Are Seniors Exempt From School Taxes Verkko 7 jouluk 2019 nbsp 0183 32 Do seniors have to pay school taxes in GA A 50 percent exemption for school tax is available to those age 65 and older with the property owner required to be at least 65 years of age on Jan 1 of the tax year

Verkko Wed January 4th 2023 CBS Austin file image AUSTIN Texas The new year is bringing with it new laws For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes Verkko 27 toukok 2023 nbsp 0183 32 As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending on the state you live in and often once you hit your 60s usually around the ages of 61 to 65 you may be eligible for a property tax exemption This exemption is often referred to as a homestead exemption

Are Seniors Exempt From School Taxes

Are Seniors Exempt From School Taxes

https://www.exemptform.com/wp-content/uploads/2022/08/free-9-sample-federal-tax-forms-in-pdf-ms-word.jpg

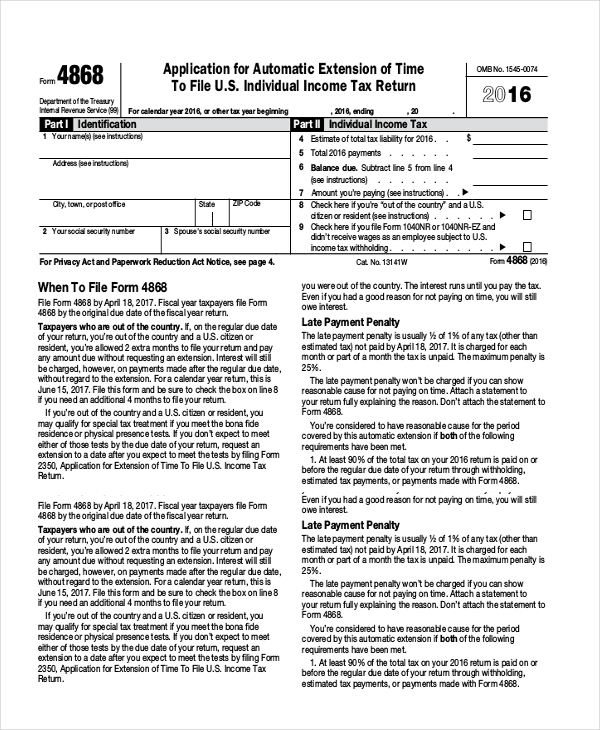

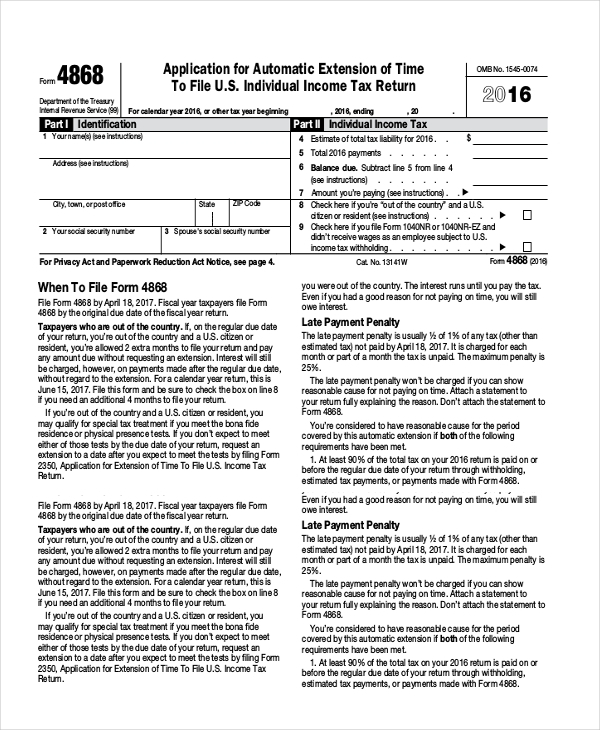

Tax Exempt Form TAX

https://images.sampletemplates.com/wp-content/uploads/2016/12/19155608/Property-Tax-Exemption-Form.jpg

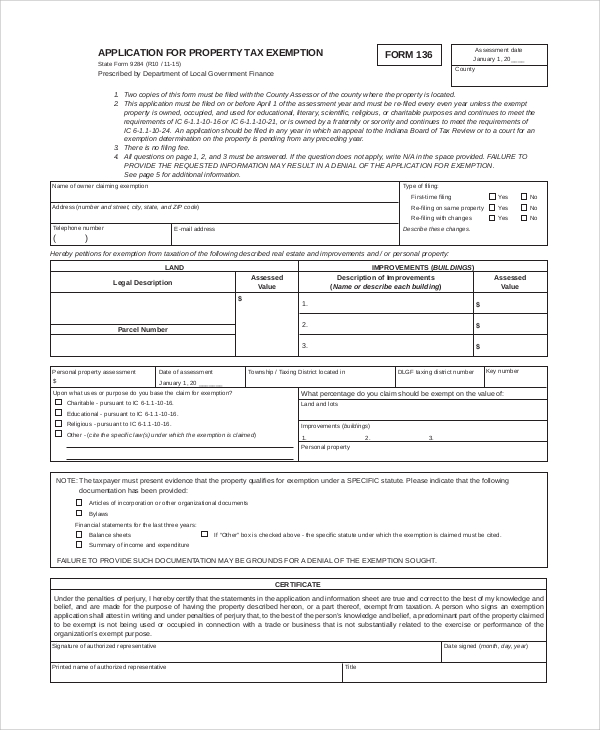

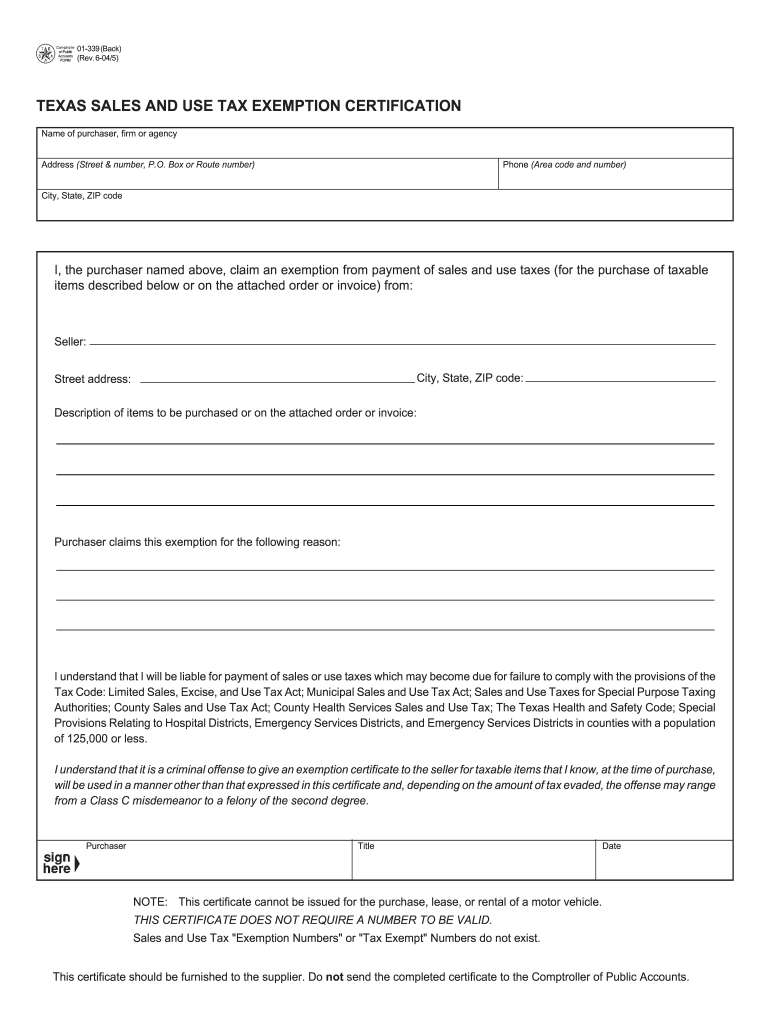

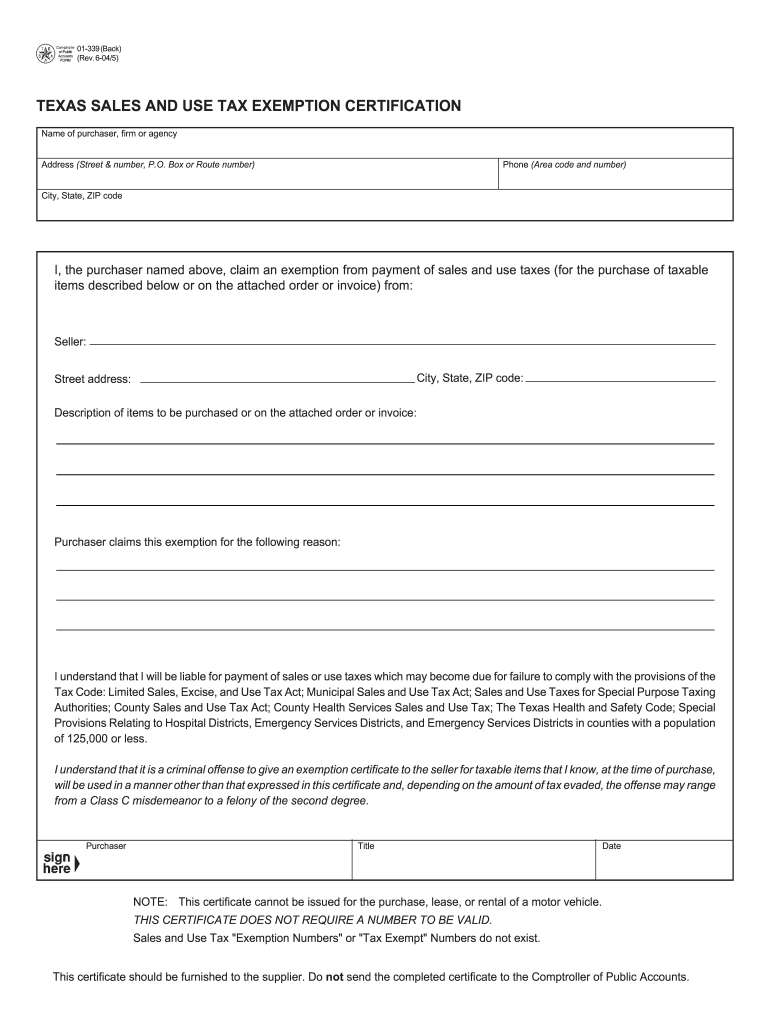

Tax Exempt Form Pdf Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/15/184/15184121/large.png

Verkko 14 maalisk 2023 nbsp 0183 32 There are no specific laws or rules that exempt seniors living in 55 communities from paying the school taxes portion of property taxes There are however many tax abatements that can reduce or eliminate school taxes but Verkko 2 huhtik 2019 nbsp 0183 32 Over 65 Exemption In addition to the 25 000 exemption that all homestead owners receive those age 65 or older qualify for a 10 000 homestead exemption for school taxes You may apply to your local appraisal district for up to one year after the date you become age 65 How to Freeze Texas Property Taxes at

Verkko 6 jouluk 2023 nbsp 0183 32 The 9 Most Expensive States for Seniors Tax Wise The Other 9 States that Are Not Tax Friendly Additional Resources References and Footnotes State by State Rankings The 13 Least Expensive States for Seniors Tax Wise Alaska Delaware Tennessee Wyoming Florida New Hampshire Alabama South Carolina South Dakota Verkko Hillsborough School District 650 342 5193 Jefferson Union High School District 650 550 7900 La Honda Pescadero Unified School District 650 879 0286 Las Lomitas Elementary School District 650 854 6311 Menlo Park City School District 650 321 7140 x5611 seniorexemption mpcsd Millbrae School District 650 697 5693 Pacifica

Download Are Seniors Exempt From School Taxes

More picture related to Are Seniors Exempt From School Taxes

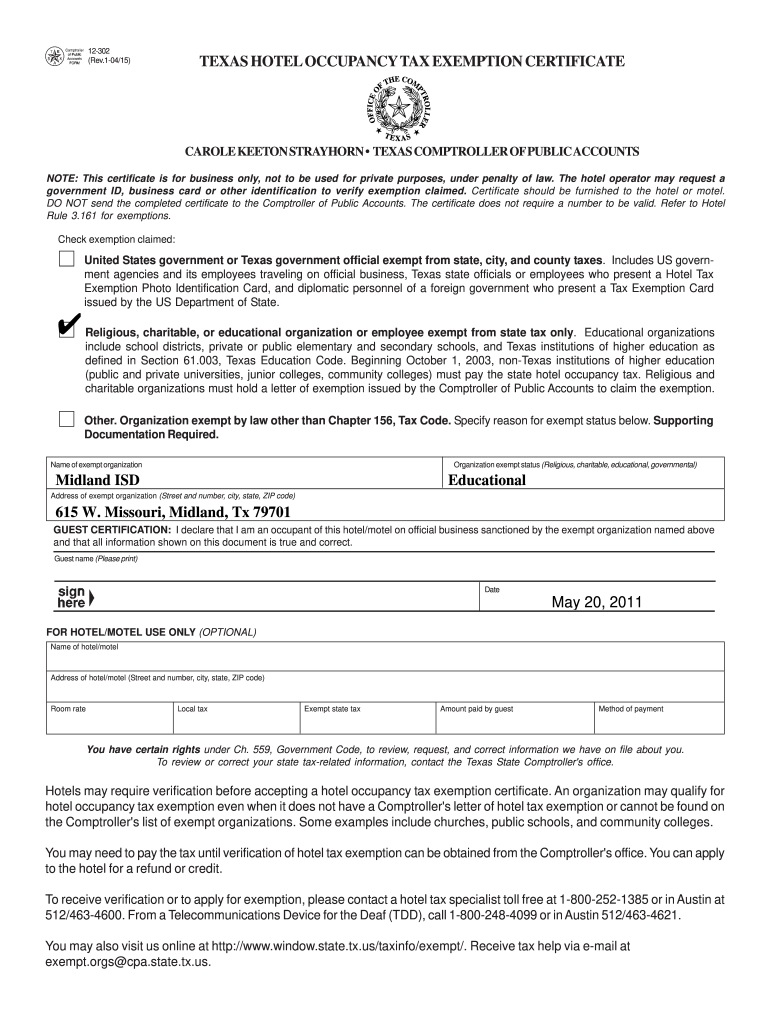

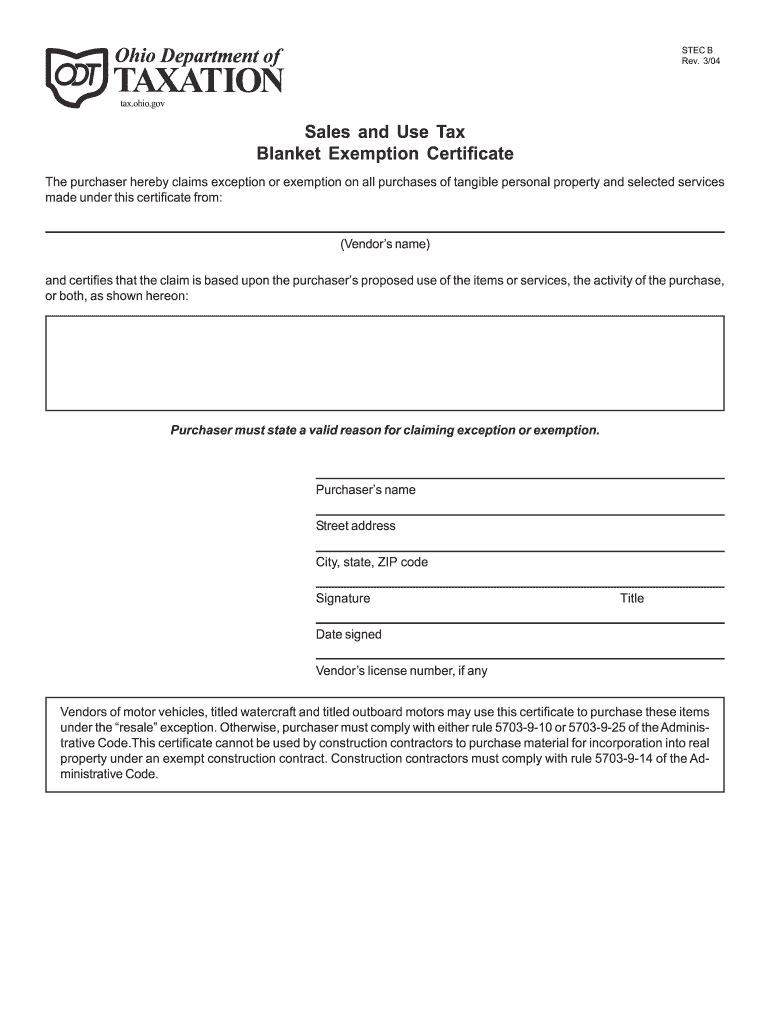

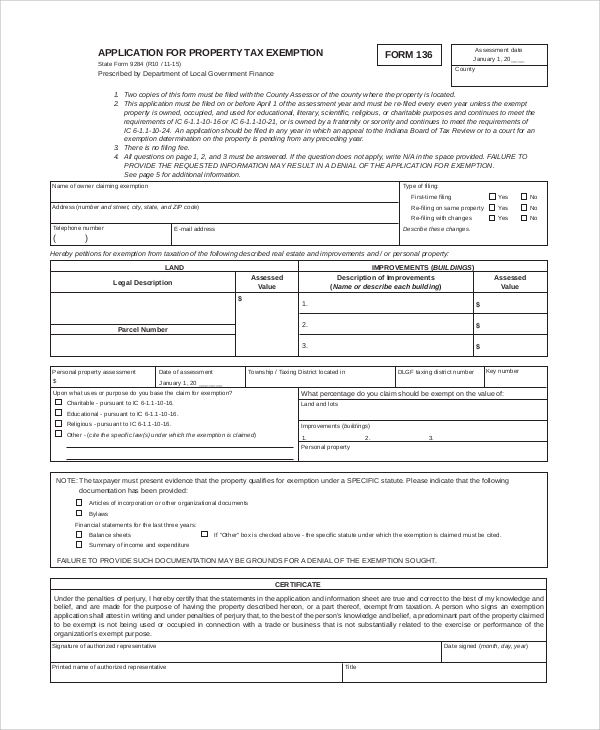

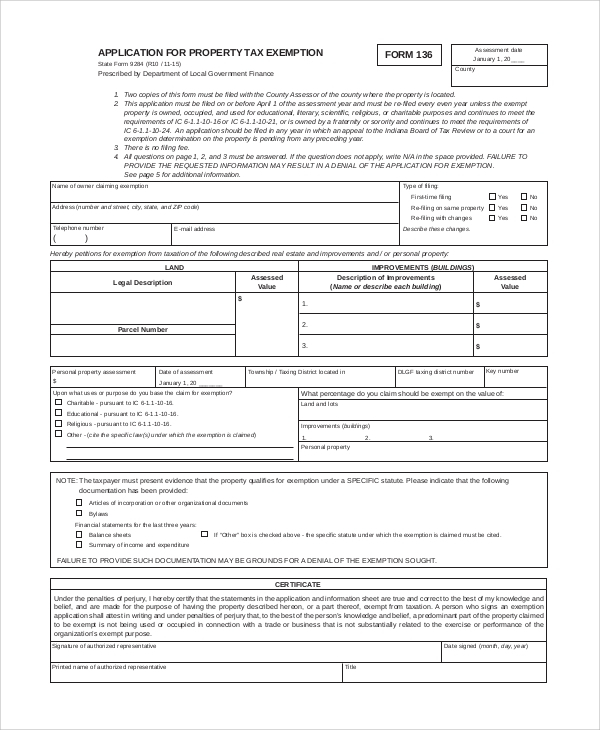

Tax Exempt Form Ohio Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/16/686/16686625/large.png

Exempt Vs Non exempt Employees

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Exempt vs non-exempt employees_featured.jpg#keepProtocol

Pdf W4 Form 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

Verkko The Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill Part of your home s assessed estimated value is exempted subtracted for school tax purposes The assessed value is the dollar amount used to decide how much you will have to pay in property taxes Verkko 20 huhtik 2023 nbsp 0183 32 The final leg of the process includes a special election in November 2023 where all registered Newton County voters will have their say regarding the senior citizen school tax exemption If approved by Newton County s registered voters eligible Newton County senior citizens will receive a reduction in their school system taxes

Verkko 19 syysk 2023 nbsp 0183 32 Bettencourt estimates that based on a 331 000 homestead and school tax rate 1 1357 the average senior disabled homeowner would see a two year savings of 2919 33 and that other homeowners Verkko 11 huhtik 2019 nbsp 0183 32 Previous letters Yes exempt seniors from school taxes School board elections are important Please vote in the upcoming school board elections

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

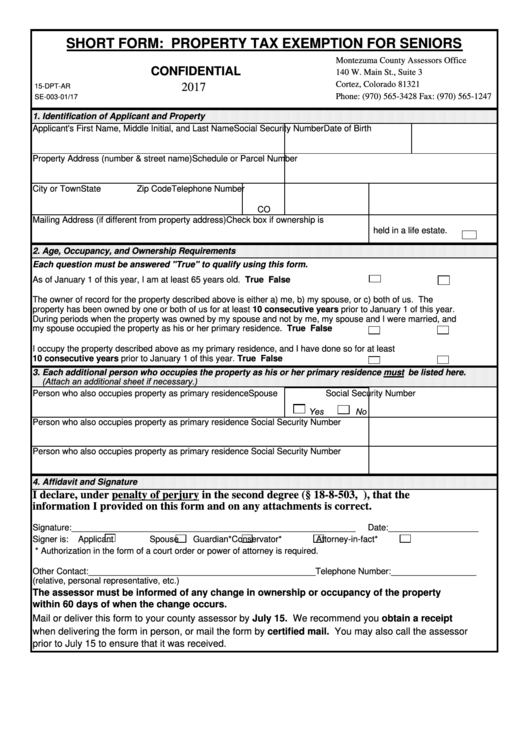

Fillable Short Form Property Tax Exemption For Seniors 2017

https://data.formsbank.com/pdf_docs_html/134/1344/134427/page_1_thumb_big.png

https://wise-answer.com/when-can-i-stop-paying-school-taxes-in-georgia

Verkko 7 jouluk 2019 nbsp 0183 32 Do seniors have to pay school taxes in GA A 50 percent exemption for school tax is available to those age 65 and older with the property owner required to be at least 65 years of age on Jan 1 of the tax year

https://cbsaustin.com/news/local/new-texas-law-gives-elderly-and...

Verkko Wed January 4th 2023 CBS Austin file image AUSTIN Texas The new year is bringing with it new laws For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes

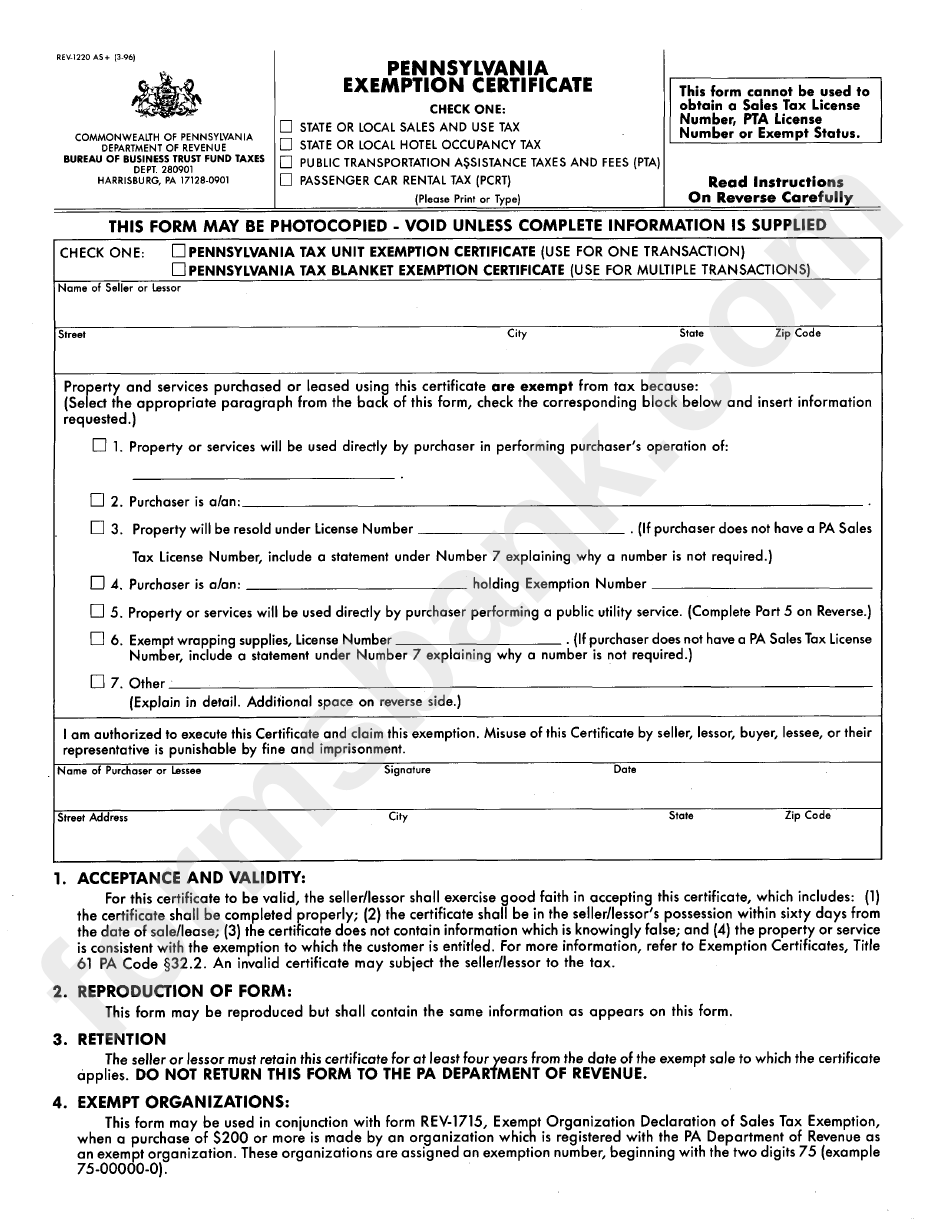

Pa Exemption Certificate Form Fill Out And Sign Printable Pdf Riset

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

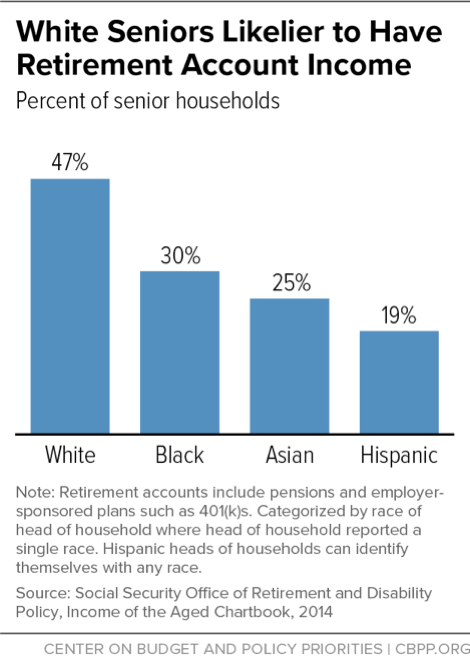

States Senior Tax Breaks Reinforce Unequal Wealth Income By Race

Exempt Vs Non Exempt LedgerGurus

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Taxact Online Fillable Tax Forms Printable Forms Free Online

Taxact Online Fillable Tax Forms Printable Forms Free Online

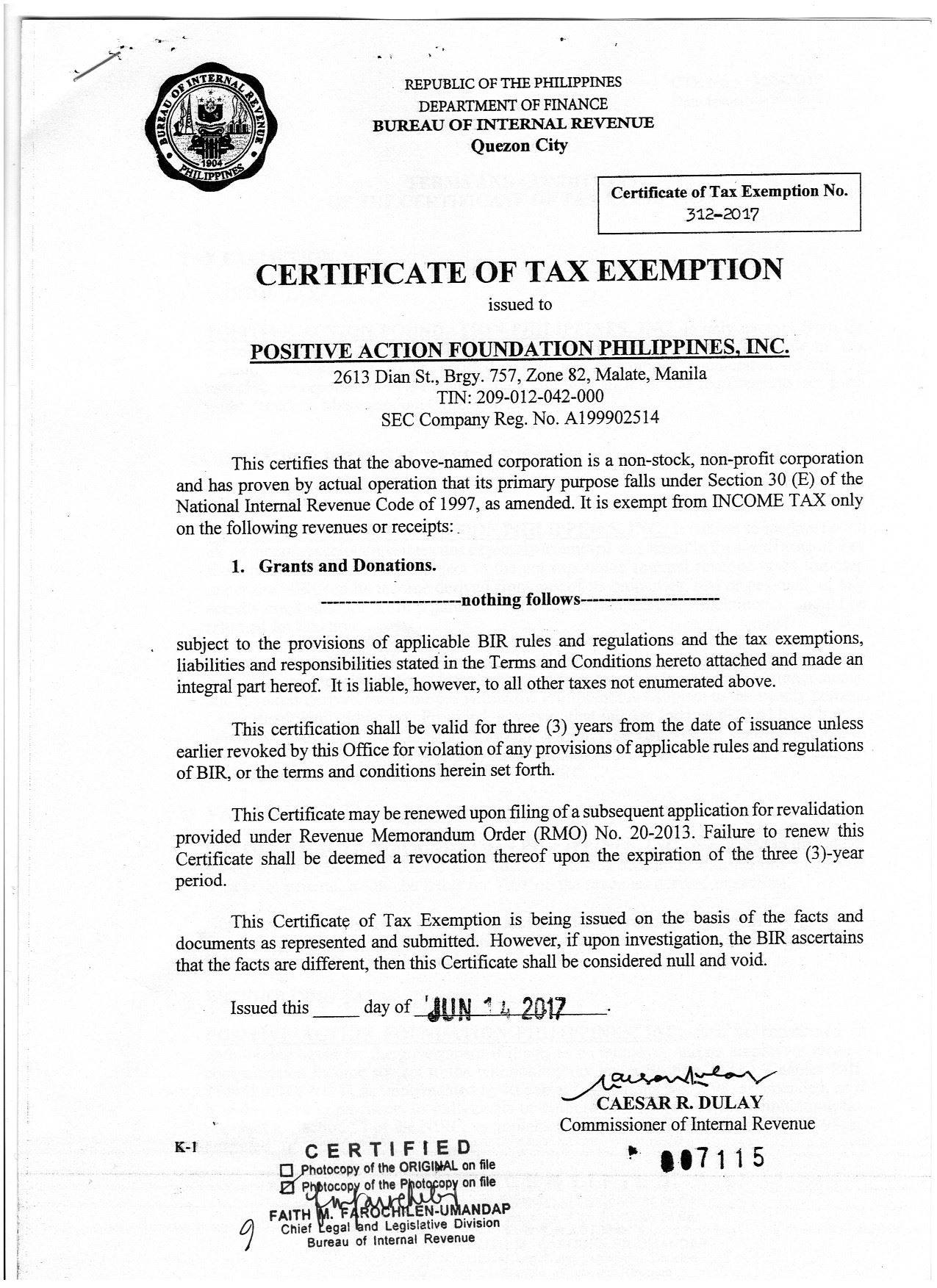

Certificate Of TAX Exemption PAFPI

2018 Form WI DoR S 211 Fill Online Printable Fillable Blank PdfFiller

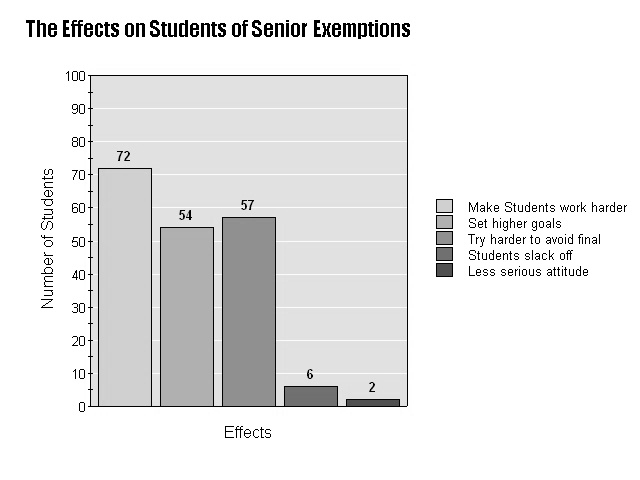

Seniors Exempt From Senior Exemptions The Chief

Are Seniors Exempt From School Taxes - Verkko 2 huhtik 2019 nbsp 0183 32 Over 65 Exemption In addition to the 25 000 exemption that all homestead owners receive those age 65 or older qualify for a 10 000 homestead exemption for school taxes You may apply to your local appraisal district for up to one year after the date you become age 65 How to Freeze Texas Property Taxes at