Are Uniforms Tax Exempt Sometimes individual items of clothing like T shirts can be excluded as de minimis fringe benefits but that exclusion is unlikely to apply when a uniform is provided to a

A clothing allowance is tax exempt if the money provided is spent exclusively on uniforms so long as the clothing purchased meets the other requirements of the working Examples of the type of uniforms that could qualify for exemption include nurses uniforms and firefighters uniforms The value of the uniform given and the amount of the allowance paid by

Are Uniforms Tax Exempt

Are Uniforms Tax Exempt

https://images05.military.com/sites/default/files/paycheck-thumbnails/2017/01/military-uniforms-tax-deductible.jpg

Tax Deductions Exploring The Eligibility Of Military Uniforms Army

https://armyuniformchanges.com/wp-content/uploads/tax-deductions-exploring-the-eligibility-of-military-uniforms.jpg

Uniform Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/work-wear-1-650x348.jpg

Rule 2BB exempts from income tax any allowance granted to meet the expenditure incurred on the purchase or maintenance of uniform for wear during the If a uniform is not branded it becomes what is known as a fringe benefit This is because it technically can be worn outside of the workplace making it taxable This means the

Yes uniforms and necessary job specific attire can be deducted for tax purposes as long as they are required for your employment and aren t suitable for everyday use Examples include Examples of the type of uniforms that could qualify for exemption include nurses uniforms and firefighters uniforms The value of the uniform given and the amount of the allowance paid by

Download Are Uniforms Tax Exempt

More picture related to Are Uniforms Tax Exempt

Employee Uniforms Tax Deductions Plymate

https://www.plymate.com/wp-content/uploads/Plymate-Blog-Images-4-3-2048x1152.jpg

These People Will Be Exempt From Paying The RTV Subscription In 2024

https://d-art.ppstatic.pl/kadry/k/r/1/4c/ae/64e5c2277ce6a_o_original.jpg

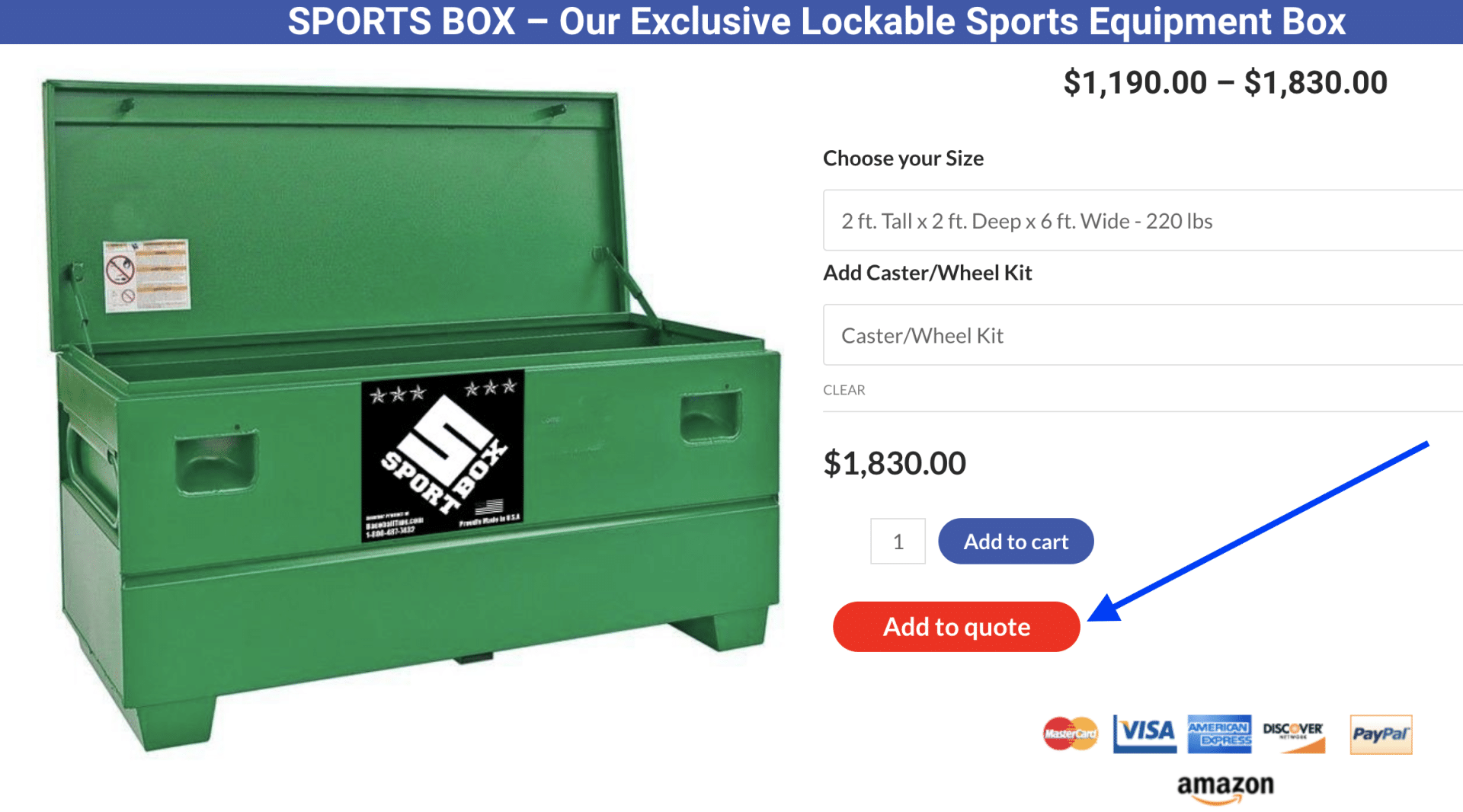

Tax Exempt Purchases Baseball Tips

https://baseballtips.com/wp-content/uploads/2023/06/Tax-Exempt-Instructions.png

A uniform allowance may be excluded from taxable income if the uniform is required as a condition of the job The uniform must also be intended solely for work and cannot have any In terms of section 8 1 a i taxpayers are required to include in their taxable income an amount which is paid or granted by their principals as an allowance or advance unless the

[desc-10] [desc-11]

Shrink Those Taxes PA Tax Exempt Form Bottom Line Tax

https://bottomline-tax.com/wp-content/uploads/2023/09/PA-Tax-Exempt-Form.png

FBT Exempt Employers

https://lirp.cdn-website.com/4e7e08ae/dms3rep/multi/opt/FBT+Exempt+Employers-1920w.png

https://tax.thomsonreuters.com › blog › is-employer...

Sometimes individual items of clothing like T shirts can be excluded as de minimis fringe benefits but that exclusion is unlikely to apply when a uniform is provided to a

https://alsco.com › resources › company-uniforms-and...

A clothing allowance is tax exempt if the money provided is spent exclusively on uniforms so long as the clothing purchased meets the other requirements of the working

:max_bytes(150000):strip_icc()/taxexemptcommercialpaper.asp-Final-67eab808ddca440ab59d7f429b8c53a8.png)

Tax Exempt Commerical Paper What It Is How It Works

Shrink Those Taxes PA Tax Exempt Form Bottom Line Tax

Tax Exempt Organizations WEXLER LAW GROUP INC

What Properties Are Exempt From The Federal Estate Tax

Is It Legal For A Tax exempt Church To Tell People How To Vote I m In

WooCommerce Tax Exempt AovUp formerly Woosuite

WooCommerce Tax Exempt AovUp formerly Woosuite

WooCommerce Tax Exempt Customer Role Based Exemption

Tax Exempt Ordering EzCater

Contact AAA Tax Service

Are Uniforms Tax Exempt - Examples of the type of uniforms that could qualify for exemption include nurses uniforms and firefighters uniforms The value of the uniform given and the amount of the allowance paid by