Irs Tax Rebate Credit Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Irs Tax Rebate Credit

Irs Tax Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

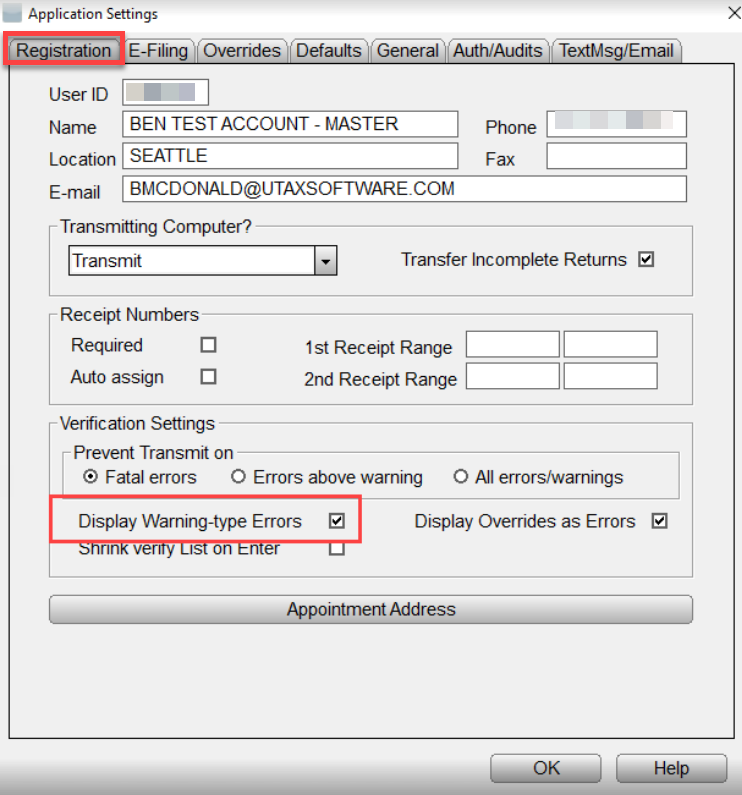

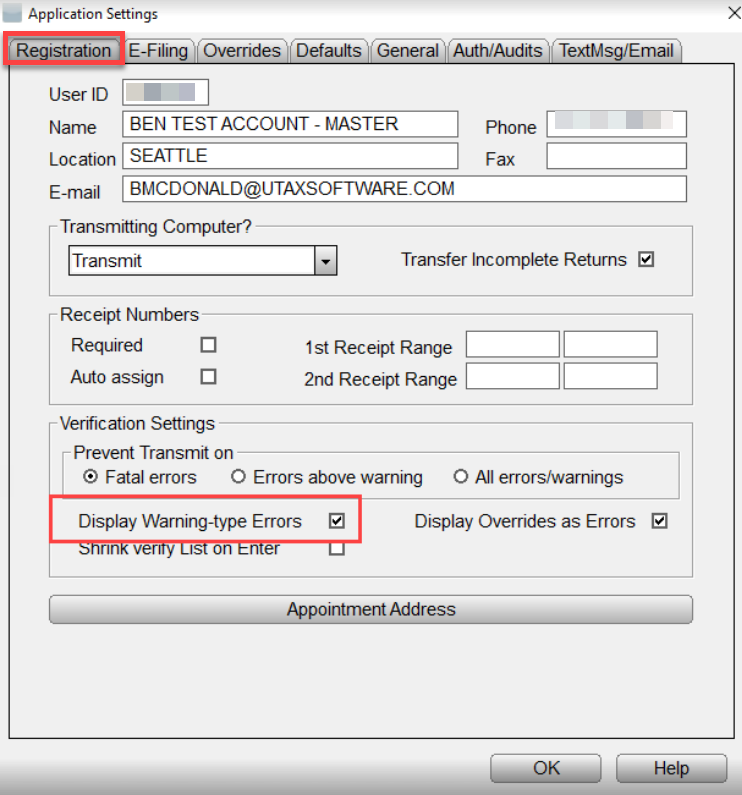

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free

Web 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax Web 15 janv 2021 nbsp 0183 32 IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Income Tax Credit EITC In 2020 the IRS

Download Irs Tax Rebate Credit

More picture related to Irs Tax Rebate Credit

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Web 17 ao 251 t 2022 nbsp 0183 32 A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 27 avr 2023 nbsp 0183 32 You qualify for the recovery rebate credit only if the IRS didn t give you a stimulus payment or if you received a partial payment How To Claim the Recovery

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

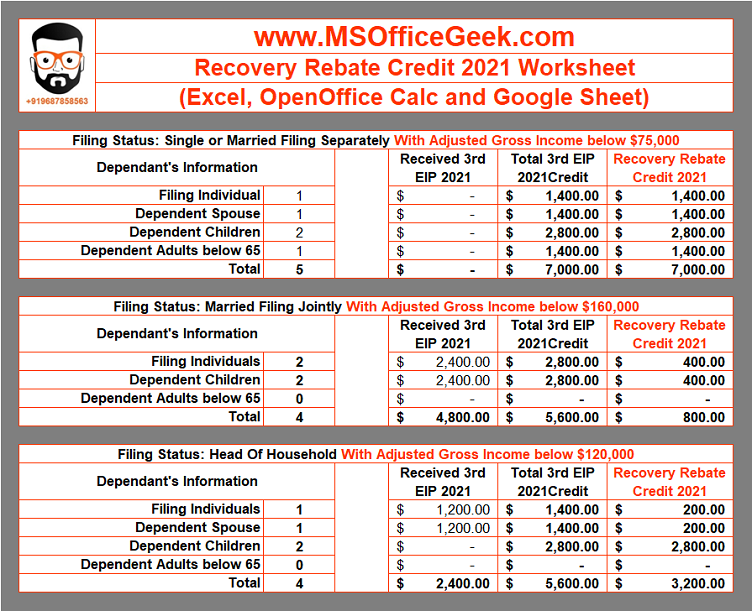

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Worksheet Example Studying Worksheets

Recovery Rebate Credit Worksheet Example Studying Worksheets

1040 Line 30 Recovery Rebate Credit Recovery Rebate

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

2022 Irs Recovery Rebate Credit Worksheet Rebate2022 Rebate2022

Irs Tax Rebate Credit - Web Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You are