In Canada

https://simrahman.com/wp-content/uploads/2021/07/Are-probate-fees-tax-deductible-in-malaysia.jpg

Are Investment Fees Tax Deductible In Canada Money ca

https://media1.money.ca/a/29094/are-investment-fees-tax-deductible-in-canada_facebook_thumb_1200x628_v20230630145026.jpg

Are Estate Planning Fees Tax Deductible In Australia A Detailed Guide

https://ssafs.com.au/wp-content/uploads/2022/02/Are-estate-planning-fees-tax-deductible-in-Australia.jpg

Identify whether you are eligible to deduct your child s tuition credit from your taxes Also find out whether to transfer or deduct the tuition amount If you paid 5 000 of eligible tuition fees in the 2023 tax year for example you would be entitled to a 750 tax credit The tuition tax credit is subtracted from the

If you re a student you know it can be challenging to balance work school and paying the bills Fortunately there are several student tax credits and deductions to You can claim tuition fees over 100 for an education tax credit For the education amount you can claim a credit for every month you were enrolled full time or

Download Are School Fees Tax Deductible In Canada

More picture related to Are School Fees Tax Deductible In Canada

Are Accounting Fees Tax Deductible In Canada Intrepidium Consulting Inc

https://www.intrepidium.com/wp-content/uploads/2023/07/what-types-of-fees-can-businesses-in-canada-claim-on-their-taxes-1024x640.jpg

Are Credit Card Fees Tax Deductible Discover The Truth

https://paymentcloudinc.com/blog/wp-content/uploads/2022/01/are-credit-card-fees-tax-deductible.jpg

How To Make Private School Tuition Tax Deductible In Canada Tax Tip

https://i.ytimg.com/vi/bD1MikWbDMU/maxresdefault.jpg

Learn about the tuition tax credit in Canada a tax credit worth 15 of eligible tuition fees paid for the tax year 2022 and how to claim it on your taxes Private School Tuition Fees Generally the cost of tuition for private school for elementary and secondary school students is not tax deductible There are non refundable tuition

Line 32300 Your tuition education and textbook amounts The federal education and textbook tax credits were eliminated in 2017 To see if you are eligible to claim a With tuition fees averaging over 6 300 a year in Canada students and their parents can use all the help they can get to offset at least some of the costs of higher

Are Tax Preparation Fees Deductible In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cad47f431a8defb31352_60d8c6866b8380743f3e37e2_tax-preparation-fees-deductible.jpeg

Are Accounting Fees Tax Deductible In Canada Intrepidium Consulting Inc

https://wwwintrepidiumcom86a27.zapwp.com/q:intelligent/r:0/wp:1/w:1/u:https://www.intrepidium.com/wp-content/uploads/2023/07/are-accounting-fees-tax-deductible-in-Canada-Intrepidium-Consulting.jpg

https://www.canada.ca/.../eligible-tuition-fees.html

To qualify the fees you paid to attend each educational institution must be more than 100 For example if you attended two educational institutions in the year the amount on

https://www.canada.ca/en/revenue-agency/services/...

The most common deductions that apply to students are child care expenses moving expenses The most common non refundable tax credits that apply to students are

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

Are Tax Preparation Fees Deductible In Canada

Is Medical Cannabis Tax deductible In Canada We Have The Answer Leafly

Advisorsavvy Are Financial Advisor Fees Tax Deductible In Canada

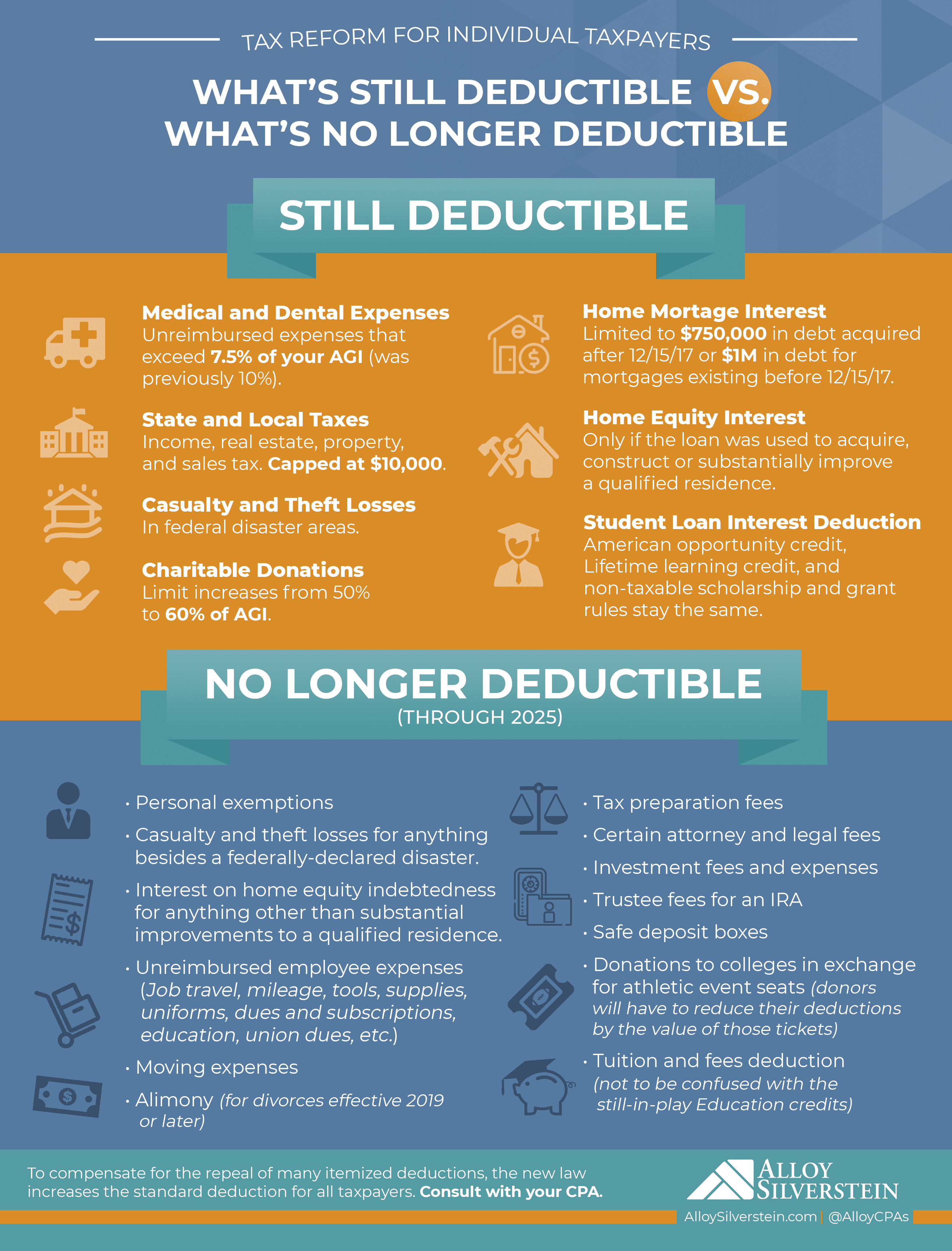

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

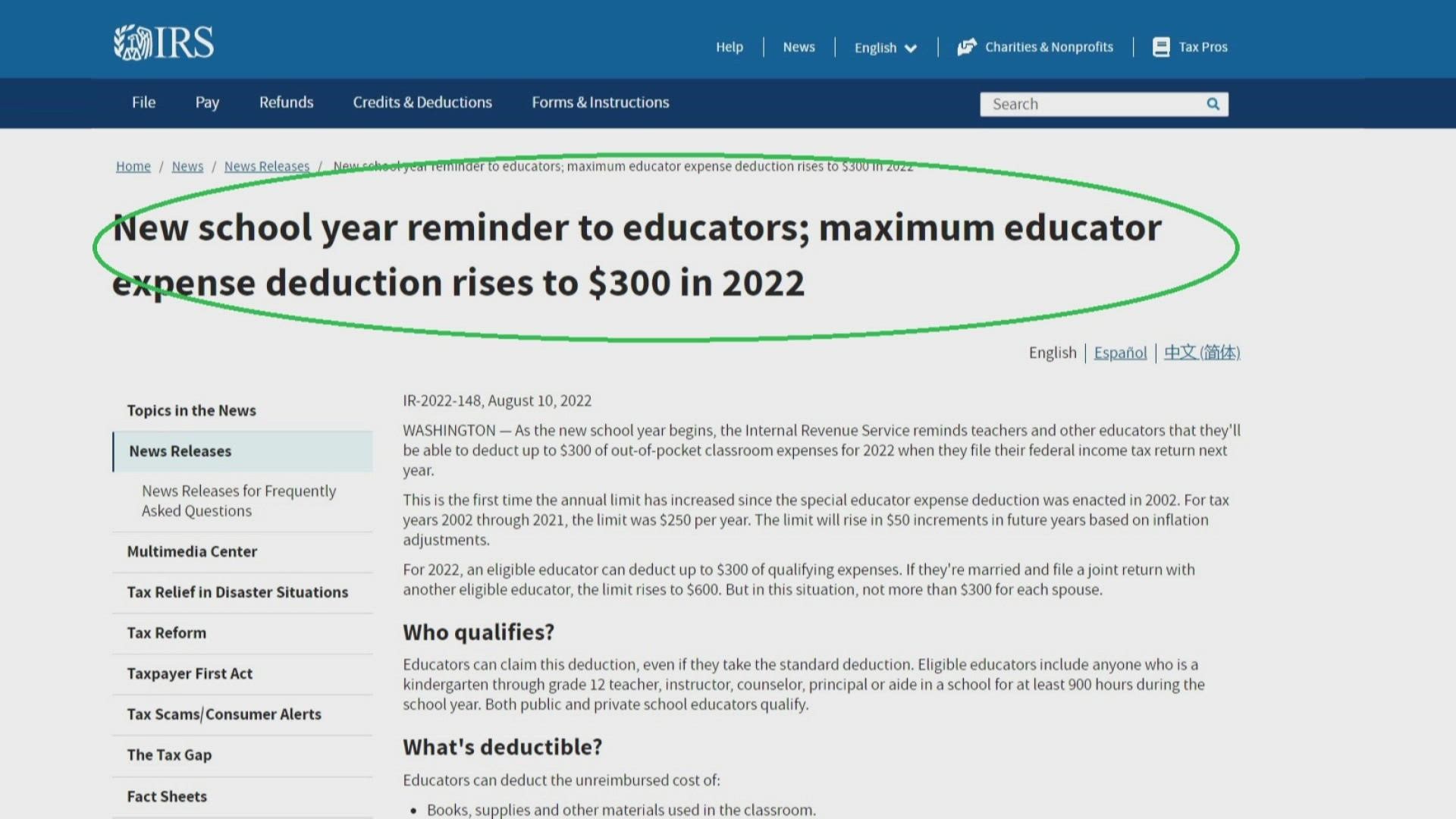

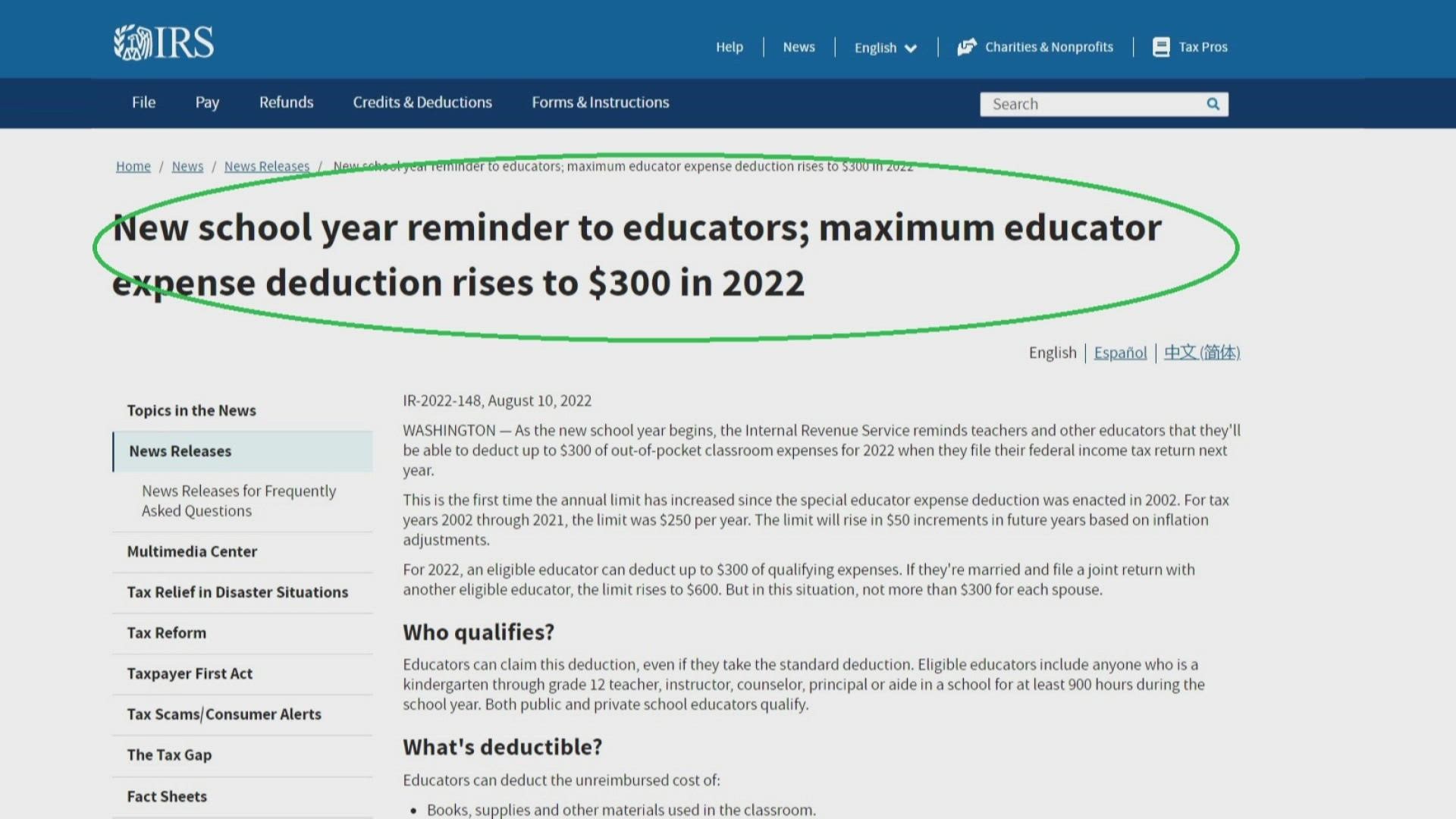

School Supplies Are Tax Deductible Wfmynews2

School Supplies Are Tax Deductible Wfmynews2

Are Tax Preparation Fees Deductible Read To Learn

Can I Get A Tax Deduction For My Child s School Fees In South Africa

Can School Fees Be Tax Deductible In South Africa Greater Good SA

Are School Fees Tax Deductible In Canada - Identify whether you are eligible to deduct your child s tuition credit from your taxes Also find out whether to transfer or deduct the tuition amount