Are Veterans Benefits Taxable Unfortunately veterans benefits do not qualify as earned income for the Earned Income Tax Credit EITC Therefore if the only income you receive would be classified as veterans benefits you would not have any earned income to qualify you for the EITC

Payments received under any GI Bill program are tax free for veterans or any dependents or survivors who may receive the benefits These include payments for tuition training testing for Bottom Line Up Front You must pay taxes on some benefits you receive as a veteran Pay from a military pension is fully taxable so you must claim it on your income taxes Other benefits like disability or education payments are not taxable

Are Veterans Benefits Taxable

Are Veterans Benefits Taxable

https://cck-law.com/wp-content/uploads/2019/07/are-veterans-va-disability-benefits-taxable.jpg

Filing For Veterans Benefits Steps To Take

https://www.mesotheliomavets.com/app/uploads/2022/05/VA-Infographics-03.jpg

Free North Carolina Veterans Month Events

https://content.govdelivery.com/attachments/fancy_images/USVA/2022/11/6662597/veteransdayeventsobservances_original.gif

We work with community and government partners to provide timely federal tax related information to Veterans about tax credits and benefits free tax preparation financial education and asset building opportunities available to Veterans An increase in the veteran s percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or the combat disabled veteran applying for and being granted Combat Related Special Compensation after an award for Concurrent Retirement and Disability

According to IRS Publication 907 veterans disability benefits are not taxable As stated in IRS publications veterans should not include in their income any veterans benefits paid under any law regulation or administrative practice administered by the Department of Veterans Affairs VA Education and training benefits received by veterans and their children are not taxable and do not need to be declared on a tax return Veterans may be eligible for the Earned Income Tax Credit EITC if they have earned income Who qualifies

Download Are Veterans Benefits Taxable

More picture related to Are Veterans Benefits Taxable

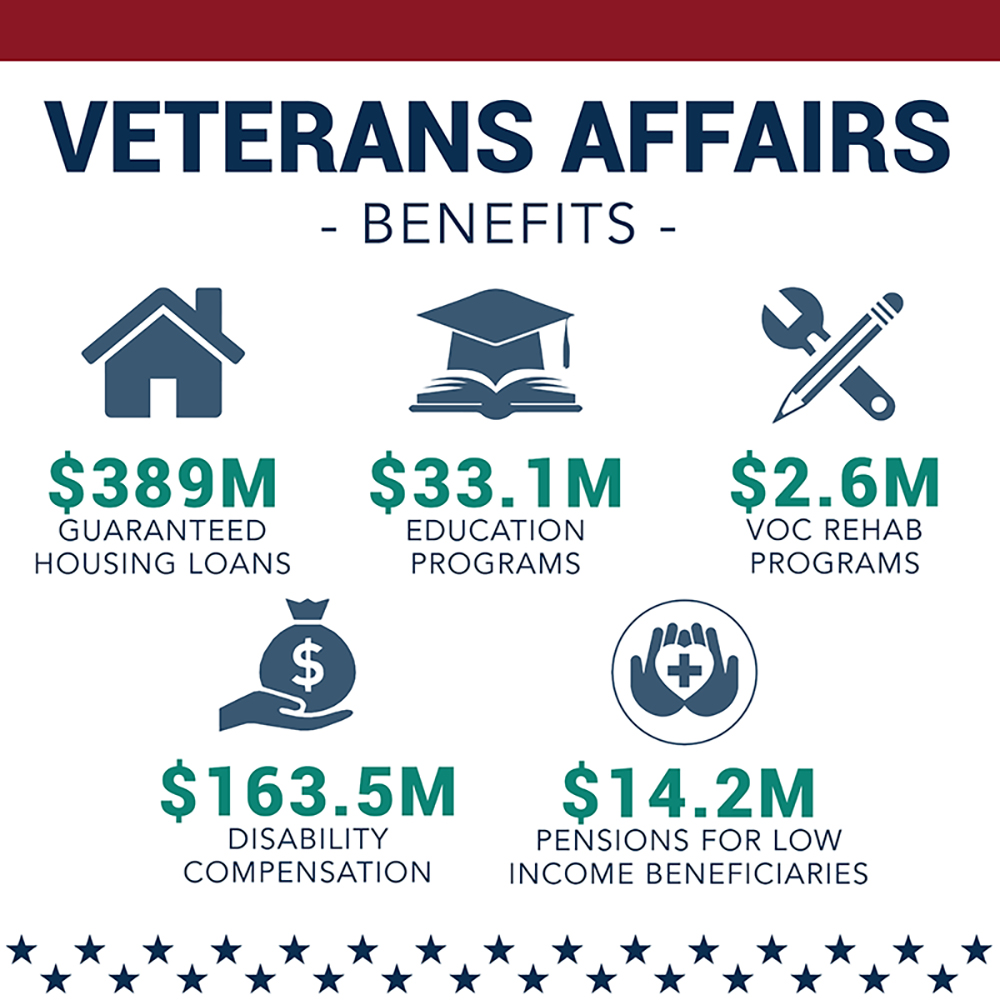

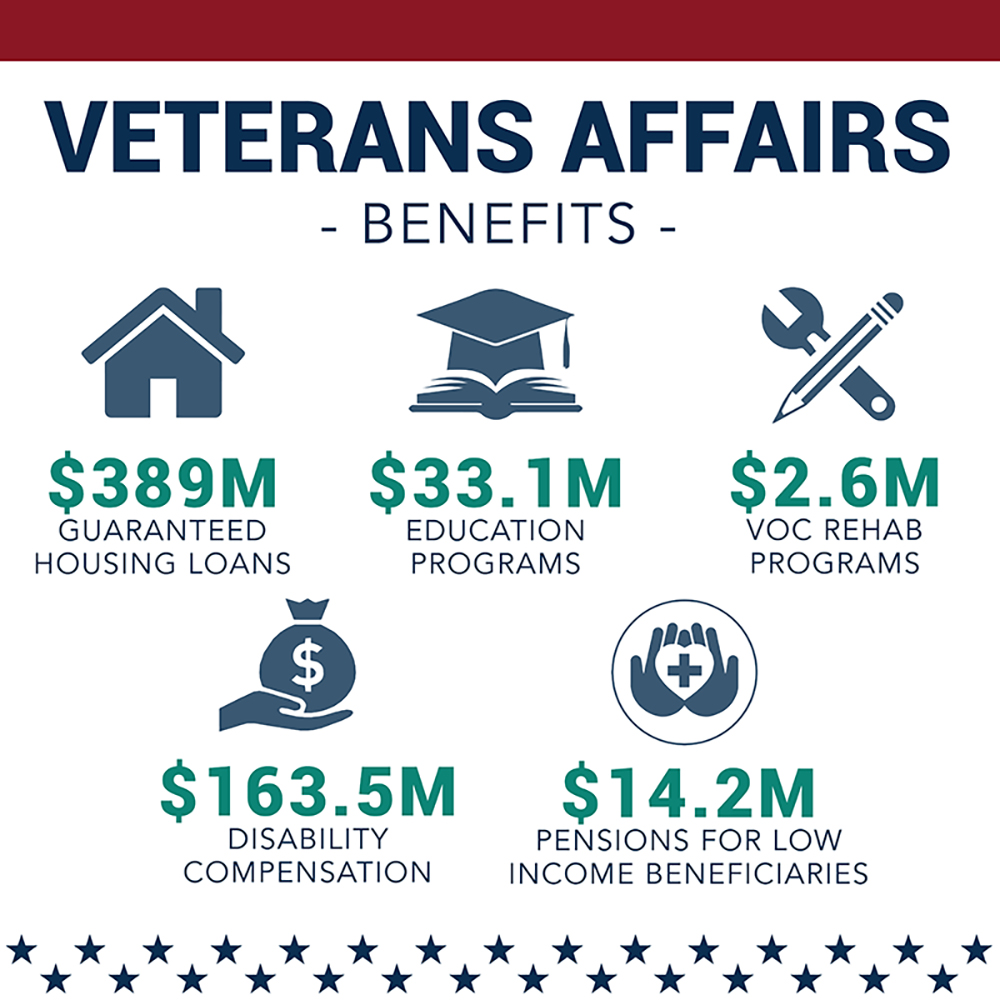

Are Veterans Affairs Benefits Taxable

https://vaclaimsinsider.com/wp-content/uploads/2023/10/Are-Veterans-Affairs-Benefits-Taxable-2048x1536.jpg

Are Veterans Benefits Taxable YouTube

https://i.ytimg.com/vi/doqnrmpI6FY/maxresdefault.jpg

Va Smc T Pay Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

September 3 2021 The U S veterans are owed a debt of gratitude by their country that can never be repaid Fortunately the IRS has a system in place that can go some way to helping veterans readjust to civilian life This is especially true if they have become disabled during or after their service As a Veteran you may be eligible for certain tax benefits under the tax code This year s filing deadline is April 18 Here s what you need to know

If you serve or served in the military and are receiving Department of Veterans Affairs VA education benefits the IRS excludes this income from taxation Publication 970 Tax Benefits for Education the authoritative source for all education tax matters covers this tax exclusion Veterans benefits are also excluded from federal taxable income The following amounts paid to veterans or their families are not taxable Education training and subsistence allowances

Get Your Government Benefits Up To 4 Days Early NexsCard

https://nexscard.com/Nexscard/img/veterans_affairs.png

Do Veterans Benefits And Military Retirement Pay Count As Income

https://www.navymutual.org/wp-content/uploads/2023/03/VA-Benefits-Taxable-scaled.jpg

https://www.hrblock.com/tax-center/lifestyle/...

Unfortunately veterans benefits do not qualify as earned income for the Earned Income Tax Credit EITC Therefore if the only income you receive would be classified as veterans benefits you would not have any earned income to qualify you for the EITC

https://www.military.com/money/personal-finance/...

Payments received under any GI Bill program are tax free for veterans or any dependents or survivors who may receive the benefits These include payments for tuition training testing for

Are Veterans Disability Benefits Taxable

Get Your Government Benefits Up To 4 Days Early NexsCard

Are Veterans VA Disability Benefits Taxable CCK Law

5 Va Disability Compensation Rates 2023 Article 2023 CGM

How To Register For Military Veterans Benefits In South Africa Beauty

Department Of Veterans Affairs Logo

Department Of Veterans Affairs Logo

The Ultimate Veterans Benefits Guide Free Download 2022 Edition

Long Term Care Benefits For Veterans And Surviving Spouses

Honoring Veterans Millersville News

Are Veterans Benefits Taxable - We work with community and government partners to provide timely federal tax related information to Veterans about tax credits and benefits free tax preparation financial education and asset building opportunities available to Veterans