Are Tools Tax Deductible Learn how to deduct the cost of uniforms work clothes and tools for your job depending on your employment status and the useful life of the tools Find out the criteria and

Tools office equipment payroll travel and office or warehouse space all are tax deductible Larger tools that you use for more than a year and add to the quality or Thankfully buying tools equipment or a vehicle for your business can be claimed as a tax expense which reduces your taxable income and tax bill Which type of tax expense you claim depends upon

Are Tools Tax Deductible

Are Tools Tax Deductible

https://cdn1.npcdn.net/image/1639399835e281476dd194aa9f2a74cd92e0a2ce07.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

How To Form An Organization That Accepts Tax Deductible Donations YouTube

https://i.ytimg.com/vi/FV4ofGRaL1w/maxresdefault.jpg

Tools and equipment are generally depreciating assets that decline in value over time How you work out your deduction will depend on if the item cost 300 or less Under tax reform you can deduct as much as your business s net income or up to 1 160 000 whichever is smaller for qualified business equipment on your 2023 taxes Examples of qualified

Several experts have said tax is potentially due on many of the freebies Labour politicians have received and called on HM Revenue Customs to give greater You may be able to reduce your taxes by deducting unreimbursed job related expenses if attributable to self employment they may be deductible on Schedule C You should

Download Are Tools Tax Deductible

More picture related to Are Tools Tax Deductible

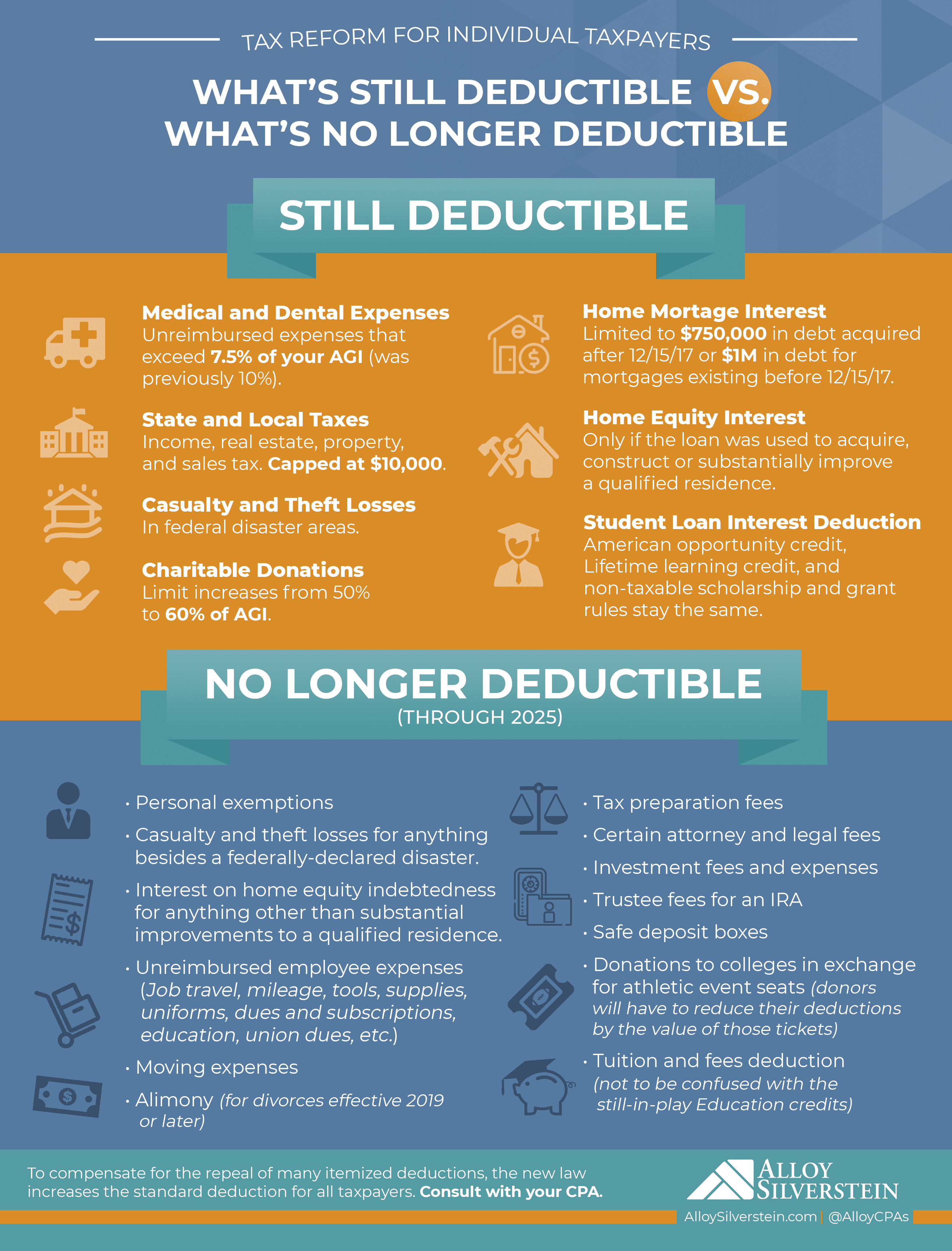

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

A Guide To Tax Deductible Donations Best Charities To Donate To

https://www.sbg.org.au/wp-content/uploads/2014/08/Tax-deductible-donations.jpg

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/ny/api/res/1.2/4oVLwF5RIk.VRMeiL2y7jA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

If you run your own handyman business then there are some expenses you should keep your receipts for as they can be used to offset your total taxable income Here are 5 deductions you can use at tax You can deduct any business costs from your profits before tax You must report any item you make personal use of as a company benefit Costs you can claim as allowable

Buying other equipment You may be able to claim tax relief on the full cost of substantial equipment that you have to buy to do your work This is because it qualifies for a type of You ll need to itemize deductions Schedule A to claim your job related expenses The cost of your tools won t be fully deductible as it will be subject to the

What Are Tax Deductible Business Expenses Compass Accounting

https://www.compass-cpa.com/wp-content/uploads/2018/08/what-are-tax-deductible-business-expenses.jpg

Explainer Why Are Donations To Some Charities Tax deductible

https://images.theconversation.com/files/160105/original/image-20170309-21047-1tidnuj.jpg?ixlib=rb-1.1.0&rect=0%2C366%2C4018%2C1948&q=45&auto=format&w=1356&h=668&fit=crop

https://www.hrblock.com/tax-center/filing...

Learn how to deduct the cost of uniforms work clothes and tools for your job depending on your employment status and the useful life of the tools Find out the criteria and

https://smallbusiness.chron.com/tax-deductions...

Tools office equipment payroll travel and office or warehouse space all are tax deductible Larger tools that you use for more than a year and add to the quality or

Tax Deductible Items For Entrepreneurs Fujn

What Are Tax Deductible Business Expenses Compass Accounting

Tax Deductible Donations FAQs

Tax Deductible Bricks R Us

Tax Deductions You Can Deduct What Napkin Finance

Sars 2022 Weekly Tax Tables Brokeasshome

Sars 2022 Weekly Tax Tables Brokeasshome

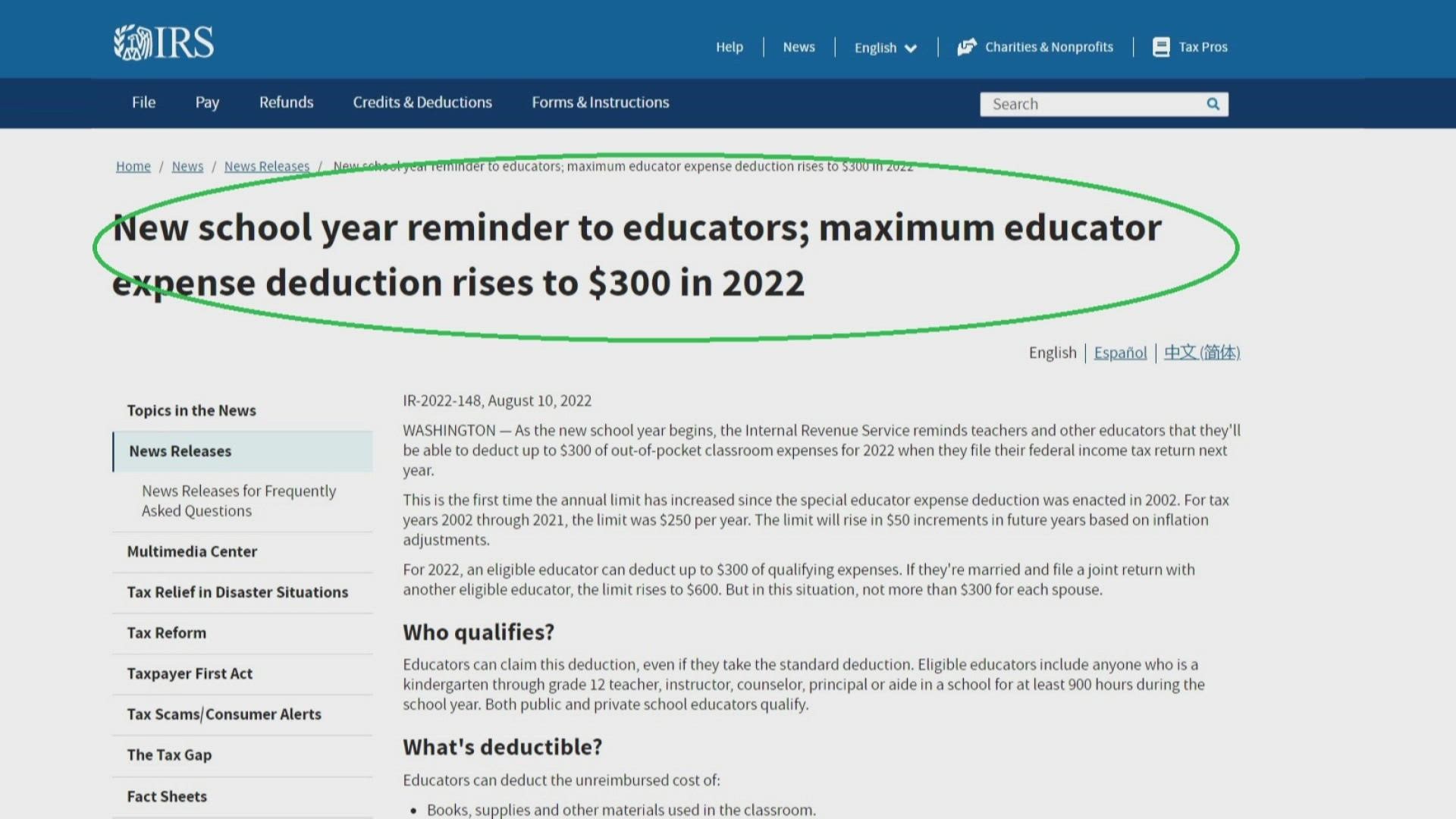

School Supplies Are Tax Deductible Wfmynews2

Tax Deductible Items For Women Entrepreneurship Fujn

Tax Deductible Donation

Are Tools Tax Deductible - Tools and equipment are generally depreciating assets that decline in value over time How you work out your deduction will depend on if the item cost 300 or less