Married Person Tax Rebate Web 8 juin 2023 nbsp 0183 32 Verified 08 June 2023 Legal and Administrative Information Directorate Prime Minister Are you married or past Your couple is subject to common taxation

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If

Married Person Tax Rebate

Married Person Tax Rebate

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

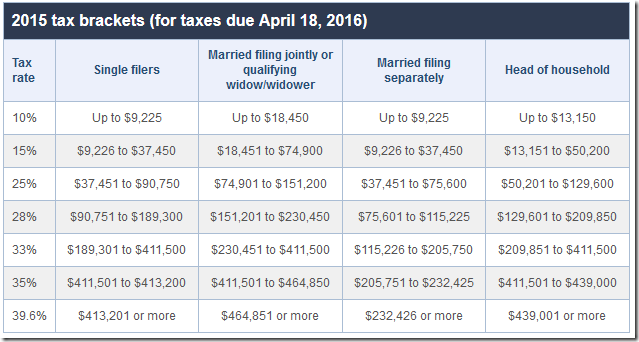

Will You Pay More Or Less Taxes When You Get Married SpreadsheetSolving

https://spreadsheetsolving.com/wp-content/uploads/2015/12/image_thumb.png

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

Web Overview Married Couple s Allowance could reduce your tax bill by between 163 401 and 163 1 037 50 a year You can claim Married Couple s Allowance if all the following apply Web Apply for Marriage Allowance online Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner if you both meet Web 11 sept 2023 nbsp 0183 32 Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 163 252 in 2022 23 plus other tax breaks available for married couples and civil

Download Married Person Tax Rebate

More picture related to Married Person Tax Rebate

Can A Married Person File Taxes Without Their Spouse

https://images.ctfassets.net/w4ut7xjvgytx/7rp7PhDocxMeDFGnPe0d4b/6b675b162e7309b4f29d8e5f423aa7be/married-file-taxes-separate_-example_for_married_filing_jointly.png

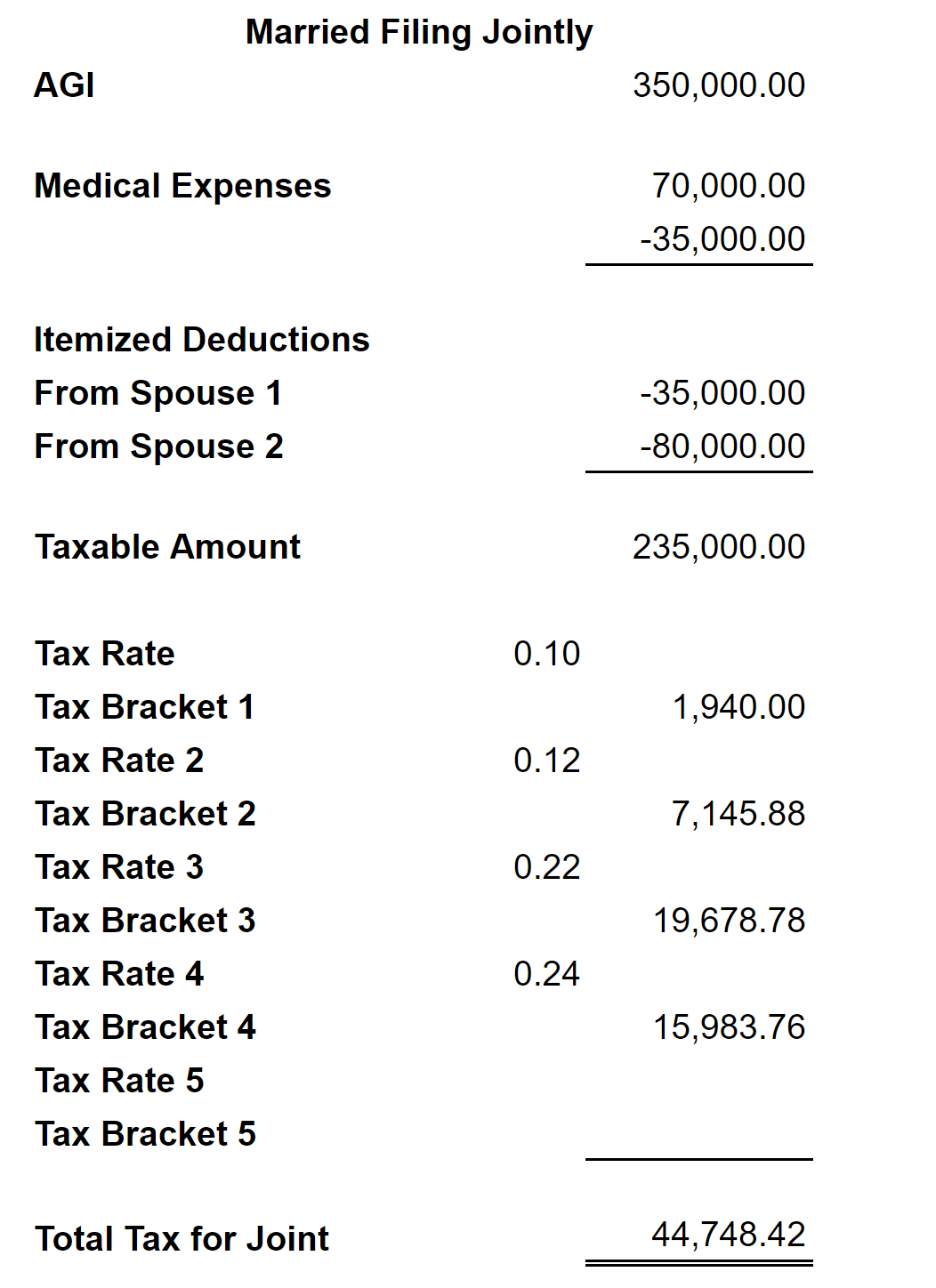

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately.png

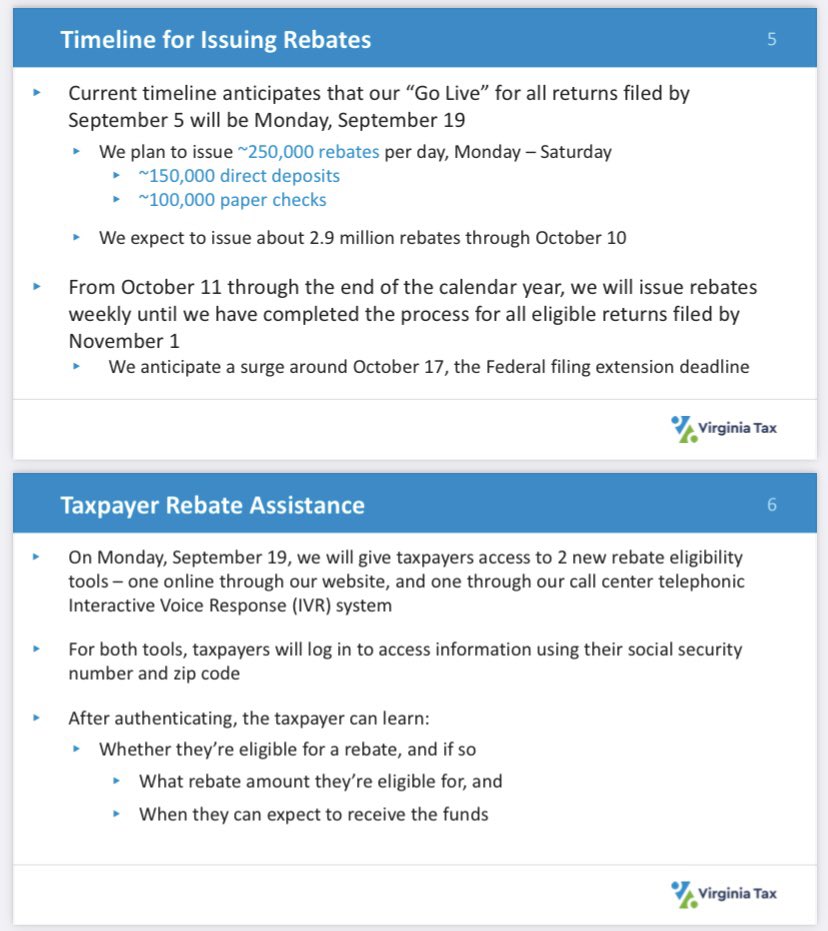

Jackie DeFusco On Twitter Virginia s Tax Commissioner Says The First

https://pbs.twimg.com/media/FciofsTWQAIsug8.jpg

Web How much can Marriage Tax Allowance save you The marriage allowance will allow you to save a maximum of 163 252 in tax in the 21 22 tax year As shown in the above example it will vary from couple to couple Web 16 f 233 vr 2020 nbsp 0183 32 La facture peut augmenter en cas de mariage Le premier est celui du m 233 canisme dit de la d 233 cote qui permet de r 233 duire la facture d 232 s lors que l imp 244 t est inf 233 rieur 224 un certain niveau Or ce niveau n est pas

Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance allows married couples or those in civil partnerships to share their personal tax allowances if one partner earns an income under their Web 2 janv 2022 nbsp 0183 32 Marriage tax allowance enables eligible Britons to transfer 163 1 260 of their personal allowance to their spouse or civil partner to cut their yearly tax bill and claims

Good News For Married Persons CNIC And SIM Holders Ehsas Program 7000

https://i.ytimg.com/vi/fKG1zvyLwyQ/maxresdefault.jpg

2019 2022 Form AK DR 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/487/436/487436791/large.png

https://www.service-public.fr/particuliers/vosdroits/F2705?lang=en

Web 8 juin 2023 nbsp 0183 32 Verified 08 June 2023 Legal and Administrative Information Directorate Prime Minister Are you married or past Your couple is subject to common taxation

https://www.moneysavingexpert.com/family/m…

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

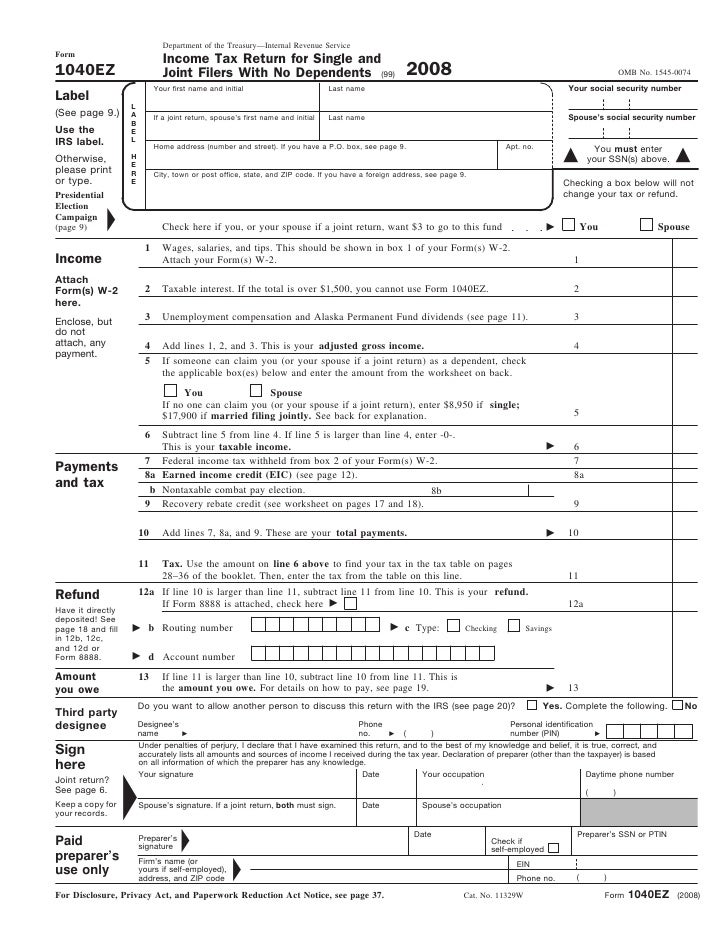

Form 1040EZ For Filers With No Dependents And Taxable Income Less

Good News For Married Persons CNIC And SIM Holders Ehsas Program 7000

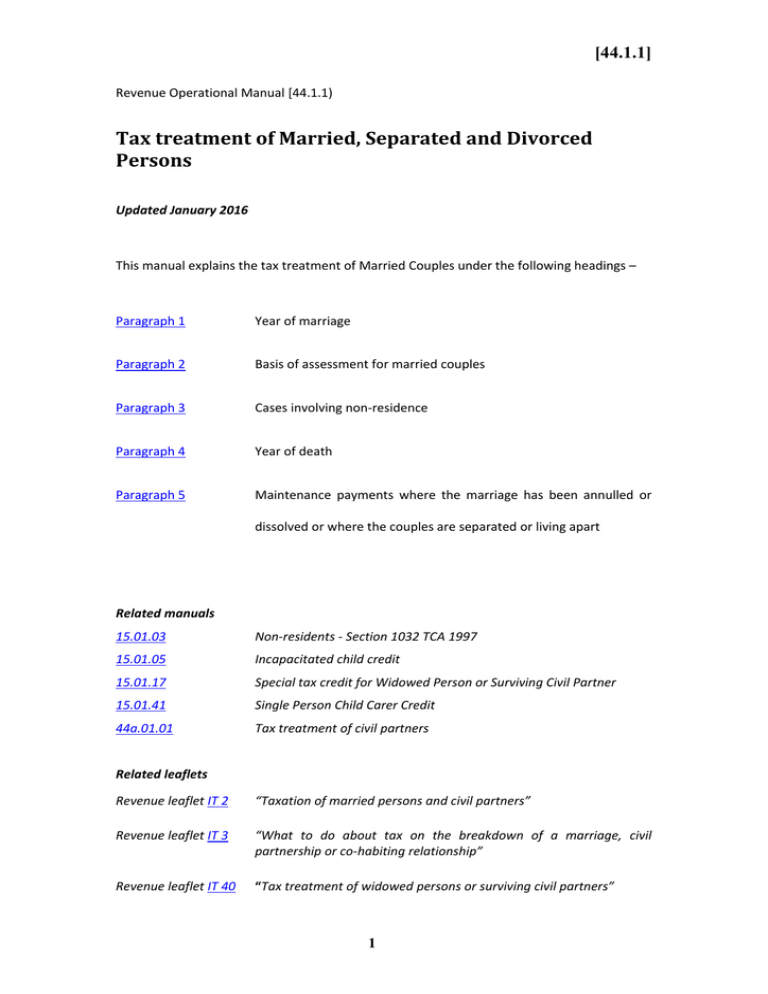

Tax Treatment Of Married Separated And Divorced Persons 44 1 1

2007 Tax Rebate Tax Deduction Rebates

Marriage Tax Allowance Tax Rebate Online

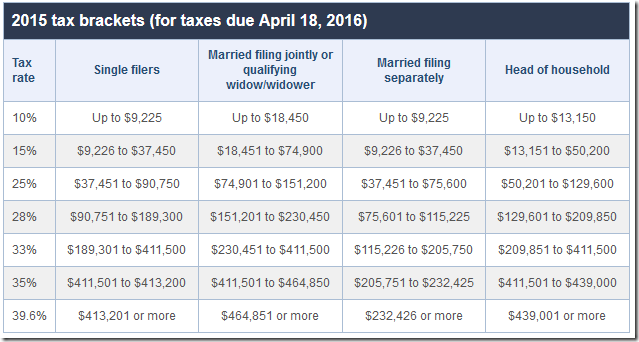

How Trump Changed Tax Brackets And Rates Stock News Stock Market

How Trump Changed Tax Brackets And Rates Stock News Stock Market

2020 Tax Brackets Rates Released By IRS What Am I Paying In Taxes

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Flores Team Services

Married Person Tax Rebate - Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner