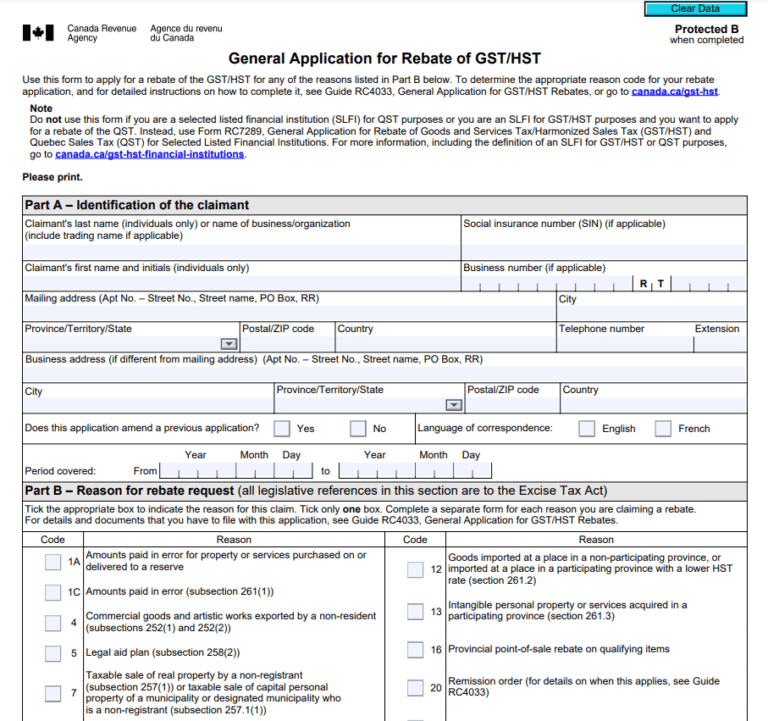

Are You Eligible To Claim The Gst Hst Rebate Do you qualify for the rebate As an employee you may qualify for a GST HST rebate if all of the following conditions apply You paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return Your employer is

Eligibility You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the same period you have or had a spouse or common law partner If you deduct the GST HST you paid on these expenses you might be eligible to claim a GST HST rebate Eligible Expenses You must have paid the GST or HST on your expenses and included them on your tax return before you can claim the rebate

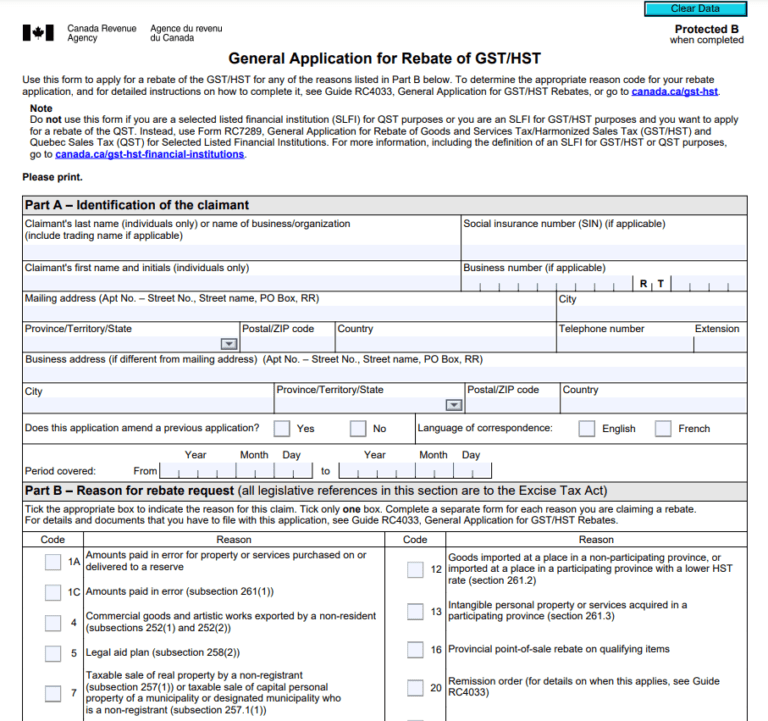

Are You Eligible To Claim The Gst Hst Rebate

Are You Eligible To Claim The Gst Hst Rebate

https://printablerebateform.net/wp-content/uploads/2022/10/How-To-Fill-Out-HST-Rebate-Form-768x721.png

Did You Know You Can Claim The GST HST Rebate On Your Expenses 2023

https://academia.guide/805a1e58/https/52b387/turbotax.intuit.ca/tips/images/Untitled-design-40.jpg

Top 5 Questions About The GST HST Housing Rebate

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

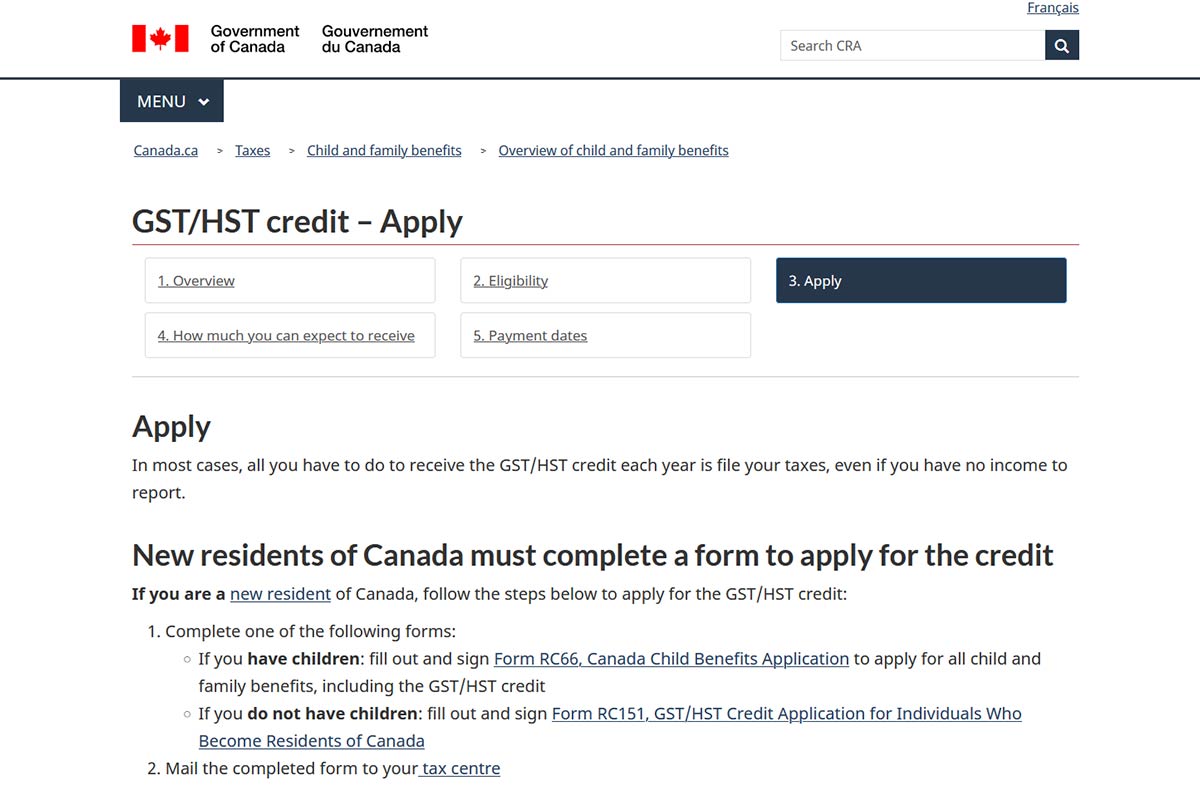

Thanks to the GST HST credit low earning taxpayers can get back a portion or all of the federal sales tax they pay Here s everything you need to know about the credit how it works who is eligible and how much you could be entitled to You can also find the different provincial and territorial benefits you could collect as well Tax rebate Canadians with low to modest incomes to receive payment Canadian 20 and 50 bills are shown in a display case at the Bank of Canada Museum in Ottawa on Wednesday Sept 4 2024

If no GST or HST was paid for the expense it is not eligible for a GST HST rebate The employee and partner GST HST rebate is taxable income and must be included in income on line 10400 line 104 prior to 2019 of your tax return for the year it is received To qualify for the GST HST credit your adjusted net family income must be below a certain threshold which for the 2023 tax year ranges from 54 704 to 72 244 depending on your marital

Download Are You Eligible To Claim The Gst Hst Rebate

More picture related to Are You Eligible To Claim The Gst Hst Rebate

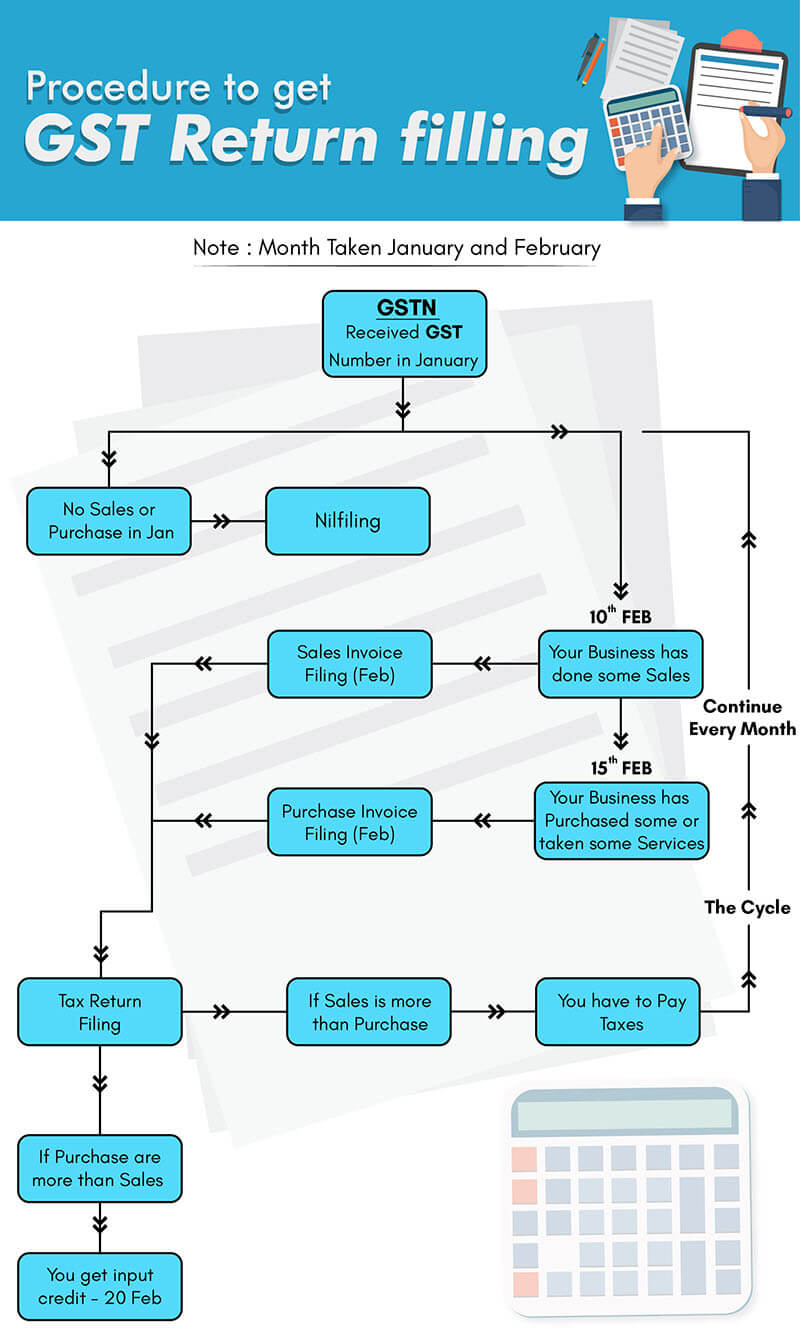

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

Who Can Claim GST HST Rebate Sproule Associates

https://my-rebate.ca/wp-content/uploads/2022/10/gst-768x512.jpg

Am I eligible for the Canada GST HST refund You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and the month in which the CRA makes a payment The GST HST credit is a quarterly payment for individuals and families with low to modest incomes meant to help offset the goods and services tax harmonized sales tax GST HST they pay In

[desc-10] [desc-11]

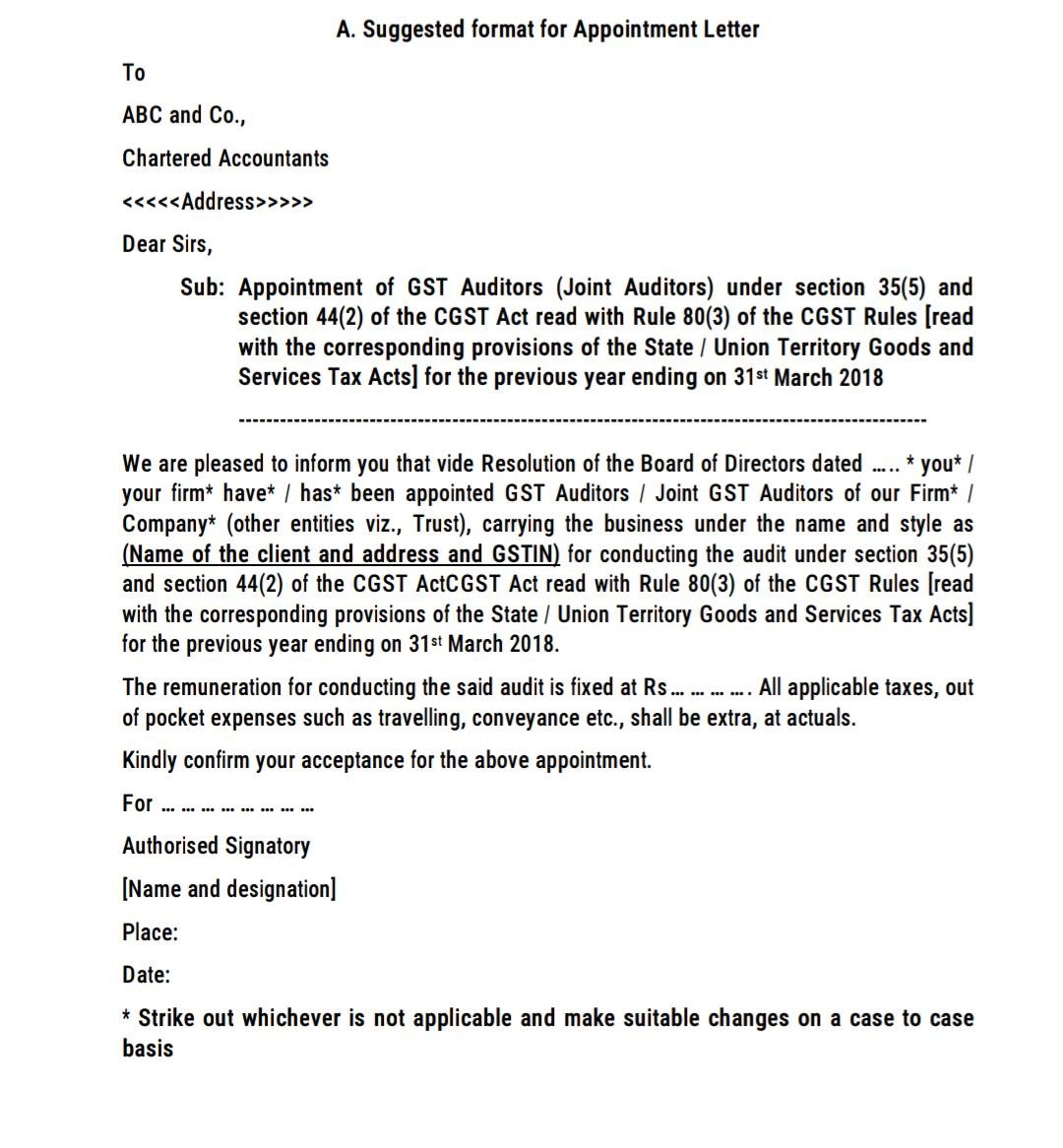

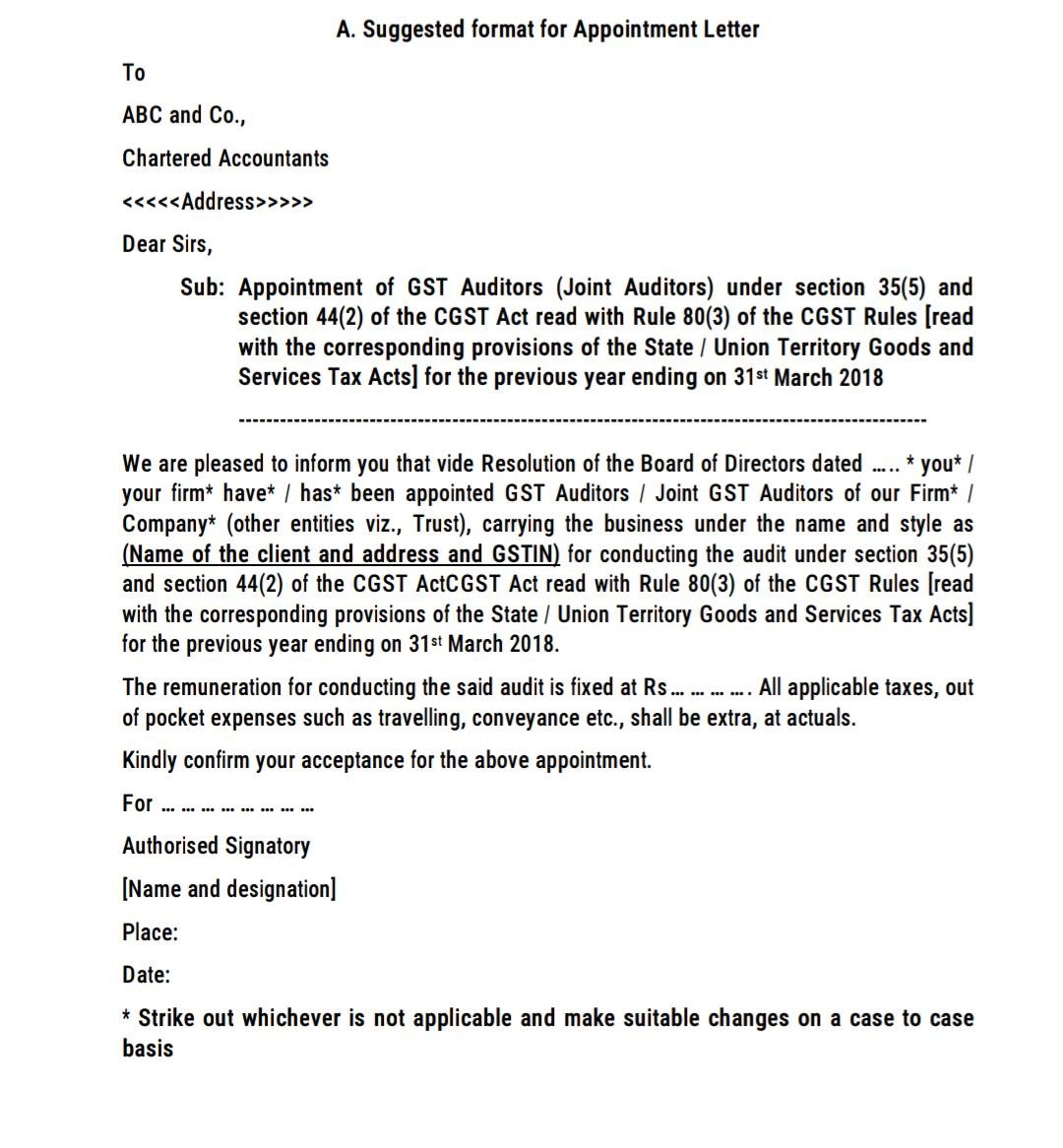

GST Auditor Appointment Letter Format

https://thetaxtalk.com/wp-content/uploads/2018/12/IMG-20181208-WA0102-2.jpg

Who Is Eligible For HST New Home Rebate PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

https://www.canada.ca › ... › employee-gst-hst-rebate.html

Do you qualify for the rebate As an employee you may qualify for a GST HST rebate if all of the following conditions apply You paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return Your employer is

https://www.canada.ca › en › revenue-agency › services › child-family...

Eligibility You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the same period you have or had a spouse or common law partner

GST HST Public Service Bodies Rebate

GST Auditor Appointment Letter Format

GST Refund Form Rfd 01 Printable Rebate Form

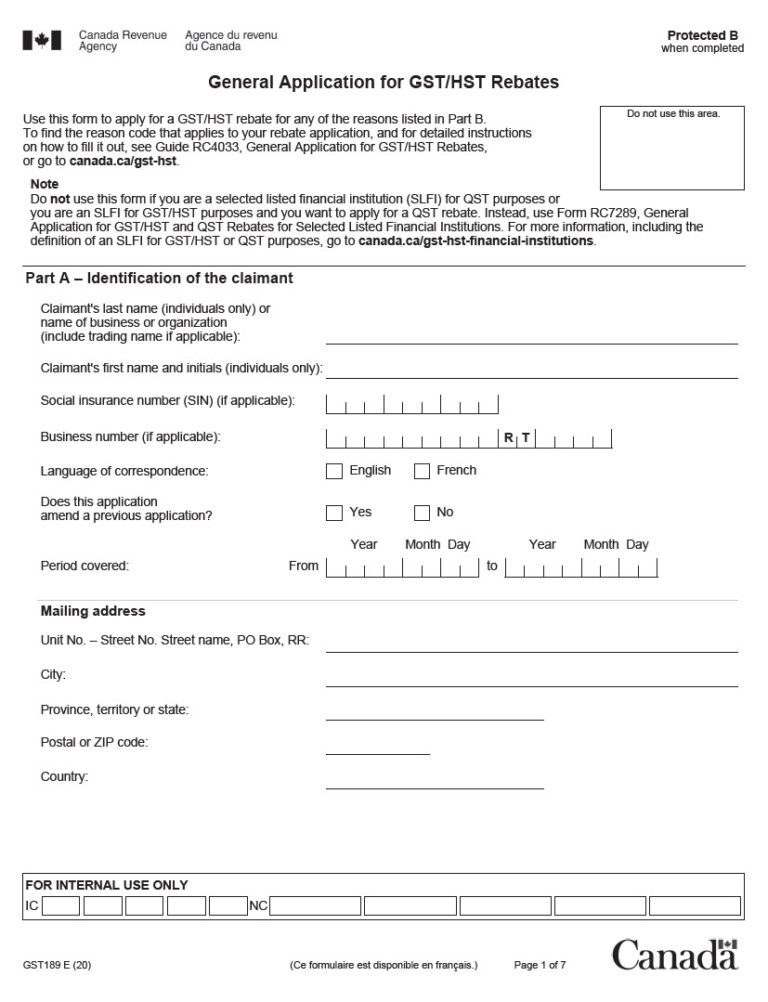

Fillable Online New Housing GST HST Rebate Application Form GST 190 Fax

GST HST Rebate For Owner Built Homes Sproule Associates

Am I Eligible For A GST HST Rebate

Am I Eligible For A GST HST Rebate

What Are My Options For GST HST Prior To Registration With The Canada

How To Complete A Canadian GST Return with Pictures WikiHow

GST In Malaysia Explained

Are You Eligible To Claim The Gst Hst Rebate - [desc-13]