Are You Taxed On Your Hsa Contributions This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on

You can make contributions to your employees HSAs You deduct the contributions on your business income tax return for the year in which you make the contributions If the contribution Interest earned by HSAs is not taxable There s no use it or lose it rule like with an FSA If you don t use all the money in the year it rolls over from year to year and continues earning interest

Are You Taxed On Your Hsa Contributions

Are You Taxed On Your Hsa Contributions

https://www.madisontrust.com/wp-content/uploads/2023/02/most-taxed-state-5_thumb.jpg

What Parts Of Your Federal Retirement Income Are You Taxed On YouTube

https://i.ytimg.com/vi/0yAPn8-TjVE/maxresdefault.jpg

Are You Taxed On The Profit From Selling A House YouTube

https://i.ytimg.com/vi/4qOG74BAjI8/maxresdefault.jpg

So how is this money taxed or not taxed Here s how this works Your HSA contributions are tax deductible For example if you earn 60 000 for the year and contribute 3 000 to an HSA Money contributed to your HSA is deducted from your taxable income reducing your overall tax liability by lowering your taxable income and potentially moving you into a lower tax bracket NOTE California and New

All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions can Tax Benefits Employer contributions are not taxed nor are contributions you make through a Section 125 arrangement Watch Out for Exceptions In rare cases where your employer

Download Are You Taxed On Your Hsa Contributions

More picture related to Are You Taxed On Your Hsa Contributions

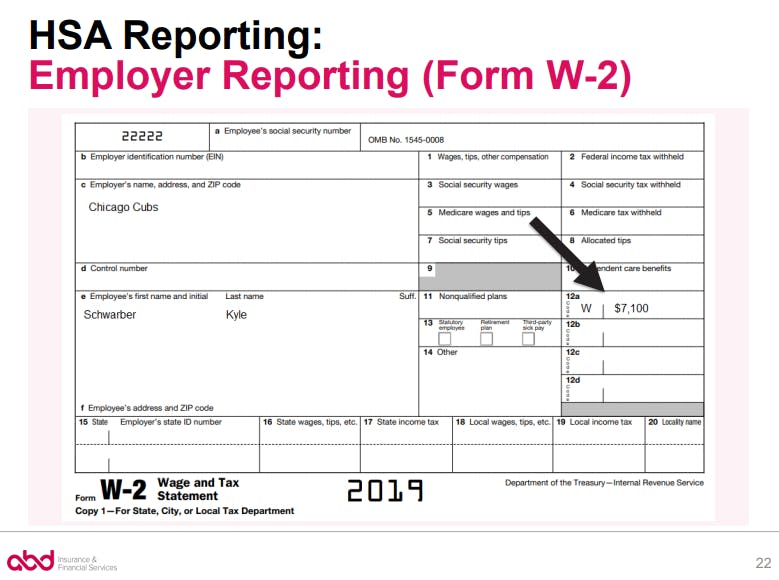

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

Are You Taxed On Your Real Estate Capital Gains Delano News

https://assets.paperjam.lu/images/articles/are-you-taxed-on-your-real-est/0.5/0.5/600/400/484249.png

How Much Can You Contribute To An Hsa In 2022 2022 CGR

https://i2.wp.com/hrworkplaceservices.com/wp-content/uploads/2021/05/HRWS.2022-Limits-for-HSAs.Chart-A3.jpg

Contributions from your employer are not considered as part of your income and are not taxed However employer contributions are listed on your W 2 form in Box 12 and Contributions to a health savings account HSA can be made by or on behalf of for example by a family member any eligible individual and are deductible by the eligible

In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040 Additionally Are HSA contributions tax deductible Yes you ll receive a tax deduction on Schedule 1 Part II Line 13 which then flows into Form 1040 line 10 as an adjustment to your

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

Can Income Tax Expense Be Negative

https://www.simpletaxcalculator.com/img/fd69790d08f2c2fb8279f8620535ffa4.jpg?13

https://www.fidelity.com › ... › hsa-tax-form

This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on

https://www.irs.gov › publications

You can make contributions to your employees HSAs You deduct the contributions on your business income tax return for the year in which you make the contributions If the contribution

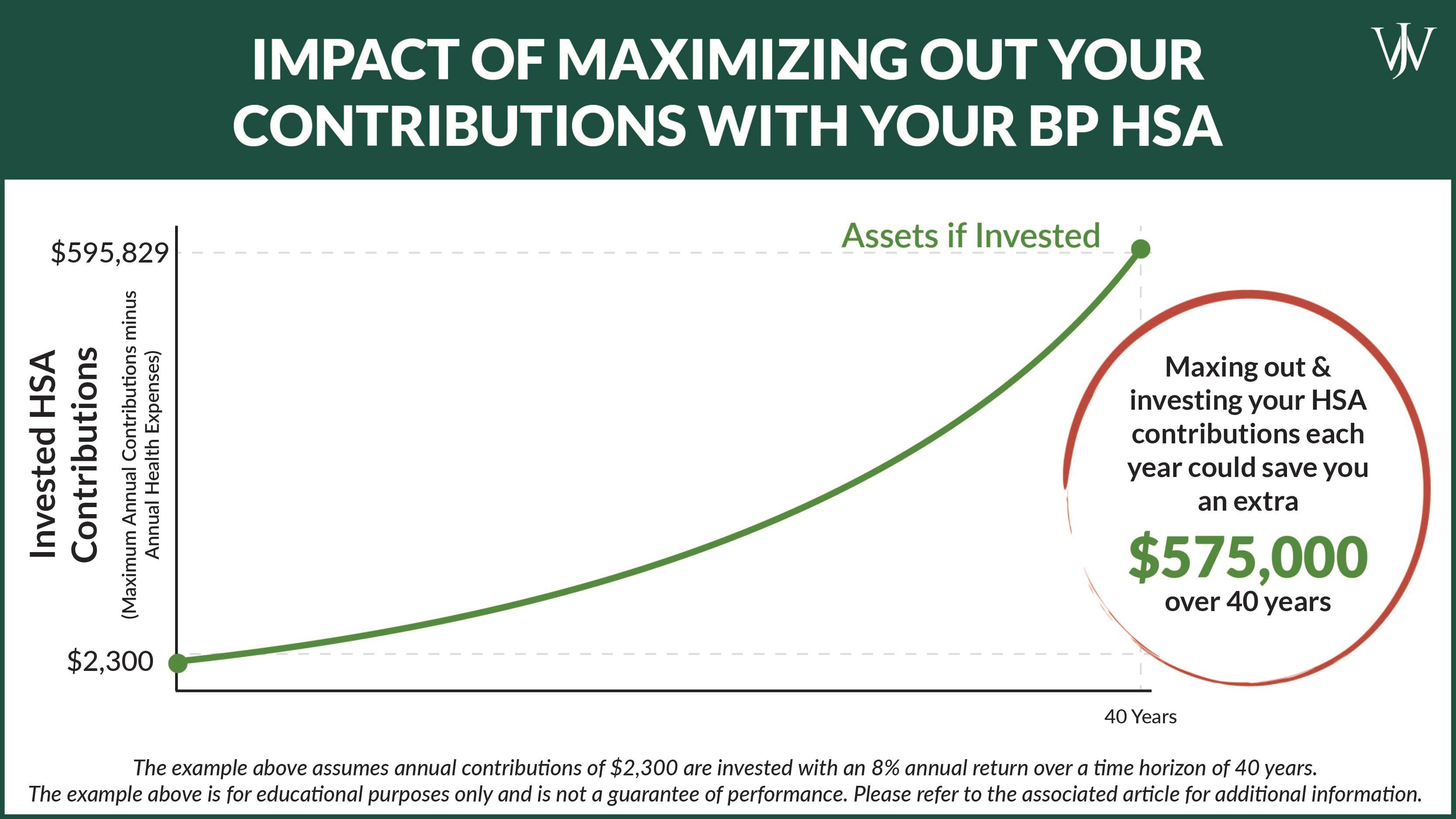

BP HSA Tax Benefits Investment Strategies To Consider In Open Enrollment

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

What Is Total Income In Income Tax Return

What Income Are You Taxed On A Comprehensive Guide

Are You Taxed On Plasma Donations Uncovering The Facts

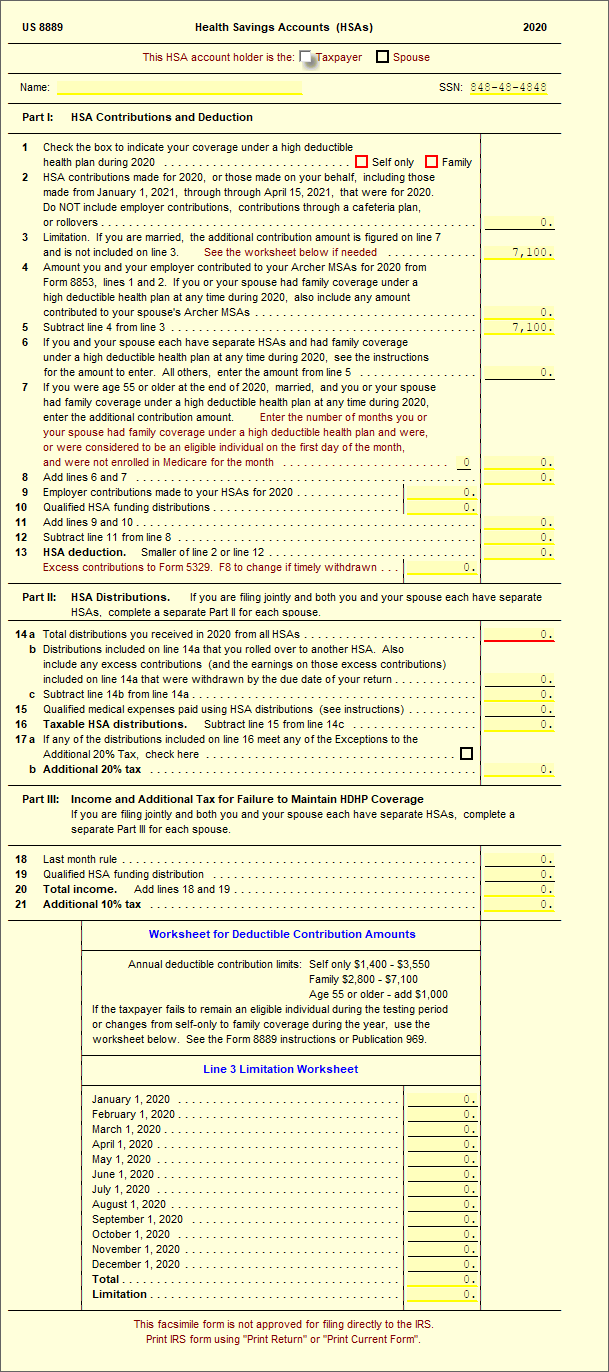

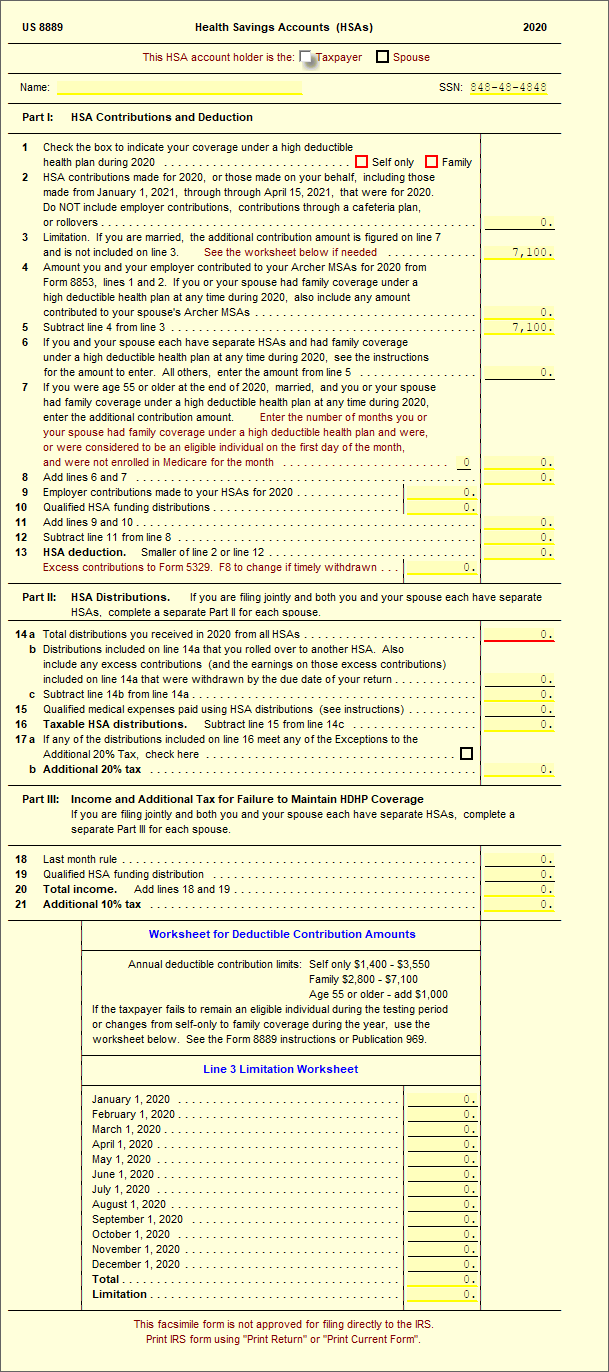

8889 Health Savings Accounts HSAs UltimateTax Solution Center

8889 Health Savings Accounts HSAs UltimateTax Solution Center

How To Calculate Itr Tax

HSA Contributions How To Find Them On Your W 2 Form

Are You Taxed On Money Paid As Child Support

Are You Taxed On Your Hsa Contributions - Purpose IRS Form 8889 is used to report HSA contributions deductions distributions and to calculate any tax penalties When to Use File Form 8889 with your annual tax return if you