Are School Fees Tax Deductible Key Takeaways Under federal tax law private school tuition isn t tax deductible unless your child is attending a private school for special needs If a physician s referral proves that your child requires access to special needs private education the expenses could qualify as deductible medical expenses

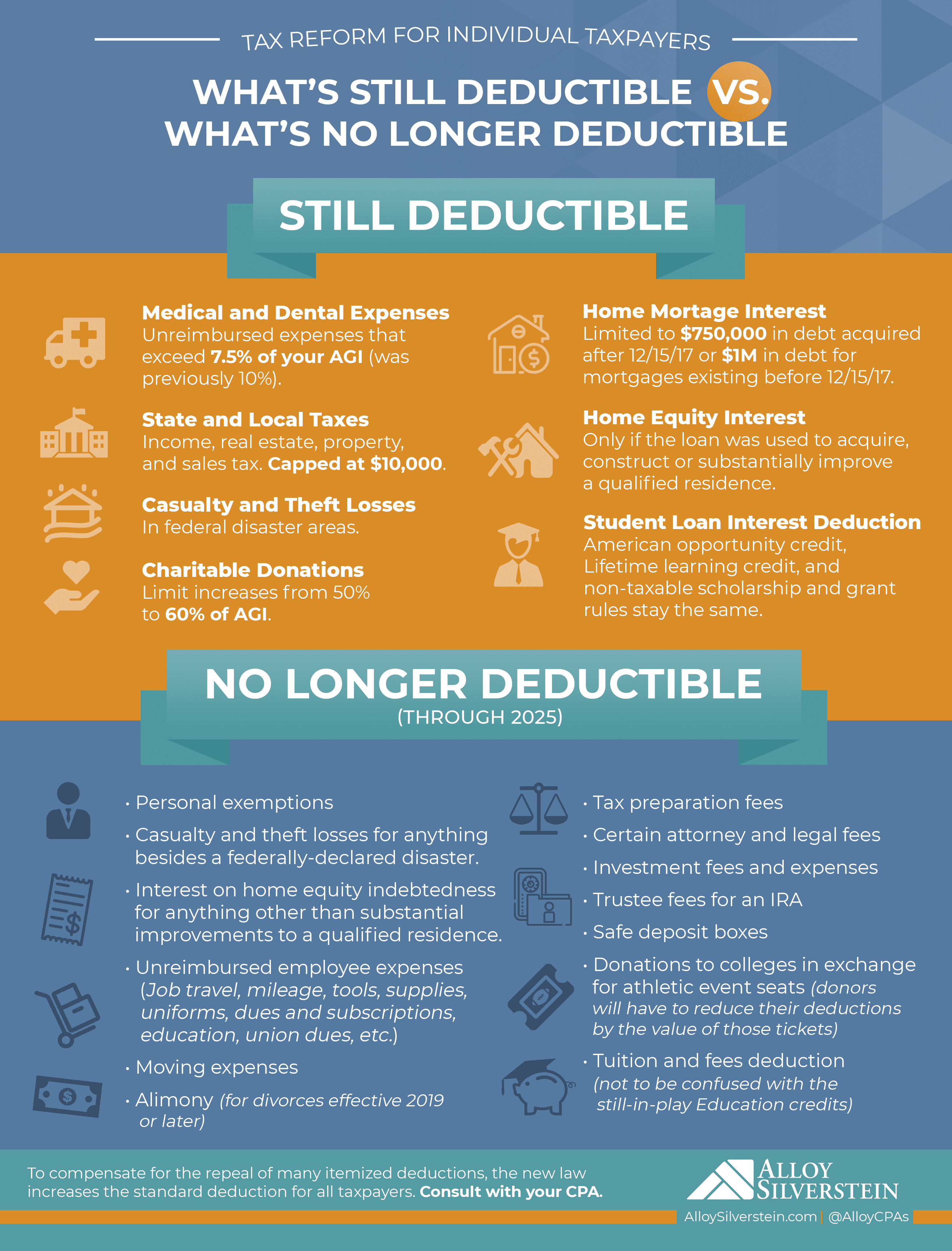

Is a donation to a private school tax deductible In short no However there are ways to reduce private school fees while also paying less tax easing the pressure We ve outlined some of them here so that you can make the best Given the tax changes in recent years it s important to check which college expenses are tax deductible or allow you to take a credit and which expenses no longer qualify Check out the list below Tuition and fees are no longer tax deductible after 2020

Are School Fees Tax Deductible

Are School Fees Tax Deductible

https://rainbowpreschoolvabeach.com/wp-content/uploads/2021/12/Are-Preschool-Fees-Tax-Deductible-980x654.jpg

3 Ways To Determine Whether Your Legal Fees Are Tax Deductible

https://www.wikihow.com/images/e/e6/Determine-Whether-Your-Legal-Fees-Are-Tax-Deductible-Step-15.jpg

Are Guardianship Legal Fees Tax Deductible Van Slett Law LLC

https://images.squarespace-cdn.com/content/v1/5ba1307855b02c52b1dc94e1/1595653110884-YELMWRJ2K4OWRDBZXKBE/Guardianship+Legal+Fees+Tax+Deduction+Picture+Van+Slett+Law+LLC.jpeg

Unfortunately no private school fees are not specifically deductible from your self assessment tax return However there are several tax efficient steps you can take to reduce the cost of private school fees for your children I m often asked if parents can claim any tax relief on school fees Funding private school feels can be a challenge but there are ways to ensure that challenge is do able Are private school fees tax deductible The short answer is no but there are several ways to pay less tax and pay less in private school fees at the same time Win win

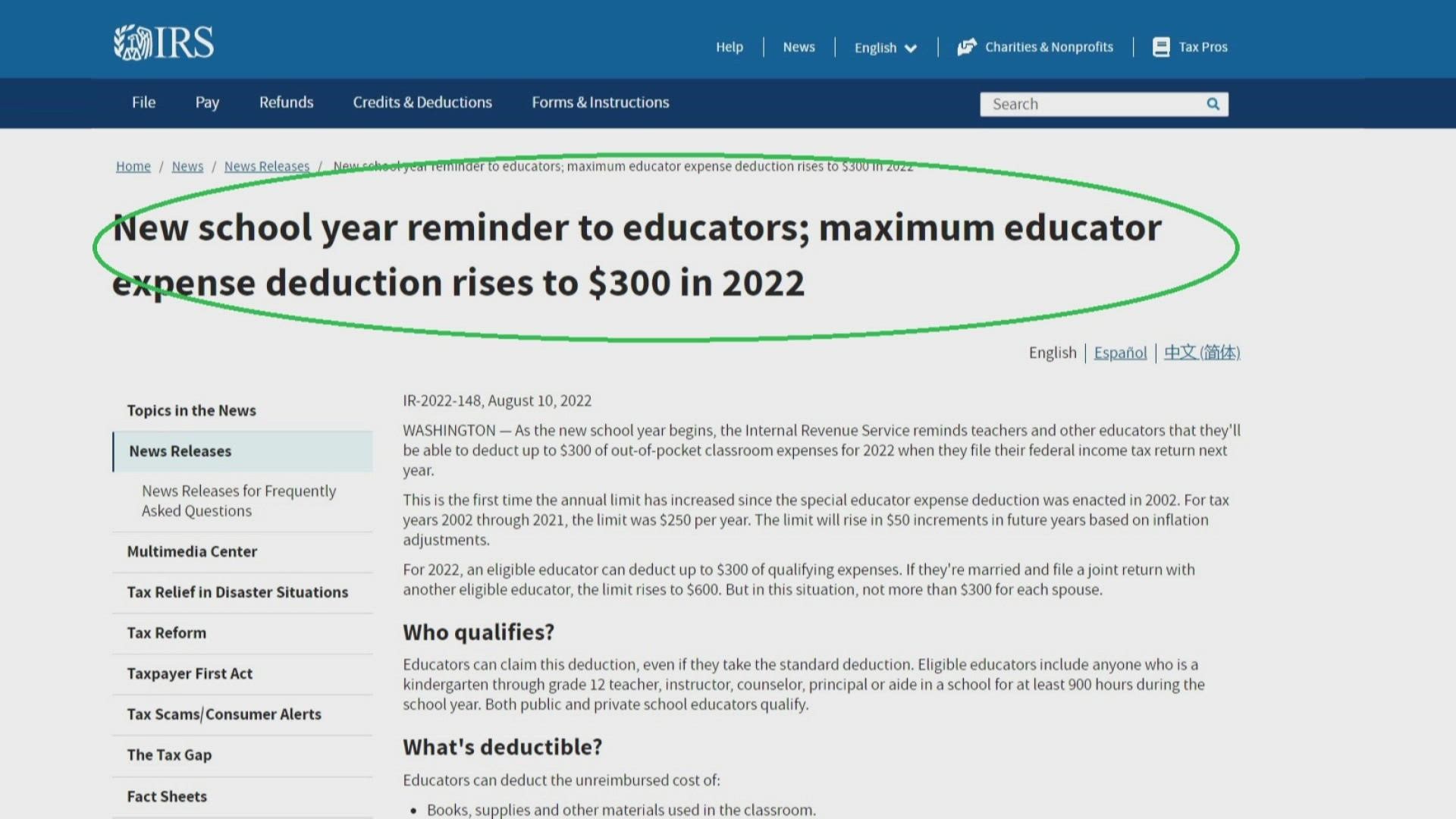

No Some people think private school fees are tax deductible but they re not School fees can t be used to offset your tax bill but here are some easy ways to cut your tax bill The Tuition and Fees Deduction Expired in 2020 The tuition and fees deduction was on unsteady footing after the passing of the Tax Cuts and Jobs Act TCJA in 2017 That legislation ended this tax break However Congress revived the deduction the next year with the Bipartisan Budget Act of 2018 BBA The BBA retroactively renewed it

Download Are School Fees Tax Deductible

More picture related to Are School Fees Tax Deductible

Why Not Make Private School Fees Tax Deductible

https://www.telegraph.co.uk/content/dam/news/2022/12/10/TELEMMGLPICT000001917908_trans_NvBQzQNjv4BqWqpbAtgKJyHaMBh-yZTXbeDb_zHeougPJk0-Rsnxim0.jpeg?imwidth=680

Are Probate Fees Tax Deductible In Malaysia

https://simrahman.com/wp-content/uploads/2021/07/Are-probate-fees-tax-deductible-in-malaysia.jpg

Are Membership Fees Tax Deductible

https://bristax.com.au/wp-content/uploads/2023/05/are-membership-fees-tax-deductible-bristax-tax-accountants-1.webp

Investing isn t the only way to get the cash you need to pay for school fees You could borrow money and lots of parents remortgage or use offset mortgages to release money Be aware that any money you borrow will need to be repaid and you ll have to pay interest on it You should also consider taking out insurance With the cost of private K 12 education topping 12 000 a year on average nationwide many parents wonder is private school tuition tax deductible Unfortunately the answer is no on federal

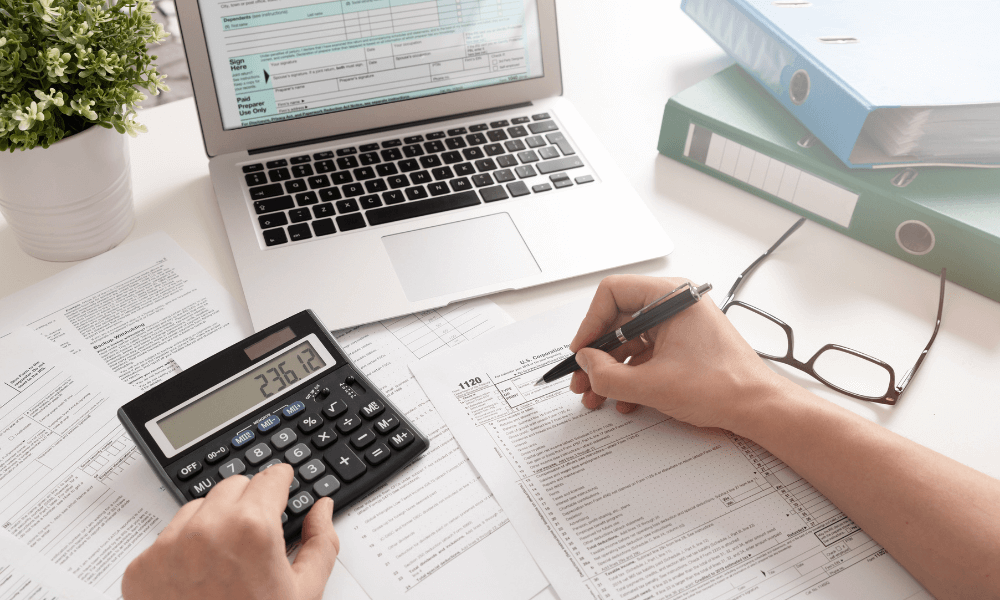

The credit is calculated as 100 of the first 2 000 of qualifying expenses plus 25 of the next 2 000 making the maximum credit 2 500 per student Eligible expenses include tuition and You may exclude certain educational assistance benefits from your income That means that you won t have to pay any tax on them However it also means that you can t use any of the tax free education expenses as the basis for any other deduction or credit including the lifetime learning credit

Are Property Manager s Fees Tax deductible

https://mcdonald.eieio.co.nz/hubfs/[PM] Graphics V86/tax-deductible blog image.png

Are Credit Card Fees Tax Deductible Discover The Truth

https://paymentcloudinc.com/blog/wp-content/uploads/2022/01/are-credit-card-fees-tax-deductible.jpg

https://turbotax.intuit.com/tax-tips/college-and...

Key Takeaways Under federal tax law private school tuition isn t tax deductible unless your child is attending a private school for special needs If a physician s referral proves that your child requires access to special needs private education the expenses could qualify as deductible medical expenses

https://www.theprivateoffice.com/insights/claim...

Is a donation to a private school tax deductible In short no However there are ways to reduce private school fees while also paying less tax easing the pressure We ve outlined some of them here so that you can make the best

Are Tax Preparation Fees Deductible Tax Relief Center

Are Property Manager s Fees Tax deductible

Are Stripe Fees Tax Deductible

Are Timeshare Fees Tax Deductible Timeshare Attorneys

Are School Fees Deductible

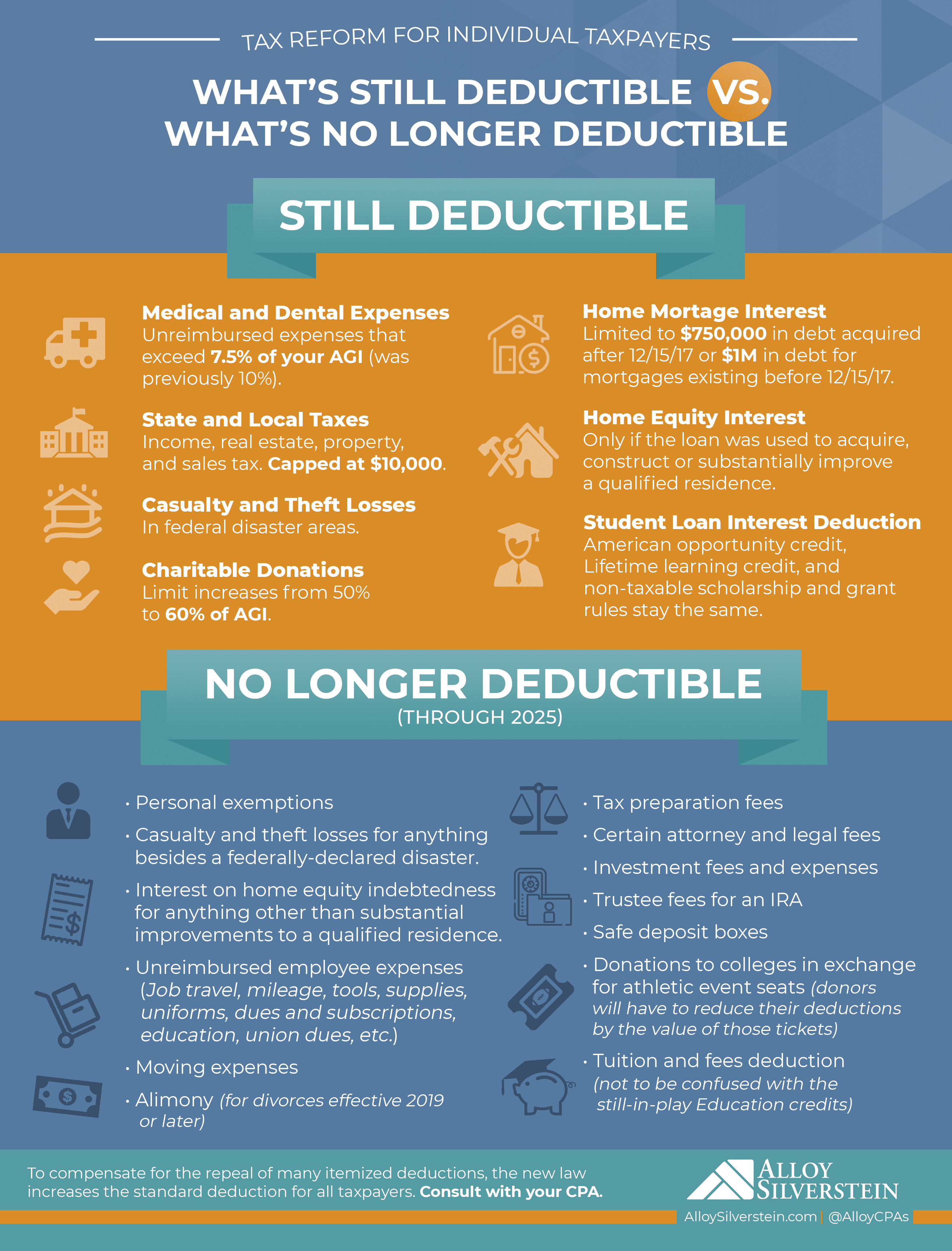

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductible Donations Bold

Are Web Hosting Fees Tax Deductible InMotion Hosting Blog

School Supplies Are Tax Deductible Wfmynews2

Are School Fees Tax Deductible - When you fill out your tax return this year you can include all contributions you make to these schools as a deductible charitable contribution Amount of deduction The amount you can deduct is equal to the value of all cash and property you donate to the school district programs