Are Tax Rebates Taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers these rewards as a discount not as income Taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state rebates and what it could mean for you

Are Tax Rebates Taxable

Are Tax Rebates Taxable

https://www.carrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-for-electric-vehicle-charging-stations-3.jpg

IRS Says California Most State Tax Rebates Aren t Taxable Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17lDJ6.img?w=1600&h=1600&m=4&q=74

Are Idaho s Tax Rebates Taxable

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17zLZr.img?w=986&h=554&m=4&q=89

The IRS and the courts agree that rebates paid by nonsellers are not excludable reasoning that only the seller can agree to a price adjustment Although the IRS appears to be moving toward allowing most seller paid rebates as exclusions it is now insisting that even accrual taxpayers delay the exclusion until the rebate is paid In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South Carolina and Virginia are taxable if the payment was a refund of state taxes and the individual itemized and received a Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back bonus the rewards are viewed by

Download Are Tax Rebates Taxable

More picture related to Are Tax Rebates Taxable

Admira Filozofic Carne De Oaie Calculate My Tax Otak kiri

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

2022 Tax Brackets JeanXyzander

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Forbes On Twitter Are State Tax Refunds And Rebates Federally Taxable

https://pbs.twimg.com/media/FohbLfQX0AEHgbM.jpg

WASHINGTON The Department of Treasury and the Internal Revenue Service today issued Announcement 2024 19 PDF that addresses the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements The IRS guidance provides that taxpayers receiving rebates for purchases of subsidized products do not need to include the rebates in income but must reduce their basis in the property by the amount of the rebate

The IRS on Friday issued federal tax guidance for millions of Americans who received state rebates or payments in 2022 The announcement came about a week after the agency had urged those Eighteen states issued special rebates and payments to tax filers last year The IRS said it will soon issue guidance as to whether those payment will be subject to federal income tax

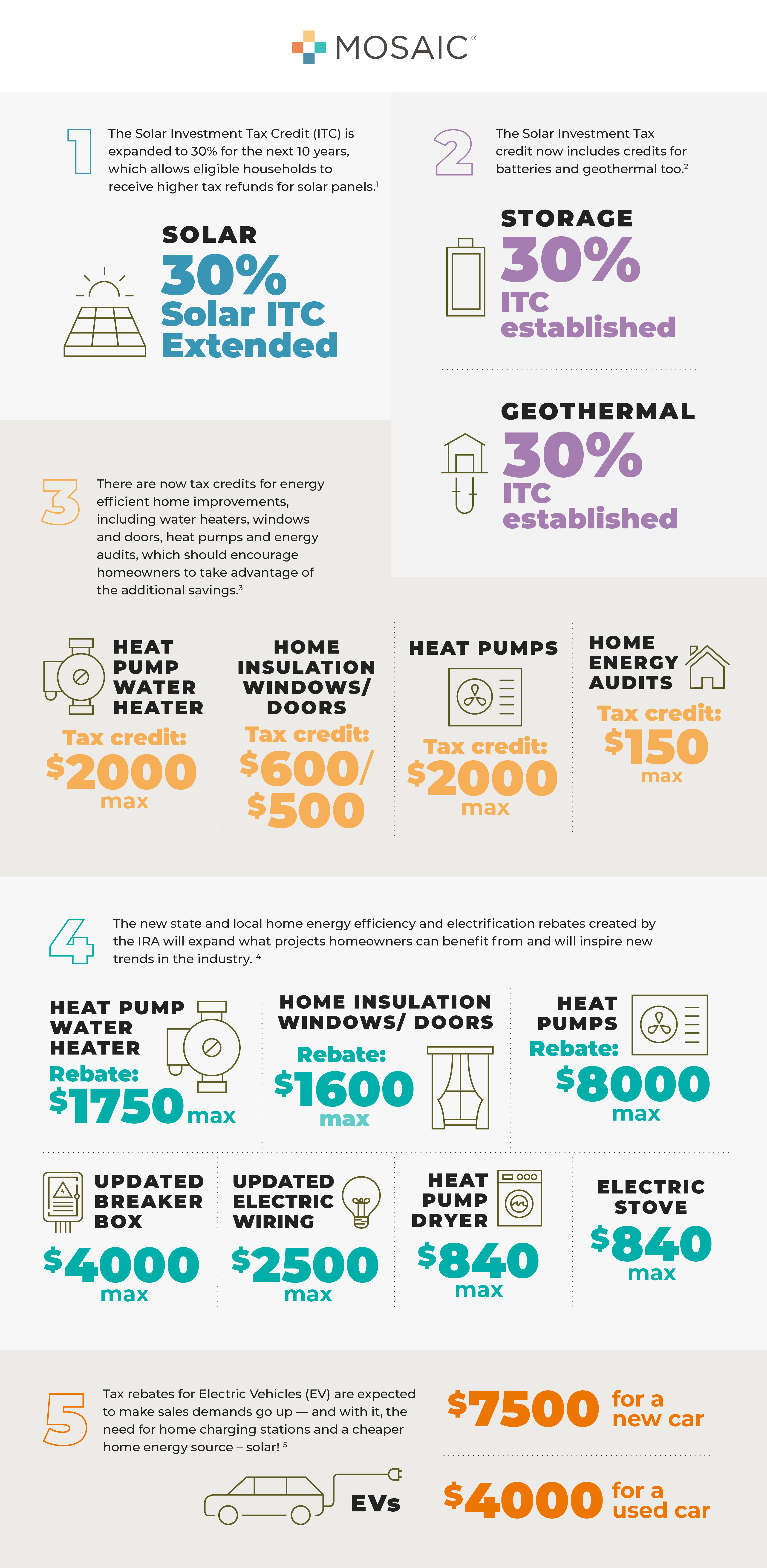

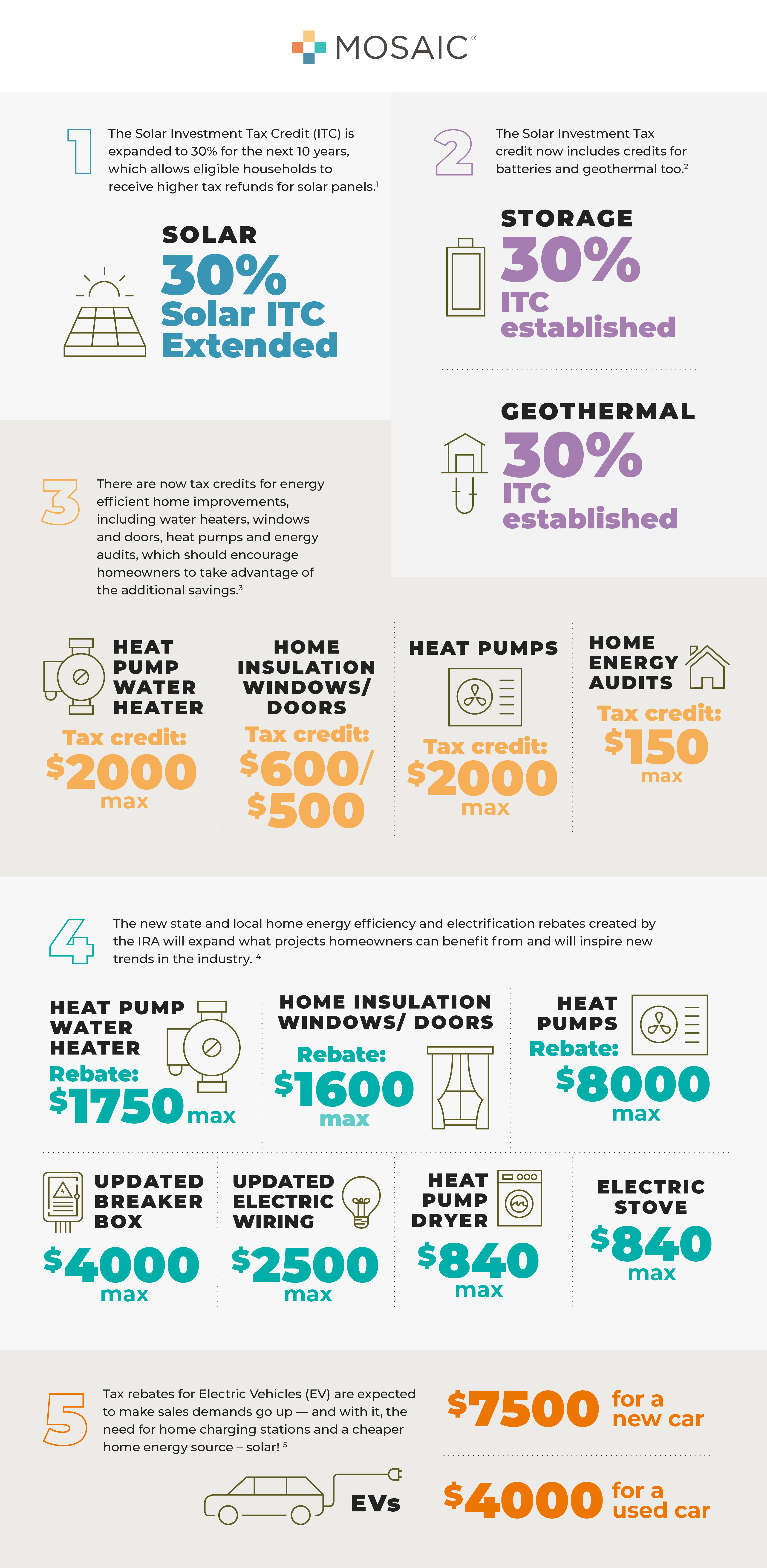

5 Ways The IRA Will Benefit Homeowners and Contractors

https://joinmosaic.com/wp-content/uploads/2022/12/IRA-benefits-infographic_final.png

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

https://www.healthplanrate.com/wp-content/uploads/2020/07/ACA-rebates-tax-deductible-1-1536x1036.jpg

https://donotpay.com/learn/are-rebates-taxable

A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

https://www.hackyourtax.com/taxing-rebates-points-rewards

How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers these rewards as a discount not as income

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

5 Ways The IRA Will Benefit Homeowners and Contractors

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Personal Income Tax Guide In Malaysia 2016 Tech ARP

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

How Are Credit Card Rewards Taxed

How Are Credit Card Rewards Taxed

Are Cash For Clunkers Rebates Taxable The Truth About Cars

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Are Tax Rebates Taxable - On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South Carolina and Virginia are taxable if the payment was a refund of state taxes and the individual itemized and received a