Are Utility Rebates Taxable Income In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject

Taxation of utility rebates matters to the property owner because the tax on the payment functionally reduces the rebate amount Thus a taxable rebate payment will not cover Treasury IRS issue guidance on the tax treatment of amounts paid as rebates for energy efficient property and improvements IR 2024 97 April 5 2024

Are Utility Rebates Taxable Income

Are Utility Rebates Taxable Income

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

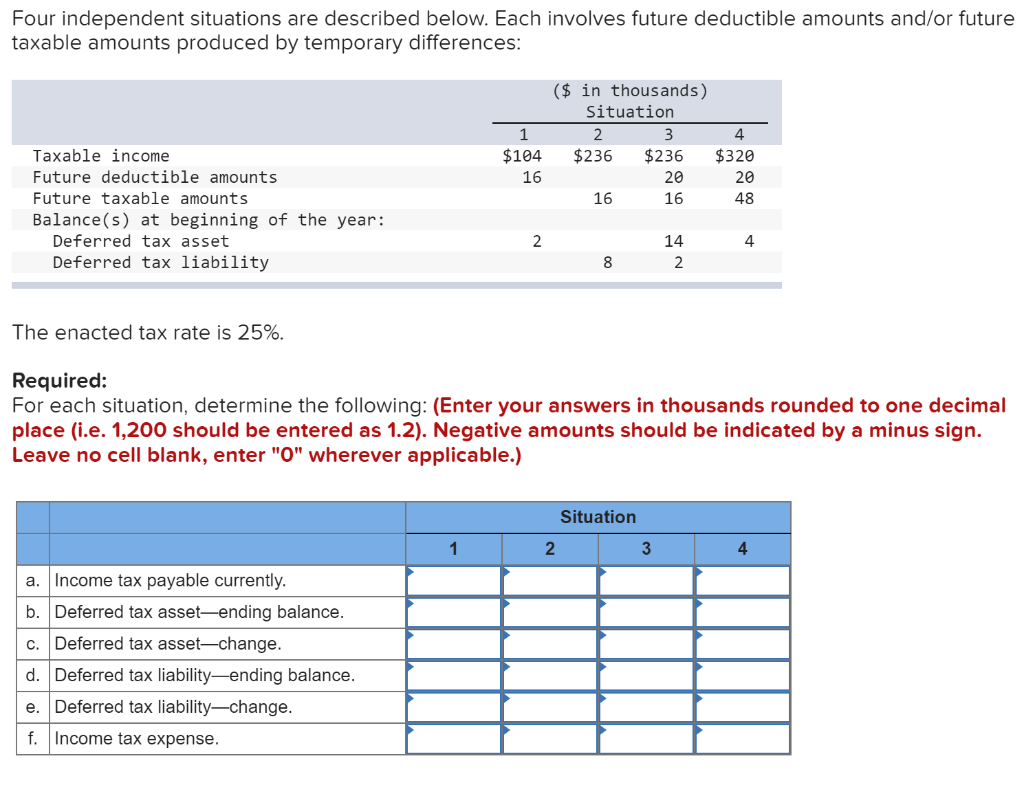

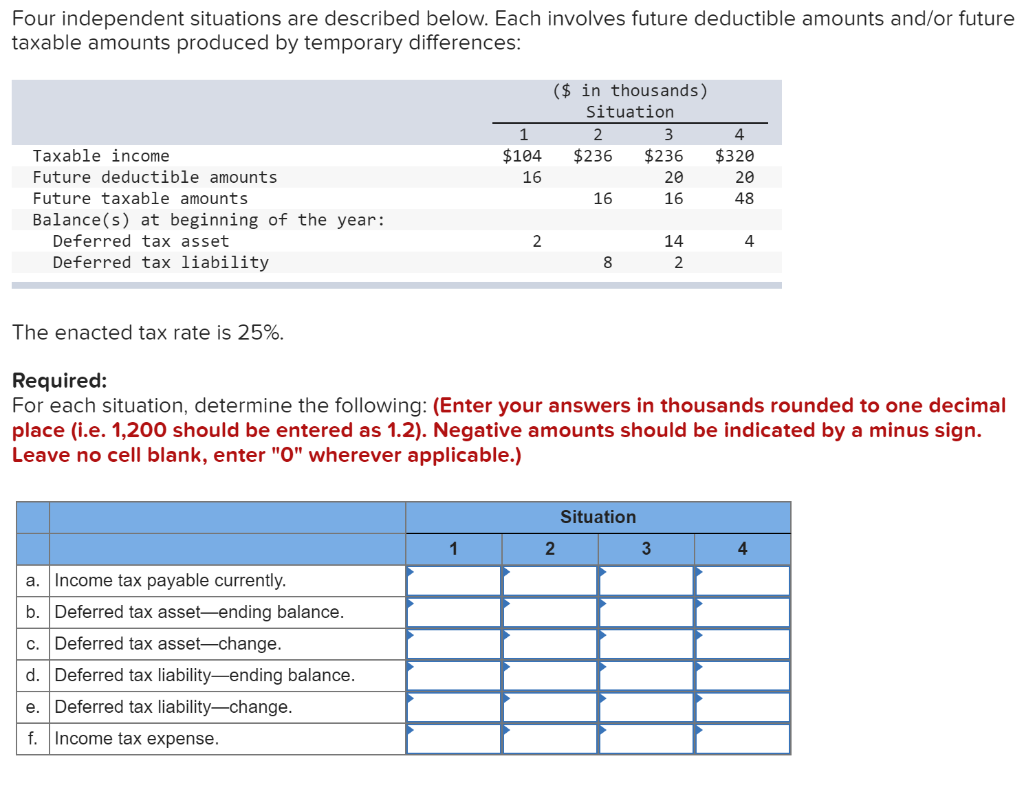

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Employee Gifts Are They Taxable Income Tax Deductible For The Company

https://www.gannett-cdn.com/-mm-/53ed1c02a484aa0c0dd5755eb74649939ad78bce/c=0-296-1077-905/local/-/media/2017/11/30/TennGroup/Nashville/636476613769144276-1212-LBMC.jpg?width=3200&height=1680&fit=crop

But a major issue remains unsettled whether a rebate is a sales price adjustment reducing gross income exclusion or a deduction from gross income This would be a distinction Language in the Build Back Better Act clarifies that these rebates are not taxable income but rather an effort to defray up front consumer costs for a public

Thus gross income generally includes rebates Federal law does provide some exceptions For example IRC Sec 136 exempts energy conservation subsidies Taxpayers who receive rebates as the Inflation Reduction Act describes performance based incentives and electrification product subsidies for the purchase of

Download Are Utility Rebates Taxable Income

More picture related to Are Utility Rebates Taxable Income

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

https://www.taxwarehouse.com.au/wp-content/uploads/money-1673582_1280.png

Tax Reductions Rebates And Credits

https://sb.studylib.net/store/data/008702919_1-5fc3b4877f75d05a02ea5cfa273ba161-768x994.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

Federal tax law does not include water conservation rebates with energy rebates Although there has been extensive lobbying by utilities to change that law at the present time it Rebates for other purposes such as car sales are generally not considered to be income Nevertheless the IRS does not have a specific policy regarding water efficiency rebates and therefore some utilities

April 8 2024 Rebates paid at the time of sale under two home energy rebate programs created in the Inflation Reduction Act are not includible in individual purchasers gross Announcement 2024 19 says amounts received from the Department of Energy home energy rebate programs won t be taxed as income and instead will be

Write Off An Employee s Loan Tax Tips Galley And Tindle

https://galleyandtindle.co.uk/wp-content/uploads/2020/06/employee-loans.jpg

Taxable Payments Annual Report Bosco Chartered Accountants

https://bosco.accountants/wp-content/uploads/2019/06/1660x1105-subcontractors.jpg

https://www.irs.gov/publications/p525

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject

https://tapin.waternow.org/resources/taxability-of...

Taxation of utility rebates matters to the property owner because the tax on the payment functionally reduces the rebate amount Thus a taxable rebate payment will not cover

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

Write Off An Employee s Loan Tax Tips Galley And Tindle

Lowering Personal Income Tax PIT Government PH

Savings Rebates Application BWFL

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

How To Calculate Accounts Payable Formula Modeladvisor

How To Calculate Accounts Payable Formula Modeladvisor

Taxable Vs Non taxable Benefits What You Should Know About Them Talk

How To Reduce Your Taxable Income 2023

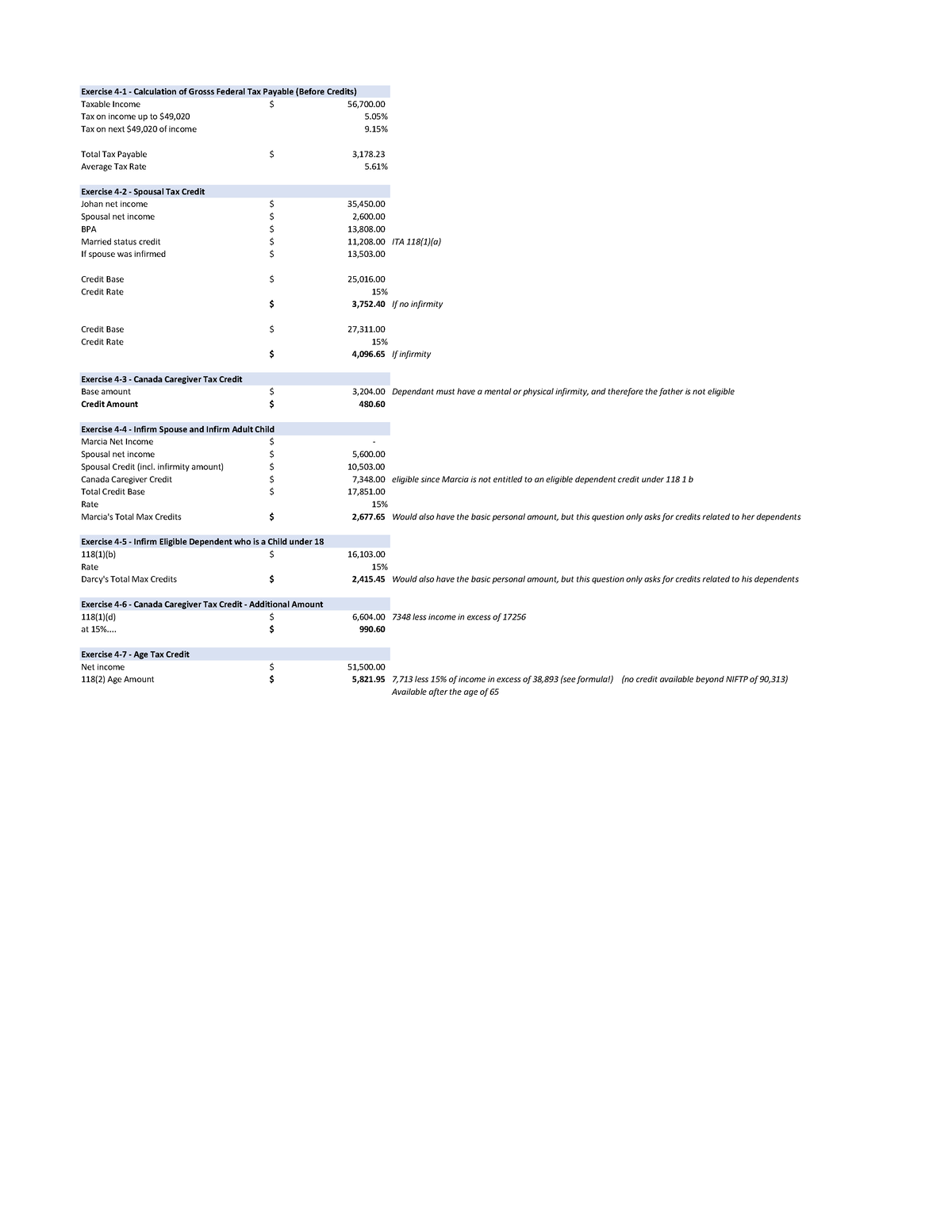

Chapter 4 Exercise Answers Taxable Income And Tax Payable For An

Are Utility Rebates Taxable Income - Taxpayers who receive rebates as the Inflation Reduction Act describes performance based incentives and electrification product subsidies for the purchase of