Federal And State Rebates For Electric Cars Web 20 mars 2023 nbsp 0183 32 Some states offer no incentives at all while others such as Oregon offer as much as a 7 500 rebate Read on to learn what offers you might find from states local

Web 7 janv 2023 nbsp 0183 32 You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For Web New EVs are eligible for a 7 500 credit for now until the Treasury and IRS release further guidance That guidance could mean automakers have to have increasing percentages of home grown battery

Federal And State Rebates For Electric Cars

Federal And State Rebates For Electric Cars

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/electric-car-rebates-by-state-electriccartalk.png

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Is It Possible To Claim Another Federal And State Tax Rebate For

https://i0.wp.com/electriccarexperience.com/wp-content/uploads/2022/12/Can-you-apply-for-a-new-federal-and-state-tax-credit-for-electric-cars-when-you-convert-from-one-to-another-1.webp

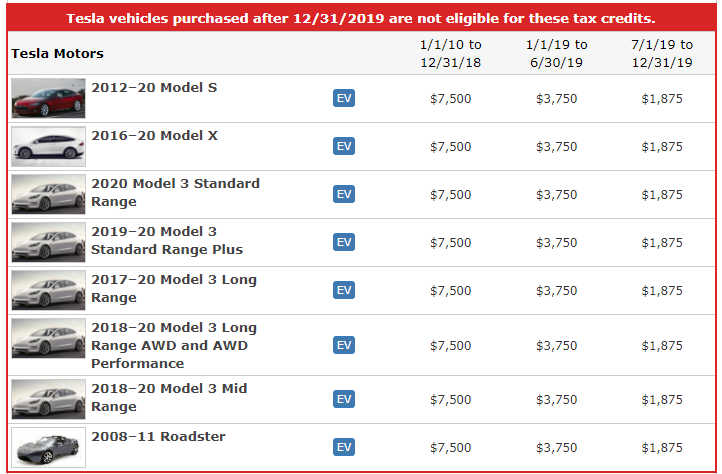

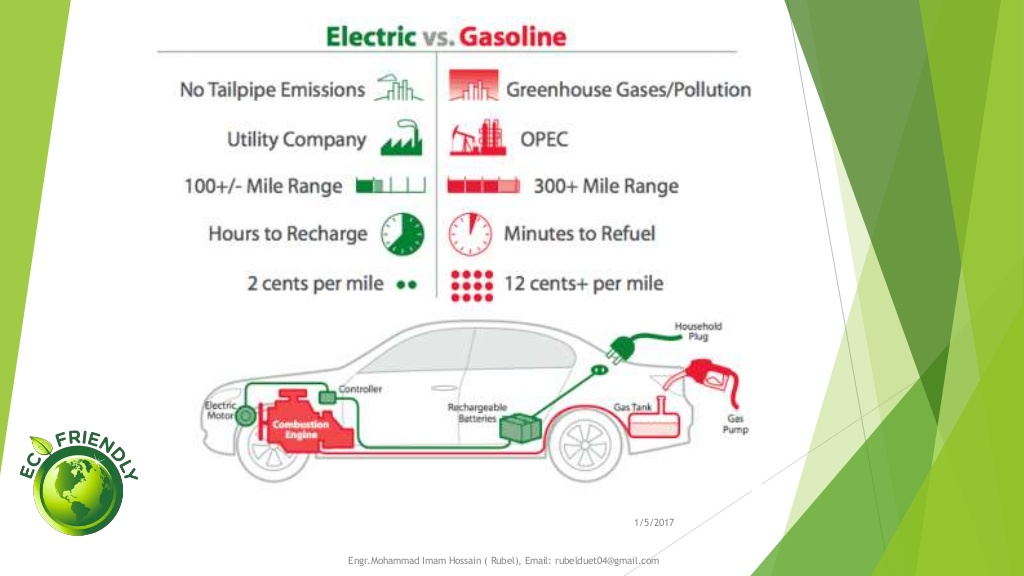

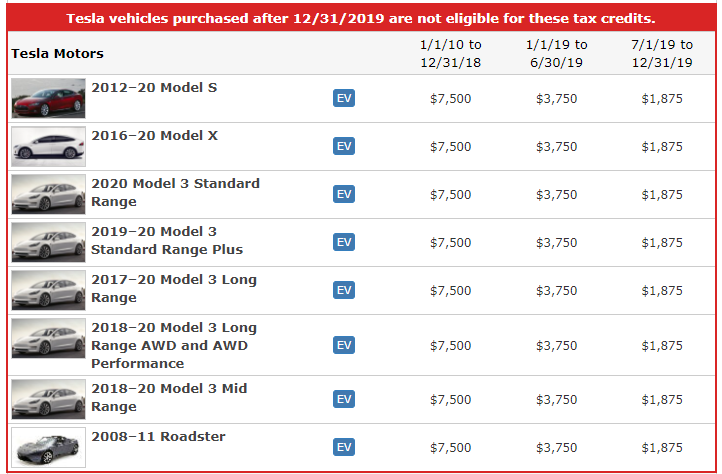

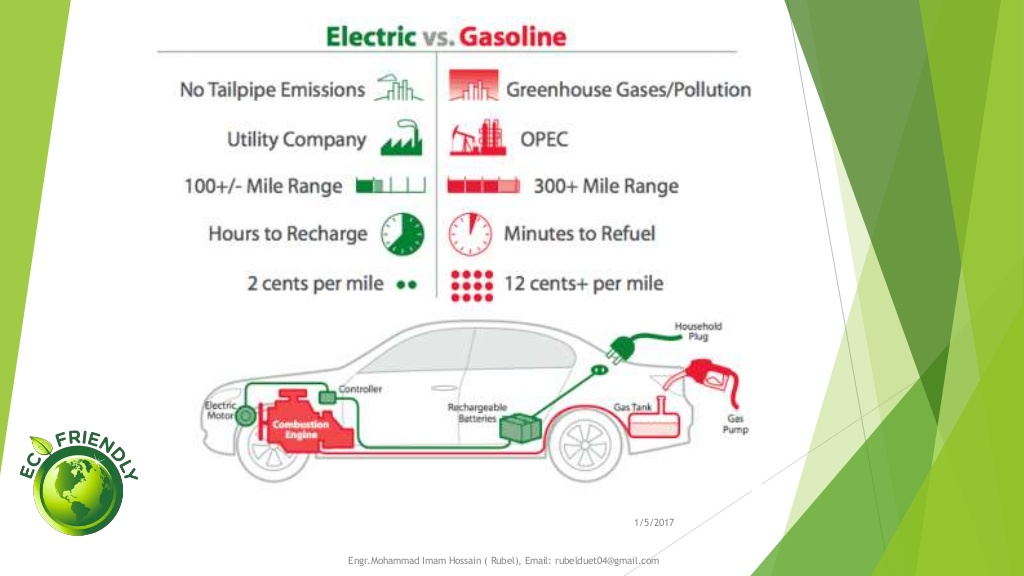

Web 25 juil 2023 nbsp 0183 32 They include a federal income tax credit of up to 7 500 for some new EVs And don t forget added rebates and other perks from state and local utilities While this Web 7 sept 2023 nbsp 0183 32 Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to

Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Download Federal And State Rebates For Electric Cars

More picture related to Federal And State Rebates For Electric Cars

California Electric Car Rebate

https://www.electricinfos.com/wp-content/uploads/2023/06/california-electric-car-rebate.jpg

The California Electric Car Rebate A State Incentive Program OsVehicle

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/the-california-electric-car-rebate-a-state-incentive-program-osvehicle-3.jpg?w=1030&ssl=1

Federal Rebate On Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/electric-vehicle-rebate-available-until-331-mcleod-cooperative-power.png

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web Il y a 1 jour nbsp 0183 32 Listen 183 4 04 4 Minute Listen Playlist Download Embed Enlarge this image Energy Secretary Jennifer Granholm is working hard to convince more Americans to

Web Electric Car Incentives Electric vehicle tax credits rebates and other incentives Use this tool to find tax credits incentives and rebates that may apply to your purchase or lease of Web Il y a 1 jour nbsp 0183 32 Californians who earn more than 300 of the federal poverty level will no longer qualify for a state subsidy when they purchase an electric car according to the

Federal Electric Car Rebate Rules ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

Canada Rebates For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ev-rebates-canada-electric-car-rebate-2022-show-me-the-green.png

https://cars.usnews.com/cars-trucks/advice/state-ev-tax-credits

Web 20 mars 2023 nbsp 0183 32 Some states offer no incentives at all while others such as Oregon offer as much as a 7 500 rebate Read on to learn what offers you might find from states local

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Federal Electric Car Rebate Rules ElectricRebate

Texas Rebate For Electric Cars 2023 Carrebate

Rebate On Electric Cars Canada 2022 Carrebate

Electric Car Rebates Federal 2023 Carrebate

Electric Car Rebates Washington State 2023 Carrebate

Electric Car Rebates Washington State 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Cars That Meet Federal Rebate On Electric Cars 2022 2023 Carrebate

2022 Tax Rebate For Electric Cars 2023 Carrebate

Federal And State Rebates For Electric Cars - Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s