Are Solar Panel Rebates Taxable The ITC allows you to claim 30 of the total cost of your solar panel installation on your taxes which results in thousands of dollars in savings Rebates on the other hand tend to differ by region and the

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

Are Solar Panel Rebates Taxable

Are Solar Panel Rebates Taxable

https://lirp.cdn-website.com/dcc94ddc/dms3rep/multi/opt/Depositphotos_5111838_L-1920w.jpg

Solar Panel Rebates Solar Tax Incentives GreenLight Solar Roofing

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/solar-panel-rebates-solar-tax-incentives-greenlight-solar-roofing.png?w=4000&ssl=1

Everything You Need To Know About Solar Panel Rebates

https://browningelectrickc.com/wp-content/uploads/2022/03/solar-panel-rebates.jpeg

Key Takeaways The federal tax credit covers 30 of a consumer s total solar system cost which means you could get 6 000 for a solar installation with a price of 20 000 This incentive is Generally a taxpayer is not required to reduce the purchase price or cost of property acquired with a governmental energy efficiency incentive unless that

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When

Download Are Solar Panel Rebates Taxable

More picture related to Are Solar Panel Rebates Taxable

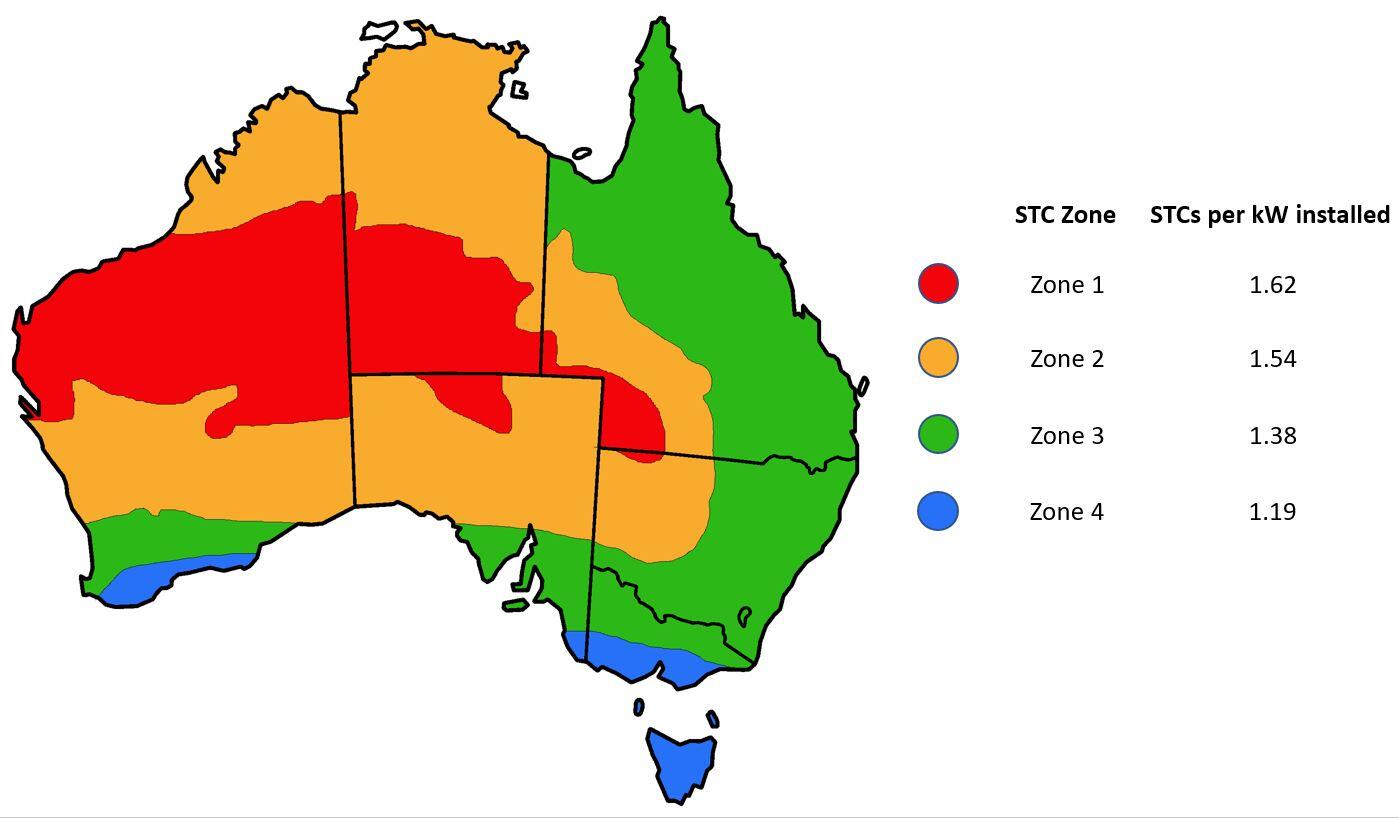

Government Solar Rebate Solar Power Incentives Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019.jpg

Through Government Rebates And Tax Incentives This Solar Program Is

https://i.pinimg.com/originals/d2/29/17/d229173fd3591329bf6586d0ecd4bf80.jpg

Solar Panel Tax Credits Rebates And Savings Electric Choice

https://www.electricchoice.com/wp-content/uploads/2017/03/solar-panel-tax-credits.jpg

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x

Solar Panel Rebates HMI Electrical

https://hmielectrical.com.au/wp-content/uploads/2023/04/Rebates.jpg

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

https://www.energysage.com/solar/sola…

The ITC allows you to claim 30 of the total cost of your solar panel installation on your taxes which results in thousands of dollars in savings Rebates on the other hand tend to differ by region and the

https://www.nerdwallet.com/article/taxe…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

Solar Victoria Panel Rebate Find Out If You re Eligible Grow Energy

Solar Panel Rebates HMI Electrical

What Solar Energy Rebates And Incentives Are Available Atlantic Key

Solar Tax Credits Rebates Missouri Arkansas

Complete Guide For WA Solar Panel Rebates 2023

Government Home Solar Panel Incentives Rebates In Australia 2022

Government Home Solar Panel Incentives Rebates In Australia 2022

How To Find And Claim Solar Panel Rebates

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Solar Panel Rebate Victoria CEC Approved Solar Retailer In Melbourne

Are Solar Panel Rebates Taxable - Key Takeaways The federal tax credit covers 30 of a consumer s total solar system cost which means you could get 6 000 for a solar installation with a price of 20 000 This incentive is