Are You Required To Pay Taxes On Disability Income Under the tax code most payments to compensate you for being injured including most legal settlements may be taxable or not depending on your injuries If you have non physical

When you re on disability the requirement to file taxes depends on the nature and amount of your income If you receive Social Security Disability Insurance SSDI benefits they might be taxable if you have additional substantial income Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable The portion of benefits that are taxable depends on the taxpayer s income and filing status

Are You Required To Pay Taxes On Disability Income

![]()

Are You Required To Pay Taxes On Disability Income

https://www.longtermdisabilitylawyer.com/wp-content/uploads/2016/08/rawpixel-com-586673-unsplash.jpg

Do I Need To Pay Taxes The Minimum Income To File Taxes

https://www.taxslayer.com/blog/wp-content/uploads/2018/09/do-i-make-enough-to-pay-taxes-e1605639489394-2048x1154.jpg

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=3200&height=1680&fit=crop

Key Takeaways Social Security Disability Insurance SSDI benefits may be taxable if you receive income from other sources such as dividends or tax exempt interest or if your spouse earns income Do I have to pay taxes on my social security benefits Answer Social security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income SSI payments which aren t taxable

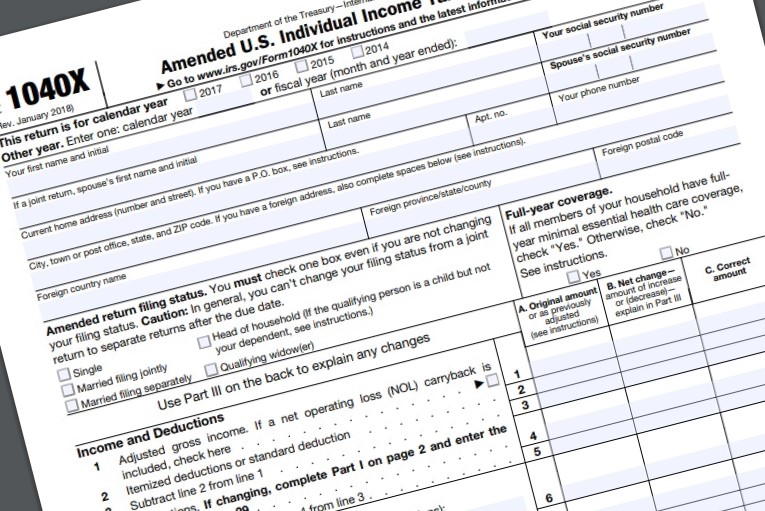

Disability benefits may or may not be taxable You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars This includes A policy you bought yourself with after tax dollars A employer sponsored policy you contributed to If you retired on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040 SR until you reach minimum retirement age

Download Are You Required To Pay Taxes On Disability Income

More picture related to Are You Required To Pay Taxes On Disability Income

Is Disability Retirement Income Taxable

https://www.realized1031.com/hs-fs/hubfs/is disability retirement income taxable%3F-924084404.jpg?width=750&height=392&name=is disability retirement income taxable%3F-924084404.jpg

Is Social Security Disability Income Taxable TurboTax Tax Tips Videos

https://digitalasset.intuit.com/content/dam/intuit/cg/en_us/turbotax/tax-tips/images/general/is_social_security_disability_taxable.jpg

Does Everyone Have To File Their Income Tax Returns

https://digitalasset.intuit.com/IMAGE/A7WNPg8Cw/1does-everyone-need-to-file-an-income-tax-return_L7pluHkoW.jpg

Is short term disability taxable The answer depends on who pays for premiums and the plan s structure Learn more about when you ll owe tax on benefits Social Security disability benefits SSDI can be subject to tax but most disability recipients don t end up paying taxes on them because they don t have much other income About a third of Social Security disability recipients however do pay some taxes usually because of their spouse s income or other household income

Virtually no one receiving supplemental security income SSI has to pay federal taxes on their benefits However that s not the case for people who receive disability insurance benefits DIB also known as Social Security disability insurance SSDI The portion of SSDI benefits that you ll have to pay taxes on depends on how much other income you have If you file your taxes as an individual and your income is more than 25 000 per year but less than 34 000 you would have to pay taxes on up to half the value of your Social Security benefits

What If Everyone In USA Stopped Paying Taxes YouTube

https://i.ytimg.com/vi/N_5lcdpaKeY/maxresdefault.jpg

Top 1 Pay Nearly Half Of Federal Income Taxes

https://image.cnbcfm.com/api/v1/image/102558054-538528619.jpg?v=1532564324

https://www.forbes.com › sites › robertwood › ...

Under the tax code most payments to compensate you for being injured including most legal settlements may be taxable or not depending on your injuries If you have non physical

https://www.financestrategists.com › tax › how-to-file...

When you re on disability the requirement to file taxes depends on the nature and amount of your income If you receive Social Security Disability Insurance SSDI benefits they might be taxable if you have additional substantial income

Do I Have To Pay Taxes On My Checking Account Millennial Money

What If Everyone In USA Stopped Paying Taxes YouTube

Eligible Veterans Can Seek Refund For Taxes On Disability Severance

Can Debt Collectors Take Your Disability Income Wtsp

Filing Taxes On Disability Income SSDI George Sink

Law On Paying Taxes Declan Khan

Law On Paying Taxes Declan Khan

Do You Pay Taxes On Disability Payments The Classroom Synonym

2023 Va Disability Pay Chart Get Latest 2023 News Update

Long Term Disability Taxable Vs Nontaxable RespectCareGivers

Are You Required To Pay Taxes On Disability Income - Do I have to pay taxes on my social security benefits Answer Social security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income SSI payments which aren t taxable