Income Tax Rebate And Relief Under Chapter Viii Web CHAPTER VIII REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87

Web 20 ao 251 t 2022 nbsp 0183 32 Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of Web In the Income tax Act in Chapter VIII with effect from the 1st day of April 1991 for the heading the following heading shall be substituted namely quot REBATES AND

Income Tax Rebate And Relief Under Chapter Viii

Income Tax Rebate And Relief Under Chapter Viii

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2019/12/Rebate-under-Section-87A-of-Income-Tax-Act.jpg

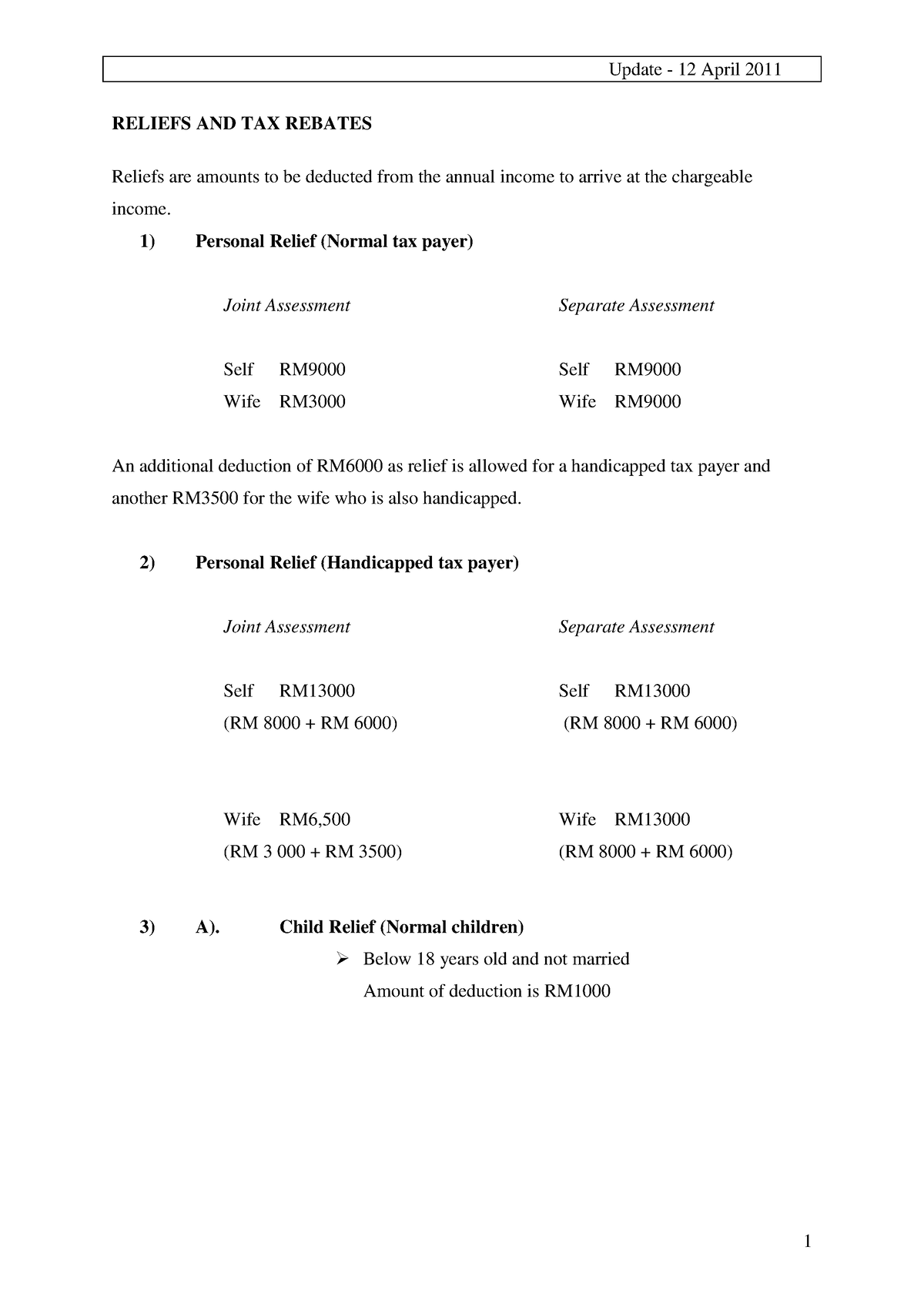

Income TAX reliefs And Rebates RELIEFS AND TAX REBATES Reliefs Are

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/282139760885f52ec10c99459eb6f12f/thumb_1200_1697.png

Web Chapter VIII REBATES AND RELIEFS Part A Rebate of income tax Section 87 Rebate to be allowed in computing income tax Section 87A Rebate of income tax in Web 5 d 233 c 2017 nbsp 0183 32 CHAPTER VIII REBATES AND RELIEFS A Rebate of income tax 87 Rebate to be allowed in computing income tax

Web Chapter VIII Sections 87 to 89 of the Income Tax Act 1961 deals with the provisions related to rebates and reliefs Section 88 of IT Act 1961 2023 provides for rebate on life Web CHAPTER VIII 39 REBATES AND RELIEFS 40 A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the

Download Income Tax Rebate And Relief Under Chapter Viii

More picture related to Income Tax Rebate And Relief Under Chapter Viii

Rebates And Reliefs Of Income Tax Law

https://taxguru.in/wp-content/uploads/2022/08/Rebates-and-Reliefs-of-Income-Tax-Law.jpg

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Web CHAPTER VIII 1 REBATES AND RELIEFS 2 A Rebate of income tax 87 Rebate to be allowed in computing income tax 1 In computing the amount of income tax on Web 3 nov 2022 nbsp 0183 32 This section comes under Chapter VIII Rebates and Reliefs of the Income Tax Act 1961 A person can claim relief under section 89 if he she receives an arrear of salary in the cases mentioned below

Web 1 mars 2018 nbsp 0183 32 Section 87A Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed Web 18 juil 2023 nbsp 0183 32 Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Union Budget 2023 No Income Tax Up To Rs 7 Lakh Under New Tax Regime

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=3219443401609601&get_thumbnail=1

https://taxmacs.com/.../2018/05/8.-Chapter-VIII-Rebates-an…

Web CHAPTER VIII REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87

https://taxguru.in/income-tax/rebates-reliefs-income-tax-law.html

Web 20 ao 251 t 2022 nbsp 0183 32 Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of

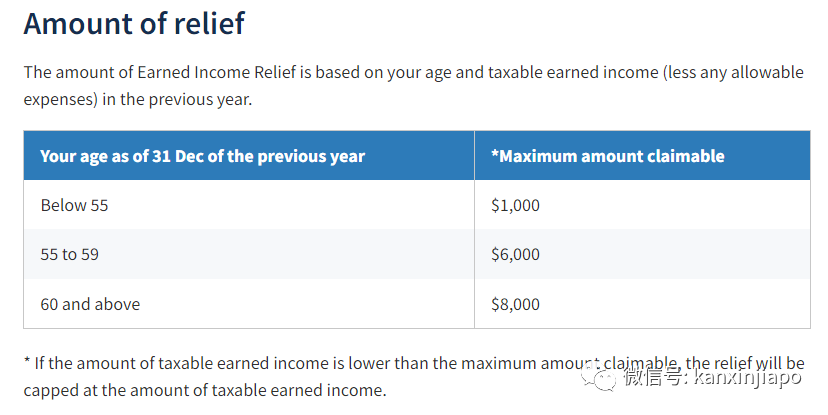

Understanding Tax Reliefs Loanstreet

Georgia Income Tax Rebate 2023 Printable Rebate Form

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

Budget 2023 Five Income Tax Reliefs Announced By Nirmala Sitharaman

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Income Tax Rebate And Relief Under Chapter Viii - Web Chapter VIII REBATES AND RELIEFS Part A Rebate of income tax Section 87 Rebate to be allowed in computing income tax Section 87A Rebate of income tax in